Wealth Building in Your 30s and 40s: The Acceleration Years

Welcome to your financial acceleration phase. If your twenties were about building the foundation, your thirties and forties are about stepping on the gas pedal. These are typically your peak earning years, but they’re also when life gets expensive—homes, families, aging parents, and lifestyle inflation all compete for your growing income.

The challenge? Making the right financial choices among competing priorities while building serious wealth for the future. The opportunity? You have both higher income and financial wisdom that your younger self lacked.

Let’s explore how to navigate this critical phase and emerge in your fifties with significant wealth and financial security.

Why Your 30s and 40s Are Make-or-Break Decades

The Income Reality: Most people see their biggest salary increases during these decades. The median income typically grows by 60-100% from age 30 to age 45. But here’s the catch—expenses often grow even faster if you’re not careful.

The Lifestyle Inflation Trap:

- Age 25: Making $45,000, saving 15%

- Age 35: Making $75,000, saving 8% (lifestyle inflation ate the difference)

- Age 45: Making $95,000, saving 5% (now supporting family, bigger house, more expenses)

The Wealth Building Opportunity: If you avoid lifestyle inflation and maintain or increase your savings rate, these decades can generate 60-70% of your lifetime wealth accumulation.

Example: Someone earning $50,000 at 30 who increases to $100,000 by 45 while maintaining a 20% savings rate will accumulate $850,000+ during these 15 years alone (assuming 7% investment returns).

The Big Financial Decisions of Your 30s and 40s

Decision #1: Rent vs. Buy Your Home

This isn’t just about monthly costs—it’s about lifestyle, wealth building, and flexibility.

When Buying Makes Sense:

- Stable location: Planning to stay 5+ years

- Financial readiness: 20% down payment + 3-6 months expenses still remaining

- Total housing costs: Including maintenance, taxes, and insurance under 28% of income

- Career stability: Steady income with growth trajectory

When Renting Makes Sense:

- High mobility: Career requires potential relocation

- Expensive markets: Purchase prices 20+ times annual rent

- Investment opportunity: Can invest down payment for higher returns

- Life uncertainty: Major life changes possible (marriage, career change, family)

Global Considerations: Housing markets vary dramatically. In cities like Hong Kong, London, or San Francisco, the price-to-rent ratio might favor renting. In smaller cities or countries with stable property markets, buying often builds wealth.

The Hidden Costs of Homeownership:

- Maintenance: 1-3% of home value annually

- Property taxes: Varies by location (0.5-3% annually)

- Insurance: Higher than renter’s insurance

- Opportunity cost: Down payment could be invested instead

- Transaction costs: 6-8% of home value when buying/selling

Decision #2: Family Financial Planning

Childcare Costs (Global Examples):

- United States: $200-2,000/month per child

- United Kingdom: £100-1,500/month per child

- Germany: €300-1,200/month per child

- Australia: AUD $400-2,500/month per child

Education Planning: The approach varies dramatically by country:

Countries with Free Higher Education: (Germany, France, Norway)

- Focus savings on living expenses during studies

- Consider international education options

- Invest education savings for other goals

Countries with Expensive Higher Education: (US, UK, Australia)

- Start education savings early (even $100/month helps)

- Use tax-advantaged education accounts where available

- Consider education inflation (typically 3-5% annually)

Family Income Strategy:

- Dual income: Coordinate careers to maximize total household income

- Career sequencing: One partner advances while other focuses on family, then switch

- Flexible work: Remote work, freelancing, or entrepreneurship for family balance

Decision #3: Insurance Optimization

Your insurance needs peak during these decades when you have dependents and significant assets to protect.

Life Insurance Strategy:

- Amount needed: 8-12x annual income for income replacement

- Term vs. whole: Term life insurance is typically more cost-effective

- Duration: Until children are independent and retirement savings sufficient

Disability Insurance: More important than life insurance for most people—you’re more likely to become disabled than die during your career.

- Amount: 60-70% of current income

- Waiting period: 90-180 days to reduce premiums

- Own occupation: Coverage if you can’t perform your specific job

Health Insurance Optimization:

- High-deductible plans: With health savings accounts where available

- Employer benefits: Maximize employer contributions

- International considerations: Supplemental coverage for global families

Decision #4: Career and Income Acceleration

Your thirties and forties are prime time for major career moves and income growth.

