The Complete Guide to Teaching Kids About Money: Age-Appropriate Financial Education

Money skills aren’t taught in most schools, yet they’re among the most important life skills children need to develop. As a parent, grandparent, or educator, you have the power to give children a tremendous advantage by teaching them financial literacy from an early age.

Research shows that children’s money habits are largely formed by age seven, and their financial behaviors as adults are significantly influenced by what they learn in childhood. Despite this, many parents feel unprepared to teach financial concepts, unsure of when to start, or unclear about age-appropriate approaches.

This comprehensive guide provides practical, proven strategies for teaching children about money at every stage of development. From toddlers learning to count coins to teenagers managing their first jobs, you’ll discover activities, frameworks, and approaches that build strong financial foundations for life.

Why Financial Education for Kids Matters

The Current State of Financial Literacy

Financial illiteracy is a widespread problem affecting adults worldwide:

- Only 57% of American adults are financially literate

- 40% of adults can’t cover a $400 emergency expense

- Average American has less than $1,000 in savings

- Two-thirds of Americans can’t pass a basic financial literacy test

These statistics highlight a critical gap in education that starts in childhood and persists throughout life.

The Benefits of Early Financial Education

Academic and Cognitive Benefits:

- Improved math skills through practical application

- Enhanced critical thinking and decision-making abilities

- Better understanding of cause-and-effect relationships

- Development of planning and goal-setting skills

Character and Life Skills:

- Increased self-discipline and delayed gratification

- Better understanding of value and priorities

- Development of responsibility and accountability

- Enhanced problem-solving abilities

Long-term Financial Benefits:

- Higher savings rates as adults

- Better investment decisions

- Lower likelihood of debt problems

- Greater financial confidence and security

Family Benefits:

- Reduced money-related family conflicts

- Better communication about financial goals

- Shared family values around money

- Preparation for major financial decisions

Age-Appropriate Teaching Strategies

Ages 3-5: Foundation Building

At this age, children are naturally curious and learning basic concepts. Focus on concrete, visual learning experiences that establish fundamental money concepts.

Core Concepts to Teach:

- Money is used to buy things

- Different coins and bills have different values

- We work to earn money

- Sometimes we have to wait to buy things we want

- Needs vs. wants basic distinction

Teaching Activities:

1. Coin Sorting and Counting

- Use real coins for tactile learning

- Sort by type, size, and color

- Count pennies up to 10, then 20

- Play “coin store” games with simple items

- Create coin rubbings with paper and crayons

2. Play Store Activities

- Set up a pretend store with toy cash register

- Use play money or real coins

- Price simple items (stickers, small toys)

- Practice “buying” and “selling”

- Take turns being customer and cashier

3. Needs vs. Wants Introduction

- During shopping trips, point out needs (food, clothes) vs. wants (toys, candy)

- Use picture books about money and spending

- Create simple visual charts with needs/wants categories

- Discuss choices: “We need groceries, but we want ice cream. What should we buy first?”

4. Savings Container

- Provide a clear jar for saving coins

- Let them add money and watch it grow

- Count the money together regularly

- Set simple savings goals (enough for a small toy)

Teaching Tools:

- Picture books about money (“The Berenstain Bears’ Trouble with Money,” “Alexander, Who Used to Be Rich Last Sunday”)

- Play money and toy cash registers

- Clear savings jars or piggy banks

- Simple math games involving money

Parental Strategies:

- Use cash when shopping with children so they can see money being exchanged

- Let them handle money (with supervision)

- Narrate your financial decisions: “I’m choosing the store-brand cereal because it costs less”

- Be patient with questions and encourage curiosity

- Keep lessons short (5-10 minutes) to match attention spans

Ages 6-8: Basic Money Management

Children this age can understand more complex concepts and handle simple responsibilities. They’re developing reading and math skills that support financial learning.

Core Concepts to Teach:

- Earning money through chores and tasks

- Making choices about spending

- Saving for specific goals

- Comparing prices and finding deals

- Understanding that money is finite

Teaching Activities:

1. First Allowance System Set up a structured allowance that teaches responsibility:

Weekly Allowance Structure:

- Base amount: $1 per year of age (6-year-old gets $6/week)

- Divide into three categories: Save (30%), Share/Give (10%), Spend (60%)

- Use clear jars or envelopes labeled for each purpose

- Consistency is key—pay on the same day each week

2. Chore Charts and Earning

- Create age-appropriate chore lists with payment amounts

- Examples: Making bed ($0.50), feeding pets ($1), helping with laundry ($2)

- Distinguish between family responsibilities (unpaid) and extra earning opportunities

- Track completion with visual charts

3. Simple Budgeting Games

- Give them a “budget” for a specific purchase (like snacks for a family movie night)

- Let them compare options and make choices

- Practice at dollar stores where everything costs the same

- Use board games like Payday Jr. or The Game of Life Jr.

