Wealth Optimization in Your 50s: The Pre-Retirement Homestretch

Your fifties represent the final sprint in your wealth-building marathon. This is your last decade of peak earning power, your final opportunity for aggressive wealth accumulation, and the time when retirement transforms from a distant goal into an imminent reality.

The stakes are higher now. Mistakes made in your twenties had decades to recover. Mistakes made in your fifties have maybe 10-15 years. But here’s the good news: you have more financial resources, wisdom, and focus than ever before. It’s time to optimize everything.

Why Your 50s Are Critical for Financial Success

The Reality Check: Most people reach their fifties with far less saved than they need for a comfortable retirement. The median retirement account balance for Americans aged 50-59 is only $174,000—nowhere near the $1-2 million most financial experts recommend.

The Opportunity: Your fifties are typically your peak earning years. Many people see their highest salaries during this decade, while major expenses (children’s education, mortgage) often decrease. This creates a powerful wealth-building window.

The Math of Catch-Up: Starting at age 50, many countries allow additional “catch-up” contributions to retirement accounts. In the US, for example, you can contribute an extra $7,500 annually to 401(k) plans and $1,000 to IRAs. Over 15 years, this extra $8,500 annually becomes $200,000+ in retirement savings.

Example Calculation: A 50-year-old with $200,000 saved who maximizes contributions for 15 years:

- Regular contributions: $22,500/year

- Catch-up contributions: $8,500/year

- Total annual: $31,000

- Result at 65: $1.1 million+ (assuming 7% returns)

The Five Pillars of Wealth Optimization in Your 50s

Pillar #1: Maximize Retirement Contributions

This is your highest leverage financial move. Every dollar contributed to retirement accounts provides immediate tax benefits and decades of tax-deferred growth.

Global Retirement Account Strategies:

United States:

- 401(k) maximum: $23,000 + $7,500 catch-up = $30,500 (2024)

- IRA maximum: $7,000 + $1,000 catch-up = $8,000

- HSA maximum: $4,300 individual / $8,550 family + $1,000 catch-up

United Kingdom:

- Pension contributions: Up to £40,000 annually

- ISA contributions: £20,000 annually in tax-free accounts

- SIPP contributions: Self-invested personal pensions for additional control

Australia:

- Superannuation: 11% employer contribution + voluntary contributions

- Concessional contributions: Up to $27,500 annually

- Non-concessional contributions: Up to $110,000 annually

Canada:

- RRSP contributions: 18% of income up to $31,560 (2024)

- TFSA contributions: $6,500 annually in tax-free accounts

- Catch-up room: Use unused contribution room from previous years

Strategy Implementation:

- Maximize employer match first (still free money)

- Max out catch-up contributions in all available accounts

- Consider Roth conversions during lower income years

- Coordinate with spouse to optimize household contributions

Pillar #2: Healthcare and Long-Term Care Planning

Healthcare costs increase dramatically with age and can devastate retirement savings if not planned for.

Global Healthcare Considerations:

Countries with Universal Healthcare (UK, Canada, Germany, France):

- Supplemental insurance for enhanced coverage

- Dental and vision coverage often not included

- International coverage if planning to travel or relocate

- Long-term care planning still essential

Countries with Private Healthcare (US, Switzerland):

- Health Savings Accounts for triple tax advantages where available

- Medicare planning (US) or equivalent national programs

- Long-term care insurance becomes increasingly important

- Healthcare inflation planning (typically 2-3x general inflation)

Long-Term Care Statistics:

- 70% of people over 65 will need some long-term care

- Average cost: $50,000-100,000+ annually depending on country/region

- Duration: Average of 2-3 years, but can extend much longer

Planning Strategies:

- Long-term care insurance purchased in your 50s has lower premiums

- Health Savings Accounts become retirement healthcare funds after age 65

- Healthy lifestyle investments reduce future healthcare costs

- International healthcare research if considering retirement abroad

Pillar #3: Strategic Career and Income Optimization

Your fifties are time to maximize your earning power while planning your eventual exit strategy.