Salary Negotiation Strategy:

- Market research: Know your worth in current market

- Value documentation: Track and quantify your contributions

- Timing: Negotiate after major achievements or during review periods

- Total compensation: Consider benefits, equity, flexibility, not just salary

Career Advancement Paths:

- Management track: Leading teams and departments

- Technical expertise: Becoming the go-to expert in your field

- Entrepreneurship: Starting your own business or consulting

- Industry switching: Moving to higher-paying sectors

Side Income Development:

- Consulting: Leveraging your professional expertise

- Digital products: Creating courses, apps, or content

- Investment income: Real estate, dividends, or business ownership

- Passive income: Building systems that generate income without active work

Advanced Investment Strategies for Peak Earners

Asset Allocation Evolution

Your investment strategy should evolve as your income and net worth grow:

Early 30s (Building Phase):

- 80% stocks / 20% bonds

- Focus on growth and accumulation

- Higher risk tolerance with long time horizon

Late 30s to Early 40s (Acceleration Phase):

- 70% stocks / 25% bonds / 5% alternatives

- Begin diversification into real estate, international markets

- Start considering tax optimization

Late 40s (Mature Accumulation):

- 60% stocks / 30% bonds / 10% alternatives

- Increase stability while maintaining growth

- Focus on tax-efficient strategies

Geographic Diversification

Don’t put all your wealth in your home country’s assets:

Global Stock Allocation:

- 40-60% home country stocks

- 20-30% developed international markets

- 10-20% emerging markets

- 5-10% alternative investments

Currency Hedging: Consider currency exposure, especially if you plan to retire in a different country or have international expenses.

Tax-Efficient Investing

As your income grows, tax efficiency becomes increasingly important:

Account Prioritization:

- Employer match (free money)

- Tax-advantaged accounts (maximize contributions)

- Tax-efficient funds in taxable accounts

- Tax-loss harvesting to offset gains

Asset Location Strategy:

- Tax-inefficient investments (bonds, REITs) in tax-advantaged accounts

- Tax-efficient investments (index funds) in taxable accounts

- Growth stocks in accounts where gains won’t be taxed

Managing Multiple Financial Goals

The Priority Framework

With limited resources and multiple goals, prioritization is crucial:

Tier 1 (Non-Negotiable):

- Emergency fund maintenance

- High-interest debt elimination

- Employer retirement match

- Adequate insurance coverage

Tier 2 (High Priority):

- Retirement savings (15-20% of income)

- Home down payment (if buying)

- Children’s education (if applicable)

Tier 3 (Nice to Have):

- Extra home payments

- Taxable investment accounts

- Luxury purchases and experiences

The Bucket Strategy

Organize your money into different “buckets” based on time horizons:

Emergency Bucket (0-1 year):

- High-yield savings account

- 3-6 months of expenses

- Immediate access required

Short-term Goals Bucket (1-5 years):

- Home down payment

- Car replacement

- Family vacation fund

- Conservative investments (CDs, short-term bonds)

Medium-term Goals Bucket (5-15 years):

- Children’s education

- Early retirement fund

- Balanced investment portfolio

Long-term Wealth Bucket (15+ years):

- Retirement accounts

- Growth-focused investments

- Real estate investments

Avoiding Common Mistakes in Your Peak Years

Mistake #1: Lifestyle Inflation Without Purpose

Every income increase doesn’t need to become an immediate lifestyle upgrade.

Smart Lifestyle Scaling:

- Save 50% of every raise

- Upgrade selectively in areas that truly improve life quality

- Avoid status symbol purchases that impress others but don’t add value

Mistake #2: House Poor Syndrome

Buying too much house because you “can afford the payments.”

Healthy Housing Guidelines:

- Total housing costs under 28% of gross income

- Down payment doesn’t exhaust emergency fund

- Consider total cost including maintenance, taxes, insurance

- Room for growth in income and family size

Mistake #3: Neglecting Retirement for Current Goals

Children’s education and home purchases are important, but retirement should remain the top priority.

Why Retirement Comes First:

- No loans available for retirement

- Compound interest is most powerful over long periods

- Children have options for education funding

- Financial stress in retirement affects the whole family

Mistake #4: Not Teaching Kids About Money

Your children are watching your financial habits and forming their own money beliefs.

Financial Education for Kids:

- Age 5-10: Basic money concepts, saving vs. spending

- Age 11-14: Budgeting, earning money through chores

- Age 15-18: Banking, investing, credit, job skills

- College age: Real-world money management, student loans, career planning

Mistake #5: Ignoring Aging Parents

Many people in their 40s face the “sandwich generation” challenge—supporting both children and aging parents.

