The Psychology of Financial Stress: How Money Anxiety Impacts Your Decisions (And How to Fix It)

Picture this: Your heart races when you check your bank balance. You lose sleep worrying about bills. You avoid opening financial statements, hoping problems will somehow resolve themselves. You make impulsive purchases when stressed, then feel guilty afterward. If any of this sounds familiar, you’re experiencing financial stress—and you’re far from alone.

Financial stress affects 73% of Americans and similar percentages globally, making it one of the most common sources of anxiety in modern life. But here’s what most people don’t realize: financial stress doesn’t just make you feel bad—it literally changes how your brain functions, leading to worse financial decisions that create more stress in a vicious cycle.

This comprehensive guide explores the psychology behind financial stress, how it impacts your decision-making, and most importantly, practical strategies to break free from money anxiety and regain control of your financial well-being.

Understanding Financial Stress: More Than Just Money Problems

Defining Financial Stress

Financial stress is the emotional tension, anxiety, and worry that arises from concerns about money, whether related to current financial situations or future financial security. Unlike temporary financial setbacks, financial stress becomes a chronic condition that affects mental health, physical health, relationships, and ironically, financial decision-making ability.

Key Characteristics of Financial Stress:

- Persistent worry about money, even when basic needs are met

- Physical symptoms like insomnia, headaches, or digestive issues related to financial concerns

- Avoidance behaviors around money management

- Emotional responses that seem disproportionate to actual financial situations

- Impact on relationships due to money-related tension

- Difficulty concentrating on non-financial aspects of life

The Difference Between Financial Problems and Financial Stress

It’s crucial to understand that financial stress and actual financial problems, while related, are distinct phenomena:

Financial Problems:

- Objective financial difficulties (insufficient income, high debt, unexpected expenses)

- Can often be measured and quantified

- May have clear solutions through budgeting, debt management, or income increases

- Directly related to actual financial circumstances

Financial Stress:

- Subjective emotional response to financial situations

- Can exist even when finances are objectively stable

- Often disproportionate to actual financial circumstances

- Involves psychological and physiological responses

- Can persist even after financial problems are resolved

This distinction is important because it means that simply “fixing” financial problems doesn’t automatically eliminate financial stress, and conversely, reducing financial stress can improve your ability to address actual financial challenges.

The Neuroscience of Money Anxiety

How Financial Stress Affects Your Brain

When you experience financial stress, your brain undergoes significant changes that impact decision-making, memory, and emotional regulation. Understanding these neurological responses helps explain why financial stress can be so debilitating and why it leads to poor financial choices.

The Stress Response System:

- Amygdala Activation: Your brain’s alarm system triggers fight-or-flight responses to financial threats, real or perceived

- Cortisol Release: Chronic stress hormones impair memory formation and recall

- Prefrontal Cortex Impairment: The brain region responsible for planning and rational decision-making becomes less active

- Default Mode Network Disruption: Your brain’s ability to rest and process information becomes compromised

The Scarcity Mindset

Financial stress often creates what psychologists call a “scarcity mindset”—a mental framework where your brain becomes hyperfocused on immediate financial threats while losing sight of long-term planning and opportunities.

Characteristics of Scarcity Mindset:

- Tunneling: Excessive focus on immediate financial pressures

- Reduced cognitive capacity: Less mental bandwidth for complex decisions

- Present bias: Overvaluing immediate rewards versus long-term benefits

- Risk aversion: Avoiding potentially beneficial financial decisions due to fear

- Analysis paralysis: Inability to make decisions due to overwhelming anxiety

Research Example: Studies by Harvard economist Sendhil Mullainathan show that people experiencing financial stress perform 10-15 points lower on IQ tests—equivalent to losing a full night’s sleep or being under the influence of alcohol. This isn’t because they’re less intelligent, but because worry consumes mental resources needed for complex thinking.

