Building Wealth in Your 20s: The Foundation That Sets You Up for Life

Your twenties are the most powerful decade for building wealth—not because you’re earning the most money, but because you have the most valuable asset of all: time. The financial decisions you make now will compound over the next 40+ years, creating either massive wealth or persistent financial stress.

The good news? You don’t need a high salary to build a strong financial foundation. You just need the right strategies and the discipline to stick with them.

Why Your 20s Are Your Wealth-Building Superpower

Let’s start with a reality check that will change how you think about money:

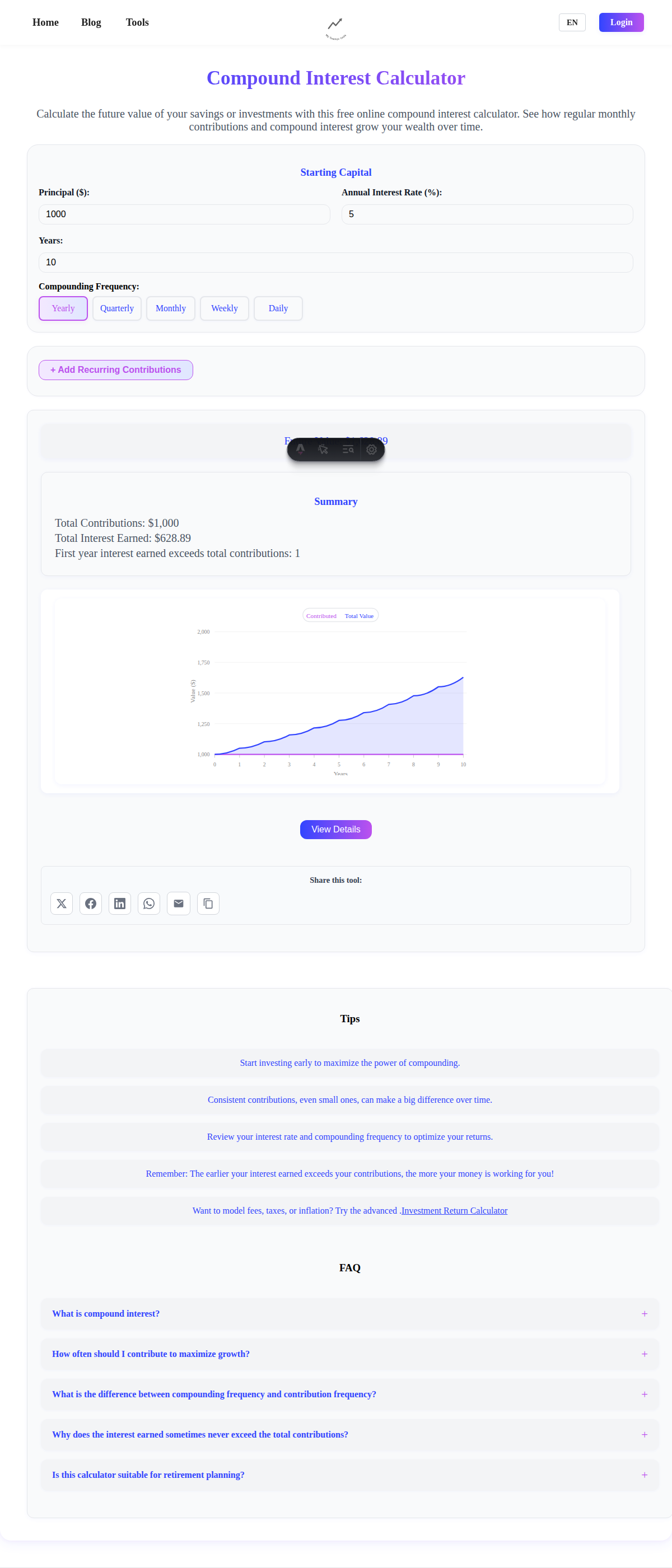

The $100 Monthly Investment Test:

- Start investing $100/month at age 22: $1.37 million by age 65

- Start investing $100/month at age 32: $540,000 by age 65

- Start investing $100/month at age 42: $204,000 by age 65

(Assuming 7% annual returns)

That 10-year delay from 22 to 32 costs you nearly $830,000. This is why your twenties matter so much—every dollar you invest now has 40+ years to grow.

The 4 Financial Foundations Every 20-Something Needs

Foundation #1: Emergency Fund (Your Financial Safety Net)

Target: 3-6 months of expenses saved in cash

Your emergency fund isn’t just about unexpected expenses—it’s about freedom. It lets you take calculated risks, leave bad jobs, and avoid debt when life throws curveballs.

