Choosing between a Traditional IRA and Roth IRA is one of the most important retirement planning decisions for US investors. The choice affects your taxes today, your taxes in retirement, and ultimately how much wealth you’ll accumulate over your lifetime.

This decision becomes even more critical when combined with other retirement strategies. As we discussed in our compound interest guide, the power of tax-advantaged compounding over decades can mean the difference between a comfortable retirement and financial struggle.

Note: This guide focuses specifically on US tax law and IRA rules. International readers should consult their local retirement account options and tax implications.

IRA Basics: What You Need to Know

Individual Retirement Account (IRA) Fundamentals

What is an IRA? An Individual Retirement Account is a tax-advantaged investment account designed to help Americans save for retirement. Unlike employer-sponsored 401(k) plans, IRAs are opened and managed directly by individuals.

Key Benefits for US Investors:

- Tax advantages: Either immediate deduction or tax-free growth

- Investment control: Choose from wide range of investments

- Portability: Stays with you regardless of employment changes

- Supplemental savings: Complements employer retirement plans

2025 IRA Contribution Limits (US)

Standard Contribution Limits:

- Under age 50: $7,000 per year

- Age 50 and older: $8,000 per year (includes $1,000 catch-up contribution)

- Deadline: Contributions can be made until tax filing deadline (typically April 15)

Income Limits for 2025:

- Traditional IRA deduction phase-out: Varies based on workplace retirement plan coverage

- Roth IRA contribution phase-out: $138,000-$153,000 (single), $218,000-$228,000 (married filing jointly)

These limits are adjusted annually for inflation by the IRS.

Traditional IRA: The Immediate Tax Benefit

How Traditional IRAs Work

Tax Treatment:

- Contributions: Tax-deductible in the year you contribute (if eligible)

- Growth: Tax-deferred—no taxes on gains, dividends, or interest while in account

- Withdrawals: Taxed as ordinary income in retirement

The Tax Logic: You get an immediate tax deduction when you contribute, effectively reducing your current tax bill. The money grows tax-free for decades, but you’ll pay ordinary income taxes when you withdraw in retirement.

Traditional IRA Tax Deduction Rules

Full Deduction Available:

- No workplace retirement plan: Full deduction regardless of income

- Have workplace plan: Full deduction if AGI is below phase-out thresholds

2025 Deduction Phase-Out Ranges (with workplace plan):

- Single filers: $77,000-$87,000 AGI

- Married filing jointly: $123,000-$143,000 AGI

- Married filing separately: $0-$10,000 AGI

Example: Single taxpayer earning $82,000 with workplace 401(k)

- Falls in phase-out range

- Can deduct approximately $3,500 of $7,000 contribution

- Remaining $3,500 becomes non-deductible contribution

Required Minimum Distributions (RMDs)

RMD Rules for Traditional IRAs:

- Starting age: Must begin by April 1 following the year you turn 73

- Annual requirement: Must withdraw minimum amount based on IRS life expectancy tables

- Penalty: 25% penalty on amount not withdrawn (reduced from 50% in 2023)

Impact on Retirement Planning:

- Forced distributions: Can’t let money grow indefinitely

- Tax planning: Need to manage distributions to minimize tax bracket jumps

- Estate planning: Affects inheritance strategies

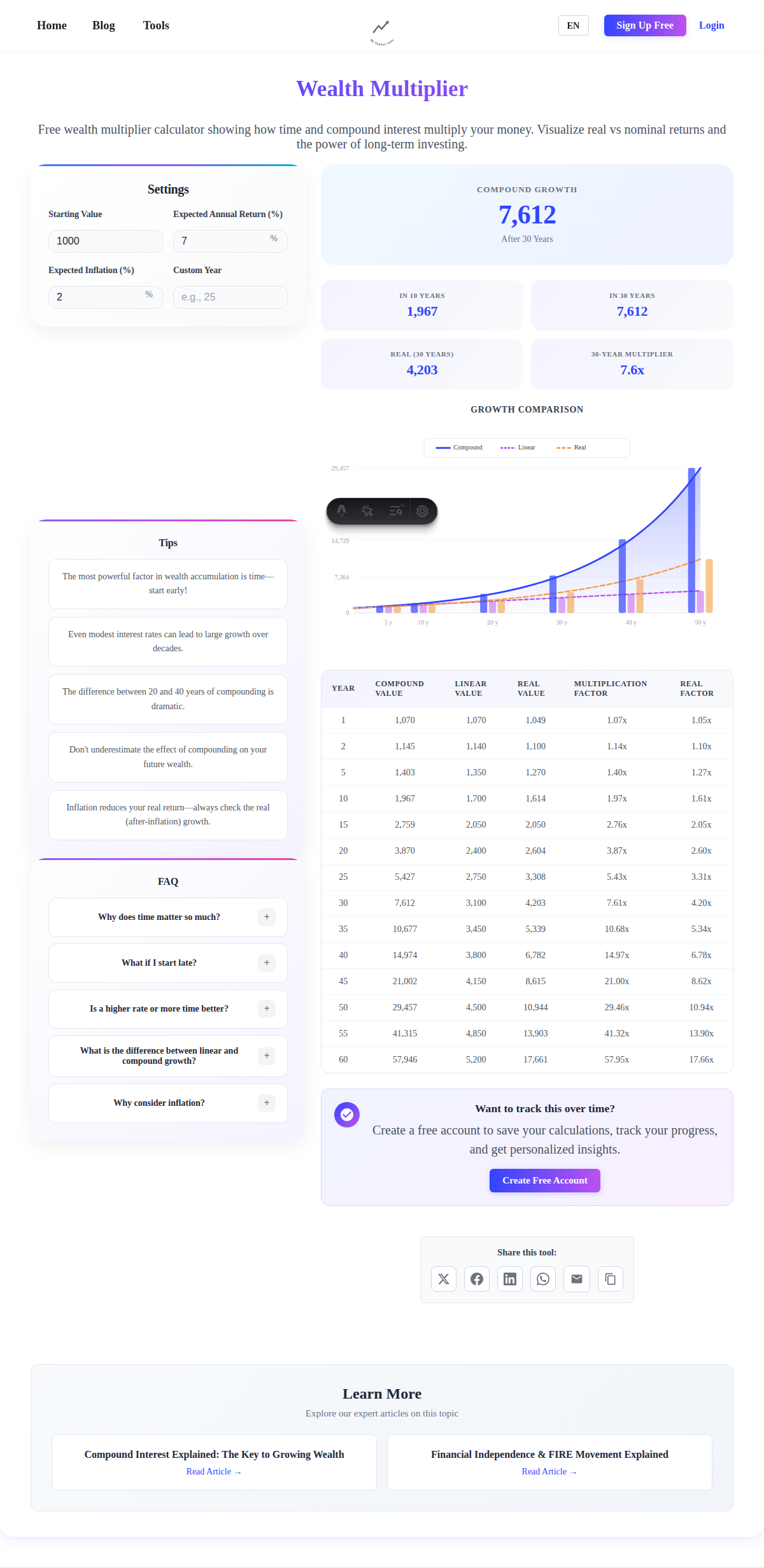

Use our compound interest calculator to see how RMDs affect your long-term growth projections.

Roth IRA: The Tax-Free Growth Account

How Roth IRAs Work

Tax Treatment:

- Contributions: Made with after-tax dollars (no immediate deduction)

- Growth: Tax-free—no taxes on gains, dividends, or interest ever

- Withdrawals: Tax-free in retirement (contributions and earnings)

The Tax Logic: You pay taxes upfront on your contributions but never pay taxes again. All growth and withdrawals in retirement are completely tax-free.