4. Goal-Setting Activities

- Help them identify something they want to buy

- Calculate how many weeks of saving it will take

- Create visual progress charts

- Celebrate when goals are achieved

5. Price Comparison Shopping

- Involve them in grocery shopping decisions

- Compare unit prices on simple items

- Look for sales and use coupons together

- Discuss why you choose certain brands or stores

Teaching Tools:

- Three-jar savings system (Save, Share, Spend)

- Age-appropriate board games with money elements

- Simple budget worksheets with pictures

- Price comparison worksheets for common items

Common Mistakes to Avoid:

- Don’t rescue them from poor spending decisions—let them learn

- Don’t tie allowance to basic chores—separate earning from family responsibilities

- Don’t make it too complex—keep systems simple and visual

- Don’t bail them out if they spend their “save” money—let natural consequences teach

Ages 9-12: Expanding Financial Concepts

Pre-teens can handle more sophisticated financial concepts and take on greater responsibility. They’re developing stronger math skills and can understand abstract concepts like interest and inflation.

Core Concepts to Teach:

- Interest on savings (compound growth)

- Budgeting with multiple categories

- Comparison shopping and research

- Understanding value vs. price

- Introduction to banking concepts

- Basic entrepreneurship

Teaching Activities:

1. Advanced Allowance System Increase complexity while maintaining structure:

Monthly Allowance Structure:

- Increase base amount: $4-5 per year of age per month

- Add more categories: Save (25%), Long-term Save (15%), Give (10%), Spend (50%)

- Introduce “interest” payments: Add 10% monthly to long-term savings

- Let them manage clothing budget for certain items

2. Banking Introduction

- Open their first savings account

- Explain how banks work and pay interest

- Review monthly statements together

- Set goals for account balance growth

- Compare interest rates at different banks

3. Research Projects Before major purchases, teach research skills:

- Compare products online and in stores

- Read reviews and ratings

- Calculate cost per use (how much per hour of enjoyment)

- Consider alternatives (new vs. used, different brands)

4. Entrepreneurship Activities

- Lemonade stands or neighborhood services

- Selling crafts or baked goods

- Pet-sitting or plant-watering for neighbors

- Teaching younger children skills they’ve mastered

- Calculate profit vs. revenue

5. Family Budget Involvement

- Share age-appropriate information about family expenses

- Let them help with specific budget categories (groceries, entertainment)

- Involve them in family financial decisions that affect them

- Discuss trade-offs: “If we spend more on vacation, we have less for dining out”

6. Charitable Giving Projects

- Research charities together

- Let them choose where to donate their “give” money

- Volunteer as a family

- Discuss different ways to help others (time, money, skills)

Teaching Tools:

- Real bank accounts with online access

- Spreadsheets for tracking allowance and goals

- Research worksheets for major purchases

- Business plan templates for entrepreneurship projects

- Family budget discussions (age-appropriate portions)

Advanced Concepts to Introduce:

- Opportunity cost: “If you buy this game, you won’t have money for the movie”

- Delayed gratification: “If you wait three months, you could afford the better version”

- Risk vs. reward: “Lending money to your sibling might mean you don’t get it back”

- Value of time: “Working two hours to earn money for something you’ll use once”

Ages 13-15: Pre-Teen Money Management

Teenagers need more sophisticated financial education as they prepare for greater independence. They can understand complex concepts and handle significant responsibility.

