How to Build an Emergency Fund: Global Guide to Financial Security in 2025

Imagine losing your job tomorrow, facing a major medical emergency, or dealing with urgent home repairs that cost thousands. For 73% of people worldwide, such emergencies would trigger a financial crisis because they lack sufficient emergency savings. But you don’t have to be part of that vulnerable majority.

An emergency fund is your financial safety net—money set aside specifically for unexpected expenses or income loss. It’s the foundation of financial security and the difference between weathering life’s storms and drowning in debt. Whether you’re starting from zero or looking to optimize your existing emergency savings, this comprehensive guide will show you how to build robust financial protection.

For additional insights on the importance of emergency funds, also check out our comprehensive emergency fund guide which covers specific building and management strategies.

What Is an Emergency Fund?

An emergency fund is a dedicated savings account containing money reserved exclusively for genuine financial emergencies. Unlike other savings goals, this fund serves one critical purpose: providing immediate access to cash when unexpected expenses arise or income suddenly stops.

What Qualifies as an Emergency?

True Emergencies:

- Job loss or income reduction (unemployment, business closure, hour cuts)

- Medical emergencies (surgery, hospitalization, urgent dental work)

- Major home repairs (roof damage, heating system failure, plumbing disasters)

- Car repairs (engine failure, transmission problems, accident repairs)

- Family emergencies (caring for sick relatives, emergency travel)

NOT Emergencies:

- Planned expenses (known car maintenance, annual insurance premiums)

- Wants disguised as needs (new clothes, electronics, vacation)

- Predictable costs (Christmas gifts, back-to-school expenses)

- Investment opportunities (stock market dips, real estate deals)

The key distinction: emergencies are unexpected, urgent, and necessary expenses that can’t be delayed or avoided.

How Much Should You Save?

The universal guideline is 3-6 months of essential expenses, but your ideal amount depends on several personal factors.

The 3-6 Month Rule Explained

This doesn’t mean 3-6 months of your current income, but rather the money needed to cover essential expenses for that period:

Essential Monthly Expenses:

- Housing (rent/mortgage, utilities, insurance)

- Food and groceries

- Transportation (car payments, insurance, fuel, public transit)

- Minimum debt payments

- Healthcare and insurance premiums

- Basic telecommunications (phone, internet)

Example Calculation: If your essential monthly expenses total $3,000:

- Minimum emergency fund: $9,000 (3 months)

- Ideal emergency fund: $18,000 (6 months)

Factors That Determine Your Target Amount

Lean Toward 3 Months If You Have:

- Stable employment with strong job security

- Dual-income household with both partners employed

- Government safety nets (strong unemployment benefits, universal healthcare)

- Family support available in emergencies

- Additional income sources (rental income, side business)

Lean Toward 6+ Months If You Have:

- Irregular income (freelance, commission-based, seasonal work)

- Single income household with dependents

- High-demand, specialized skills that take longer to replace

- Health issues or family members with chronic conditions

- Self-employment or business ownership

- Limited social safety nets in your country

Special Considerations by Region

Countries with Strong Social Safety Nets:

- Nordic countries, Germany, Canada, Australia

- May lean toward lower end (3-4 months) due to unemployment benefits and universal healthcare

Countries with Limited Safety Nets:

- United States, many developing countries

- Should target higher end (6+ months) due to healthcare costs and limited unemployment support

High-Cost Living Areas:

- Major cities like London, Tokyo, San Francisco, Zurich

- May need larger absolute amounts even if months-of-expenses remain the same

Where to Keep Your Emergency Fund

Your emergency fund needs three critical characteristics: safety, liquidity, and growth protection. Here’s how to choose the right account globally.

High-Yield Savings Accounts

Best for: Most people seeking the optimal balance of safety and returns.