Roth IRA Income Limits

2025 Income Phase-Out Ranges:

- Single filers: $138,000-$153,000 AGI

- Married filing jointly: $218,000-$228,000 AGI

- Married filing separately: $0-$10,000 AGI

Above income limits?

- Backdoor Roth IRA: Make non-deductible Traditional IRA contribution, then convert to Roth

- Mega backdoor Roth: Through employer 401(k) plans (if available)

Roth IRA Withdrawal Rules

Contribution Withdrawals:

- Always available: Can withdraw contributions penalty-free anytime

- No taxes: Since you already paid taxes on contributions

- No RMDs: No required distributions during your lifetime

Earnings Withdrawals:

- 5-year rule: Account must be open 5 years

- Age 59½ rule: Must be at least 59½ for penalty-free earnings withdrawals

- Exceptions: First-time home purchase ($10,000 lifetime), qualified education expenses, medical expenses

Early Withdrawal Example:

- Contributed $35,000 over 5 years

- Account worth $50,000 (includes $15,000 in earnings)

- Can withdraw up to $35,000 anytime without taxes or penalties

- $15,000 in earnings subject to age and time restrictions

Tax Bracket Strategy: The Core Decision Factor

Current vs. Future Tax Rate Analysis

Choose Traditional IRA when:

- Current tax bracket is higher than expected retirement bracket

- Peak earning years: Currently in 24%+ tax bracket

- Lower retirement income: Expect to need less income in retirement

- State tax considerations: Currently in high-tax state, plan to retire in no-tax state

Choose Roth IRA when:

- Current tax bracket is lower than expected retirement bracket

- Early career: Currently in 12% or 22% tax bracket

- Income growth expected: Anticipate earning more in future

- Tax diversification: Want mix of pre-tax and after-tax retirement accounts

Real-World Tax Bracket Examples

Scenario 1: Young Professional

- Age: 25

- Current income: $55,000 (22% tax bracket)

- Expected retirement income needs: $80,000+ (potentially 24% bracket)

- Recommendation: Roth IRA

- Logic: Pay 22% tax now, avoid potentially higher taxes later

Scenario 2: Peak Earner

- Age: 45

- Current income: $150,000 (24% tax bracket)

- Expected retirement income needs: $100,000 (22% bracket)

- Recommendation: Traditional IRA

- Logic: Save 24% in taxes now, pay 22% in retirement

Scenario 3: High Earner

- Age: 35

- Current income: $200,000 (32% tax bracket)

- Above Roth income limits

- Strategy: Backdoor Roth IRA conversion

- Logic: High current bracket makes Traditional attractive, but Roth provides tax diversification

State Tax Considerations for US Investors

State Income Tax Impact

No state income tax states (2025): Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming

High state income tax states: California (up to 13.3%), New York (up to 8.82%), New Jersey (up to 10.75%)

Strategic considerations:

- Moving states: Traditional IRA if moving from high-tax to no-tax state in retirement

- Staying put: Roth may be better if staying in high-tax state

- State-specific rules: Some states don’t tax retirement income

Examples by State

California Resident:

- Current situation: $100,000 income, 9.3% state tax + 22% federal = 31.3% combined

- Retirement plan: Stay in California

- Analysis: Traditional IRA saves 31.3% now, likely pays similar rate in retirement

- Consideration: Roth provides hedge against future California tax increases

Texas Resident Planning Florida Retirement:

- Current: 22% federal tax only

- Retirement: 22% federal tax only (no state change benefit)

- Decision: Based purely on federal tax bracket expectations

Advanced Strategies for US Investors

Backdoor Roth IRA Strategy

Who benefits:

- High earners above Roth income limits

- Want Roth benefits despite income restrictions

- Have no existing Traditional IRA balances (avoids pro-rata rule)

Step-by-step process:

- Contribute: Make non-deductible Traditional IRA contribution ($7,000 in 2025)

- Convert: Immediately convert to Roth IRA

- Pay taxes: On any growth between contribution and conversion (usually minimal)

- Result: $7,000 in Roth IRA despite being over income limits

Pro-rata rule warning: If you have existing Traditional IRA balances, the conversion is partially taxable based on the ratio of deductible to non-deductible contributions across all your Traditional IRAs.

