Understanding Inflation: How to Protect Your Money’s Purchasing Power

Inflation is often called the “silent wealth killer” because it quietly erodes the value of your money over time. While a dollar today buys the same goods and services as it did yesterday, over months and years, that same dollar will buy progressively less. Understanding how inflation works and learning to protect your purchasing power is crucial for long-term financial success.

In this comprehensive guide, we’ll explore what inflation really means, how it impacts your finances, and most importantly, proven strategies to safeguard and grow your wealth even when prices are rising.

What Is Inflation and Why Does It Matter?

Inflation is the general increase in prices of goods and services over time, which reduces the purchasing power of money. When inflation occurs, each unit of currency buys fewer goods and services than it could in previous periods.

The Real-World Impact of Inflation

Consider this example: If inflation averages 3% per year, an item that costs $100 today will cost approximately $103 next year, $106 the year after, and $134 in ten years. Meanwhile, if your money sits in a savings account earning 1% interest, you’re actually losing purchasing power every year.

This effect compounds over time. The Bureau of Labor Statistics reports that what cost $1 in 1970 would cost about $7.25 today – a purchasing power decline of over 85%.

Common Causes of Inflation

Understanding what drives inflation can help you anticipate and prepare for it:

Demand-Pull Inflation: When demand for goods and services exceeds supply, prices rise. This often happens during economic growth periods when consumers have more money to spend.

Cost-Push Inflation: When the costs of production increase (wages, raw materials, energy), businesses pass these costs to consumers through higher prices.

Monetary Inflation: When central banks increase the money supply faster than economic growth, more money chases the same goods, driving up prices.

Supply Chain Disruptions: Events like pandemics, natural disasters, or geopolitical conflicts can reduce supply while demand remains constant, pushing prices higher.

How Inflation Erodes Different Types of Assets

Cash and Cash Equivalents

Traditional savings accounts, checking accounts, and money market funds are most vulnerable to inflation. With interest rates often below inflation rates, these accounts lose purchasing power over time.

Example: With 3% inflation and a 1% savings account interest rate, you experience a real return of -2% annually – meaning your money loses 2% of its buying power each year.

Fixed-Income Investments

Bonds and certificates of deposit (CDs) with fixed interest rates also struggle during inflationary periods. While they may offer higher returns than savings accounts, they often fail to keep pace with rising prices.

Variable-Rate Investments

Some bonds and loans have variable rates that adjust with inflation, offering better protection. Treasury Inflation-Protected Securities (TIPS) are specifically designed to combat inflation.

Proven Strategies to Protect Your Purchasing Power

1. Invest in Real Assets

Real Estate: Property values and rental income typically rise with inflation. Real estate investment trusts (REITs) offer an accessible way to invest in real estate without direct property ownership.

Precious Metals: Gold, silver, and other precious metals have historically served as inflation hedges. While they don’t always keep perfect pace with inflation, they often perform well during periods of high inflation and economic uncertainty.

Commodities: Basic materials like oil, agricultural products, and industrial metals often rise in price during inflationary periods.

2. Build a Diversified Stock Portfolio

Historically, stocks have been one of the best long-term protections against inflation. Companies can often raise prices to maintain profit margins during inflationary periods.

Focus on Quality Companies: Businesses with strong competitive advantages (moats) can more easily pass increased costs to consumers.

International Diversification: Global stocks provide exposure to different currencies and economies, reducing your dependence on any single country’s monetary policy.

Inflation-Resistant Sectors: Consider utilities, consumer staples, and healthcare companies that provide essential services with inelastic demand.

3. Consider Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS): These government bonds adjust their principal value based on inflation, ensuring your investment keeps pace with rising prices.

I Bonds: Series I Savings Bonds earn a combination of fixed and inflation-adjusted rates, making them an excellent low-risk inflation hedge.

4. Optimize Your Debt Strategy

Fixed-Rate Debt Can Be Your Friend: If you have fixed-rate loans (mortgages, student loans), inflation actually works in your favor. You’re paying back the debt with “cheaper” dollars over time.

Strategic Borrowing: In moderate inflation environments, taking on fixed-rate debt to purchase appreciating assets can be advantageous.

5. Develop Multiple Income Streams

Skill Development: Invest in skills that remain valuable regardless of economic conditions. Technology, healthcare, and essential services often see wage growth that outpaces inflation.