Core Concepts to Teach:

- Advanced budgeting and expense tracking

- Understanding credit and debt

- Basic investment principles

- Cost of lifestyle choices

- Consumer rights and responsibilities

- Tax basics

Teaching Activities:

1. Teen Banking and Debit Cards

- Open teen checking accounts with debit cards

- Teach ATM usage and fees

- Explain overdraft protection and consequences

- Practice online banking and mobile apps

- Discuss fraud protection and security

2. Budget for Personal Expenses Expand their financial responsibility:

- Clothing budget: Give them seasonal amounts to manage

- Entertainment budget: Movies, games, outings with friends

- Personal care: Shampoo, cosmetics, personal items

- Phone expenses: If they have a phone, they help pay for it

3. Part-Time Work Introduction

- Age-appropriate jobs: Babysitting, lawn care, tutoring

- Understand labor laws for their age

- Calculate hourly wages after taxes

- Discuss workplace rights and responsibilities

- Open their first “paycheck” direct deposit

4. Credit Education Even though they can’t get credit cards yet, teach the concepts:

- How credit scores work and why they matter

- Dangers of debt and minimum payments

- Good debt vs. bad debt concepts

- Identity theft prevention

- Building credit responsibly (for future reference)

5. Investment Basics

- Open a custodial investment account

- Explain stocks, bonds, and mutual funds

- Start with companies they know (Apple, Disney, Nike)

- Discuss risk and diversification

- Track their investments monthly

6. Major Purchase Planning For bigger items (gaming systems, sports equipment, tech):

- Research and comparison shopping

- Calculate total cost of ownership

- Consider financing vs. saving up

- Evaluate need vs. want more critically

- Plan for maintenance and accessories

Teaching Tools:

- Teen-friendly banking apps

- Investment tracking websites and apps

- Credit score simulators and educational games

- Part-time job search websites

- Budgeting apps designed for teens

Real-World Applications:

- Let them plan and budget for a school trip

- Have them research and present options for family purchases

- Give them responsibility for specific household budgets

- Let them negotiate better deals on family services (phone plans, subscriptions)

Ages 16-18: Pre-Adult Financial Preparation

High school students need comprehensive financial education to prepare for independence. Focus on real-world skills they’ll need immediately after graduation.

Core Concepts to Teach:

- Advanced budgeting for independent living

- College financing and student loans

- Career planning and salary research

- Apartment hunting and lease agreements

- Insurance basics

- Tax preparation and filing

- Long-term financial planning

Teaching Activities:

1. Independent Living Budget Simulation Create realistic scenarios for post-graduation life:

- Research local apartment rents and utilities

- Calculate grocery and transportation costs

- Factor in student loan payments

- Include insurance costs (health, auto, renters)

- Determine required income for different lifestyle levels

2. College Financial Planning

- Understand different types of financial aid

- Compare in-state vs. out-of-state vs. community college costs

- Calculate student loan payments for different scenarios

- Research career earning potential

- Evaluate return on investment for different majors

3. First Real Job Preparation

- Resume writing and interview skills

- Understanding employment contracts and benefits

- Negotiation basics for salary and benefits

- Workplace professionalism and financial responsibility

- Understanding payroll deductions and taxes

4. Credit Building When age-appropriate:

- Become authorized user on parent’s credit card

- Understand credit reports and how to read them

- Learn about different types of credit

- Practice with secured credit cards

- Plan for building credit history responsibly

5. Tax Education

- File their first tax return

- Understand W-2s and 1099s

- Learn about deductions and credits

- Use tax preparation software

- Understand tax obligations for different income types

6. Insurance Education

- Understand health insurance basics

- Learn about auto insurance requirements and costs

- Introduction to renters and life insurance

- Risk assessment and coverage decisions

- How to file claims and work with insurers

Teaching Tools:

- College cost calculators

- Student loan payment calculators

- Apartment hunting websites and cost-of-living calculators

- Tax preparation software

- Credit monitoring services

- Insurance comparison websites

Transition Strategies:

- Gradually increase financial responsibility

- Joint bank accounts that transition to individual accounts

- Co-signed arrangements with clear expectations

- Regular financial check-ins during first year of independence

- Emergency fund for unexpected situations

Allowance Systems and Frameworks

The Three-Jar System (Ages 3-8)

Structure:

- Save: 30% of allowance

- Share/Give: 10% of allowance

- Spend: 60% of allowance

Implementation:

- Use clear jars so children can see money accumulating

- Label jars with pictures for non-readers

- Make deposits a weekly ritual

- Set minimum accumulation before spending from save jar

- Let children choose charitable recipients for share jar

Benefits:

- Visual and tactile learning

- Establishes good habits early

- Simple enough for young children

- Covers all major money concepts

The Five-Envelope System (Ages 9-15)

Structure:

- Emergency Save: 15% (untouchable except for real emergencies)

- Goal Save: 15% (for specific larger purchases)

- Give: 10% (charity, gifts, helping others)