Peak Earning Strategies:

- Leverage expertise: Consulting, board positions, speaking engagements

- Leadership roles: Senior management positions with higher compensation

- Equity compensation: Stock options, profit sharing, ownership stakes

- Geographic arbitrage: Remote work from lower-cost areas

- Entrepreneurship: Leveraging decades of experience and networks

Career Transition Planning: Many people in their fifties start planning their exit from traditional careers:

Gradual Retirement Approach:

- Reduce to part-time with current employer

- Consulting in your area of expertise

- Portfolio career combining multiple part-time roles

- Geographic relocation to lower-cost areas

Skills Development:

- Technology skills to remain competitive

- Teaching/training abilities for consulting or part-time work

- Board service qualifications for nonprofit or corporate boards

- Entrepreneurial skills for post-retirement business ventures

Pillar #4: Portfolio Risk Management and Optimization

Your investment strategy should evolve to balance growth with increasing protection of accumulated wealth.

Age-Appropriate Asset Allocation:

Early 50s (Aggressive Growth):

- 70% stocks / 25% bonds / 5% alternatives

- Still focusing on growth with 15+ years to retirement

- International diversification becomes more important

Mid-50s (Balanced Growth):

- 60% stocks / 30% bonds / 10% alternatives

- Beginning to reduce volatility while maintaining growth

- Focus on dividend-paying stocks for income

Late 50s (Conservative Growth):

- 50% stocks / 40% bonds / 10% alternatives

- Wealth preservation becomes increasingly important

- Consider target-date funds for automatic rebalancing

Global Diversification Strategy:

- 40% domestic stocks for familiarity and currency matching

- 30% international developed markets for diversification

- 15% emerging markets for growth potential

- 15% bonds and alternatives for stability

Risk Management Techniques:

- Dollar-cost averaging large investment amounts

- Rebalancing quarterly to maintain target allocations

- Tax-loss harvesting to optimize after-tax returns

- Laddered bond portfolios for predictable income

Pillar #5: Estate Planning and Wealth Transfer

Your fifties are when estate planning becomes critical, both for asset protection and efficient wealth transfer.

Essential Estate Planning Documents:

- Will and testament updated for current assets and wishes

- Power of attorney for financial and healthcare decisions

- Healthcare directives for end-of-life care preferences

- Beneficiary designations on all accounts (supersede wills)

Wealth Transfer Strategies:

- Annual gifting within tax-free limits to children/grandchildren

- Education funding for grandchildren through 529 plans or equivalent

- Charitable giving for tax benefits and philanthropic goals

- Trust structures for complex family situations

Global Considerations:

- International assets require specialized estate planning

- Tax treaties between countries affect estate taxes

- Currency hedging for international assets

- Professional advice essential for complex situations

Advanced Strategies for High Net Worth Individuals

Tax Optimization in Peak Earning Years

With higher income comes higher tax obligations—but also more optimization opportunities.

Income Tax Strategies:

- Retirement account maximization for immediate deductions

- Tax-loss harvesting to offset investment gains

- Charitable giving strategies for deductions

- Business ownership structures for tax efficiency

Capital Gains Management:

- Hold periods for long-term capital gains treatment

- Tax-loss harvesting to offset realized gains

- Roth conversions during lower income years

- Estate planning to step up basis for heirs

International Tax Considerations:

- Foreign tax credits for international investments

- Currency hedging strategies

- Retirement abroad tax implications

- Professional advice for complex international situations

Real Estate Strategy Evolution

Real estate strategy in your fifties should balance income generation with wealth preservation.

