Why Financial Literacy Matters: Essential Money Concepts Everyone Should Know

Financial literacy—the ability to understand and effectively use various financial skills—is one of the most critical life skills you can develop, yet it’s surprisingly rare. Despite money touching every aspect of our lives, most people never receive formal financial education, leaving them vulnerable to poor decisions that can impact their entire future.

The statistics are sobering: only 57% of American adults are financially literate, 40% can’t cover a $400 emergency, and the average person carries over $6,000 in credit card debt. These numbers represent real people struggling with preventable financial problems that proper education could have avoided.

But here’s the empowering truth: financial literacy isn’t about complex formulas or advanced economics. The core concepts that drive financial success are surprisingly simple and learnable by anyone, regardless of their background or current situation. This comprehensive guide explores why financial literacy matters and breaks down the essential money concepts that form the foundation of financial prosperity.

The High Cost of Financial Illiteracy

Personal Consequences

Financial illiteracy isn’t just an abstract problem—it has devastating real-world consequences that affect millions of people:

Immediate Financial Problems:

- High-interest debt that compounds monthly

- Predatory lending and financial products

- Missed opportunities for employer benefits

- Overpaying for financial services and products

- Inability to build emergency savings

Long-term Life Impact:

- Retirement security threatened or impossible

- Limited housing and education options

- Reduced earning potential over lifetime

- Intergenerational poverty transmission

- Stress-related health problems from financial anxiety

Relationship and Family Effects:

- Money-related divorce and family conflict

- Children inheriting poor financial habits

- Social isolation due to financial shame

- Inability to help family members in need

- Limited opportunities for children’s education

Economic and Social Costs

Financial illiteracy doesn’t just hurt individuals—it damages entire economies and societies:

Economic Impact:

- Reduced consumer spending and economic growth

- Higher bankruptcy and foreclosure rates

- Increased burden on social safety nets

- Lower productivity due to financial stress

- Reduced innovation and entrepreneurship

Social Consequences:

- Widening wealth inequality

- Reduced social mobility

- Political instability from economic frustration

- Decreased civic engagement

- Intergenerational cycles of poverty

The Financial Literacy Crisis

Multiple factors contribute to widespread financial illiteracy:

Educational System Gaps:

- Only 21 US states require high school financial education

- Limited teacher training in financial concepts

- Curriculum focused on academic rather than practical skills

- No standardized financial education requirements

Cultural and Social Factors:

- Money considered taboo topic in many families

- Complex financial system that’s difficult to navigate

- Marketing that encourages consumption over saving

- Lack of accessible, trustworthy financial information

Technological Disruption:

- Digital payments making money feel less real

- Complex financial products and investment options

- Information overload from too many sources

- Scams and misinformation targeting the uninformed

The Life-Changing Power of Financial Literacy

Immediate Benefits

Financial literacy provides immediate improvements to your life:

Enhanced Decision-Making:

- Compare financial products effectively

- Avoid predatory lending and scams

- Negotiate better terms on loans and services

- Make informed investment choices

- Understand contracts and agreements

Stress Reduction:

- Confidence in financial decision-making

- Ability to plan for unexpected expenses

- Understanding of your financial situation

- Control over money rather than being controlled by it

- Reduced anxiety about financial future

Financial Efficiency:

- Lower fees and interest payments

- Better returns on investments and savings

- Optimal use of tax advantages

- Maximized employer benefits

- Elimination of unnecessary financial products

Long-term Advantages

The compound benefits of financial literacy build over time:

Wealth Building:

- Higher savings rates and investment returns

- Earlier retirement through proper planning

- Real estate ownership and equity building

- Business ownership and entrepreneurship opportunities

- Generational wealth creation

Life Opportunities:

- Career flexibility and risk-taking ability

- Educational investments for yourself and family

- Travel and experience opportunities

- Philanthropy and community contribution

- Peace of mind and life satisfaction

Risk Management:

- Adequate insurance coverage

- Emergency funds for unexpected events

- Diversified investments reducing volatility

- Estate planning for family protection

- Protection against financial predators

Essential Money Concept #1: The Time Value of Money and Compound Interest

Understanding Compound Interest

Compound interest is often called “the eighth wonder of the world” because of its incredible power to build wealth over time. It’s the process where your money earns returns, and those returns earn returns, creating exponential growth.