Building Strategy:

- Start small: Even $500 makes a difference

- Automate it: Set up automatic transfers of $50-100/month

- Use windfalls: Tax refunds, bonuses, gifts go straight to emergency fund

- High-yield savings: Keep it in an account earning 3-5% interest

Global Considerations: Emergency fund needs vary by country. In places with strong social safety nets (universal healthcare, unemployment benefits), 3 months might suffice. In countries with limited social programs, aim for 6+ months.

Foundation #2: Eliminate High-Interest Debt

Priority: Pay off credit cards, personal loans, and other high-interest debt (typically 15%+ interest rates)

High-interest debt is wealth destruction. A credit card at 18% interest rate means you need investments returning 25%+ just to break even (after taxes).

The Debt Elimination Strategy:

- List all debts with balances and interest rates

- Minimum payments on everything

- Attack strategy: Either snowball (smallest balance first) or avalanche (highest interest first)

- No new debt while paying off existing debt

Student Loan Strategy: Student loans often have lower interest rates (3-7%). Pay minimums while building other foundations, then decide whether to accelerate payments or invest the difference.

Foundation #3: Start Investing (Even with $25)

Minimum: Start with whatever you can, even $25/month

The biggest mistake twenty-somethings make is waiting until they can invest “enough.” There is no “enough”—there’s only starting versus not starting.

Investment Hierarchy:

- Employer match (if available): This is free money—contribute enough to get the full match

- Low-cost index funds: Broad market funds with fees under 0.2%

- Global diversification: Don’t just invest in your home country

- Consistency: Monthly investing beats trying to time the market

Global Investment Options:

- Developed markets: US, European, Japanese index funds

- Emerging markets: Developing countries for growth potential

- Local options: Many countries have tax-advantaged investment accounts

Platform Selection: Look for brokers offering:

- Low or no account minimums

- Fractional shares (buy partial shares of expensive stocks)

- Automatic investing features

- Low fees (under 0.5% annually)

Foundation #4: Build Your Earning Power

Focus: Increase your income through skills, networking, and career advancement

Your income in your twenties sets the trajectory for your entire career. A $5,000 salary increase now, growing at 3% annually, adds $250,000+ to your lifetime earnings.

Income Growth Strategies:

- Skill development: Focus on high-value skills in your industry

- Certifications: Professional certifications that boost earning potential

- Side income: Freelancing, consulting, or passive income streams

- Networking: Build relationships that create opportunities

- Job hopping: Strategic job changes can boost salary 10-20%

The 20s Money Management System

The 50/30/20 Budget (Modified for Wealth Building)

Traditional budgeting often doesn’t work for twenty-somethings because income can be irregular and expenses unpredictable. Use this flexible framework:

50% - Needs (Fixed Expenses):

- Rent/housing

- Transportation

- Food (groceries)

- Insurance

- Minimum debt payments

30% - Wants (Variable Spending):

- Entertainment

- Dining out

- Hobbies

- Travel

- Shopping

20% - Future You (Savings & Investing):

- Emergency fund (until complete)

- Retirement investing

- Extra debt payments

- Short-term savings goals

Adjustment Strategy: If you can’t hit 20% savings, start with 10% or even 5%. Increase by 1% every six months until you reach 20%+.

Automate Your Success

Set up these automatic transfers:

- Emergency fund: $50-200/month to high-yield savings

- Investing: $100-500/month to investment account

- Bills: All fixed expenses on autopay

- Debt payments: Extra payments scheduled automatically

Automation removes willpower from the equation. You can’t spend money that’s already been moved to savings.

Common Money Mistakes to Avoid in Your 20s

Mistake #1: Lifestyle Inflation Without Income Growth

Every raise doesn’t need to immediately become a lifestyle upgrade. When your income increases:

- Save 50% of the increase

- Enjoy 50% through lifestyle improvements

Mistake #2: Financing Depreciating Assets

Cars, furniture, electronics—if it loses value, don’t finance it unless absolutely necessary. Save up and buy used instead.

Mistake #3: Ignoring Your Credit Score

Your credit score affects loan rates, apartment approvals, even job opportunities in some countries. Build credit with:

- One credit card used responsibly

- On-time payments for all bills

- Low credit utilization (under 30% of limits)

Mistake #4: Not Tracking Spending

You can’t improve what you don’t measure. Use apps, spreadsheets, or banking tools to track where your money goes. Most people are shocked by their actual spending patterns.

Mistake #5: Waiting for “Perfect” Conditions

There’s never a perfect time to start investing, saving, or improving your finances. Start with what you have, where you are, and improve along the way.

