Financial Independence on Any Income: The FIRE Movement Explained

Imagine waking up every morning with complete freedom over how you spend your time. No alarm clock demanding you rush to a job you tolerate. No boss dictating your schedule. No financial stress keeping you awake at night. This isn’t just a fantasy—it’s the reality that thousands of people worldwide have achieved through the FIRE movement: Financial Independence, Retire Early.

FIRE isn’t about getting rich quick or winning the lottery. It’s a systematic approach to building wealth and reducing expenses that can work for people at virtually any income level. Whether you’re earning $40,000 or $400,000 annually, the principles of FIRE can help you achieve financial independence faster than traditional retirement planning.

This comprehensive guide explores what FIRE really means, the different approaches within the movement, practical strategies for implementation, and realistic expectations for various income levels. You’ll discover that financial independence isn’t just for high earners—it’s a achievable goal for anyone willing to be intentional about their money.

Understanding FIRE: More Than Just Early Retirement

What FIRE Really Means

FIRE stands for Financial Independence, Retire Early, but the movement encompasses much more than simply quitting work young:

Financial Independence (FI):

- Having enough assets to live indefinitely without employment income

- Freedom to choose work based on passion, not financial necessity

- Security from economic downturns, job loss, or health issues

- Ability to take risks, pursue dreams, or help others

- Peace of mind that comes from financial security

Retire Early (RE):

- Option to stop traditional employment before typical retirement age

- Freedom to pursue passion projects, travel, or volunteer work

- Time for family, health, hobbies, and personal growth

- Escape from jobs that are unfulfilling or harmful to well-being

- Flexibility to work when and how you choose

The Core FIRE Principle: The 4% Rule

The foundation of FIRE planning is the 4% rule, which suggests you can safely withdraw 4% of your investment portfolio annually without depleting the principal. This means:

FIRE Number = Annual Expenses ÷ 0.04

Examples:

- Annual expenses of $40,000 → FIRE number of $1,000,000

- Annual expenses of $60,000 → FIRE number of $1,500,000

- Annual expenses of $100,000 → FIRE number of $2,500,000

Key Insight: Your FIRE number depends more on your expenses than your income. A person earning $50,000 who spends $30,000 needs less to retire than someone earning $100,000 who spends $80,000.

Common FIRE Misconceptions

Myth 1: “FIRE is only for high earners” Reality: FIRE is about the gap between income and expenses, not absolute income level. Lower earners often have advantages like simpler lifestyles and lower target numbers.

Myth 2: “You have to live like a monk” Reality: FIRE emphasizes intentional spending on what truly matters while cutting ruthlessly on what doesn’t. Many FIRE practitioners live rich, fulfilling lives.

Myth 3: “You can never spend money again” Reality: FIRE provides financial security that often allows for more generous spending on meaningful experiences and causes.

Myth 4: “You have to quit working completely” Reality: Many choose “Barista FIRE” or part-time work, using financial independence for flexibility rather than complete retirement.

The Different Types of FIRE

Lean FIRE: Minimalist Financial Independence

Target: 25x annual expenses at a lean lifestyle (typically $25,000-$40,000 annually) FIRE Number: $625,000-$1,000,000 Timeline: Often achievable in 10-15 years on modest incomes

Characteristics:

- Minimalist lifestyle focused on essentials

- Geographic arbitrage (living in low-cost areas)

- Emphasis on experiences over possessions

- Strong community focus and DIY approach

- Often appeals to those seeking simple living

Strategies:

- House hacking or alternative housing arrangements

- Growing your own food or bulk buying

- Mastering repair and maintenance skills

- Choosing free or low-cost entertainment

- Optimizing every expense category

Real Example: Sarah, a teacher earning $45,000, achieved Lean FIRE in 12 years by:

- Living in a tiny house (no mortgage)

- Cycling instead of car ownership

- Growing vegetables and cooking at home

- Saving 60% of income through extreme optimization

- Retiring at 35 with $800,000 invested

Regular FIRE: Mainstream Financial Independence

Target: 25x annual expenses at middle-class lifestyle (typically $40,000-$80,000 annually) FIRE Number: $1,000,000-$2,000,000 Timeline: Typically 15-25 years depending on income and savings rate

Characteristics:

- Comfortable middle-class lifestyle maintained

- Balance between optimization and enjoyment

- Moderate geographic flexibility

- Family-friendly approach

- Most common FIRE path

Strategies:

