Tax-loss harvesting is one of the most powerful yet underutilized strategies for reducing investment taxes and boosting long-term returns. By strategically realizing investment losses to offset gains, you can significantly reduce your tax bill while maintaining your desired asset allocation.

This advanced strategy builds on the investment principles we discussed in our compound interest guide and complements the systematic investment approaches covered in our dollar-cost averaging article.

Important Note: This guide focuses on US tax laws and regulations. International investors should consult their local tax rules, as different countries have varying approaches to investment losses and capital gains.

What Is Tax-Loss Harvesting?

The Basic Concept

Tax-loss harvesting is the practice of selling investments at a loss to offset capital gains from other investments, thereby reducing your overall tax liability.

How it works:

- Identify losses: Find investments in your portfolio that are worth less than you paid

- Sell strategically: Realize the loss by selling the investment

- Offset gains: Use the loss to reduce taxes on profitable investments

- Reinvest: Purchase a similar (but not identical) investment to maintain exposure

Simple example:

- You have $5,000 in capital gains from Stock A

- You have $3,000 in unrealized losses from Stock B

- Sell Stock B to realize the $3,000 loss

- Net taxable gain: $5,000 - $3,000 = $2,000

- Tax savings: Up to $600 (if in 20% capital gains bracket)

Types of Investment Losses

Capital losses (what we’re harvesting):

- Short-term losses: Investments held 1 year or less

- Long-term losses: Investments held more than 1 year

- Unrealized losses: Paper losses that become real when you sell

- Realized losses: Actual losses from completed sales transactions

What qualifies for tax-loss harvesting:

- Individual stocks

- Mutual funds

- Exchange-traded funds (ETFs)

- Bonds and bond funds

- Real estate investment trusts (REITs)

US Tax Rules and Regulations

Capital Gains Tax Rates (2025)

Short-term capital gains (held ≤ 1 year):

- Taxed as ordinary income

- Rates: 10%, 12%, 22%, 24%, 32%, 35%, 37%

Long-term capital gains (held > 1 year):

- 0% rate: Income up to $47,025 (single), $94,050 (married filing jointly)

- 15% rate: Income up to $518,900 (single), $583,750 (married filing jointly)

- 20% rate: Income above those thresholds

Net Investment Income Tax (NIIT):

- Additional 3.8% tax on investment income

- Applies to high earners: $200,000+ (single), $250,000+ (married filing jointly)

Loss Offset Rules

Offsetting priority:

- Like offsets like: Short-term losses offset short-term gains first

- Cross-category offsetting: Excess losses offset other category gains

- Net loss treatment: Up to $3,000 annual deduction against ordinary income

- Loss carryforward: Excess losses carry forward indefinitely

Example of offset sequence:

- Short-term gains: $8,000

- Long-term gains: $4,000

- Short-term losses: ($10,000)

- Long-term losses: ($1,000)

Calculation:

- Short-term: $8,000 gains - $10,000 losses = ($2,000) net short-term loss

- Net short-term loss offsets long-term gains: $4,000 - $2,000 = $2,000 net long-term gain

- Remaining long-term losses: ($1,000)

- Net result: $2,000 taxable long-term gain, $1,000 loss carried forward

The $3,000 Annual Deduction Limit

Ordinary income offset:

- Maximum $3,000 per year deduction against wages/salary

- $1,500 limit if married filing separately

- Excess losses carry forward to future years

Strategic implication: If you have large losses, you may want to spread gain realization over multiple years to fully utilize the tax benefits.

Use our salary breakdown calculator to understand how tax-loss harvesting affects your overall tax situation.

The Wash-Sale Rule: Critical to Understand

What Is the Wash-Sale Rule?

The wash-sale rule prevents you from claiming a tax loss if you buy a “substantially identical” security within 30 days before or after the sale.