The Stress-Spending Cycle

Financial stress creates paradoxical behaviors where people often make financial decisions that worsen their situations:

- Stress Triggers: Financial worry or anxiety arises

- Coping Behaviors: Shopping, avoiding financial tasks, or making impulsive decisions to relieve stress

- Temporary Relief: Brief mood improvement from spending or avoidance

- Increased Problems: Actions create more financial stress

- Cycle Repeats: Higher stress levels lead to more destructive coping behaviors

Common Symptoms and Manifestations of Financial Stress

Physical Symptoms

Financial stress manifests in numerous physical ways, often mimicking other health conditions:

Immediate Physical Responses:

- Rapid heartbeat when checking account balances

- Sweating or trembling when discussing money

- Nausea or stomach upset related to financial situations

- Tension headaches during financial planning

- Shallow breathing or feeling short of breath

Chronic Physical Symptoms:

- Insomnia or disrupted sleep patterns

- Chronic fatigue despite adequate rest

- Digestive issues (acid reflux, IBS, loss of appetite)

- Muscle tension, particularly in neck and shoulders

- Weakened immune system leading to frequent illness

- Changes in weight (loss due to stress or gain from emotional eating)

Emotional and Behavioral Symptoms

Emotional Manifestations:

- Persistent worry about money, even when finances are stable

- Feelings of shame or embarrassment about financial situations

- Irritability or anger that seems disproportionate to triggers

- Sadness or depression related to financial circumstances

- Feeling overwhelmed by financial decisions

- Loss of enjoyment in activities due to money concerns

Behavioral Changes:

- Avoiding financial tasks (bill paying, budget reviews, investment checking)

- Compulsive shopping or spending as stress relief

- Social isolation to avoid spending money

- Relationship conflicts over money management

- Procrastination on important financial decisions

- Obsessive checking of account balances or investment values

Cognitive Symptoms

Thinking Patterns:

- Racing thoughts about financial “what-if” scenarios

- Difficulty concentrating on non-financial tasks

- Memory problems, especially regarding financial information

- Catastrophic thinking about financial futures

- All-or-nothing thinking about money decisions

- Difficulty seeing financial solutions or opportunities

Decision-Making Impacts:

- Analysis paralysis when facing financial choices

- Impulsive decisions to escape financial anxiety

- Avoidance of important financial planning

- Overcomplicating simple financial decisions

- Second-guessing previously made financial choices

The Cultural and Social Dimensions of Financial Stress

Money Scripts and Childhood Programming

Many of our financial stress responses originate from “money scripts”—unconscious beliefs about money developed during childhood. These beliefs often operate below conscious awareness but significantly impact financial behavior and stress levels.

Common Destructive Money Scripts:

- “Money is the root of all evil” (leading to guilt about earning or wanting money)

- “Rich people are greedy” (creating internal conflict about financial success)

- “There’s never enough money” (perpetuating scarcity mindset)

- “Money doesn’t buy happiness” (justifying poor financial decisions)

- “I don’t deserve financial success” (self-sabotaging behaviors)

- “Talking about money is rude/inappropriate” (avoiding necessary financial conversations)

Origins of Money Scripts:

- Family attitudes and behaviors around money during childhood

- Socioeconomic circumstances growing up

- Traumatic experiences related to money or poverty

- Cultural and religious teachings about money and materialism

- Social messages from media and peer groups

Cultural Influences on Financial Stress

Different cultures have varying relationships with money, financial planning, and financial stress:

Individualistic Cultures (US, Western Europe):

- High emphasis on personal financial responsibility

- Greater stress around individual financial achievement

- Social pressure to appear financially successful

- Less family-based financial support systems

Collectivistic Cultures (East Asia, Latin America, Africa):

- Family-oriented financial planning and support

- Different stressors around family financial obligations

- Shared financial responsibilities reducing individual pressure

- Cultural expectations around supporting extended family

Religious and Spiritual Influences:

- Various religious teachings about money, debt, and material possessions

- Conflicts between spiritual values and practical financial needs

- Community support systems that may reduce financial stress

- Guilt or anxiety around wealth accumulation

Social Comparison and Financial Stress

Social media and modern connectivity have intensified financial stress through constant comparison with others:

Social Media Impacts:

- Curated representations of others’ financial success

- FOMO (fear of missing out) on lifestyle purchases

- Pressure to maintain appearances online

- Unrealistic benchmarks for financial achievement

Keeping Up with the Joneses 2.0:

- Global comparison rather than local community comparison

- 24/7 exposure to others’ apparent financial success

- Algorithmic feeds that promote comparison and envy

- Influencer culture promoting consumption and lifestyle inflation

How Financial Stress Sabotages Financial Decision-Making

Impaired Cognitive Function

Financial stress literally reduces your ability to make good financial decisions through several mechanisms:

Reduced Working Memory:

- Difficulty holding multiple financial factors in mind simultaneously

- Problems with complex calculations or comparisons

- Forgetting important financial information or deadlines

Decreased Attention Control:

- Difficulty focusing on financial planning tasks

- Easily distracted during important financial conversations

- Problems maintaining attention during financial education

Impaired Inhibitory Control:

- Reduced ability to resist financial temptations

- Difficulty sticking to budgets or spending plans

- Increased susceptible to marketing and sales pressure

Time Perspective Distortion

Financial stress alters how you perceive and weigh different time horizons:

Present Bias Intensification:

- Overvaluing immediate financial relief versus long-term benefits

- Difficulty making short-term sacrifices for long-term gains

- Tendency to choose immediate rewards over delayed gratification

Future Discounting:

- Dramatically undervaluing future financial benefits

- Difficulty visualizing or planning for future financial needs

- Increased willingness to borrow against future income

Risk Assessment Problems

Chronic financial stress impairs your ability to accurately assess financial risks and opportunities:

Risk Aversion Extremes:

- Avoiding all financial risks, including beneficial ones

- Keeping money in low-yield savings when investment would be appropriate

- Refusing to take calculated risks that could improve financial situations

Risk Seeking Behaviors:

- Alternatively, seeking high-risk investments as “get rich quick” solutions

- Gambling or lottery playing as financial strategies

- Taking on debt for risky business ventures

Decision Avoidance

Perhaps most destructively, financial stress often leads to avoiding financial decisions entirely:

Ostrich Effect:

- Avoiding checking account balances, investment statements, or credit reports

- Procrastinating on important financial planning tasks

- Ignoring financial problems hoping they’ll resolve themselves

- Delaying necessary financial conversations with partners or advisors

The Relationship Between Financial Stress and Money Management

Why Financial Stress Makes Money Management Harder

Financial stress creates a paradox: the times when you most need clear thinking about money are exactly when financial stress makes clear thinking most difficult.

Planning Impairment:

- Difficulty setting and maintaining long-term financial goals

- Problems with budgeting and expense tracking

- Reduced ability to anticipate and plan for future expenses

- Trouble prioritizing competing financial needs

Execution Problems:

- Following through on financial plans becomes more difficult

- Increased likelihood of abandoning budgets during stressful periods

- Problems maintaining consistent financial habits

- Difficulty resisting emotional financial decisions

Learning Interference:

- Reduced ability to learn from financial mistakes

- Difficulty absorbing new financial information or education

- Problems updating financial strategies based on new information

- Decreased willingness to seek financial help or advice

The Self-Reinforcing Nature of Financial Stress

Financial stress creates behaviors that often worsen financial situations, leading to more stress:

Avoidance Behaviors:

- Not paying bills on time due to anxiety (leading to late fees and damaged credit)

- Avoiding investment decisions (missing growth opportunities)

- Procrastinating on financial planning (missing tax benefits, employer matching)

- Not shopping around for better financial products (paying higher fees)

Emotional Spending:

- Retail therapy to cope with financial stress

- Impulse purchases during emotionally charged moments

- Social spending to maintain appearances despite financial strain

- Comfort purchasing when feeling financially insecure

Analysis Paralysis:

- Spending excessive time researching financial decisions without acting

- Seeking perfection in financial planning rather than making good decisions

- Waiting for ideal conditions that never come

- Missing time-sensitive financial opportunities

Breaking the Cycle: Strategies for Managing Financial Stress

Immediate Stress Management Techniques

When financial stress hits acutely, these techniques can help restore mental clarity:

Breathing Techniques:

- 4-7-8 Breathing: Inhale for 4 counts, hold for 7, exhale for 8

- Box Breathing: Inhale for 4, hold for 4, exhale for 4, hold for 4

- Belly Breathing: Deep diaphragmatic breathing for 5-10 minutes

Grounding Techniques:

- 5-4-3-2-1 Method: Identify 5 things you see, 4 you hear, 3 you touch, 2 you smell, 1 you taste

- Progressive Muscle Relaxation: Systematically tense and release muscle groups

- Mindful Observation: Focus intensely on a single object for 2-3 minutes

Cognitive Techniques:

- Reality Testing: Ask “What are the actual facts versus my fears?”