Primary Residence Decisions:

- Downsizing to reduce expenses and free up equity

- Aging in place modifications for long-term livability

- Geographic relocation to lower-cost or preferred climate areas

- International relocation for retirement lifestyle or cost savings

Investment Real Estate:

- Rental properties for income generation

- REITs for diversified real estate exposure without management

- International real estate for diversification and lifestyle

- Real estate partnerships for larger investments

Business and Entrepreneurship

Your fifties might be the perfect time for entrepreneurship, leveraging decades of experience and networks.

Business Strategies:

- Consulting business in your area of expertise

- Acquisition opportunities of existing businesses

- Partnership investments in other entrepreneurs

- Franchise ownership for proven business models

Exit Strategy Planning:

- Business valuation for retirement planning

- Succession planning for family businesses

- Sale preparation to maximize business value

- Tax optimization for business sales

Managing Financial Anxiety in Your 50s

Retirement Readiness Anxiety

Many people in their fifties experience anxiety about retirement preparedness.

Reality Check Strategies:

- Professional financial planning to assess true readiness

- Scenario planning for different retirement lifestyles

- Healthcare cost modeling for realistic planning

- Social Security/pension optimization for government benefits

Confidence Building Measures:

- Emergency fund expansion to 12+ months expenses

- Multiple income streams development

- Skills development for post-retirement work

- Health optimization to reduce future costs

Supporting Adult Children and Aging Parents

The “sandwich generation” pressure peaks in your fifties.

Adult Children Support:

- Education funding without compromising your retirement

- Home buying assistance through gifts or loans

- Emergency support while maintaining boundaries

- Financial education to promote independence

Aging Parent Care:

- Financial assessment of parents’ situation

- Care planning and cost estimation

- Legal documents and decision-making authority

- Resource coordination with siblings

Balancing Competing Priorities:

- Your retirement remains the top priority

- Emergency support for family crises

- Planned support within budget constraints

- Clear communication about expectations and limitations

Global Retirement Location Planning

Many people use their fifties to research and plan retirement relocations.

Domestic Relocation Factors:

- Cost of living differences between regions

- Healthcare access and quality

- Tax implications of state/provincial changes

- Family proximity considerations

International Retirement Considerations:

- Cost of living advantages in developing countries

- Healthcare quality and accessibility

- Visa requirements and residency paths

- Tax implications of international residence

- Currency exchange risks and hedging

Popular Retirement Destinations:

- Lower-cost developed countries: Portugal, Greece, Eastern Europe

- Developing countries with good infrastructure: Mexico, Costa Rica, Malaysia

- English-speaking options: Belize, Philippines, Malta

- Healthcare-focused destinations: Singapore, Switzerland, Germany

Research and Planning Process:

- Visit potential locations for extended periods

- Research visa requirements and residency paths

- Healthcare system assessment for your needs

- Tax professional consultation for implications

- Gradual transition planning rather than abrupt moves

Technology and Financial Management

Leverage technology to optimize your financial management during this critical decade.

Investment Management Technology:

- Robo-advisors for automated portfolio management

- Tax-loss harvesting automation

- Rebalancing alerts and automatic execution

- Performance tracking across all accounts

Financial Planning Software:

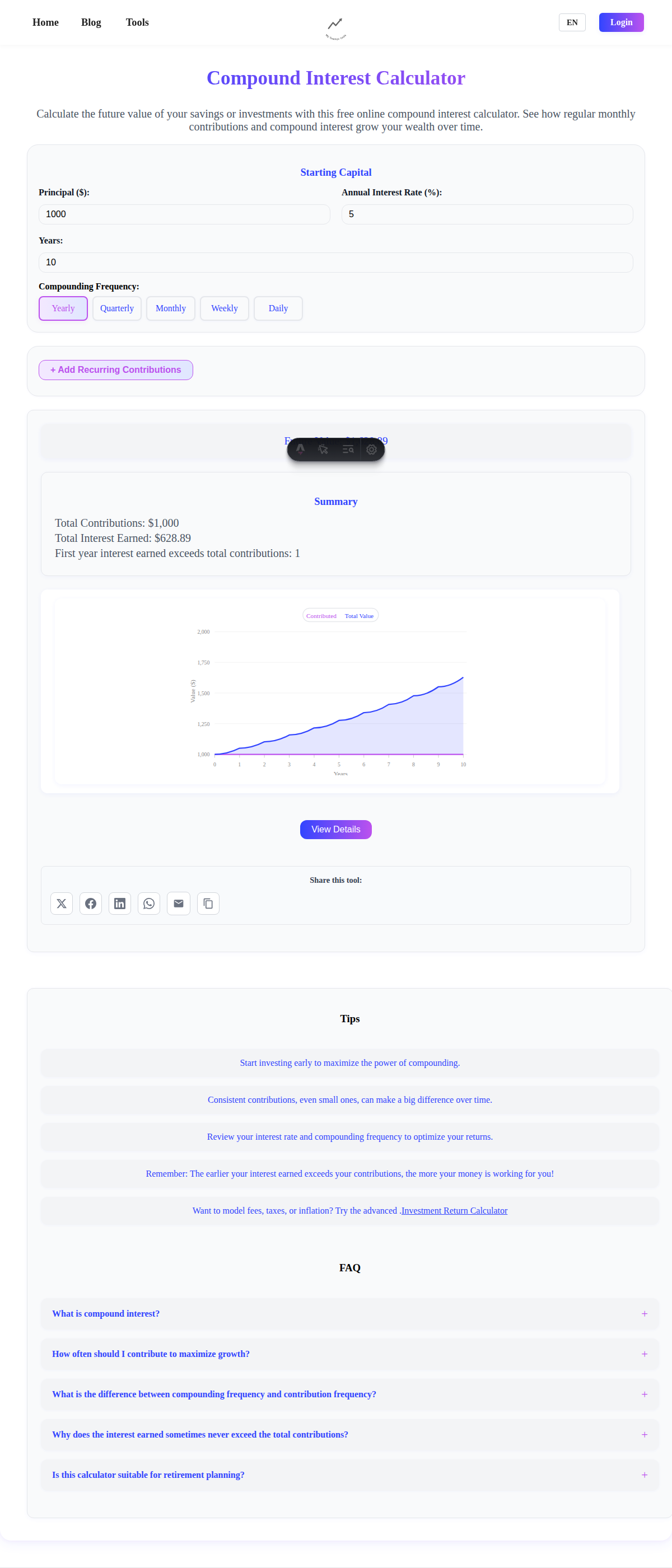

- Retirement planning tools for scenario analysis

- Healthcare cost calculators for planning

- Estate planning software for document management

- Tax optimization tools for strategic planning

Security and Fraud Protection:

- Identity monitoring services

- Account alerts for unusual activity

- Secure communication with financial advisors

- Regular security updates for all financial accounts

Health and Wealth Connection

Your health becomes increasingly important to your wealth as you age.

Preventive Healthcare Investment:

- Annual comprehensive exams to catch issues early

- Specialist consultations for preventive care

- Dental and vision care to avoid major procedures

- Mental health support for stress management

Fitness and Longevity Investment:

- Personal training for safe, effective exercise

- Nutrition counseling for optimal health

- Stress reduction through meditation, yoga, hobbies

- Social engagement for mental health

Healthcare Cost Reduction:

- Generic medications where appropriate

- Preventive care to avoid emergency treatments

- Healthcare shopping for procedures and services

- Health Savings Account optimization for tax benefits

Creating Your 50s Optimization Plan

Phase 1: Assessment and Goal Setting (Month 1)

- Comprehensive net worth calculation and retirement readiness analysis

- Healthcare needs assessment and cost projection

- Career trajectory evaluation and optimization planning

- Estate planning document review and updates

Phase 2: Strategy Implementation (Months 2-6)

- Retirement contribution maximization across all accounts

- Investment portfolio rebalancing for appropriate risk level

- Healthcare and long-term care insurance evaluation

- Estate planning document updates and beneficiary reviews

Phase 3: Optimization and Monitoring (Months 7-12)