Advantages:

- FDIC insured (US) or equivalent deposit protection in other countries

- Immediate access to funds

- Competitive interest rates (2-5% APY in many countries as of 2025)

- No market risk or volatility

Global Considerations:

- United States: Look for FDIC-insured accounts with competitive APY

- European Union: Ensure accounts have deposit guarantee protection up to €100,000

- United Kingdom: Check for FSCS protection up to £85,000

- Canada: CDIC protection up to CAD $100,000

- Australia: Government guarantee up to AUD $250,000

How to Find the Best Rates:

- Compare online banks vs traditional banks

- Look for promotional rates for new customers

- Consider credit unions or building societies

- Use comparison websites specific to your country

Money Market Accounts

Best for: Those wanting slightly higher returns with check-writing access.

Advantages:

- Higher interest rates than traditional savings

- Check-writing and debit card access

- FDIC insured or equivalent protection

- Minimum balance requirements may limit fees

Disadvantages:

- Usually require higher minimum balances

- May limit monthly transactions

- Interest rates can be variable

Certificates of Deposit (CDs) Laddering

Best for: Disciplined savers comfortable with slightly reduced liquidity.

Strategy: Divide emergency fund across multiple CDs with staggered maturity dates.

Example CD Ladder:

- 25% in 3-month CD

- 25% in 6-month CD

- 25% in 12-month CD

- 25% in 18-month CD

Advantages:

- Higher interest rates than savings accounts

- Predictable returns

- FDIC insured or equivalent protection

Disadvantages:

- Early withdrawal penalties

- Reduced immediate liquidity

- Interest rate risk if rates rise

What to Avoid for Emergency Funds

Checking Accounts:

- Minimal interest earnings

- Easy to accidentally spend

- Better for daily expenses, not emergency storage

Stock Market Investments:

- High volatility and market risk

- Could lose significant value when you need it most

- Not appropriate for emergency funds

Cryptocurrency:

- Extreme volatility

- Regulatory uncertainty

- Technical risks and potential loss

Real Estate or REITs:

- Illiquid - can’t access quickly

- Market risk and volatility

- Transaction costs reduce effectiveness

Step-by-Step Emergency Fund Building Strategy

Phase 1: Start Small (Target: $1,000-$2,000)

Why Start Small:

- Builds momentum and confidence

- Covers most minor emergencies

- Prevents reliance on credit cards for small unexpected expenses

Quick Start Strategies:

- Save windfalls immediately (tax refunds, bonuses, gifts)

- Round-up apps that save spare change automatically

- 30-day spending challenge - cut non-essential spending temporarily

- Sell unused items (electronics, clothes, furniture)

Timeline Goal: 2-3 months for initial emergency buffer

Phase 2: Build Your Foundation (Target: 1 Month of Expenses)

Focus: Calculate your essential monthly expenses and save that amount.

Monthly Expense Categories to Calculate:

- Housing: Rent/mortgage, utilities, property taxes, insurance

- Food: Groceries and essential dining

- Transportation: Car payments, insurance, fuel, maintenance, public transit

- Debt Minimums: Credit cards, student loans, personal loans

- Healthcare: Insurance premiums, prescriptions, regular medical costs

- Essential Services: Phone, basic internet, childcare

Calculation Example:

- Housing: $1,200

- Food: $400

- Transportation: $300

- Debt minimums: $250

- Healthcare: $150

- Essential services: $100

- Total monthly essentials: $2,400

Timeline Goal: 4-6 months to save one month of expenses

Phase 3: Reach Full Protection (Target: 3-6 Months)

Systematic Saving Approach:

- Automate savings - set up automatic transfers on payday

- Use percentage-based saving - save 20% of income if possible

- Leverage pay increases - direct raises and bonuses to emergency fund

- Optimize expenses - reduce recurring costs to free up savings capacity

Timeline Goal: 12-24 months to reach full emergency fund

Phase 4: Maintain and Optimize

Regular Reviews:

- Annual expense review - adjust target as life changes

- Account optimization - ensure you’re earning competitive interest

- Replenishment plan - rebuild fund quickly after using it

Building an Emergency Fund on a Low Income

Even with limited income, you can build financial security through strategic approaches and patience.