- Perspective Taking: Consider how important this will be in 5 years

- Problem vs. Emotion: Identify what parts are solvable problems versus emotional responses

Building Emotional Regulation Skills

Mindfulness Practices:

- Daily meditation focused on observing thoughts without judgment

- Mindful spending: pausing before financial decisions to check emotional state

- Body scan meditations to recognize physical stress responses

- Loving-kindness meditation to reduce financial shame and self-criticism

Emotional Awareness:

- Keeping an emotion-spending journal to identify triggers

- Learning to name and validate financial emotions

- Practicing self-compassion around financial mistakes

- Developing emotional vocabulary for financial experiences

Stress Response Management:

- Learning to recognize early signs of financial stress escalation

- Developing personal warning systems for emotional financial decisions

- Creating cooling-off periods for significant financial choices

- Building support systems for financial decision-making

Cognitive Restructuring for Financial Anxiety

Identifying Cognitive Distortions:

-

Catastrophizing: “If I lose this job, I’ll become homeless”

- Reframe: “Job loss would be challenging, but I have skills and options”

-

All-or-Nothing Thinking: “I’m terrible with money”

- Reframe: “I’m learning and improving my financial skills”

-

Mind Reading: “Everyone thinks I’m financially irresponsible”

- Reframe: “I don’t know what others think, and their opinions don’t define me”

-

Fortune Telling: “I’ll never be able to retire”

- Reframe: “I’m building retirement savings gradually and consistently”

-

Mental Filter: Focusing only on financial setbacks while ignoring progress

- Reframe: “I’ll acknowledge both challenges and successes”

Challenging Money Scripts:

- Identifying your inherited beliefs about money

- Questioning the accuracy and helpfulness of these beliefs

- Developing new, more balanced money narratives

- Practicing new self-talk around financial situations

Creating Financial Clarity and Control

Start with Baby Steps: When overwhelmed, focus on small, manageable financial actions:

- Check one account balance

- Pay one bill

- Set up one automatic transfer

- Read one financial article

- Have one financial conversation

Information Management:

- Organize financial information in one accessible location

- Create simple systems for tracking important financial data

- Set regular, limited time periods for financial review

- Avoid obsessive checking of accounts or investments

Decision-Making Frameworks:

- The 24-Hour Rule: Wait a day before non-essential purchases over a set amount

- The 10-10-10 Rule: Consider how you’ll feel about a decision in 10 minutes, 10 months, 10 years

- Values-Based Decisions: Align financial choices with personal values and long-term goals

- Cost-Benefit Analysis: Systematically weigh pros and cons of financial decisions

Practical Tools and Techniques

The Financial Stress Assessment

Regular self-assessment can help you recognize and address financial stress before it becomes overwhelming:

Weekly Check-In Questions:

- What financial worries occupied my mind this week?

- How did financial stress affect my sleep, appetite, or mood?

- What financial decisions did I avoid or rush through?

- When did I feel most and least in control of my finances?

- What financial wins or progress can I acknowledge?

Monthly Stress Inventory:

- Physical symptoms of financial stress

- Relationship impacts due to money concerns

- Work performance effects from financial worry

- Financial behaviors driven by stress rather than planning

- Progress on stress management techniques

Building Financial Resilience

Emergency Emotional Fund: Just as you need an emergency financial fund, create an emergency emotional fund:

- List of supportive people to call during financial stress

- Stress-management activities that work for you

- Reminders of past financial challenges you’ve overcome

- Positive affirmations specific to your financial journey

- Professional resources (therapists, financial counselors) for severe stress

Stress-Resistant Financial Planning:

- Build flexibility into financial plans to accommodate stress-driven decisions

- Create automatic systems that work even when you’re emotionally compromised

- Plan for emotional spending with designated “stress spending” budgets

- Develop multiple financial scenarios to reduce uncertainty anxiety

Technology and Support Tools

Helpful Apps and Tools:

- Meditation apps with specific financial stress content

- Budgeting apps with encouragement and progress tracking

- Automated savings tools that remove decision-making stress

- Financial tracking tools with positive reinforcement features

Professional Support Options:

- Financial therapists who specialize in money psychology

- Fee-only financial planners who can provide objective guidance

- Support groups for financial stress or debt management

- Employee assistance programs that include financial counseling

When to Seek Professional Help

Recognizing Severe Financial Stress

Some signs indicate that financial stress requires professional intervention:

Mental Health Red Flags:

- Persistent depression or anxiety affecting daily functioning

- Panic attacks triggered by financial situations

- Substance use to cope with financial stress

- Relationship breakdown due to financial conflict

- Suicidal thoughts related to financial problems

Behavioral Warning Signs:

- Complete avoidance of all financial management

- Compulsive spending despite financial hardship

- Financial decisions that seem completely irrational

- Inability to work or function due to financial worry

- Isolation from family and friends due to money shame

Types of Professional Help

Financial Therapists:

- Licensed mental health professionals with specialized training in financial psychology

- Help address emotional and psychological aspects of financial stress

- Combine therapy techniques with financial education

- Can work individually or with couples/families

Financial Counselors:

- Certified professionals who provide financial education and planning assistance

- Often available through non-profit organizations at low or no cost

- Focus on practical financial management skills

- May specialize in debt management, budgeting, or financial planning

Mental Health Professionals:

- Psychologists, social workers, or counselors who understand financial stress

- Traditional therapy approaches applied to money-related anxiety and depression

- May use cognitive-behavioral therapy, EMDR, or other therapeutic modalities

- Important when financial stress is part of broader mental health concerns

Building Long-Term Financial Wellness

Developing a Healthy Money Mindset

Growth vs. Fixed Mindset:

- Viewing financial skills as learnable rather than fixed traits

- Seeing financial setbacks as learning opportunities

- Believing in your ability to improve financial situations over time

- Focusing on progress rather than perfection

Abundance vs. Scarcity Thinking:

- Recognizing opportunities rather than just threats

- Understanding that others’ financial success doesn’t diminish your opportunities

- Focusing on what you have rather than what you lack

- Believing in your ability to create financial security

Self-Compassion in Financial Journey:

- Treating yourself with kindness during financial difficulties

- Recognizing that financial struggles are part of human experience

- Avoiding harsh self-judgment about financial mistakes

- Learning from setbacks without letting them define your worth

Creating Sustainable Financial Habits

Stress-Resistant Systems:

- Automate as many financial decisions as possible

- Create simple, clear financial routines

- Build in flexibility for emotional or stressful periods

- Focus on consistency rather than perfection

Regular Financial Wellness Practices:

- Weekly financial check-ins that include both practical and emotional aspects

- Monthly financial stress assessment and adjustment

- Quarterly goal review and celebration of progress

- Annual comprehensive financial and stress management review

The Role of Community and Support

Building Financial Support Networks:

- Finding trusted friends or family for financial conversations

- Joining support groups or online communities focused on financial wellness

- Working with professionals who understand financial psychology

- Creating accountability partnerships for financial goals

Reducing Financial Isolation:

- Normalizing financial conversations and challenges

- Sharing appropriate financial struggles and successes

- Learning from others’ financial experiences

- Building community around shared financial values and goals

Conclusion: From Financial Stress to Financial Wellness

Financial stress is not a character flaw or a sign of weakness—it’s a natural human response to one of life’s most significant stressors. Understanding the psychology behind financial stress is the first step toward breaking free from its grip and creating a healthier relationship with money.

Key Takeaways:

- Financial stress is real and measurable: It physically changes your brain and impairs decision-making ability

- Stress and problems are different: You can address financial stress even while working on financial problems

- Small steps matter: You don’t need to solve everything at once to reduce financial stress

- Professional help is available: Financial stress is treatable with the right tools and support

- Financial wellness is possible: With understanding and practice, you can develop a healthy, sustainable relationship with money

Moving Forward:

Start with one small step today. Whether it’s practicing a breathing technique when you check your account balance, having an honest conversation about money stress with someone you trust, or simply acknowledging that financial stress is affecting your life, taking action begins the healing process.

Remember that building financial wellness is a journey, not a destination. There will be setbacks, challenges, and stressful periods along the way. The goal isn’t to eliminate all financial stress—some level of concern about money is healthy and motivating. The goal is to develop the tools, understanding, and support systems that allow you to navigate financial challenges without being overwhelmed by them.