Simple vs. Compound Interest:

Simple Interest: You earn 5% annually on $1,000 = $50 per year

- Year 1: $1,050

- Year 10: $1,500

- Year 30: $2,500

Compound Interest: You earn 5% annually on growing balance

- Year 1: $1,050

- Year 10: $1,629

- Year 30: $4,322

The difference becomes dramatic over time: $4,322 vs. $2,500 after 30 years.

Practical Applications

Investing Early: Starting to invest at 25 vs. 35 can mean hundreds of thousands more dollars at retirement, even with the same monthly contributions.

Debt Management: Credit card debt compounds against you. A $5,000 balance at 18% interest takes 47 years to pay off with minimum payments and costs over $13,000 in interest.

Retirement Planning: Understanding compound growth helps you see why consistent, early investing is more powerful than trying to “catch up” later with larger contributions.

Action Steps:

- Use our Compound Interest Calculator to visualize growth scenarios

- Start investing immediately, even with small amounts

- Prioritize paying off high-interest debt

- Maximize employer 401(k) matching (free compound growth)

- Consider the long-term cost of every financial decision

Essential Money Concept #2: Budgeting and Cash Flow Management

The Foundation of Financial Success

Budgeting isn’t about restriction—it’s about awareness and control. It’s the process of intentionally directing your money toward your priorities rather than wondering where it went.

Different Budgeting Approaches

Zero-Based Budgeting: Every dollar has a specific purpose before the month begins. Income minus expenses equals zero.