Micro-Saving Strategies

The $5 Challenge:

- Save every $5 bill you receive

- Can accumulate $300-500 annually with minimal effort

52-Week Challenge Modified:

- Start with $1 week one, $2 week two, etc.

- Adapt amounts to your income level

- Reverse the challenge (start high, go low) if year-end is difficult

Percentage-Based Approach:

- Start with 1% of income if that’s all you can manage

- Increase by 0.5% every few months

- Even 5% of a modest income builds meaningful savings over time

Expense Reduction Tactics

Housing Optimizations:

- Get roommates or consider house-sharing

- Negotiate rent or mortgage payments

- Explore utility assistance programs

- Consider relocating to lower-cost areas

Food Savings:

- Meal planning and bulk cooking

- Generic brands and store loyalty programs

- Community food banks and assistance programs

- Growing herbs or vegetables if possible

Transportation Alternatives:

- Public transit, cycling, or walking

- Car-sharing services instead of ownership

- Maintenance DIY skills to reduce repair costs

- Carpooling arrangements

Income Augmentation

Skill-Based Side Income:

- Tutoring, consulting, or freelance work

- Online services (writing, design, programming)

- Local services (pet-sitting, house-sitting, cleaning)

Asset Monetization:

- Rent out parking space or storage

- Sell crafts or homemade goods

- Rent out tools or equipment occasionally

Government and Community Resources:

- Research available assistance programs

- Tax credits and benefits you may qualify for

- Community organizations offering financial education

Advanced Emergency Fund Strategies

The Tiered Approach

Organize your emergency fund in multiple tiers for optimal accessibility and growth:

Tier 1: Immediate Access ($1,000-2,000)

- High-yield savings account

- Available within hours

- Covers most common emergencies

Tier 2: Short-Term Access (2-4 months expenses)

- Money market account or short-term CDs

- Available within days

- Slightly higher returns than Tier 1

Tier 3: Extended Emergency (2+ months expenses)

- Longer-term CDs or conservative investments

- Available within weeks

- Higher potential returns for extended unemployment

Geographic Diversification

For international travelers or expatriates:

Multi-Currency Considerations:

- Keep emergency funds in your primary expense currency

- Consider small amounts in local currency when living abroad

- Understand currency exchange risks and costs

Multi-Country Access:

- International banks with global presence

- Online banks with worldwide access

- Multiple debit cards for different banking systems

Business Owner Considerations

Separate Business Emergency Funds:

- Personal emergencies and business emergencies are different

- Business fund should cover 6-12 months of operating expenses

- Keep personal and business emergency funds completely separate

Income Volatility Planning:

- Larger emergency funds (6-12 months) due to irregular income

- Separate fund for tax obligations

- Consider professional disability insurance

Emergency Fund Mistakes to Avoid

Mistake 1: Keeping Too Much in Emergency Funds

The Problem: Excessive emergency savings earning low returns while missing investment opportunities.

The Solution: Once you reach 6-9 months of expenses, redirect additional savings to investments or other financial goals.

Mistake 2: Using Emergency Fund for Non-Emergencies

The Problem: Treating emergency fund as general savings for wants or planned expenses.

The Solution: Create separate savings accounts for specific goals (vacation, home down payment, car replacement).

Mistake 3: Not Adjusting for Life Changes

The Problem: Keeping the same emergency fund amount as expenses, income, or family situation changes.

The Solution: Review and adjust emergency fund target annually or after major life events.

Mistake 4: Choosing Wrong Account Types

The Problem: Using checking accounts (too low returns) or investments (too risky) for emergency funds.

The Solution: Stick to savings accounts, money markets, or short-term CDs that balance safety, liquidity, and returns.