Key details:

- 30-day window: 30 days before + day of sale + 30 days after = 61-day period

- Substantially identical: Same stock, same mutual fund, identical securities

- Penalty: Loss deduction is disallowed, but cost basis is adjusted

- Applies to: You, your spouse, and companies you control

Examples of Wash-Sale Violations

Clear violations:

- Sell Apple (AAPL) stock, buy AAPL stock 20 days later

- Sell Vanguard S&P 500 fund, buy the same fund 2 weeks later

- Sell Microsoft (MSFT), buy MSFT in your IRA 10 days later

Common mistakes:

- Spouse trading: Your spouse buys what you just sold

- Different accounts: Selling in taxable account, buying in IRA

- Options: Selling stock and buying call options on same stock

- Similar funds: Selling one S&P 500 fund and buying another very similar one (this is actually usually okay)

Avoiding Wash-Sale Rules

Safe alternatives:

- Different asset classes: Sell individual stock, buy broad market ETF

- Different sectors: Sell tech stock, buy healthcare stock

- Different fund families: Sell Vanguard Total Stock Market, buy Fidelity Total Market (different underlying holdings)

- Wait 31 days: Simply wait out the wash-sale period

Example safe swap:

- Sell: Vanguard Total Stock Market Index (VTI)

- Buy: Schwab US Broad Market ETF (SCHB)

- Result: Similar exposure, no wash-sale violation

Tax-Loss Harvesting Strategies

Strategy #1: Direct Loss Harvesting

When to use: You have realized gains in the same tax year

Process:

- Identify gains: Calculate your realized capital gains year-to-date

- Find losses: Look for investments trading below your cost basis

- Prioritize harvesting: Focus on losses that offset your highest-tax-rate gains

- Execute sales: Sell losing positions to realize losses

- Reinvest: Buy similar (not identical) investments

Example implementation:

- Realized gains: $10,000 in long-term capital gains

- Available losses: $12,000 in unrealized losses across various holdings

- Harvest: $10,000 in losses to fully offset gains

- Result: Zero capital gains tax, $2,000 loss carried forward

Strategy #2: Opportunistic Harvesting

When to use: Market downturns create widespread loss opportunities

Approach:

- Bear market harvesting: During market declines, many holdings show losses

- Sector rotation losses: When certain sectors underperform

- Individual stock disappointments: Companies that haven’t met expectations

Market downturn strategy:

- Assess portfolio: Identify all positions with unrealized losses

- Prioritize harvesting: Focus on largest losses and positions you want to trim

- Maintain allocation: Use proceeds to buy similar investments

- Bank losses: Carry forward losses for future gain offsetting

Strategy #3: Systematic Annual Harvesting

Approach: Regular end-of-year portfolio review for loss opportunities

December checklist:

- Review all positions: Identify unrealized losses

- Calculate optimal harvesting: Balance tax benefits with transaction costs

- Consider future gains: Anticipate next year’s potential gains

- Execute before year-end: Complete transactions by December 31

Systematic approach benefits:

- Consistent tax management: Regular attention to tax efficiency

- Compound benefits: Multiple years of harvesting compound tax savings

- Portfolio rebalancing: Natural opportunity to adjust allocations

Strategy #4: Mutual Fund Tax-Loss Harvesting

Mutual fund complications:

- Capital gains distributions: Funds distribute gains to shareholders

- Timing issues: Distributions typically occur in December

- Double taxation: You might owe taxes on distributions even if fund value declined

Fund harvesting strategy:

- Monitor distribution estimates: Check fund company websites in fall

- Harvest before distributions: Sell losing fund positions before distribution dates

- Avoid buying before distributions: Don’t buy funds about to distribute gains

- Use ETFs instead: ETFs are generally more tax-efficient than mutual funds

Advanced Tax-Loss Harvesting Techniques

Asset Location Optimization

Account type strategy:

- Taxable accounts: Primary location for tax-loss harvesting

- Tax-advantaged accounts: No tax benefits from realizing losses

- Coordination: Place tax-inefficient investments in tax-advantaged accounts

Strategic asset placement:

- High-dividend stocks: Better in IRA/401(k) to avoid annual taxes

- Growth stocks: Good in taxable accounts for potential loss harvesting

- Bonds: Often better in tax-advantaged accounts

- REITs: Tax-advantaged accounts due to ordinary income distributions

The Tax Alpha Strategy

Concept: Generate additional “tax alpha” through sophisticated loss harvesting

Implementation:

- Diversified holdings: Own multiple similar but not identical funds

- Regular monitoring: Monthly or quarterly loss harvesting opportunities

- Systematic rebalancing: Use harvesting as rebalancing opportunity

- Loss banking: Build up loss carryforwards for future use

Example diversified approach: Instead of owning just Vanguard Total Stock Market (VTI), own:

- 40% VTI (Vanguard Total Stock Market)

- 30% ITOT (iShares Core S&P Total Stock Market)

- 30% SWTSX (Schwab Total Stock Market)

Benefits: Similar total return, multiple harvesting opportunities

Robo-Advisor Tax-Loss Harvesting

Automated approach:

- Daily monitoring: Software checks for loss opportunities daily

- Automatic execution: Losses harvested without manual intervention

- Wash-sale avoidance: Built-in rules prevent violations

- Reinvestment: Automatic purchase of similar securities

Popular platforms:

- Betterment: Tax-Loss Harvesting+ feature

- Wealthfront: Daily tax-loss harvesting

- Vanguard Personal Advisor: Human + robo combination

- Schwab Intelligent Portfolios: Automated rebalancing with tax awareness

Calculating the Benefits

Tax Savings Calculation

Direct tax savings formula: Tax Savings = Harvested Losses × Marginal Tax Rate

Example calculation:

- Harvested losses: $5,000

- Tax bracket: 24% (federal) + 6% (state) = 30% combined

- Immediate tax savings: $5,000 × 30% = $1,500

Long-Term Compounding Effect

Reinvestment benefit: The immediate tax savings can be reinvested, creating compound growth over time.

20-year compounding example:

- Initial tax savings: $1,500

- Investment return: 7% annually

- Future value: $1,500 × (1.07)^20 = $5,807

Total benefit: Tax savings + compounded reinvestment growth

Break-Even Analysis

Transaction costs consideration:

- Brokerage fees: Most major brokers now offer commission-free trading

- Bid-ask spreads: Cost of buying and selling securities

- Time and complexity: Value of your time managing the strategy

Minimum threshold: Generally worthwhile for losses above $500-1,000

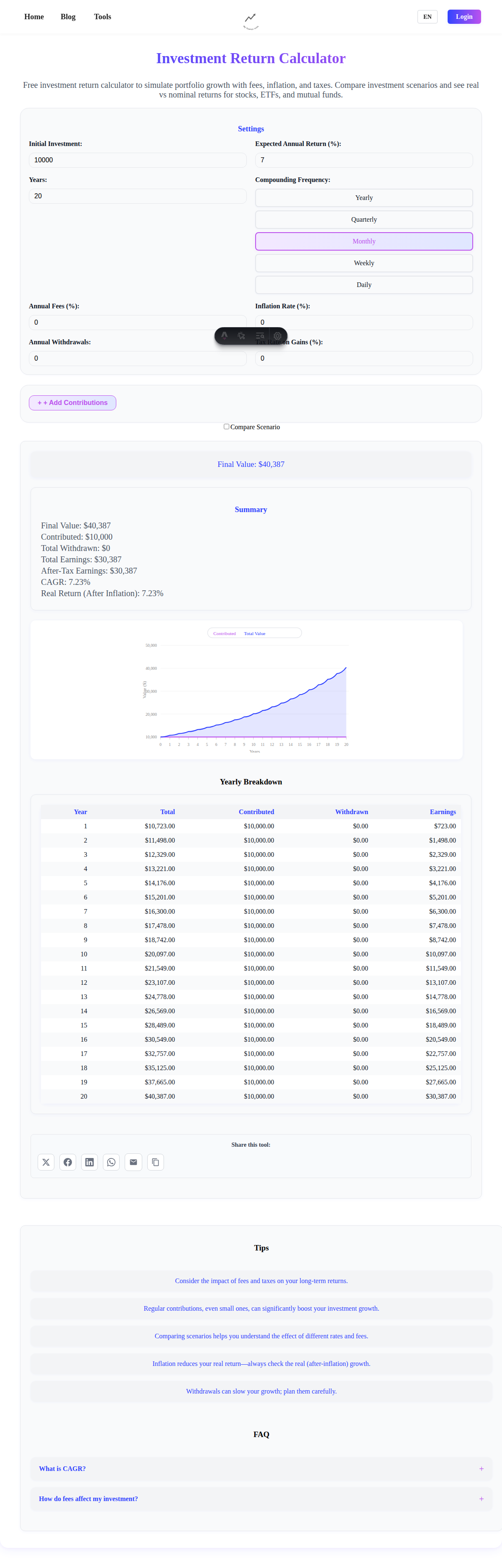

Model different scenarios with our investment return calculator to see long-term benefits.