Roth Conversion Ladder

Strategy: Systematically convert Traditional IRA money to Roth over time Best for: Early retirees, those with temporary low-income years

Example timeline:

- Ages 55-65: Convert $20,000/year from Traditional to Roth

- Tax management: Keep conversions within desired tax bracket

- Age 65+: Access converted funds penalty-free (5-year rule satisfied)

Tax planning considerations:

- Low-income years: Unemployed, between jobs, early retirement

- Market downturns: Convert when account values are depressed

- Bracket management: Stay within 12% or 22% bracket if possible

Tax Diversification Strategy

Concept: Have both Traditional and Roth accounts for retirement flexibility

Benefits:

- Tax bracket management: Choose which account to withdraw from based on annual tax situation

- Flexibility: Adapt to changing tax laws

- Roth benefits: No RMDs, tax-free growth, estate planning advantages

- Traditional benefits: Current tax deductions, required distributions may be manageable

Sample allocation strategy:

- 20s-30s: Primarily Roth (low tax brackets)

- 40s-50s: Mix of both or primarily Traditional (peak earning years)

- Pre-retirement: Consider Roth conversions during low-income years

Estate Planning Differences

Traditional IRA Inheritance Rules

For Spouses:

- Rollover option: Can treat inherited IRA as their own

- RMD flexibility: Can delay RMDs until deceased spouse would have turned 73

- Tax treatment: Distributions taxed as ordinary income to spouse

For Non-Spouse Beneficiaries:

- 10-year rule: Must distribute entire balance within 10 years of death

- No stretch: Cannot spread distributions over beneficiary’s lifetime (post-2019 rule)

- Tax impact: All distributions taxed as ordinary income to beneficiary

Roth IRA Inheritance Advantages

For Spouses:

- Rollover option: Can treat as their own Roth IRA

- No RMDs: Never required to take distributions during lifetime

- Tax-free: All distributions remain tax-free

For Non-Spouse Beneficiaries:

- 10-year rule: Must distribute within 10 years

- Tax-free distributions: No income taxes on any withdrawals

- Growth potential: Money can grow tax-free during 10-year period

Estate planning advantage: Roth IRAs provide tax-free inheritance to beneficiaries, making them powerful wealth transfer vehicles for high-net-worth families.

Investment Strategy Differences

Asset Location Optimization

Traditional IRA ideal for:

- High-dividend stocks: Tax-deferred growth on dividend income

- Bonds: Interest income tax-deferred

- REITs: High-yield real estate investments

- Active trading: No immediate tax consequences for buying/selling

Roth IRA ideal for:

- High-growth stocks: Tax-free growth on appreciation

- Small-cap stocks: Higher volatility and growth potential

- International stocks: Avoid dividend tax complications

- Alternative investments: Complex investments with tax-free growth

Risk Tolerance Implications

Traditional IRA considerations:

- Tax diversification: Future tax rates uncertain

- RMD risk: Required distributions may force selling during market downturns

- Tax drag: Future taxes reduce effective returns

Roth IRA considerations:

- Tax certainty: Know your tax rate today

- Flexibility: No required distributions allow indefinite growth

- Estate benefits: Pass tax-free money to heirs

Model different growth scenarios with our investment return calculator to see long-term implications.