- Spend Now: 50% (immediate wants and needs)

- Learn: 10% (books, classes, educational experiences)

Implementation:

- Use labeled envelopes or separate savings accounts

- Review allocations monthly

- Adjust percentages as children mature

- Connect to real banking when age-appropriate

- Track progress toward goals visually

Benefits:

- More sophisticated money management

- Introduces emergency fund concept

- Emphasizes education and giving

- Prepares for adult budgeting

The Percentage-Based System (Ages 16-18)

Structure:

- Fixed Savings: 20% (retirement mindset)

- Flexible Savings: 15% (car, college, large purchases)

- Giving: 10% (charity, family gifts)

- Living Expenses: 45% (gas, food, entertainment, clothes)

- Education/Growth: 10% (books, courses, career development)

Implementation:

- Use real bank accounts and budgeting apps

- Monthly reviews and adjustments

- Connect to part-time job income

- Practice with summer job earnings

- Prepare for post-graduation budgeting

Benefits:

- Real-world preparation

- Percentage-based thinking transfers to any income level

- Emphasizes long-term savings

- Builds budgeting skills

Common Challenges and Solutions

Challenge: “Money Doesn’t Grow on Trees” vs. Explaining Limits

Problem: Children don’t understand why parents can’t buy everything they want.

Solution:

- Be transparent about budgeting in age-appropriate ways

- Explain trade-offs: “If we buy this, we can’t afford that”

- Show them your decision-making process

- Use visual aids like family budget pie charts

- Distinguish between can’t afford and choose not to buy

Challenge: Peer Pressure and Lifestyle Inflation

Problem: Children want expensive items because their friends have them.

Solution:

- Discuss family values and priorities

- Teach about different families having different financial situations

- Focus on value and personal goals rather than comparison

- Create “want” lists and waiting periods

- Emphasize experiences over material possessions

Challenge: Instant Gratification in Digital Age

Problem: Online shopping and digital payments make spending feel less real.

Solution:

- Use cash for teaching moments

- Create waiting periods before online purchases

- Discuss the psychology of marketing and sales tactics

- Practice delayed gratification with savings goals

- Limit access to digital spending until older

Challenge: Inconsistent Teaching Between Parents

Problem: Parents have different money philosophies or teaching approaches.

Solution:

- Have honest discussions about money values as parents

- Agree on basic rules and approaches

- Respect differences while maintaining consistency on key issues

- Use differences as teaching opportunities about perspectives

- Focus on shared goals for children’s financial education

Challenge: Fear of Creating Materialistic Children

Problem: Worry that talking about money will make children too focused on material things.

Solution:

- Emphasize money as a tool, not a goal

- Include giving and sharing as core values

- Focus on experiences and relationships alongside financial goals

- Teach about contentment and gratitude

- Model healthy money attitudes yourself

Activities and Games by Age Group

Toddlers and Preschoolers (Ages 3-5)

Coin Sorting Race

- Mix different coins in a bowl

- Race to sort them into separate containers

- Practice counting and identifying differences

- Make it fun with colors and sizes

Money Memory Game

- Show different coins, then hide them

- Ask child to remember which ones were shown

- Start simple with 2-3 coins, increase complexity

- Builds observation and memory skills

Shopping List Game

- Create picture shopping lists

- Give child play money to “buy” items

- Practice counting and making change

- Use real items around the house as “store inventory”

Elementary School (Ages 6-12)

Family CFO Game

- Let child be “Chief Financial Officer” for a day

- Give them the grocery budget and shopping list

- Challenge them to stay under budget

- Discuss their decisions and strategies

Lemonade Stand Business

- Plan, execute, and analyze a lemonade stand

- Calculate costs (lemons, cups, sugar)

- Track revenue and determine profit

- Discuss weather, location, and pricing strategies

Price Is Right Challenge

- Show items from around the house

- Have children guess the price

- Reveal actual prices and discuss what makes items expensive

- Builds understanding of value and cost

Savings Goal Thermometer

- Create visual charts for savings goals

- Color in progress as money accumulates

- Celebrate milestones along the way

- Use for both individual and family goals

Middle School (Ages 13-15)

Family Budget Analyst

- Share appropriate parts of family budget

- Ask teen to find areas to save money

- Research alternatives for major expenses

- Present findings to family

Investment Club Simulation

- Give each teen $1000 in “play money”