Common Mistakes and How to Avoid Them

Mistake #1: Wash-Sale Rule Violations

Problem: Buying identical securities within 30-day window Solution: Use similar but not identical replacements, track all purchases carefully

Mistake #2: Letting Tax Tail Wag Investment Dog

Problem: Making poor investment decisions solely for tax benefits Solution: Maintain good investment strategy first, tax optimization second

Mistake #3: Ignoring State Taxes

Problem: Focusing only on federal tax implications Solution: Consider combined federal and state tax rates for true savings

Mistake #4: Harvesting in Wrong Account Types

Problem: Trying to harvest losses in IRAs or 401(k)s Solution: Focus exclusively on taxable investment accounts

Mistake #5: Poor Record Keeping

Problem: Not tracking cost basis and harvested amounts properly Solution: Use investment tracking software or detailed spreadsheets

Implementation: Getting Started

Step 1: Account Setup and Tracking

Choose appropriate accounts:

- Taxable brokerage accounts: Primary harvesting location

- Record-keeping system: Track cost basis, purchase dates, realized losses

- Tax preparation software: Ensure it can handle capital gains/losses

Step 2: Portfolio Structure for Harvesting

Build harvesting-friendly portfolio:

- Broad diversification: Multiple asset classes and sectors

- ETF preference: Generally more tax-efficient than mutual funds

- Avoid complexity: Don’t over-optimize at expense of good investing

Sample harvesting-ready portfolio:

- Large-cap stocks: 40% (split between 2-3 similar funds)

- International stocks: 20% (developed and emerging markets)

- Small/mid-cap stocks: 20%

- Bonds: 20% (mostly in tax-advantaged accounts)

Step 3: Monitoring and Execution

Regular review schedule:

- Monthly: Quick scan for obvious opportunities

- Quarterly: More thorough review and potential harvesting

- Year-end: Comprehensive harvesting before December 31

Execution checklist:

- ✅ Identify positions with unrealized losses

- ✅ Calculate potential tax savings

- ✅ Identify replacement securities

- ✅ Check for wash-sale rule compliance

- ✅ Execute sales and purchases

- ✅ Update records and tracking

Tax-Loss Harvesting Tools and Resources

Software and Platforms

- Portfolio tracking: Personal Capital, Quicken, Excel/Google Sheets

- Tax software: TurboTax, H&R Block, FreeTaxUSA for reporting

- Brokerage tools: Most brokers provide cost basis and gain/loss reports

Professional Help

When to consider a professional:

- Complex portfolios: Multiple account types and asset classes

- High income: Significant tax implications make professional advice valuable

- Time constraints: Busy professionals who want automation

- Multi-state issues: Complex state tax situations

The Bottom Line

Tax-loss harvesting is a powerful strategy that can add significant value to your investment returns over time. While it requires attention to detail and adherence to tax rules, the potential benefits make it worthwhile for most investors in taxable accounts.

Key takeaways:

- Timing matters: Harvest losses to offset gains in the same tax year when possible

- Wash-sale rule: Critical to avoid—buy similar, not identical securities

- Regular monitoring: Systematic approach generates better results than sporadic efforts

- Don’t overthink: Good investing principles come first, tax optimization second

- Start simple: Begin with basic harvesting, advance to more sophisticated strategies over time

The most important principle: Tax-loss harvesting should enhance, not replace, a solid long-term investment strategy. Focus on building a diversified portfolio first, then optimize for taxes as a secondary benefit.

Whether you implement tax-loss harvesting manually or through automated platforms, the key is consistency and attention to the rules. Even modest tax savings compound significantly over decades of investing.

Ready to optimize your investment taxes? Use our investment return calculator to model how tax-loss harvesting might affect your long-term returns, and consider starting with a simple approach during your next portfolio review.