When you have a significant amount of money to invest—whether from a bonus, inheritance, or accumulated savings—you face a crucial decision: Should you invest it all at once (lump sum) or spread it out over time (dollar-cost averaging)? This choice can significantly impact your investment returns and emotional well-being.

As we explored in our compound interest guide, time in the market generally beats timing the market. But when you’re sitting on $50,000 or more, the decision becomes more complex and emotionally charged.

Understanding the Two Strategies

Lump Sum Investing (LSI)

Definition: Investing your entire available amount immediately, all at once.

Example: You have $60,000 to invest. With lump sum investing, you purchase $60,000 worth of index funds today and let it grow over time.

The Logic:

- Markets generally trend upward over time

- The sooner your money is invested, the sooner it can benefit from compound growth

- Delaying investment means missing potential gains

Dollar-Cost Averaging (DCA)

Definition: Dividing your investment amount into equal portions and investing them at regular intervals over a predetermined period.

Example: Instead of investing $60,000 immediately, you invest $5,000 per month for 12 months, or $10,000 per month for 6 months.

The Logic:

- Reduces the impact of market volatility

- Eliminates the risk of investing at a market peak

- Provides psychological comfort through gradual market exposure

The Mathematical Evidence: What the Data Shows

Historical Performance Analysis

Vanguard’s landmark study analyzed rolling 10-year periods from 1926-2015 across U.S., UK, and Australian markets:

Lump Sum Investing Won:

- U.S. markets: 68% of the time

- UK markets: 71% of the time

- Australian markets: 70% of the time

- Average outperformance: 2.3% annually

Why Lump Sum Often Wins:

- Markets rise approximately 75% of the time

- Earlier investment captures more compound growth

- Dollar-cost averaging inherently involves holding cash, which typically underperforms stocks

Real-World Example: 2009-2019 Bull Market

Scenario: $120,000 to invest in January 2009 (market bottom)

Lump Sum Strategy (S&P 500):

- Invested: $120,000 immediately

- Value by 2019: ~$482,000

- Total return: 301%

Dollar-Cost Averaging ($10,000/month for 12 months):

- Average purchase price higher due to rising market

- Final value by 2019: ~$445,000

- Total return: 271%

- Difference: $37,000 less than lump sum

Bear Market Example: 2000-2002 Dot-Com Crash

Scenario: $60,000 to invest in January 2000 (market peak)

Lump Sum Strategy:

- Invested at market peak

- Lost ~47% by 2002

- Recovery to break-even: ~2007

Dollar-Cost Averaging ($5,000/month for 12 months):

- Averaged down during market decline

- Lost ~35% by 2002

- Recovery to break-even: ~2005

- Advantage: 2 years faster recovery

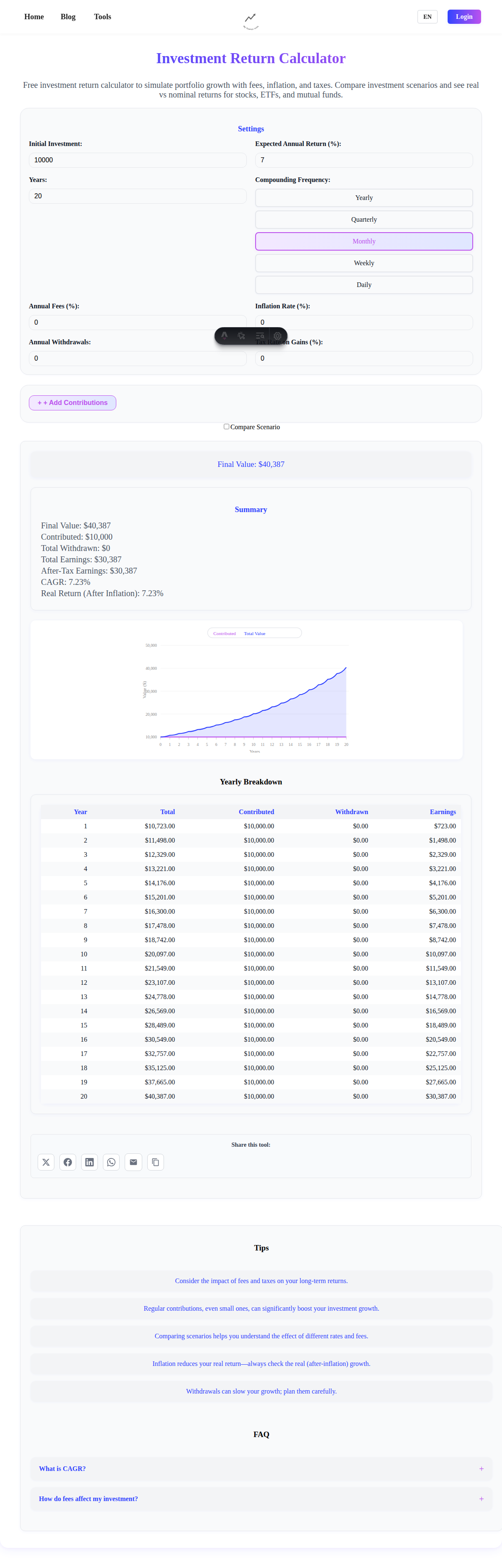

Use our investment return calculator to model different scenarios with your specific amounts and timelines.