- Research and “invest” in real stocks

- Track performance over several months

- Discuss risk, diversification, and research methods

College Cost Reality Check

- Research costs at colleges they’re interested in

- Calculate student loan payments for different scenarios

- Research starting salaries in careers they’re considering

- Create realistic post-college budgets

High School (Ages 16-18)

Apartment Hunt Project

- Research rental costs in areas where they might live

- Calculate total monthly costs including utilities

- Determine required income

- Visit actual apartments with parents

Tax Preparation Practice

- Use their actual income to file taxes

- Understand different forms and deductions

- Use tax software with guidance

- Discuss tax planning strategies

Insurance Comparison Shop

- Research auto insurance rates for their situation

- Compare health insurance plans

- Understand deductibles, premiums, and coverage

- Make actual purchasing decisions with guidance

Technology Tools and Resources

Apps for Different Age Groups

Ages 6-10:

- PiggyBot: Digital savings tracking

- Peter Pig (Visa): Games teaching financial concepts

- Roblox’s Money Smart: Virtual world financial education

- iAllowance: Chore and allowance tracking

Ages 11-15:

- Greenlight: Teen debit cards with parental controls

- GoHenry: Prepaid debit cards for teens

- Stockpile: Investment accounts for teens

- CASHCULATOR: Simple budgeting for beginners

Ages 16-18:

- Mint: Comprehensive budgeting and tracking

- YNAB (You Need A Budget): Advanced budgeting philosophy

- Acorns: Micro-investing platform

- Credit Karma: Credit monitoring and education

Educational Websites and Games

Practical Money Skills (Visa): Comprehensive curriculum and games for all ages Jump$tart Coalition: Age-appropriate financial education resources BizKid$: Videos and games for entrepreneurship education Money As You Grow: Age-specific financial education from President’s Advisory Council

Books by Age Group

Ages 3-6:

- “The Berenstain Bears’ Trouble with Money” by Stan and Jan Berenstain

- “Alexander, Who Used to Be Rich Last Sunday” by Judith Viorst

- “A Chair for My Mother” by Vera B. Williams

Ages 7-12:

- “The Kid’s Guide to Money Cents” by Susan Beacham

- “Money School” by Three Jars

- “The Everything Kids’ Money Book” by Brette Sember

Ages 13-18:

- “The Opposite of Spoiled” by Ron Lieber

- “The Index Card” by Helaine Olen

- “Your Money or Your Life” (Young Reader’s Edition)

Building Long-Term Financial Success

Creating Family Money Values

Define Core Values:

- Security vs. risk-taking

- Giving and generosity

- Work ethic and earning

- Quality vs. quantity

- Experience vs. material possessions

Communicate Through Actions:

- Model the behaviors you want to see

- Include children in family financial discussions

- Show how you make financial decisions

- Explain your values when making choices

- Be consistent between words and actions

Regular Family Financial Meetings:

- Monthly budget reviews (age-appropriate)

- Goal-setting sessions

- Celebration of financial achievements

- Problem-solving financial challenges together

- Planning for major family purchases or events

Preparing for Financial Independence

Gradual Transition Strategy:

- Age 16: Manage personal expense categories

- Age 17: Handle part-time job income and taxes

- Age 18: Co-signed accounts and shared responsibility

- Age 19-20: Independent accounts with safety net

- Age 21+: Full financial independence

Emergency Preparedness:

- Teaching about emergency funds

- Understanding insurance basics

- Building support networks

- Financial problem-solving skills

- When and how to ask for help

Career and Income Planning:

- Research career earning potential

- Understand the value of education and skills

- Network building and professional relationships

- Entrepreneurship opportunities

- Multiple income stream concepts

Conclusion: Setting Children Up for Financial Success

Teaching children about money is one of the greatest gifts you can give them. Financial literacy provides freedom, security, and opportunities throughout life. The key is starting early, staying consistent, and adapting your approach as children grow and develop.

Key Takeaways:

- Start Early: Even preschoolers can learn basic money concepts

- Make It Age-Appropriate: Match teaching methods to developmental stages

- Use Real Experiences: Hands-on learning is more effective than abstract lessons

- Be Consistent: Regular allowances and consistent rules build strong habits

- Model Good Behavior: Children learn more from what they see than what they’re told

- Allow Natural Consequences: Let children learn from spending mistakes

- Focus on Values: Money is a tool to achieve values and goals, not an end in itself

Moving Forward:

Start where your child is now, regardless of their age. If you haven’t begun financial education yet, it’s never too late to start. Choose one or two strategies from this guide and implement them consistently. As your child masters these concepts, gradually add complexity and responsibility.