- Homeownership with reasonable mortgage

- One or two modest vehicles

- Strategic travel and entertainment spending

- Quality purchases that last

- 40-60% savings rates through income optimization

Real Example: Mark and Jennifer, combined income $120,000, achieved FIRE in 18 years by:

- Buying a duplex and house-hacking

- Driving reliable used cars

- Taking strategic vacations and eating out occasionally

- Saving 50% of income consistently

- Retiring at 45 with $1.6 million invested

Fat FIRE: Luxury Financial Independence

Target: 25x annual expenses at high lifestyle (typically $100,000+ annually) FIRE Number: $2,500,000-$10,000,000+ Timeline: Often 20-30 years but with higher quality of life throughout

Characteristics:

- Maintains high standard of living

- Premium housing, travel, and experiences

- Private schools, luxury goods, etc.

- Often requires high income to achieve

- Focus on optimizing rather than cutting

Strategies:

- Maximizing high income through career advancement

- Strategic luxury purchases (quality over quantity)

- Geographic optimization for high-earning opportunities

- Business ownership or investment property

- 30-50% savings rates on high income

Real Example: David, software executive earning $300,000, achieved Fat FIRE in 22 years by:

- Maximizing stock options and bonuses

- Buying quality homes in appreciating markets

- Strategic business investments

- Maintaining lifestyle while saving $120,000+ annually

- Retiring at 50 with $4.5 million invested

Coast FIRE: Passive Financial Independence

Target: Enough invested that compound growth will reach FIRE number by traditional retirement age Current Need: Often $200,000-$500,000 by age 30-35 Benefit: Financial stress relief without complete independence

Characteristics:

- Provides security and flexibility

- Allows career risk-taking or passion pursuit

- Removes pressure for constant savings growth

- Bridge to full FIRE

- Peace of mind about retirement security

Calculation Example: If you have $300,000 invested at age 30, and it grows at 7% annually, you’ll have $2.4 million at age 60 without adding another dollar. This covers a $96,000 annual retirement lifestyle.

Barista FIRE: Semi-Retirement Financial Independence

Target: Enough invested to cover most expenses, with part-time work covering the gap Typical Split: 70-80% from investments, 20-30% from work Benefit: Earlier “retirement” with reduced financial pressure

Characteristics:

- Work becomes optional and enjoyable

- Health insurance often available through employment

- Lower FIRE number required

- Gradual transition to full retirement

- Maintains social connections and purpose

Example Strategy: Instead of needing $1.5 million for full FIRE, you might achieve Barista FIRE with $1 million invested, earning $20,000 annually from enjoyable part-time work.

FIRE Strategies by Income Level

Lower Income ($30,000-$50,000): Focus on Lean FIRE

Primary Advantages:

- Lower target FIRE numbers

- Naturally lean lifestyle

- Strong community and resourcefulness

- Geographic arbitrage opportunities

Key Strategies:

Expense Optimization:

- Housing: House hacking, roommates, or alternative arrangements

- Transportation: Cycling, public transit, or car sharing

- Food: Cooking, growing vegetables, bulk buying

- Entertainment: Free activities, library resources, community events

Income Maximization:

- Skill development for career advancement

- Side hustles and gig economy work

- Selling unused possessions

- Cashback and rewards optimization

Timeline Example: Income: $40,000, Expenses: $25,000, Savings: $15,000 (37.5%) Target: $625,000 (25x $25,000) Timeline: 15-17 years to Lean FIRE

Middle Income ($50,000-$100,000): Regular FIRE Path

Primary Advantages:

- Balanced approach possible

- Family-friendly strategies

- Reasonable timeline

- Quality of life maintenance

Key Strategies:

Balanced Optimization:

- Housing: Strategic homeownership or optimal renting

- Transportation: Reliable used vehicles, strategic locations

- Travel: Rewards hacking, off-season travel, house swapping

- Family: Quality time over expensive activities

Career Development:

- Professional skill building

- Strategic job changes for income growth

- Professional networking

- Side business development

Timeline Example: Income: $75,000, Expenses: $45,000, Savings: $30,000 (40%) Target: $1,125,000 (25x $45,000) Timeline: 18-20 years to FIRE

Higher Income ($100,000+): Multiple FIRE Options

Primary Advantages:

- Faster timelines possible

- Fat FIRE achievable

- Business investment opportunities

- Geographic flexibility

Key Strategies:

Income Optimization:

- Maximizing high-income career potential

- Business ownership or investment

- Stock options and equity compensation

- Real estate investment

Strategic Spending:

- Quality over quantity approach

- Tax-advantaged investment maximization

- Geographic optimization for income

- Strategic debt for investment leverage

Timeline Examples:

Conservative Approach: Income: $150,000, Expenses: $75,000, Savings: $75,000 (50%) Target: $1,875,000 (25x $75,000) Timeline: 12-15 years to FIRE

Aggressive Approach: Income: $200,000, Expenses: $60,000, Savings: $140,000 (70%) Target: $1,500,000 (25x $60,000) Timeline: 8-10 years to FIRE

Practical Implementation Steps

Phase 1: Foundation Building (Months 1-6)

Financial Assessment:

- Calculate net worth (assets minus liabilities)

- Track all expenses for 3-6 months

- Identify your current savings rate

- Determine your potential FIRE number

Goal Setting:

- Choose your FIRE type based on lifestyle preferences

- Set target timeline based on income and expenses

- Calculate required monthly savings rate

- Identify major expense categories for optimization

Emergency Preparation:

- Build emergency fund (3-6 months expenses)

- Optimize insurance coverage

- Eliminate high-interest debt

- Establish basic investment accounts

Phase 2: Optimization (Months 6-24)

Expense Reduction:

- Housing: Optimize biggest expense through downsizing, house hacking, or relocation

- Transportation: Reduce car expenses or eliminate car ownership

- Food: Master home cooking and strategic shopping

- Subscriptions: Audit and eliminate unused services

Income Maximization:

- Negotiate salary increases or seek promotions

- Develop marketable skills for career advancement

- Start side hustles or freelance work

- Optimize tax strategies and employer benefits

Investment Foundation:

- Maximize employer 401(k) matching

- Open and fund IRA accounts

- Choose low-cost index fund portfolio

- Automate investment contributions

Phase 3: Acceleration (Years 2-5)

Advanced Strategies:

- Real Estate: Consider rental property or house hacking

- Business: Start scalable side business or invest in others

- Geographic Arbitrage: Move to lower-cost, higher-opportunity areas

- Investment Optimization: Tax-loss harvesting, asset location

Lifestyle Design:

- Experiment with “mini-retirements” or sabbaticals

- Develop non-work interests and skills

- Build community with like-minded individuals

- Practice living on investment income

Phase 4: Financial Independence (Years 5+)

Portfolio Management:

- Reach target FIRE number

- Implement withdrawal strategy

- Maintain emergency fund

- Plan for healthcare coverage

Transition Planning:

- Gradual work reduction or career change

- Develop meaningful post-FIRE activities

- Consider geographic relocation

- Plan for potential return to work

Common Challenges and Solutions

Challenge 1: Family and Social Pressure

Problem: Family and friends don’t understand FIRE goals, creating social tension and pressure to spend.

Solutions:

- Educate close family about FIRE benefits

- Find FIRE community online and locally

- Lead by example rather than preaching

- Compromise on some social spending for relationship harmony

- Focus on shared values like security and freedom

Challenge 2: Healthcare Coverage

Problem: Employer health insurance is often crucial, making early retirement risky.

Solutions:

- Research ACA marketplace options

- Consider Barista FIRE for continued employer coverage

- Build larger emergency fund for health expenses

- Explore healthcare sharing ministries

- Factor health insurance costs into FIRE number

Challenge 3: Market Volatility and Sequence Risk

Problem: Market downturns early in retirement can devastate portfolios.

Solutions:

- Build larger emergency fund (1-2 years expenses)

- Implement bond tent as you approach FIRE

- Consider slightly higher withdrawal rate initially, adjusting based on market performance

- Maintain flexibility to return to work if necessary

- Use bucket strategy for different time horizons

Challenge 4: Lifestyle Inflation and Burnout

Problem: Aggressive saving can lead to deprivation feelings and eventual overspending.

Solutions:

- Build fun money into budget

- Focus on optimizing rather than eliminating all expenses

- Take strategic breaks or “mini-retirements”

- Remember your why—freedom and security

- Celebrate milestones along the journey

Challenge 5: Income Plateaus

Problem: Limited income growth makes FIRE timeline longer than desired.