Mistake 5: Never Starting Because the Goal Seems Too Big

The Problem: Feeling overwhelmed by needing thousands in emergency savings and never beginning.

The Solution: Start with any amount, even $25 per month. Small consistent contributions compound over time.

Mistake 6: Stopping After One Use

The Problem: Using emergency fund and never replenishing it, leaving yourself vulnerable.

The Solution: Immediately restart emergency fund contributions after any withdrawal until fully replenished.

Emergency Fund Alternatives and Supplements

While a traditional emergency fund is essential, some alternatives can supplement your financial security:

Home Equity Line of Credit (HELOC)

How it works: Credit line secured by home equity, accessed as needed.

Advantages:

- Large available credit limits

- Only pay interest on amounts used

- Potential tax deductions on interest

Disadvantages:

- Requires home ownership and equity

- Variable interest rates

- Risk of losing home if unable to repay

- Not available during market downturns when you might need it most

Best use: Supplement to, not replacement for, emergency fund.

Credit Cards (Strategic Use)

How it works: Using credit cards for emergencies with a plan for quick repayment.

Advantages:

- Immediate access to funds

- Potential rewards or cash back

- Fraud protection and dispute rights

Disadvantages:

- High interest rates if carried month-to-month

- Can lead to debt spiral if overused

- Credit limits may be reduced during economic stress

Best use: Very short-term bridge until emergency fund access, not primary emergency strategy.

Family and Friends

How it works: Informal borrowing arrangements with family or close friends.

Advantages:

- Potentially low or no interest

- Flexible repayment terms

- Immediate availability

Disadvantages:

- Can strain relationships

- Not reliable or guaranteed

- May not be available when needed most

Best use: Last resort or supplement to other emergency resources.

Government and Community Resources

Research Available:

- Unemployment insurance and benefits

- Food assistance programs

- Housing assistance

- Utility assistance programs

- Healthcare subsidies

- Community emergency funds

Tax Considerations for Emergency Funds

Interest Income Reporting

Global Considerations:

- Most countries require reporting interest income above certain thresholds

- Keep records of interest earned for tax purposes

- Consider tax-advantaged savings accounts where available

Tax-Advantaged Options by Region:

- United States: Health Savings Accounts (HSAs) can serve dual purpose

- United Kingdom: ISAs (Individual Savings Accounts) offer tax-free growth

- Canada: TFSAs (Tax-Free Savings Accounts) provide tax-free growth

- Australia: Consider high-interest savings accounts with competitive rates

Estate Planning Considerations

Joint Accounts:

- Consider joint ownership for immediate spousal access

- Understand local laws about account access after death

- Beneficiary designations where permitted

Documentation:

- Keep emergency fund information in estate planning documents

- Ensure trusted family members know account locations and access methods

Building Emergency Funds for Specific Life Situations

Young Adults (20s-30s)

Unique Challenges:

- Lower incomes early in career

- Student loan payments

- Unstable employment or frequent job changes

Strategies:

- Start with smaller goal ($1,000) and build gradually

- Use automatic savings to build discipline

- Focus on career development to increase earning potential

- Consider moving back with family temporarily to save faster

Families with Children

Unique Challenges:

- Higher expenses due to childcare, education, healthcare

- Multiple family members to protect

- Potential for single-income periods

Strategies:

- Target higher end of 6+ months expenses

- Consider separate fund for child-specific emergencies

- Include childcare costs in essential expense calculations

- Plan for potential maternity/paternity leave income gaps

Pre-Retirees (50s-60s)

Unique Challenges:

- Longer unemployment periods if job loss occurs

- Higher healthcare costs

- Less time to recover from financial setbacks

Strategies:

- Build larger emergency funds (9-12 months expenses)

- Consider healthcare-specific emergency fund

- Factor in COBRA or health insurance costs

- Plan bridge strategies to full retirement

Retirees

Unique Challenges:

- Fixed incomes with limited ability to increase

- Higher healthcare and long-term care risks

- Market volatility affecting retirement accounts

Strategies:

- Maintain smaller emergency fund (3-6 months) since income is more predictable

- Focus on healthcare and home maintenance reserves

- Consider keeping emergency fund separate from retirement investments

- Plan for long-term care costs separately

Technology and Emergency Funds

Digital Banking Solutions

Online High-Yield Savings:

- Often offer better rates than traditional banks

- 24/7 access to funds

- Lower overhead costs passed to customers as higher interest

Mobile Banking Features:

- Automatic savings programs

- Round-up savings from purchases

- Goal tracking and progress monitoring

- Instant transfers between accounts

Global Considerations for Digital Banking

Multi-Country Access:

- Banks with international presence

- Online banks accessible while traveling

- Multiple debit cards for different regions

Currency and Exchange Considerations:

- Keep emergency funds in primary expense currency

- Understand foreign transaction fees

- Consider local banking relationships when living abroad

Security Best Practices

Account Protection:

- Strong, unique passwords for all financial accounts

- Two-factor authentication where available

- Regular monitoring of account activity

- Secure internet connections for online banking

Economic Uncertainty and Emergency Funds

Adjusting for Economic Conditions

During Economic Expansion:

- May target lower end of recommended range

- Focus on growth opportunities with excess savings

- Consider maintaining minimum emergency fund while investing additional funds

During Economic Uncertainty:

- Target higher end of recommended range (6+ months)

- Increase job search and career development efforts

- Review and optimize all expenses

- Consider diversifying income sources

Inflation Protection

Maintaining Purchasing Power:

- Regularly review and adjust emergency fund targets for inflation

- Choose high-yield accounts that keep pace with inflation

- Consider I-bonds or inflation-protected securities for portion of emergency fund

Global Inflation Considerations:

- Monitor local inflation rates and adjust savings accordingly

- Consider multi-currency emergency funds if experiencing high local inflation

- Understand how inflation affects your essential expenses

Tools and Calculators

Essential Calculations

Monthly Expense Tracking: Use our Budget Calculator to identify essential expenses for emergency fund targeting.

Emergency Fund Goal Setting: Our Emergency Fund Calculator helps determine your personalized target amount and timeline.