Remember that financial education is an ongoing process, not a one-time lesson. Be patient with both yourself and your children as you learn together. The goal isn’t perfection—it’s progress toward better financial understanding and habits.

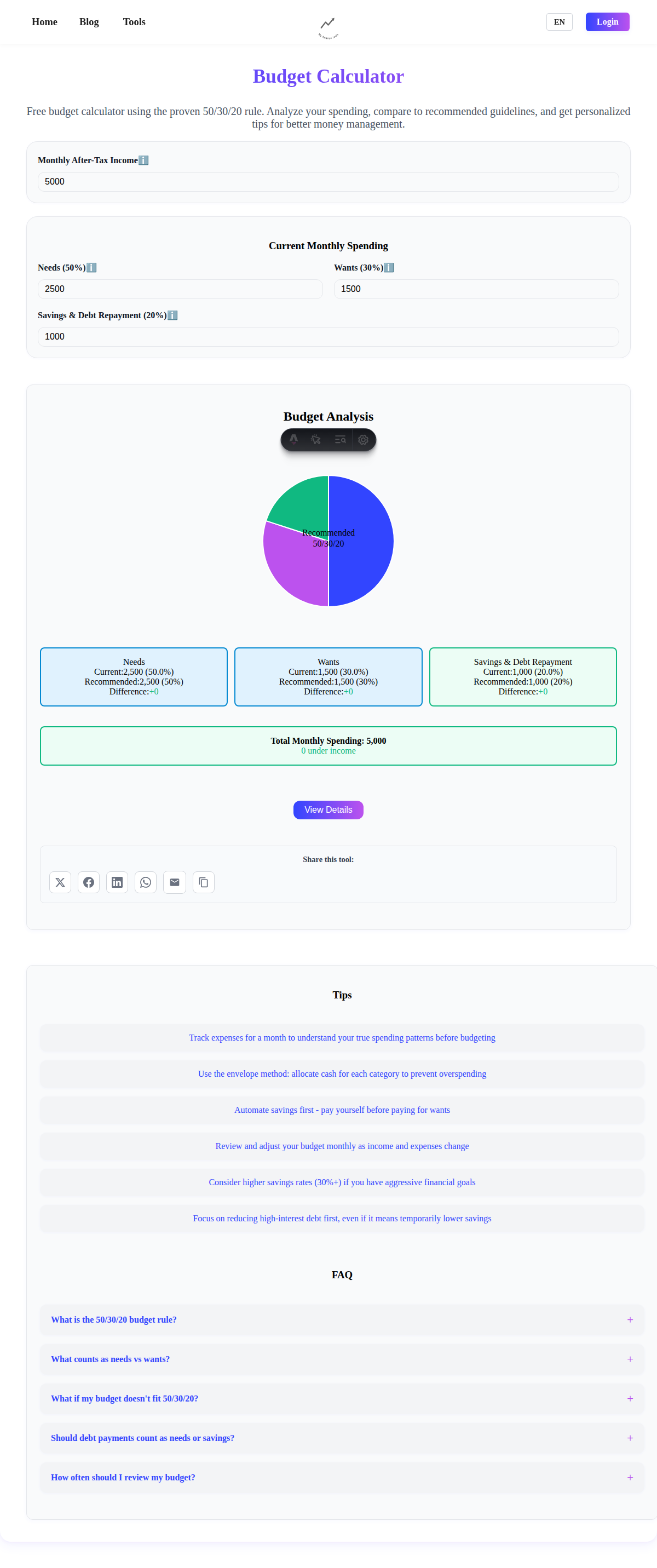

Use our financial tools to support your family’s financial education journey. The Budget Calculator can help demonstrate family budgeting concepts, the Savings Goal Calculator can help children plan for their wants and needs, and the Emergency Fund Calculator can show the importance of financial security.

The financial habits your children develop today will serve them throughout their lives. By teaching them about money management, you’re giving them the tools to build financial security, make wise decisions, and achieve their dreams. Start today, and watch as your children develop the confidence and skills they need for a financially successful future.

This guide provides general financial education strategies and should be adapted to your family’s specific circumstances and values. Consider consulting with financial professionals for guidance on specific investment or banking products for children. Always verify age requirements and parental controls for any financial products or apps mentioned.