Side Businesses: Create income streams that can adjust pricing with inflation, such as freelancing, consulting, or small business ownership.

Regional Considerations and Global Perspective

Developed vs. Developing Economies

Inflation impacts vary significantly across countries. Developing nations often experience higher inflation rates but may offer investment opportunities that benefit from this growth.

Currency Diversification

Consider holding assets in multiple stable currencies. While this adds complexity, it can protect against domestic monetary policy mistakes.

International Investment Options

Global stock markets, international bonds, and foreign real estate can provide natural hedges against domestic inflation.

Building Your Inflation-Protection Strategy

Assess Your Risk Tolerance

Your age, financial goals, and risk capacity should guide your inflation-protection approach:

Conservative Approach: Focus on TIPS, I Bonds, and high-quality dividend stocks Moderate Approach: Balanced portfolio of stocks, REITs, and inflation-protected bonds Aggressive Approach: Growth stocks, real estate, commodities, and international investments

Create an Asset Allocation Plan

A typical inflation-protection portfolio might include:

- 60-70% Stocks (domestic and international)

- 10-15% Real estate (REITs or direct ownership)

- 10-15% Inflation-protected bonds (TIPS, I Bonds)

- 5-10% Commodities or precious metals

- 5% Cash for emergencies

Regular Rebalancing

Review and rebalance your portfolio annually or when asset allocations drift significantly from your targets.

Tools and Calculators to Help You Plan

Emergency Fund Calculator

Use our Emergency Fund Calculator to ensure your emergency savings maintain purchasing power. Consider the impact of inflation when determining how much to save.