Advanced Strategies for High Achievers

Tax-Advantaged Accounts

Many countries offer tax-advantaged savings accounts. Research options in your country:

- Retirement accounts (401k, pension schemes, superannuation)

- Education savings (529 plans, education savings accounts)

- Health savings (HSAs where available)

Geographic Arbitrage

Consider living in lower-cost areas while working remotely for higher-paying companies. This can dramatically boost your savings rate.

Skill Stacking

Combine complementary skills to become uniquely valuable. For example: coding + design, finance + technology, or marketing + data analysis.

Building Wealth Habits That Last

Weekly Money Habits

- Review spending from the previous week

- Check investment accounts (but don’t obsess over daily changes)

- Meal plan to control food costs

Monthly Money Habits

- Review budget and adjust as needed

- Calculate net worth (assets minus debts)

- Look for expense optimization opportunities

Quarterly Money Habits

- Review investment allocation and rebalance if needed

- Assess career progress and skill development

- Update financial goals based on life changes

Annual Money Habits

- Complete financial checkup with all accounts and goals

- Research new investment options or account types

- Plan major financial goals for the following year

The Psychology of Money in Your 20s

Delayed Gratification

Your twenties are about building systems that pay off later. Every dollar saved now buys you future freedom—the freedom to take risks, change careers, or even retire early.

Social Pressure Management

Don’t let social media or peer pressure derail your financial goals. Most people posting expensive lifestyles are either in debt or have family money. Build wealth quietly and consistently.

Growth Mindset

View financial setbacks as learning opportunities. Made a mistake? Analyze it, adjust your system, and move forward. Perfection isn’t the goal—progress is.

Your 20s Financial Roadmap

Years 22-24: Foundation Building

- Focus: Emergency fund, debt elimination, basic investing

- Goal: Financial stability and good money habits

Years 25-27: Acceleration

- Focus: Increase income, boost savings rate, optimize investments

- Goal: 1x annual salary in net worth

Years 28-29: Advanced Planning

- Focus: Major life decisions (home buying, family planning), advanced investing

- Goal: 2-3x annual salary in net worth

Global Considerations for Wealth Building

Healthcare Systems

In countries with universal healthcare, you can allocate less to health savings and more to investments. In countries without universal coverage, factor healthcare costs into your emergency fund.

Education Costs

Education funding varies dramatically worldwide. In countries with free university education, you can focus more on retirement savings. Where education is expensive, start dedicated education savings early.

Currency and Inflation

In countries with unstable currencies or high inflation, consider:

- Foreign currency investments for stability

- Real assets (real estate, commodities) as inflation hedges

- Shorter-term financial goals due to economic uncertainty

Technology Tools for Your 20s

Essential Apps

- Budget tracking: Mint, YNAB, or local banking apps

- Investment platforms: Low-cost brokers with mobile apps

- Credit monitoring: Free credit score tracking

- Automation tools: Automatic savings and investment transfers

Avoid These Financial Apps

- “Buy now, pay later” services that encourage overspending

- Day trading apps that gamify investing

- Expensive robo-advisors with high fees

When Life Doesn’t Go According to Plan

Job Loss Strategy

- Immediately reduce expenses to essential only

- Use emergency fund strategically while job hunting

- Continue minimum debt payments to protect credit

- Pause investing temporarily if needed

Major Expense Strategy

- Check if emergency fund should cover it

- Research financing options if needed (avoid credit cards)

- Adjust other goals temporarily

- Plan to rebuild any used emergency funds

Income Volatility Strategy

- Build larger emergency fund (6+ months)

- Use percentage-based budgeting instead of fixed amounts

- Invest during high-income months

- Plan for lean periods in advance

Preparing for Your 30s

As you approach 30, you should have:

- Solid emergency fund (3-6 months expenses)

- No high-interest debt (credit cards, personal loans)

- Investment habit ($100+ monthly contributions)

- 1-2x annual salary in net worth

- Clear career trajectory with growing income

Your twenties are about building the foundation. Your thirties are about accelerating wealth building with higher income and refined strategies.

Taking Action Today

Don’t wait for perfect conditions or more money. Start with these three actions this week:

- Open a high-yield savings account and transfer $100 for your emergency fund

- Set up automatic investment of $25-50/month into a low-cost index fund

- Track your spending for one week to understand your money patterns

The sooner you start, the more time compound growth has to work its magic. Your 65-year-old self will thank you for every dollar you save and invest today.

Remember: building wealth isn’t about depriving yourself—it’s about making intentional choices that create freedom and options for your future. Start small, stay consistent, and watch your foundation grow into lasting financial security.

Ready to build your financial foundation? Use our financial calculators to create your personalized savings and investment plan, and start building the wealth that will set you up for life.