Common Mistakes to Avoid

Mistake #1: Only Considering Current Tax Bracket

Problem: Choosing based solely on today’s tax rate Solution: Project future income needs and likely tax brackets

Mistake #2: Ignoring State Taxes

Problem: Forgetting state income tax implications Solution: Factor in both federal and state tax considerations

Mistake #3: Not Understanding RMD Impact

Problem: Underestimating how RMDs affect retirement tax planning Solution: Project RMD amounts and their tax consequences

Mistake #4: Pro-Rata Rule Complications

Problem: Attempting backdoor Roth with existing Traditional IRA balances Solution: Understand pro-rata rule or consider rolling Traditional IRAs to 401(k)

Mistake #5: All-or-Nothing Approach

Problem: Putting all retirement savings in one account type Solution: Consider tax diversification with both account types

Decision Framework for US Investors

Age-Based Guidelines

20s-30s:

- Default: Roth IRA (low current tax brackets)

- Exception: Very high earners may prefer Traditional

- Strategy: Maximize Roth contributions for decades of tax-free growth

40s-50s:

- Analysis required: Compare current vs. projected retirement brackets

- Peak earners: Traditional IRA likely optimal

- Moderate earners: Could go either way

- Strategy: Consider tax diversification

55+:

- Traditional focus: Higher current brackets, shorter growth period

- Roth conversions: If in low-income period before Social Security

- Strategy: Optimize for next 10-15 years of taxes

Income-Based Decision Points

Under $50,000: Roth IRA usually optimal (12% bracket) $50,000-$100,000: Depends on retirement projections and state taxes $100,000-$200,000: Traditional often better (24% bracket) Above $200,000: Backdoor Roth strategy required

The Calculation: Traditional vs. Roth

Break-even analysis example:

- Traditional IRA: $7,000 contribution in 24% bracket = $1,680 tax savings invested separately

- Roth IRA: $7,000 after-tax contribution

- Break-even: Need retirement tax rate below 24% for Traditional to win

- Variables: Investment returns, time horizon, state taxes, RMD impact

Tools and Implementation Resources

Essential Calculators

- Compound Interest Calculator: Compare long-term growth scenarios

- Investment Return Calculator: Model different contribution strategies

- Savings Goal Calculator: Plan retirement income needs

IRA Providers for US Investors

Low-cost brokerages:

- Vanguard: Excellent low-cost index funds, strong retirement focus

- Fidelity: Zero-fee index funds, comprehensive research tools

- Schwab: Full-service platform, good customer service

- TD Ameritrade/Charles Schwab: Robust trading platform

Robo-advisors:

- Betterment: Automated tax-loss harvesting, retirement planning tools

- Wealthfront: Tax optimization, financial planning integration

- Vanguard Personal Advisor: Human advisors + robo-management

Tax Preparation Considerations

Tax software compatibility:

- Most tax software handles IRA contributions automatically

- Track basis in non-deductible Traditional IRA contributions (Form 8606)

- Consider professional help for complex strategies (backdoor Roth, conversions)

The Bottom Line for US Investors

The Traditional vs. Roth IRA decision isn’t just about taxes—it’s about creating a comprehensive retirement strategy that maximizes your after-tax wealth and provides flexibility for an uncertain future.

Key takeaways:

- Tax bracket comparison is the primary decision factor

- State taxes significantly impact the analysis for many Americans

- Tax diversification provides valuable flexibility in retirement

- Roth conversions can be powerful during low-income years

- Estate planning benefits strongly favor Roth IRAs

- Income limits may require backdoor strategies for high earners

The most important action: Start contributing to either account type rather than paralyzed by the decision. You can always adjust your strategy over time, and both Traditional and Roth IRAs provide substantial advantages over taxable investing.

For most young Americans in the 12% or 22% tax brackets, Roth IRAs are optimal. For peak earners in the 24%+ brackets, Traditional IRAs usually make more sense. The decision becomes more nuanced in the middle ranges where personal factors and long-term projections matter most.

Ready to start your IRA strategy? Use our compound interest calculator to see how consistent contributions can grow over decades, regardless of which account type you choose. The power of tax-advantaged compounding makes either choice far superior to regular taxable investing.

Remember: The best retirement account is the one you’ll contribute to consistently. Choose the option that makes sense for your situation and start building your financial future today.