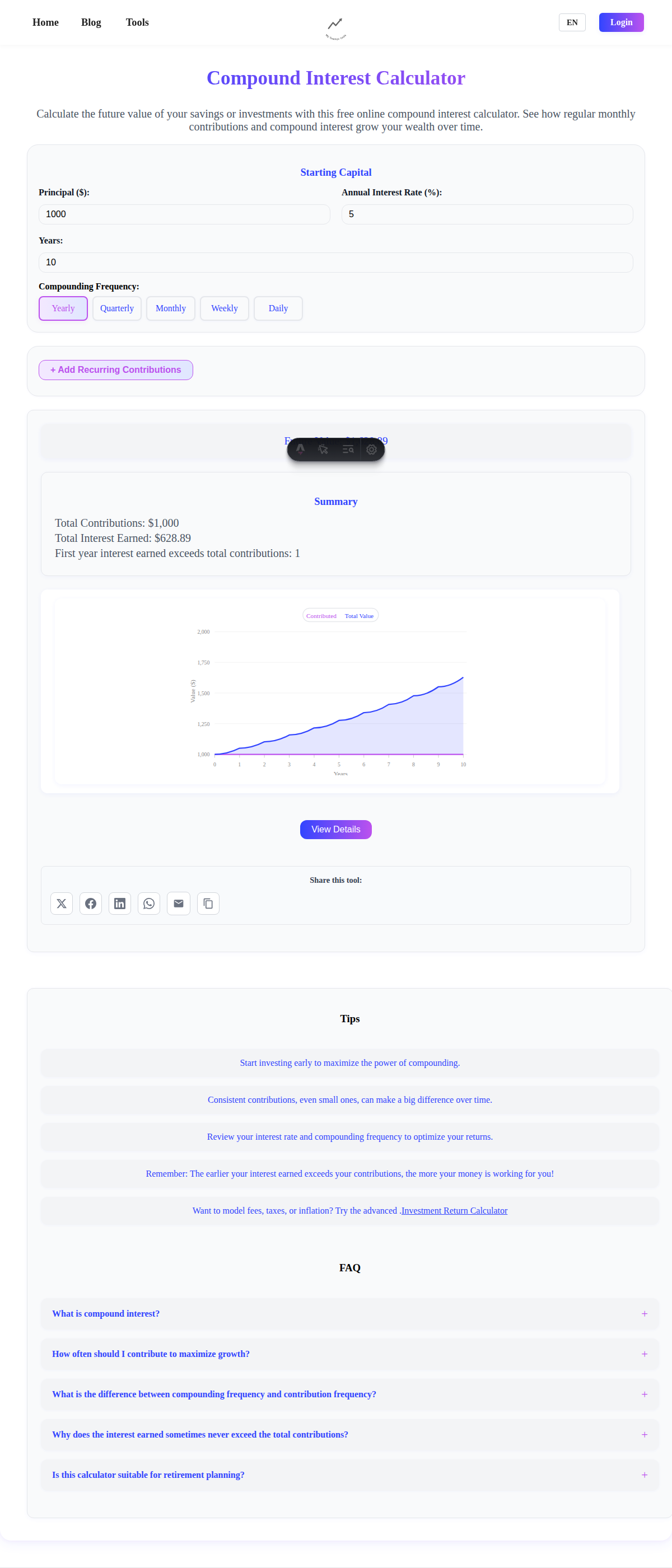

Investment Return Calculator

Our Investment Return Calculator can help you model how different investment strategies perform under various inflation scenarios.

Budget Calculator

The Budget Calculator helps you track how inflation affects your spending and adjust your budget accordingly.

Common Mistakes to Avoid

Over-Reliance on Cash

While emergency funds are essential, keeping too much money in low-yield accounts is a guaranteed way to lose purchasing power to inflation.

Timing the Market

Trying to predict short-term inflation trends and adjust your portfolio accordingly often leads to poor investment decisions. Focus on long-term strategies instead.

Ignoring Geographic Diversification

Concentrating all investments in your home country exposes you to domestic monetary policy risks. Global diversification provides better protection.

Panic Reactions

High inflation periods can trigger emotional investment decisions. Stick to your long-term strategy and avoid making drastic changes based on short-term economic news.

Advanced Strategies for High-Inflation Environments

Real Estate Investment Strategies

Primary Residence: Your home can serve as an inflation hedge while providing utility. Consider the long-term appreciation potential of your location.

Rental Properties: Real estate with positive cash flow can provide income that adjusts with inflation through rent increases.

Commercial Real Estate: REITs focusing on properties with inflation-escalation clauses in their leases offer excellent protection.

Business and Entrepreneurship

Service Businesses: Companies that can easily adjust pricing (consulting, software, professional services) often outperform during inflationary periods.

Essential Services: Businesses providing necessities (food, healthcare, utilities) have pricing power during inflation.

Monitoring Your Progress

Regular Financial Check-ups

Review your net worth and purchasing power annually, adjusting for inflation to understand your real financial progress.

Tracking Inflation Metrics

Stay informed about official inflation rates, but also monitor the costs of goods and services you personally consume, as your experience may differ from national averages.

Portfolio Performance Analysis

Evaluate your investments’ real returns (adjusted for inflation) rather than just nominal returns.

The Psychology of Inflation Protection

Long-Term Thinking

Inflation protection requires patience and discipline. Short-term volatility in inflation-hedging assets can test your resolve, but long-term success depends on staying the course.

Education and Understanding

The better you understand inflation and your protection strategies, the more confident you’ll be during periods of economic uncertainty.

Regular Plan Updates

As your life circumstances change, your inflation-protection strategy should evolve. Major life events, career changes, or shifts in economic conditions may require strategy adjustments.

Conclusion: Taking Action Against Inflation

Inflation is an inevitable part of most modern economies, but it doesn’t have to destroy your financial future. By understanding how inflation works and implementing a comprehensive protection strategy, you can preserve and grow your purchasing power over time.

The key is to start now, regardless of current inflation levels. Building an inflation-resistant financial foundation takes time, and the earlier you begin, the more protected you’ll be when inflation accelerates.

Remember that no single strategy provides perfect inflation protection. Diversification across asset classes, geographic regions, and time horizons gives you the best chance of maintaining your standard of living as prices rise.

Most importantly, don’t let fear of inflation paralyze you into inaction. While cash loses purchasing power to inflation, well-planned investments in real assets, quality companies, and inflation-protected securities can help you not just preserve wealth, but continue building it even in challenging economic environments.

Start with our Budget Calculator to understand how inflation affects your current spending, then use our Investment Return Calculator to model different inflation-protection strategies. Your future self will thank you for taking action today to protect your purchasing power.

The information provided in this article is for educational purposes only and should not be considered as personalized financial advice. Consider consulting with a qualified financial advisor before making significant investment decisions.