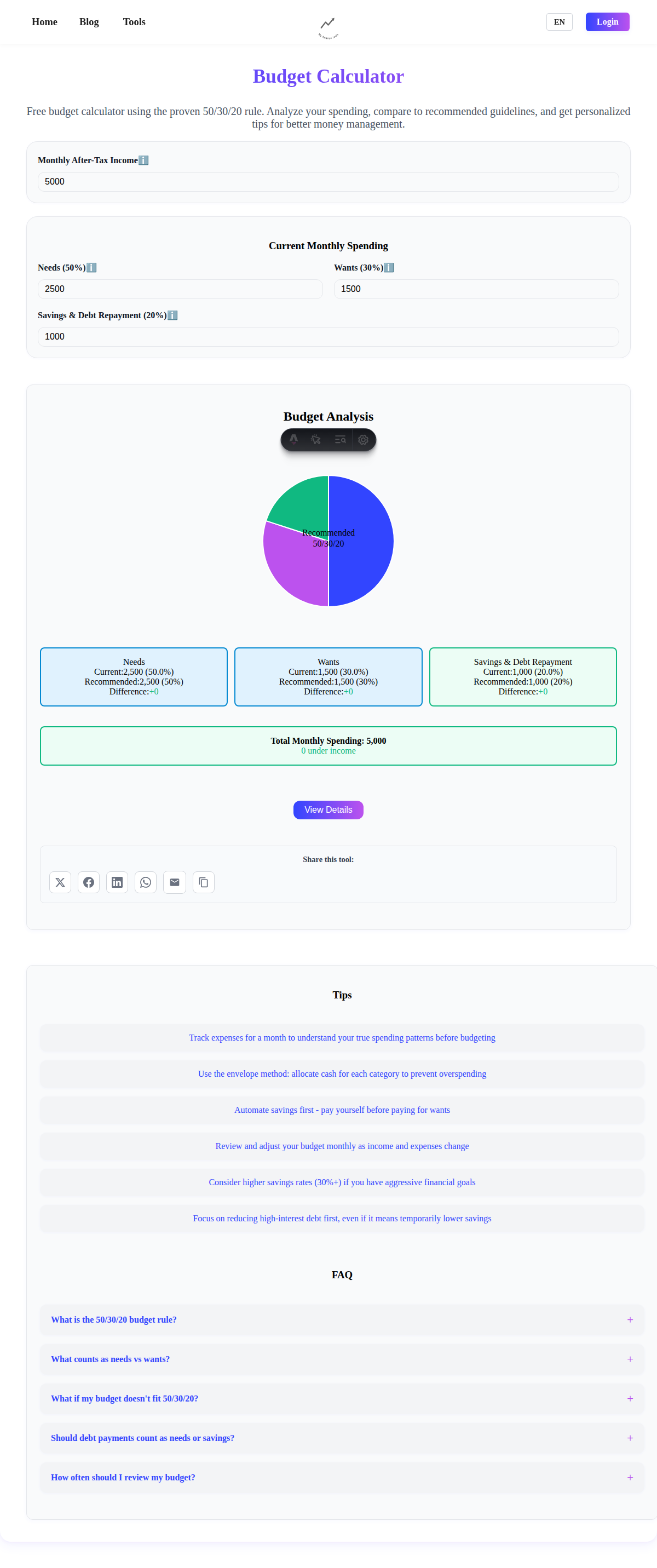

50/30/20 Rule:

- 50% for needs (housing, utilities, groceries, minimum debt payments)

- 30% for wants (entertainment, dining out, hobbies)

- 20% for savings and debt payoff

Pay Yourself First: Automatically save and invest a percentage before budgeting for expenses.

Envelope System: Allocate cash into categories and spend only what’s in each envelope.

Cash Flow Management

Understanding Income vs. Expenses:

- Track all money coming in and going out

- Identify patterns and trends in spending

- Recognize seasonal variations in income/expenses

- Plan for irregular expenses (car maintenance, gifts, taxes)

Creating Positive Cash Flow:

- Increase income through skills, side hustles, or career advancement

- Reduce unnecessary expenses without sacrificing quality of life

- Optimize recurring expenses (subscriptions, insurance, utilities)

- Eliminate high-interest debt that drains cash flow

Action Steps:

- Track expenses for one month to understand current patterns

- Use our Budget Calculator to create a sustainable plan

- Automate savings and bill payments to reduce decision fatigue

- Review and adjust budget monthly based on actual results

- Focus on increasing income alongside expense management

Essential Money Concept #3: Emergency Funds and Risk Management

The Importance of Emergency Funds

An emergency fund is your financial safety net, protecting you from unexpected expenses without going into debt. It’s the foundation of financial security and enables you to take calculated risks elsewhere.

How Much Do You Need?

Traditional Recommendation: 3-6 months of expenses Modern Considerations:

- Job stability and industry volatility

- Health status and insurance coverage

- Family responsibilities and dependents

- Multiple income sources vs. single income

- Economic uncertainty and market conditions

Building Strategy:

- Start with $1,000 minimum emergency fund

- Build to one month of expenses

- Gradually increase to 3-6 months

- Consider larger amounts for increased security

Beyond Emergency Funds: Comprehensive Risk Management

Insurance as Risk Transfer:

- Health insurance for medical emergencies

- Auto insurance for vehicle accidents

- Life insurance for income replacement

- Disability insurance for injury/illness protection

- Homeowner’s/renter’s insurance for property protection

Diversification as Risk Reduction:

- Multiple income sources

- Diversified investment portfolio

- Skills development for career security

- Geographic and industry diversification

Action Steps:

- Calculate your monthly expenses using our Emergency Fund Calculator

- Open a separate high-yield savings account for emergency funds

- Automate monthly contributions to build the fund gradually

- Review insurance coverage annually for adequacy

- Only use emergency funds for true emergencies, then replenish immediately

Essential Money Concept #4: Debt Management and Credit

Understanding Good Debt vs. Bad Debt

Not all debt is created equal. Understanding the difference helps you make strategic borrowing decisions.