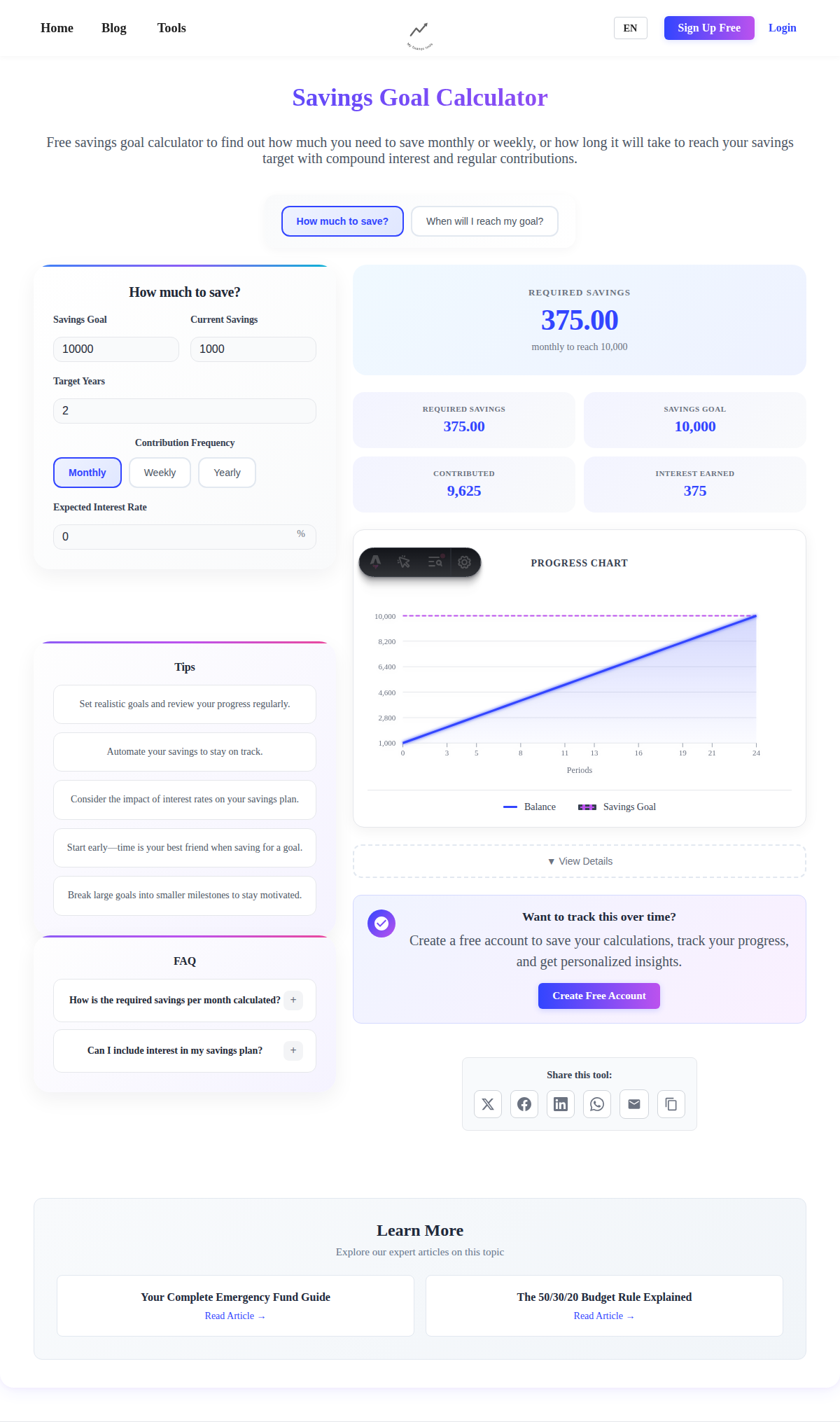

Savings Goal Planning: The Savings Goal Calculator can help you create a systematic plan to reach your emergency fund target.

Helpful Formulas

Basic Emergency Fund Target: Monthly Essential Expenses × Target Months (3-6) = Emergency Fund Goal

Monthly Savings Required: Emergency Fund Goal ÷ Timeline (months) = Monthly Savings Needed

Years to Build Fund: Emergency Fund Goal ÷ (Monthly Savings × 12) = Years to Complete

Conclusion

Building an emergency fund is one of the most important financial steps you can take, regardless of where you live or what you earn. It’s the foundation that allows you to weather life’s inevitable storms without derailing your long-term financial goals.

Remember these key principles:

- Start where you are - Any amount is better than nothing

- Automate your savings - Make emergency fund building effortless

- Choose appropriate accounts - Balance safety, liquidity, and growth

- Adjust for your situation - Consider your job security, family needs, and local safety nets

- Maintain and replenish - Keep your fund current and restore it after use

The path to financial security begins with your first emergency fund contribution. Whether that’s $25 or $250, start today. Your future self will thank you when life’s next unexpected challenge comes your way.

An emergency fund isn’t just money in the bank—it’s peace of mind, financial freedom, and the confidence to take calculated risks that can improve your life. It’s the difference between surviving and thriving when faced with life’s inevitable uncertainties.

Use our Emergency Fund Calculator to determine your personalized target and create a plan to get there. Start building your financial safety net today, and join the financially prepared minority who can handle whatever life throws their way.

This article provides general guidance on building emergency funds and should not be considered personalized financial advice. Emergency fund strategies may vary based on individual circumstances, local regulations, and available financial products. Always consider your specific situation and consult with qualified financial professionals when needed.