When Dollar-Cost Averaging Makes Sense

High Anxiety About Market Timing

Emotional considerations:

- Peace of mind: Reduces regret if markets decline after lump sum investment

- Sleep factor: Can you sleep well knowing you invested everything at once?

- Behavioral benefits: Prevents panic selling during market volatility

- Gradual adaptation: Allows you to get comfortable with market fluctuations

Example: First-time investor with $100,000 inheritance who has never owned stocks might prefer DCA to gradually build confidence.

Market Valuation Concerns

When markets appear expensive:

- High P/E ratios: When stocks seem overvalued by historical standards

- Near market peaks: During extended bull markets

- Economic uncertainty: During periods of high volatility or unclear economic conditions

Valuation indicators to consider:

- Shiller P/E ratio above 25-30 (historically expensive)

- Market cap to GDP ratio above 100%

- VIX (volatility index) below 15 (complacency) or above 30 (fear)

Systematic Investment Needs

When DCA naturally fits your situation:

- Regular income investing: 401(k) contributions, monthly savings

- Business cash flow: Irregular income that needs systematic investment

- Multiple goals: Spreading investments across different time horizons

- Tax considerations: Spreading capital gains across multiple tax years

Large Windfall Situations

When the amount is unusually large relative to your net worth:

- Inheritance: Sudden wealth that represents multiple years of normal savings

- Business sale: Lump sum that dwarfs your previous investment experience

- Stock options: Concentrated positions that need diversification

- Insurance payouts: Unexpected large sums requiring careful management

When Lump Sum Investing Is Superior

Mathematical Optimization

Time value of money principles:

- Earlier compounding: Every day out of the market is potential growth lost

- Opportunity cost: Cash typically earns 2-5% while stocks average 10% historically

- Inflation protection: Stocks provide better long-term inflation hedge than cash

Example calculation:

- $50,000 invested immediately at 8% annual return

- After 1 year: $54,000

- $50,000 DCA’d over 12 months at 8% return

- After 1 year: ~$52,100

- Lump sum advantage: $1,900 in just one year

Long Investment Horizons

When you won’t need the money for 10+ years:

- Retirement investing: Money for retirement decades away

- Young investors: Long time horizon to ride out volatility

- Estate planning: Wealth intended for future generations

- Educational funding: Children’s college funds with long timelines

Low-Volatility Periods

Favorable market conditions for lump sum:

- Steady uptrends: Markets in consistent growth phases

- Low interest rates: When opportunity cost of cash is minimal

- Strong economic fundamentals: GDP growth, low unemployment, stable inflation

Experience and Discipline

When you have investment experience:

- Market veterans: Investors who’ve weathered multiple market cycles

- Disciplined approach: Ability to ignore short-term volatility

- Diversified strategy: Spreading across multiple asset classes and geographies

- Rebalancing discipline: Regular portfolio adjustments regardless of timing

The Hybrid Approach: Strategic Combinations

Core-Satellite Strategy

Structure: Combine both approaches strategically

- Core position (70-80%): Lump sum into broad market index funds

- Satellite positions (20-30%): DCA into specific sectors or international markets

Benefits:

- Captures most of lump sum advantage

- Provides some volatility protection

- Allows for tactical adjustments

Time-Based Splitting

3-6 Month DCA: Compromise between immediate investment and extended averaging

- Month 1: Invest 50% immediately

- Months 2-4: Invest remaining 50% in equal installments

- Result: Captures most market growth while providing some protection

Value-Based DCA

Market-responsive approach:

- Rising markets: Accelerate investment schedule

- Declining markets: Maintain or slow investment pace

- Volatile periods: Stick to regular schedule

Example:

- Start with 6-month DCA plan

- If market drops 10%+, invest 2 months’ worth immediately

- If market rises 15%+, accelerate remaining investments

Sector-Specific Considerations

Index Fund Investing

Best for lump sum:

- Broad diversification: Reduces single-stock risk

- Low volatility: Less dramatic price swings than individual stocks

- Historical performance: Strong long-term track record

- Cost efficiency: Lower fees maximize returns

Popular index choices:

- Total Stock Market Index: Broadest U.S. diversification

- S&P 500 Index: Large-cap U.S. stocks

- International Index: Global diversification

- Bond Index: Fixed-income allocation

Individual Stock Investing

Better for DCA:

- Higher volatility: Individual stocks swing more dramatically

- Research timing: Allows for gradual position building

- Earnings seasons: Can time purchases around quarterly reports

- Risk management: Spreads concentration risk over time

Sector ETFs and Thematic Investing

Consider DCA for:

- Technology sector: High volatility and growth potential

- Emerging markets: Greater political and economic uncertainty

- Commodity ETFs: Cyclical and volatile price patterns

- Small-cap funds: Higher volatility than large-cap alternatives

Tax Implications of Each Strategy

Lump Sum Tax Considerations

Immediate tax impacts:

- Capital gains: If selling existing investments to fund lump sum

- Tax-loss harvesting: Opportunity to offset gains with losses

- Asset location: Placing investments in appropriate account types

Tax efficiency strategies:

- Tax-advantaged accounts first: Max out 401(k), IRA contributions

- Tax-efficient funds: Index funds generate fewer capital gains distributions

- Municipal bonds: For high-income investors in high-tax states

DCA Tax Considerations

Advantages:

- Spread capital gains: Across multiple tax years if selling to fund investments

- Tax-loss opportunities: Multiple chances to harvest losses

- Income smoothing: Spreads tax impacts over time

Complications:

- Record keeping: More transactions to track for tax purposes

- Wash sale rules: Need to avoid repurchasing same securities within 30 days

- Gift tax: If funding comes from multiple gifts over time

Behavioral Psychology and Investment Success

Emotional Factors in Decision Making

Fear-based decisions:

- Loss aversion: Fear of losing money often outweighs potential gains

- Regret minimization: DCA reduces “what if” scenarios

- Control illusion: DCA provides feeling of actively managing risk

- Anchoring bias: Fixating on recent market performance

Overcoming emotional barriers:

- Historical perspective: Understanding long-term market trends

- Systematic approach: Removing emotion from investment decisions

- Education: Learning about market cycles and volatility

- Professional guidance: Working with financial advisors

Behavioral Advantages of Each Strategy

Lump Sum Behavioral Benefits:

- Decision simplicity: One decision, done

- Reduced monitoring: Less ongoing decision-making required

- Commitment device: Harder to change course once invested

- Focus on long-term: Less temptation to tinker with strategy

DCA Behavioral Benefits:

- Gradual comfort building: Slowly getting used to market ownership

- Reduced regret: Less chance of major timing mistakes

- Learning opportunity: Observing market behavior over time

- Flexibility: Can adjust strategy based on new information

Risk Management Considerations

Market Risk

Lump sum exposure:

- Sequence risk: Poor returns early can significantly impact outcomes

- Concentration risk: All money subject to same market conditions

- Timing risk: Possibility of investing at peak values

DCA risk management:

- Volatility smoothing: Reduces impact of short-term market swings

- Average price benefit: Potentially better average purchase price

- Systematic approach: Removes guesswork from timing decisions

Opportunity Risk

DCA limitations:

- Cash drag: Money waiting to be invested earns lower returns

- Rising market risk: Missing gains during bull markets

- Inflation impact: Purchasing power erosion while holding cash

Lump sum advantages:

- Full market exposure: All money working immediately

- Compound growth: Maximum time for money to grow

- Inflation protection: Stocks historically outpace inflation

Real-World Implementation Strategies

Setting Up Lump Sum Investing

Step-by-step process:

- Emergency fund first: Ensure 3-6 months expenses saved separately

- Account selection: Choose appropriate investment accounts (401k, IRA, taxable)

- Asset allocation: Determine stock/bond mix based on goals and timeline

- Fund selection: Choose low-cost, diversified index funds

- Execute and forget: Invest the full amount and avoid frequent monitoring

Sample lump sum allocation for $100,000:

- Total Stock Market Index: $60,000 (60%)

- International Stock Index: $20,000 (20%)

- Bond Index: $20,000 (20%)

Setting Up Dollar-Cost Averaging

Implementation considerations:

- Timeline: 6-12 months is typical for DCA periods

- Frequency: Monthly is most common, weekly possible for shorter periods

- Automation: Set up automatic transfers to eliminate decision fatigue

- Monitoring: Review and adjust only at predetermined intervals

Sample 12-month DCA for $60,000:

- Monthly investment: $5,000

- Automatic transfer: 1st of each month

- Asset allocation: Same percentages as lump sum, scaled down

- Review schedule: Quarterly progress check

Advanced Strategies and Modifications

The Glide Path Approach

Strategy: Start with conservative allocation, gradually increase stock exposure

- Month 1-3: 40% stocks, 60% bonds

- Month 4-6: 60% stocks, 40% bonds

- Month 7-12: 80% stocks, 20% bonds

Benefits: Reduces early volatility impact while building toward target allocation

Volatility-Based DCA

Concept: Adjust investment amounts based on market volatility

- Low volatility periods: Invest larger amounts

- High volatility periods: Invest smaller amounts more frequently

- Trigger: Use VIX or other volatility measures as guide

Geographic and Sector Rotation

Strategy: Rotate DCA investments across different markets

- Months 1-4: U.S. market focus

- Months 5-8: International developed markets

- Months 9-12: Emerging markets and sectors

Making Your Decision: A Framework

Personal Assessment Questions

Financial factors:

- How large is this investment relative to your net worth?

- What’s your investment timeline?

- How stable is your income and employment?

- Do you have adequate emergency savings separate from this investment?

Emotional factors:

- How would you feel if the market dropped 20% the day after you invested?

- Have you invested large amounts before?

- Do you tend to panic during market downturns?

- How important is peace of mind vs. potential returns?

Market factors:

- Are current market valuations high or reasonable by historical standards?

- What’s your outlook for the next 1-2 years?

- Are you comfortable with current economic conditions?

- Do you have strong convictions about market direction?

Decision Matrix

Choose Lump Sum If:

- ✅ Investment timeline is 10+ years

- ✅ Amount is less than 25% of net worth

- ✅ You have investment experience

- ✅ You can ignore short-term volatility

- ✅ Markets appear reasonably valued

- ✅ You prioritize mathematical optimization

Choose Dollar-Cost Averaging If:

- ✅ You’re new to investing large amounts

- ✅ Markets appear highly valued

- ✅ Amount represents windfall wealth

- ✅ You need psychological comfort

- ✅ You have strong market timing concerns

- ✅ You value risk reduction over return maximization

The Compromise Solution

For those truly torn between strategies:

- Immediate investment: 50-70% of total amount

- DCA remainder: Over 3-6 months

- Result: Capture most lump sum benefits while providing volatility protection

Common Mistakes to Avoid

Mistake #1: Analysis Paralysis

Problem: Spending months deciding while staying in cash Solution: Set a decision deadline—indecision is itself a decision

Mistake #2: Market Timing Attempts

Problem: Trying to predict market movements to optimize entry Solution: Focus on time in market, not timing the market

Mistake #3: Inconsistent DCA Execution

Problem: Skipping or modifying DCA schedule based on market conditions Solution: Automate investments and stick to predetermined plan

Mistake #4: Ignoring Fees and Taxes

Problem: Not considering transaction costs and tax implications Solution: Choose low-cost funds and consider tax-advantaged accounts first

Mistake #5: Emotional Decision Making

Problem: Choosing strategy based on recent market performance Solution: Base decision on personal factors and long-term goals

Tools and Resources

Essential Calculators

- Investment Return Calculator: Model both lump sum and DCA scenarios

- Compound Interest Calculator: See long-term growth potential

- Savings Goal Calculator: Plan your investment timeline

Research Resources

Market valuation metrics:

- CAPE Ratio: Long-term price-to-earnings measure

- Market Cap to GDP: Total market value relative to economic output

- VIX: Volatility index for current market fear/greed levels

Investment platforms for implementation:

- Vanguard: Low-cost index funds, automatic investing

- Fidelity: Zero-fee index funds, research tools

- Schwab: Comprehensive platform, fractional shares

- Betterment/Wealthfront: Robo-advisors with automatic DCA

The Bottom Line

The choice between lump sum investing and dollar-cost averaging isn’t just about mathematics—it’s about aligning your investment strategy with your personality, risk tolerance, and financial situation.

Key takeaways:

- Lump sum historically wins about 70% of the time mathematically

- DCA provides psychological benefits that may outweigh slight return disadvantages

- Your comfort level is crucial for long-term investment success

- Compromise solutions can capture benefits of both approaches

- Consistency matters more than the specific strategy chosen

The most important factor is getting your money invested in a diversified portfolio and staying invested through market cycles. Whether you choose lump sum, DCA, or a hybrid approach, the key is starting and sticking with your plan.

Ready to implement your strategy? Use our investment return calculator to model different scenarios with your specific investment amount and timeline. The right choice becomes clearer when you see the projections with your actual numbers.

Remember: The best investment strategy is the one you can execute consistently over the long term. Choose the approach that lets you sleep well at night while staying committed to building wealth over time.