Good Debt:

- Mortgages: Build equity and provide tax advantages

- Student loans: Invest in earning potential (with caveats)

- Business loans: Generate income and build assets

- Investment property: Generate rental income and appreciation

Bad Debt:

- Credit card debt: High interest on depreciating purchases

- Auto loans: Rapidly depreciating assets

- Personal loans for consumption: High interest on lifestyle inflation

- Payday loans: Extremely high interest, predatory terms

Credit Scores and Management

What Affects Your Credit Score:

- Payment history (35%): Always pay at least minimums on time

- Credit utilization (30%): Keep balances below 30% of limits

- Length of credit history (15%): Keep old accounts open

- Types of credit (10%): Mix of credit cards, loans, mortgages

- New credit inquiries (10%): Limit applications for new credit

Building and Maintaining Good Credit:

- Pay all bills on time, every time

- Keep credit card balances low

- Don’t close old credit cards

- Monitor credit reports for errors

- Use credit regularly but responsibly

Debt Elimination Strategies

Debt Snowball Method: Pay minimums on all debts, then attack smallest balance first. Provides psychological momentum through quick wins.

Debt Avalanche Method: Pay minimums on all debts, then attack highest interest rate first. Mathematically optimal, saves most money.

Debt Consolidation: Combine multiple debts into one payment, potentially at lower interest rate.

Action Steps:

- List all debts with balances, interest rates, and minimum payments

- Choose snowball or avalanche method based on your personality

- Avoid taking on new debt while paying off existing debt

- Check credit reports annually from all three bureaus

- Set up automatic payments to ensure on-time payments

Essential Money Concept #5: Investing and Wealth Building

Why Investing is Essential

Saving alone isn’t enough to build wealth due to inflation. Investing allows your money to grow faster than inflation, building real purchasing power over time.

Core Investment Principles

Start Early: Time is your greatest asset in investing. The earlier you start, the more compound growth works in your favor.

Diversification: Don’t put all eggs in one basket. Spread risk across different asset types, industries, and geographic regions.

Dollar-Cost Averaging: Invest consistently regardless of market conditions. This reduces the impact of market volatility and removes timing decisions.

Low Costs: Fees compound just like returns. Choose low-cost index funds and ETFs over expensive actively managed funds.

Long-term Perspective: Markets fluctuate short-term but tend to grow long-term. Stay invested through market cycles.

Asset Classes and Investment Vehicles

Stocks (Equities):

- Ownership shares in companies

- Higher potential returns, higher volatility

- Growth through price appreciation and dividends

- Best for long-term goals (10+ years)

Bonds (Fixed Income):

- Loans to companies or governments

- Lower returns, lower volatility

- Regular interest payments

- Good for shorter-term goals or portfolio balance

Real Estate:

- Direct property ownership or REITs

- Inflation hedge and diversification

- Regular income through rents

- Requires more capital and management

Mutual Funds and ETFs:

- Diversified portfolios in single investments

- Professional management (mutual funds) or index tracking (ETFs)

- Instant diversification with small amounts

- Ideal for most individual investors

Tax-Advantaged Accounts

401(k) Plans:

- Employer-sponsored retirement accounts

- Often include employer matching (free money)

- Tax-deferred growth

- Required minimum distributions in retirement

IRAs (Individual Retirement Accounts):

- Personal retirement accounts

- Traditional (tax-deferred) or Roth (tax-free growth)

- More investment options than 401(k)s

- Annual contribution limits

HSAs (Health Savings Accounts):

- Triple tax advantage: deductible, growth, withdrawals

- Must be paired with high-deductible health plan

- Can become retirement account after age 65

Action Steps:

- Start with employer 401(k) to capture full matching

- Open IRA for additional retirement savings

- Choose low-cost, diversified index funds

- Automate monthly investments to remove emotion

- Increase contributions annually with income growth

Essential Money Concept #6: Insurance and Risk Protection

Why Insurance Matters

Insurance transfers financial risk from you to insurance companies. While you hope never to use it, insurance protects your financial plan from catastrophic events.