Solutions:

- Invest in education and skill development

- Network strategically for career opportunities

- Start side business or freelance work

- Consider geographic arbitrage

- Focus on expense optimization if income is truly limited

Global Perspectives on FIRE

FIRE in Different Countries

United States:

- Strong 401(k) and IRA systems support FIRE

- Healthcare challenges require planning

- Geographic arbitrage opportunities within country

- Strong FIRE community and resources

Europe:

- Stronger social safety nets reduce some FIRE urgency

- Higher tax rates require different strategies

- Geographic arbitrage across EU countries

- Pension systems complement FIRE planning

Australia:

- Superannuation system aligns with FIRE principles

- Strong property investment culture

- Geographic isolation affects arbitrage options

- Growing FIRE community

Asia:

- Rapid economic growth creates FIRE opportunities

- Strong saving cultures support FIRE principles

- Lower cost of living in many areas

- Family obligations may affect FIRE planning

Cultural Considerations

Individualistic vs. Collectivistic Cultures:

- FIRE may conflict with family support obligations

- Different attitudes toward work and retirement

- Varying social pressures around consumption

- Need to adapt FIRE principles to cultural values

Economic Development Levels:

- FIRE strategies vary based on economic stability

- Infrastructure affects lifestyle choices

- Investment options differ by country

- Currency risk considerations for international FIRE

Advanced FIRE Strategies

Geographic Arbitrage

Domestic Arbitrage:

- Work remotely from lower-cost areas

- Retire to areas with favorable tax treatment

- Take advantage of cost-of-living differences

- Consider climate and lifestyle preferences

International Arbitrage:

- Retire to countries with lower living costs

- Navigate visa and residency requirements

- Consider healthcare and infrastructure quality

- Plan for currency exchange risks

Business and Real Estate Investment

Business Ownership:

- Start scalable businesses for passive income

- Invest in franchises or established businesses

- Partner with others for larger investments

- Focus on businesses that align with FIRE lifestyle

Real Estate Strategies:

- Rental property for passive income

- House hacking to reduce living expenses

- REITs for diversified real estate exposure

- Real estate syndications for larger investments

Tax Optimization

Pre-Tax vs. Roth Strategy:

- Balance current tax savings with future tax rates

- Consider tax diversification across account types

- Plan for healthcare subsidies based on income

- Time Roth conversions strategically

Geographic Tax Planning:

- Consider state income tax implications

- Plan for property tax differences

- Understand international tax obligations

- Time major income events for tax efficiency

Measuring Progress and Staying Motivated

Key FIRE Metrics

Financial Metrics:

- Net worth growth rate

- Savings rate percentage

- Investment return performance

- Years to FIRE remaining

Lifestyle Metrics:

- Stress levels and life satisfaction

- Work flexibility and options

- Relationship quality

- Health and well-being

Celebrating Milestones

Financial Milestones:

- First $100,000 invested

- One year of expenses saved

- Coast FIRE achievement

- 50% to FIRE number

Lifestyle Milestones:

- Debt freedom achievement

- Major expense optimization

- Side income development

- Work flexibility gained

Building Community

Online Communities:

- Reddit FIRE forums

- Facebook FIRE groups

- FIRE blogs and podcasts

- Meetup groups

Local Communities:

- FIRE meetups in major cities

- Financial independence clubs

- Investment clubs

- Minimalist and simple living groups

Conclusion: Your Path to Financial Independence

Financial independence through the FIRE movement isn’t about deprivation or extreme measures—it’s about being intentional with your money so you can be intentional with your life. Whether you choose Lean FIRE, Fat FIRE, or something in between, the principles remain the same: save aggressively, invest wisely, and optimize your lifestyle for both happiness and efficiency.

Key Takeaways:

- FIRE is accessible at any income level - focus on the gap between income and expenses

- Choose the FIRE type that fits your values - lean, regular, fat, coast, or barista

- Start with foundation building - emergency fund, debt elimination, basic investing

- Optimize both income and expenses - career development and lifestyle design

- Think globally - geographic arbitrage can accelerate your timeline

- Build community - surround yourself with like-minded people

- Stay flexible - adapt your plan as life circumstances change

Your Next Steps:

- Calculate your current savings rate and potential FIRE number

- Choose which type of FIRE appeals to you most

- Use our Savings Goal Calculator to plan your timeline

- Start tracking expenses and identifying optimization opportunities

- Begin automating investments and building your portfolio

- Connect with the FIRE community for support and motivation

The journey to financial independence is a marathon, not a sprint. Every dollar saved and invested today compounds into future freedom. Whether you achieve FIRE in 10 years or 25, the habits and mindset you develop will create a more intentional, secure, and fulfilling life.

Your financial independence doesn’t require a perfect plan—it requires starting today with the income and circumstances you have. The best time to plant a tree was 20 years ago. The second-best time is now.

