📚 This is Part 1 of our 7-part series “Complete Money Education for Kids”:

- Part 1: Teaching Kids to Save ← You are here

- Part 2: Teaching Kids to Spend Wisely ← Next

- Part 3: Teaching Kids to Earn

- Part 4: Teaching Kids About Budgeting

- Part 5: Teaching Kids About Debt

- Part 6: Teaching Kids About Investing

- Part 7: Teaching Kids About Giving

Saving money is one of the most fundamental financial skills anyone can learn, and the best time to start teaching it is during childhood. Children who develop strong saving habits early are more likely to become financially secure adults who can weather financial storms, achieve their goals, and build wealth over time.

Yet teaching kids to save isn’t always straightforward. In a world of instant gratification, where one-click purchases and same-day delivery are the norm, helping children understand the value of delayed gratification can feel like swimming against the current. However, with the right approach, patience, and creativity, you can instill saving habits that will serve your children for a lifetime.

This comprehensive guide will walk you through everything you need to know about teaching kids to save, from the psychology behind saving behavior to age-specific strategies, practical tools, and common pitfalls to avoid.

Why Teaching Saving Matters More Than Ever

Before diving into the how, it’s worth understanding the why. Financial literacy, particularly around saving, is increasingly critical:

Economic Uncertainty: Today’s children will face economic challenges we can barely predict. Strong saving habits provide resilience against job losses, economic downturns, and unexpected expenses.

Declining Pension Security: Unlike previous generations who could rely on employer pensions, today’s children will need to fund much of their own retirement through personal savings and investments.

Rising Costs: Education, healthcare, and housing costs continue to outpace inflation in many countries. The ability to save substantial sums will be essential for achieving major life goals.

Mental Health Benefits: Research shows that financial stress is a leading cause of anxiety and depression. People with emergency funds and healthy savings habits report significantly lower stress levels and better overall wellbeing.

Delayed Gratification Skills: The ability to save teaches broader life skills like patience, goal-setting, planning, and self-control—all of which correlate with success in multiple life domains.

The Psychology of Saving: Understanding How Kids Think About Money

To effectively teach saving, you need to understand how children’s brains process the concept of delayed gratification and future planning.

Developmental Stages and Saving

Ages 3-5: Concrete Thinking Young children think in very concrete terms. They struggle with abstract concepts like “the future” or “later.” For them, a toy they can see and touch right now is infinitely more appealing than a nebulous “bigger toy later.”

At this stage, savings lessons must be:

- Highly visual (clear jars or piggy banks where they can see money accumulating)

- Immediate (short saving periods of days, not weeks)

- Tangible (saving for specific toys they can picture)

Ages 6-9: Beginning Abstract Thinking Children start understanding that time passes and can begin to grasp “next week” or “next month.” They can start connecting actions (saving) with future outcomes (having more money).

At this stage, you can introduce:

- Slightly longer saving periods (weeks to a month)

- Simple goal charts that track progress

- Basic cause-and-effect: “If you save this week’s allowance, you’ll have enough for that game”

Ages 10-12: Growing Future Orientation Pre-teens can think several months ahead and understand more complex financial concepts. They can grasp that small amounts add up over time and that choices today affect future possibilities.

Now you can teach:

- Multi-month saving goals

- The concept of “opportunity cost” (choosing one purchase means not buying something else)

- Basic interest and growth concepts

Ages 13+: Abstract and Long-Term Thinking Teenagers can understand long-term consequences and complex financial systems. They can grasp concepts like compound interest, investment growth, and multi-year planning.

Appropriate lessons include:

- Saving for college or a car

- Understanding investment accounts

- Planning for major life goals

- The power of starting early with retirement savings

The Marshmallow Test and Delayed Gratification

The famous Stanford marshmallow experiment demonstrated that children who could delay gratification (wait to eat one marshmallow to receive two later) showed better life outcomes decades later. However, more recent research has nuanced this finding: the ability to delay gratification is partly innate, but it’s also highly teachable and influenced by environment.

Key insights for parents:

- Trust matters: Children who trust adults will follow through are better at delaying gratification

- Skills can be taught: Strategies like distraction, reframing, and goal visualization help children wait

- Context matters: Children save better when they understand why and can visualize the goal

- Early wins build capacity: Small successful saving experiences build the “delayed gratification muscle”

Age-Appropriate Saving Strategies

Let’s dive into specific, actionable strategies for each age group.

Ages 3-5: Making Saving Visible and Fun

The Clear Jar Method Forget traditional piggy banks that hide the money. Use a clear jar or container where children can watch their money grow. This visual reinforcement is powerful for young minds.

Implementation:

- Use a large, clear plastic jar

- Let your child decorate it with stickers representing their goal

- Make depositing money a small ceremony (“Let’s add to your toy fund!”)

- Count the money together regularly

The Three-Jar System Introduce the concept of money allocation with three clear jars labeled: “Spend,” “Save,” and “Share” (for giving/charity).

How it works:

- When your child receives money (allowance, gifts, found change), help them divide it among the three jars

- A simple split might be: 50% Spend, 40% Save, 10% Share

- The “Spend” jar can be used for small immediate purchases

- The “Save” jar accumulates for bigger goals

- The “Share” jar goes to charity or helping others

Story-Based Learning At this age, stories are incredibly effective. Read books about saving:

- “A Chair for My Mother” by Vera B. Williams

- “Bunny Money” by Rosemary Wells

- “Alexander, Who Used to Be Rich Last Sunday” by Judith Viorst

After reading, discuss: “What did the character do with their money? What happened when they saved? How did they feel?”