Parent Care Planning:

- Have conversations about their financial situation

- Understand their insurance and long-term care coverage

- Plan for potential support in your own budget

- Consider legal documents (power of attorney, wills)

Advanced Wealth Building Strategies

Real Estate Investment

Beyond your primary residence, real estate can be a powerful wealth building tool:

Rental Property Investment:

- Cash flow positive properties in growing areas

- Property management considerations (time vs. hiring managers)

- Tax advantages (depreciation, expense deductions)

- Market research crucial for success

Real Estate Investment Trusts (REITs):

- Lower barrier to entry than direct property ownership

- Professional management and diversification

- Liquidity compared to physical real estate

- Dividend income potential

Business Ownership

Your peak earning years might be the perfect time to start a business:

Business Investment Strategies:

- Side business development while maintaining primary income

- Partnership opportunities leveraging your expertise

- Franchise ownership for proven business models

- Investment in others’ businesses through equity stakes

International Diversification

Consider global opportunities as your wealth grows:

International Investing:

- Foreign stock markets for diversification

- International real estate in growing markets

- Currency diversification to hedge domestic currency risk

- Global business opportunities leveraging technology

Health and Wealth Connection

Your health directly impacts your wealth, especially as you age:

Preventive Health Investment:

- Regular checkups to catch issues early

- Dental and vision care to avoid expensive emergency treatments

- Mental health support during stressful career and family phases

- Fitness investment for long-term health and energy

Health Savings Strategies:

- Health Savings Accounts (where available) for triple tax advantage

- Preventive care to avoid major medical expenses

- Healthy lifestyle choices that reduce long-term healthcare costs

Technology and Wealth Building

Leverage technology to optimize your financial management:

Investment Technology:

- Robo-advisors for automated portfolio management

- Investment apps for easy contributions and monitoring

- Tax software for optimization and filing

- Financial planning tools for goal tracking

Automation Systems:

- Automatic investing increases with salary bumps

- Bill pay automation to avoid late fees and optimize credit

- Savings automation for multiple goals simultaneously

- Rebalancing automation to maintain target allocations

Preparing for Your 50s and Beyond

As you approach 50, your wealth building strategy should begin shifting:

Wealth Preservation Focus:

- Reduce portfolio risk gradually

- Increase emergency fund to 6-12 months expenses

- Optimize tax strategies for pre-retirement years

- Plan career transition strategy

Estate Planning Basics:

- Will and testament updated for current situation

- Beneficiary designations on all accounts

- Power of attorney documents

- Life insurance review for changing needs

Creating Your Acceleration Plan

Phase 1: Assessment (Month 1)

- Net worth calculation (assets minus debts)

- Cash flow analysis (income minus expenses)

- Goal prioritization using the tier system

- Insurance review for adequate coverage

Phase 2: Optimization (Months 2-3)

- Increase savings rate to 20%+ of income

- Optimize investment allocation for your age and goals

- Refinance debt at lower rates where possible

- Automate financial systems for consistency

Phase 3: Acceleration (Months 4-12)

- Implement income growth strategies

- Execute major financial decisions (home buying, etc.)

- Monitor and adjust systems quarterly

- Plan for next life phase financial needs

Your 30s and 40s Financial Milestones

By Age 35:

- Net worth: 2x annual salary

- Retirement savings: 15%+ of income

- Emergency fund: 3-6 months expenses

- Home ownership decision made and implemented

By Age 40:

- Net worth: 3-4x annual salary

- Retirement accounts: Well-established and growing

- Education funding: On track if applicable

- Estate planning: Basic documents in place

By Age 45:

- Net worth: 5-6x annual salary

- Peak earning years: Maximizing income potential

- Wealth diversification: Beyond just retirement accounts

- Pre-retirement planning: Beginning transition strategies

The Psychology of Peak Earning Years

Managing Success Stress

Higher income and more responsibilities can create stress. Financial systems help manage this:

- Automated systems reduce daily money decisions

- Clear priorities prevent overwhelming choices

- Regular reviews keep you on track without obsessing

Family Financial Dynamics

Money discussions become more complex with families:

- Joint financial goals with spouse/partner

- Teaching children good money habits

- Balancing individual and family financial needs

Peer Pressure and Lifestyle Inflation

Success can lead to expensive social circles:

- Value-based spending aligned with your priorities

- Ignore status symbols that don’t add real value

- Find like-minded friends who support your financial goals

When Life Doesn’t Go as Planned

Job Loss Strategy

With higher expenses and responsibilities, job loss planning is crucial:

- Larger emergency fund (6-12 months expenses)

- Professional network maintenance for opportunities

- Skill development to stay competitive

- Contingency plans for major expense reduction

Divorce Financial Planning

Unfortunately common during these decades:

- Separate financial identity maintenance

- Asset protection strategies where legally appropriate

- Updated estate planning documents

- Financial independence for both partners

Health Crisis Management

Health issues can derail financial plans:

- Adequate insurance coverage for major medical events

- Disability insurance for income protection

- Flexible financial plans that can adapt to health changes

- Health-focused lifestyle choices for prevention

Taking Action in Your Acceleration Years

The strategies in your thirties and forties are more complex than your twenties, but the principles remain the same: spend less than you earn, invest the difference wisely, and stay consistent.