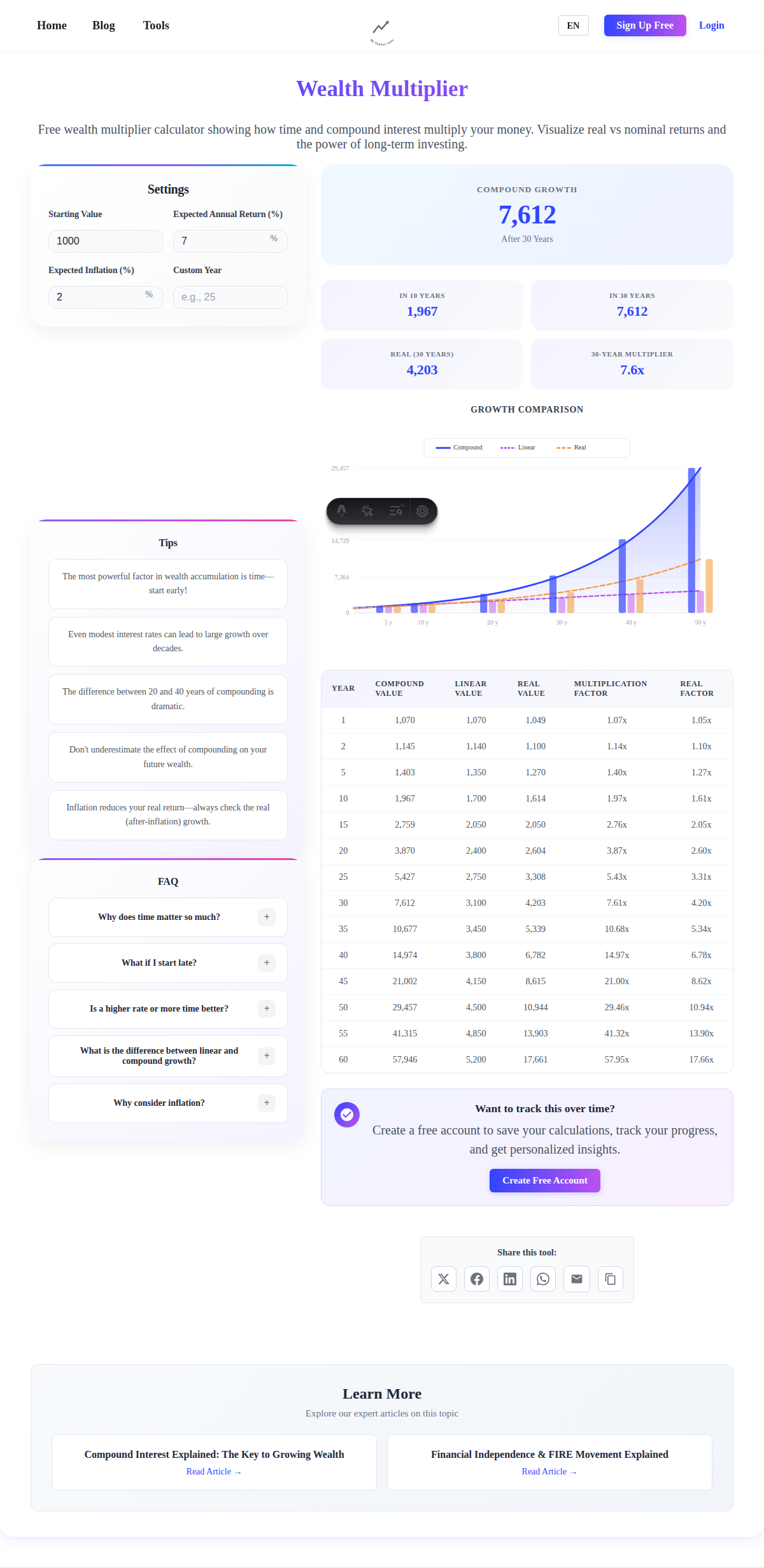

Use our financial calculators to model your FIRE journey: the Investment Return Calculator to project portfolio growth, the Compound Interest Calculator to see the power of time, and the Savings Goal Calculator to track your progress toward financial independence.

Financial independence isn’t just about money—it’s about designing a life of purpose, freedom, and security. Your FIRE journey starts with the next financial decision you make. Make it count.

This guide provides general information about the FIRE movement and should not be considered personalized financial advice. Consider consulting with qualified financial professionals for guidance specific to your situation. Past investment performance does not guarantee future results, and all investments carry risk of loss.