Essential Insurance Types

Health Insurance:

- Protects against medical bankruptcies

- Provides access to quality healthcare

- Often required by law

- Choose based on health needs, doctor preferences, and budget

Life Insurance:

- Replaces your income if you die

- Especially important with dependents

- Term life for temporary needs, whole life for permanent needs

- Amount should be 10-12 times annual income

Disability Insurance:

- Replaces income if you can’t work due to injury/illness

- Often overlooked but statistically more likely than death

- Short-term and long-term options

- Often available through employer

Auto Insurance:

- Required by law in most states

- Liability covers damage you cause to others

- Comprehensive/collision covers your vehicle

- Choose deductibles based on emergency fund size

Homeowner’s/Renter’s Insurance:

- Protects property and belongings

- Liability coverage for accidents on your property

- Additional living expenses if home becomes uninhabitable

- Often required by mortgage lenders

How Much Insurance Do You Need?

Life Insurance Calculation:

- Replace 10-12 years of income

- Cover outstanding debts (mortgage, student loans)

- Fund children’s education

- Provide cushion for final expenses

Disability Insurance:

- Replace 60-70% of income

- Consider how long you could survive without income

- Factor in spouse’s income and family expenses

- Look for inflation protection and cost-of-living adjustments

Action Steps:

- Review all current insurance policies annually

- Shop for better rates while maintaining adequate coverage

- Increase deductibles if you have adequate emergency funds

- Ensure life and disability insurance keep pace with income growth

- Consider umbrella policies for additional liability protection

Essential Money Concept #7: Tax Planning and Optimization

Understanding How Taxes Work

Taxes are often your largest expense, but they’re also one of the most controllable through proper planning and strategy.

Types of Tax-Advantaged Accounts

Tax-Deferred Accounts:

- Traditional 401(k), 403(b), 457 plans

- Traditional IRAs

- Contributions reduce current taxes

- Pay taxes on withdrawals in retirement

Tax-Free Accounts:

- Roth 401(k) and IRAs

- Health Savings Accounts (HSAs)

- Pay taxes now, withdrawals are tax-free

- Especially valuable for young people in low tax brackets

**Tax Strategies for Different Life Stages

Early Career (Low Income):

- Maximize Roth contributions while in low tax brackets

- Take advantage of Saver’s Credit if eligible

- Contribute to HSA if available

- Keep taxes simple with standard deduction

Mid-Career (Higher Income):

- Balance traditional and Roth contributions

- Maximize employer matching first

- Consider tax-loss harvesting in taxable accounts

- Plan for major purchases (home, children’s education)

Pre-Retirement:

- Focus on traditional contributions for tax reduction

- Consider Roth conversions in lower-income years

- Plan withdrawal strategy for retirement

- Maximize catch-up contributions after age 50

Common Tax Mistakes to Avoid

Not Maximizing Employer Benefits:

- Missing out on 401(k) matching

- Not using HSA if available

- Forgetting about other pre-tax benefits (commuter, dependent care)

Poor Investment Location:

- Holding tax-inefficient investments in taxable accounts

- Not utilizing tax-loss harvesting

- Missing out on qualified dividend tax rates

Lack of Planning:

- Not considering tax implications of financial decisions

- Failing to plan for Required Minimum Distributions

- Not updating tax strategy as income changes

Action Steps:

- Understand your current marginal tax rate

- Maximize all available tax-advantaged account contributions

- Consider working with a tax professional for complex situations

- Review tax strategy annually and adjust as income changes

- Keep detailed records and receipts for potential deductions

Building Your Financial Education: Next Steps

Continuous Learning Approach

Financial literacy isn’t a one-time achievement—it’s an ongoing process of learning and adapting to changing circumstances and opportunities.

Essential Reading:

- Personal finance books by respected authors

- Financial news from reputable sources

- Investment prospectuses and fund reports

- Economic indicators and market analysis

Practical Experience:

- Start investing with small amounts to learn

- Track your spending and budgeting progress

- Compare financial products before major purchases

- Practice negotiating better rates and terms

Professional Guidance:

- Fee-only financial planners for comprehensive advice

- Tax professionals for complex tax situations

- Estate attorneys for legacy planning

- Insurance agents for risk assessment

Common Learning Pitfalls to Avoid

Information Overload:

- Focus on fundamentals before advanced strategies

- Choose a few trusted sources rather than consuming everything

- Implement basic concepts before moving to complex ones

Perfectionism Paralysis:

- Start with imperfect action rather than perfect planning

- Adjust strategies as you learn and circumstances change

- Don’t let fear of mistakes prevent you from starting

Get-Rich-Quick Thinking:

- Avoid schemes promising unrealistic returns

- Focus on proven, long-term strategies

- Be skeptical of complex investment products

- Remember that building wealth takes time and consistency

Creating Your Personal Financial Plan

Step 1: Assess Your Current Situation

- Net worth calculation (assets minus liabilities)

- Cash flow analysis (income minus expenses)

- Risk tolerance and time horizon evaluation

- Current insurance and investment review

Step 2: Set Clear Financial Goals

- Short-term (1-2 years): Emergency fund, debt payoff

- Medium-term (3-10 years): Home purchase, children’s education

- Long-term (10+ years): Retirement, legacy planning

Step 3: Implement Core Strategies

- Emergency fund building

- Debt elimination plan

- Investment strategy with proper asset allocation

- Insurance coverage review and optimization

- Tax strategy implementation

Step 4: Monitor and Adjust

- Monthly budget reviews

- Quarterly investment rebalancing

- Annual comprehensive financial review

- Life change adaptations (marriage, children, career changes)

The Social Impact of Financial Literacy

Breaking Cycles of Financial Struggle

When you become financially literate, you don’t just improve your own life—you create positive ripple effects:

Family Impact:

- Children learn healthy money habits through observation

- Reduced financial stress improves family relationships

- Ability to help family members in financial emergencies

- Creating generational wealth that benefits future generations

Community Benefits:

- Financial stability contributes to community economic health

- Educated consumers make better financial decisions

- Reduced burden on social safety nets

- Support for local businesses and economic growth

Societal Change:

- Demand for better financial products and services

- Political pressure for financial education and consumer protection

- Reduced inequality through improved financial outcomes

- Cultural shift toward long-term thinking and planning

Teaching Others

As you develop financial literacy, consider sharing your knowledge:

Family Education:

- Teach children age-appropriate money concepts

- Share strategies with spouse or partner

- Help extended family members with financial planning

- Model good financial behavior consistently

Community Involvement:

- Volunteer for financial literacy programs

- Mentor young adults entering the workforce

- Support policies that promote financial education

- Share experiences (anonymously) to help others learn

Conclusion: Your Financial Future Starts Today

Financial literacy isn’t just about numbers and calculations—it’s about freedom, security, and the ability to live life on your own terms. Every concept in this guide, from compound interest to insurance planning, works together to create a comprehensive approach to financial success.

Key Takeaways:

- Start Now: Time is your greatest asset in building wealth

- Learn Continuously: Financial education is a lifelong process

- Focus on Fundamentals: Master basic concepts before advanced strategies

- Take Action: Imperfect action beats perfect planning

- Think Long-term: Most financial success comes from consistent, boring strategies

- Protect What You Build: Risk management is as important as wealth building

- Share Your Knowledge: Help others benefit from what you’ve learned

Your Next Steps:

Don’t let this information remain theoretical. Choose one concept from this guide and take action today:

- Calculate your net worth and cash flow

- Open an emergency fund savings account

- Sign up for your employer’s 401(k) with matching

- Use our Budget Calculator to create a spending plan

- Review your insurance coverage for gaps

- Start tracking your expenses for one month

The path to financial literacy and prosperity isn’t always easy, but it’s always worth it. Every small step you take today compounds into significant results over time. Your future self will thank you for starting now, and your family will benefit from the knowledge and security you build.

Financial literacy gives you the power to make informed decisions, avoid costly mistakes, and build the life you want. The essential concepts in this guide provide the foundation—now it’s up to you to build upon it.

Remember: You don’t need to be perfect, just consistent. You don’t need to be wealthy to start, just willing to learn. Your financial education begins with the next decision you make about money. Make it a good one.

This guide provides general financial education and should not be considered personalized financial advice. Consider consulting with qualified financial professionals for guidance specific to your situation. Continue your financial education through reputable sources and always be skeptical of investment opportunities that seem too good to be true.