Your Week 1 Action Items:

- Calculate your current net worth and compare to age-based targets

- Review your investment allocation and rebalance if needed

- Assess your insurance coverage for adequacy

- Set up automatic increases in your retirement contributions

Your Month 1 Goals:

- Create a comprehensive financial plan addressing all major goals

- Optimize your investment accounts for tax efficiency

- Research major financial decisions (home buying, education funding)

- Build systems for ongoing financial management

Remember: these are your peak earning and wealth building years. The decisions you make now will determine whether you reach your fifties with significant wealth and options, or find yourself financially stressed as retirement approaches.

The key is balancing current life enjoyment with future financial security. You don’t have to choose between living well today and building wealth for tomorrow—but you do need to be intentional about both.

Your future self is counting on the financial decisions you make during these critical decades. Make them count.

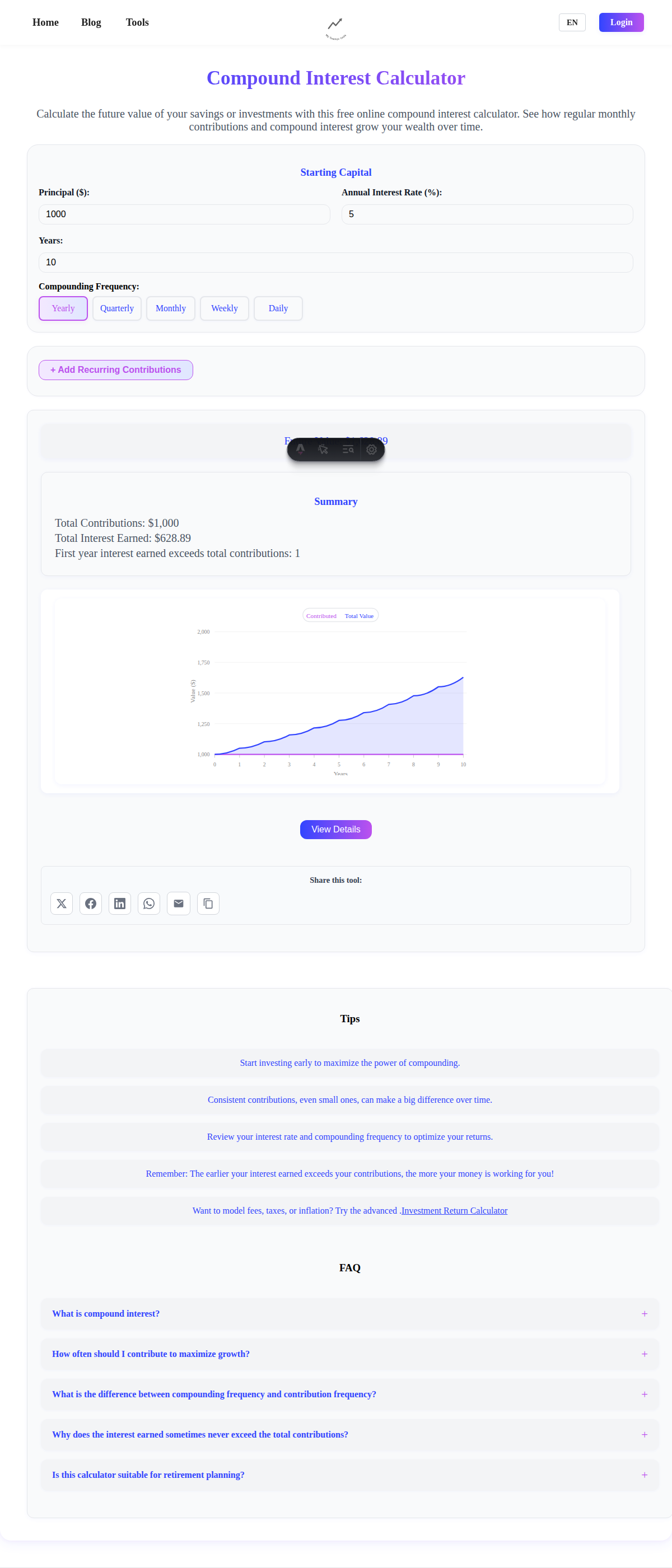

Ready to accelerate your wealth building? Use our financial calculators to model different scenarios and create your personalized acceleration plan for your peak earning years.