- Tax strategy implementation for high-earning years

- Career transition planning and skill development

- Retirement location research and preliminary planning

- Family financial coordination and support planning

Your 50s Financial Milestones

By Age 52:

- Net worth: 6-8x annual salary

- Retirement contributions: Maximizing all available accounts

- Healthcare planning: Long-term care insurance evaluated

- Estate planning: Documents updated and current

By Age 55:

- Net worth: 8-10x annual salary

- Career transition: Planning or implementing changes

- Investment strategy: Appropriate for age and risk tolerance

- Retirement location: Research and planning underway

By Age 59:

- Net worth: 10-12x annual salary

- Retirement readiness: Clear picture of retirement lifestyle

- Healthcare planning: Comprehensive strategy in place

- Legacy planning: Estate and wealth transfer strategies implemented

When Life Doesn’t Go According to Plan

Job Loss in Your 50s

Age discrimination makes job loss particularly challenging in your fifties.

Immediate Response Strategy:

- Larger emergency fund (12+ months expenses) becomes critical

- Professional network activation for opportunities

- Skill updating for market competitiveness

- Consulting opportunities leveraging your expertise

Long-term Adaptation:

- Career pivot to growing industries or roles

- Geographic flexibility for better opportunities

- Early retirement consideration if financially feasible

- Entrepreneurship as alternative to traditional employment

Health Crisis Management

Health issues become more common and can impact both healthcare costs and earning ability.

Financial Protection Strategies:

- Disability insurance for income protection

- Health savings accounts for medical expenses

- Long-term care insurance for extended care needs

- Flexible financial plans that adapt to health changes

Family Financial Crises

Adult children or aging parents may need significant financial support.

Support Strategy Framework:

- Emergency support within pre-planned limits

- Ongoing support that doesn’t compromise your retirement

- Resource coordination with other family members

- Professional guidance for complex family financial issues

The Psychology of Approaching Retirement

Mindset Shifts

Your relationship with money evolves as retirement approaches:

- From accumulation to preservation focus

- From growth to income generation

- From working to living off investments

- From building to spending wealth

Retirement Lifestyle Planning

Start envisioning your retirement lifestyle:

- Activity planning for fulfillment and purpose

- Budget estimation for desired lifestyle

- Location preferences and associated costs

- Social connections and community involvement

Legacy Considerations

Think about the legacy you want to leave:

- Financial legacy for children and grandchildren

- Charitable giving for causes you care about

- Knowledge transfer sharing your expertise

- Values transmission to future generations

Taking Action in Your Optimization Decade

Your fifties are about optimizing everything you’ve built while preparing for the next phase of life.

Week 1 Action Items:

- Calculate your retirement readiness using current savings and projected needs

- Maximize all catch-up contributions for this tax year

- Schedule comprehensive healthcare and insurance reviews

- Update estate planning documents and beneficiary designations

Month 1 Goals:

- Create a comprehensive financial plan addressing all major goals and concerns

- Optimize your investment strategy for your age and risk tolerance

- Develop a healthcare cost and long-term care strategy

- Begin career transition and retirement lifestyle planning

Year 1 Objectives:

- Implement all optimization strategies identified in your planning

- Monitor and adjust your plan quarterly based on life changes

- Build the systems and habits that will carry you through retirement

- Prepare for the transition from wealth building to wealth management

Remember: your fifties are your final opportunity to make major improvements to your financial situation. The decisions you make this decade will determine whether you enter retirement with confidence and security, or find yourself working longer than planned.

The key is balancing aggressive wealth building with prudent risk management. You want to squeeze every dollar of growth from your remaining working years while protecting what you’ve already built.

Your future retired self is depending on the financial optimization you implement today. Make these years count.

Ready to optimize your pre-retirement strategy? Use our financial calculators to model different scenarios and create your personalized optimization plan for your wealth-building homestretch.