Your relationship with money can change. Financial stress doesn’t have to control your life. With awareness, practice, and often professional support, you can develop the financial wellness that allows you to make clear-headed financial decisions and enjoy the security and freedom that come with financial health.

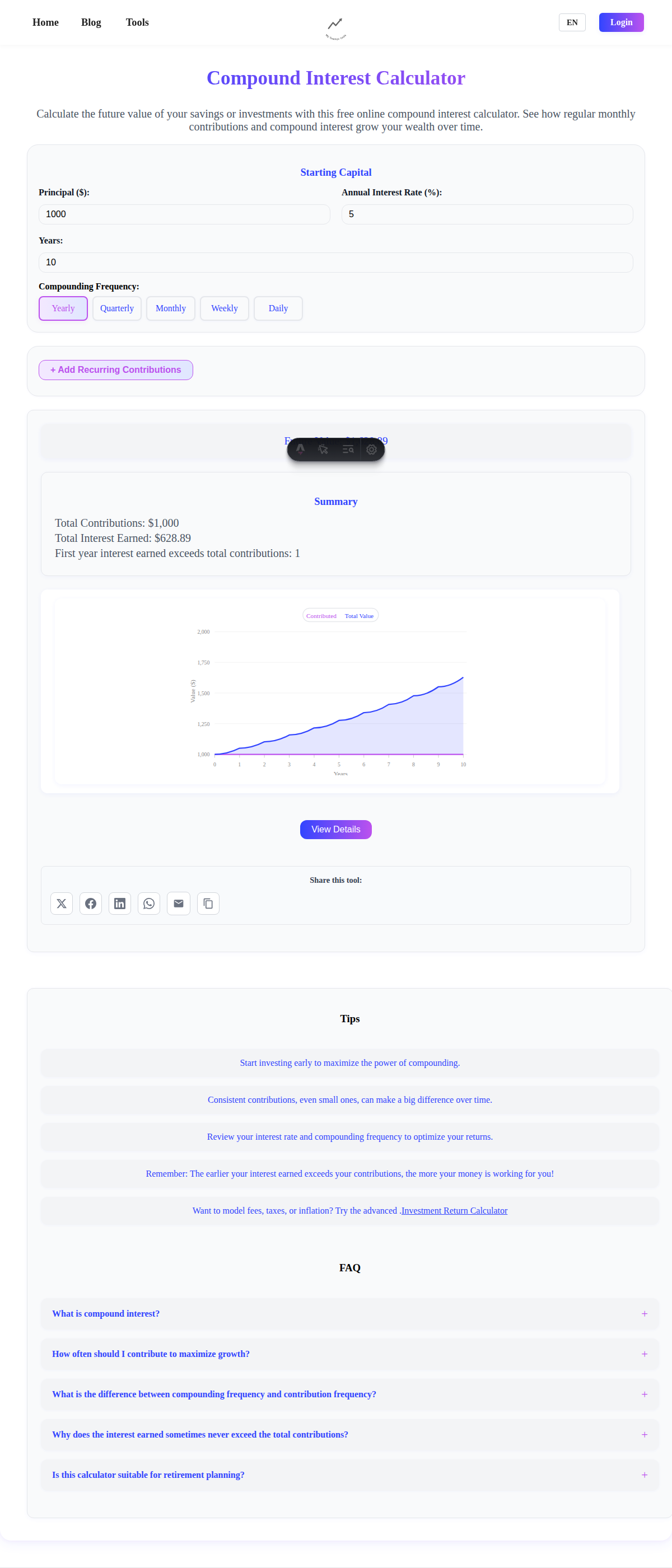

Use our financial calculators to take practical steps forward—try the Budget Calculator to regain spending control, the Emergency Fund Calculator to build security, or the Debt Payoff Calculator to create a clear debt elimination plan. Sometimes taking concrete financial action is the best antidote to financial stress.

The path from financial stress to financial wellness starts with understanding, continues with action, and leads to a more peaceful, empowered relationship with money. You have the ability to change your financial stress story—starting today.

This article provides general information about financial stress and coping strategies. It should not be considered a substitute for professional mental health treatment or financial advice. If you’re experiencing severe financial stress, depression, anxiety, or other mental health concerns, please consult with qualified mental health professionals. For personalized financial guidance, consider working with certified financial planners or counselors.