The Matching Game To make saving extra appealing, offer to match their savings. “For every coin you put in your save jar this week, I’ll add one too!” This teaches that saving grows money faster than spending.

Ages 6-9: Introducing Goals and Tracking

The Goal Chart Create a visual savings goal chart together. This could be:

- A thermometer-style chart that colors in as they save

- A ladder they climb with each saved amount

- A picture of their goal with checkboxes for each increment

Example: Your child wants a toy that costs $30. Create a chart with 30 boxes. Each time they save $1, they color in one box. Seeing progress is incredibly motivating.

The Savings Challenge Make saving a game with short challenges:

- “Can you save $5 before your birthday?”

- “Let’s see if you can go two weeks without spending your allowance”

- “For every week you save, you get a sticker. Five stickers earn a bonus from me”

Celebrate Milestones When they reach 25%, 50%, 75%, and 100% of their goal, celebrate! This might be:

- A special treat

- A certificate you create together

- Announcing their accomplishment to family

- Taking a photo with their full savings jar

The Bank Account Introduction Around age 7-8, consider opening a savings account together. Make it an event:

- Visit the bank together

- Let them fill out deposit slips

- Show them the account balance online

- Explain how banks keep money safe and even pay interest

Real-World Connections Help them understand how adults save:

- “Mommy saves money each month so we can go on vacation”

- “We’re saving for a new car, just like you’re saving for your bike”

- Show them your own savings goals

Ages 10-12: Building Saving Habits and Understanding Growth

The Multiple Goals System Pre-teens can handle saving for multiple things simultaneously. Help them create:

- Short-term goal (achievable in 1-2 months)

- Medium-term goal (3-6 months)

- Long-term goal (6-12 months)

They allocate their money among these goals based on priorities.

Percentage-Based Saving Introduce the concept of saving a percentage rather than a fixed amount:

- “Save 20% of everything you receive”

- This teaches scalability: as income grows, savings grow proportionally

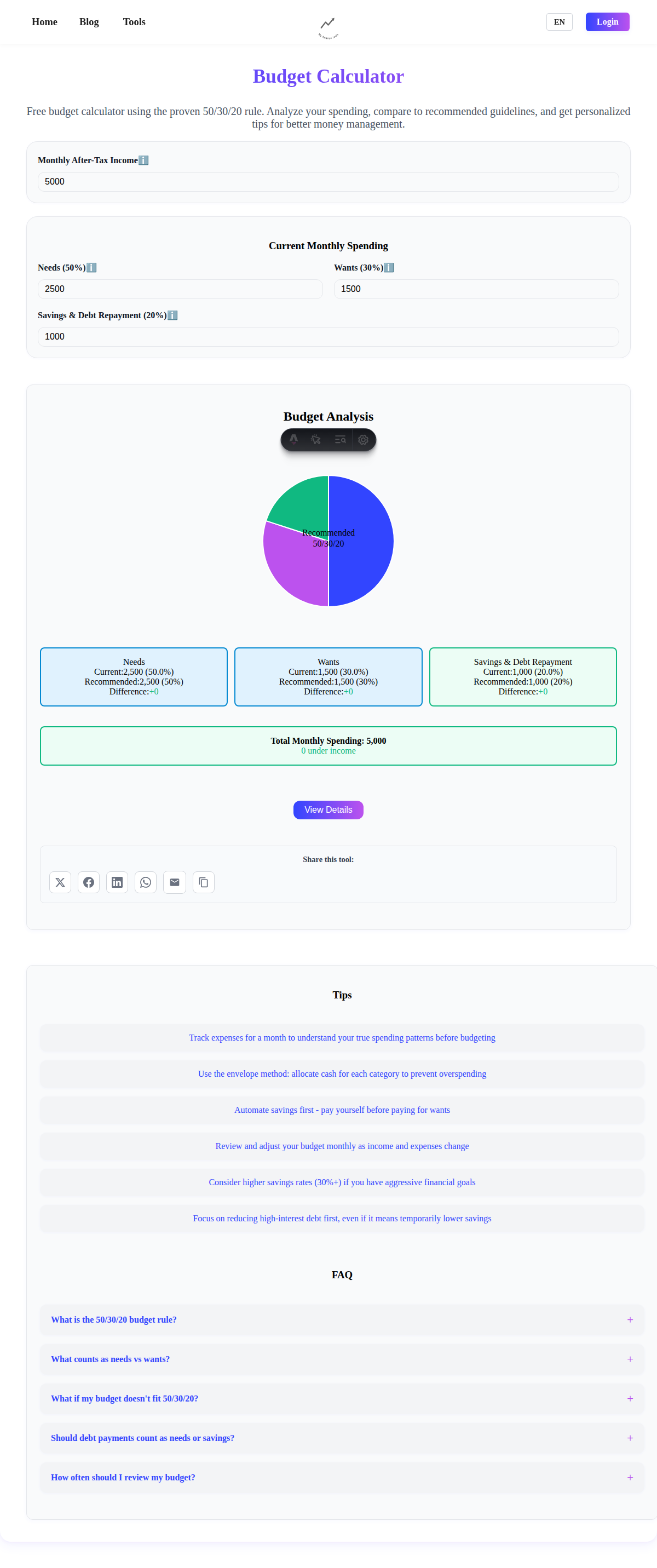

- Use our Savings Goal Calculator to show how regular saving adds up

The Opportunity Cost Game Before any purchase, discuss alternatives:

- “This video game costs $50. What else could you do with $50?”

- “If you save this money instead, in three months you’d have enough for that bigger thing you want”

- This isn’t about guilting them out of purchases, but developing thoughtful decision-making

Interest Introduction Show them how money can grow through interest:

- Use our Compound Interest Calculator with simple numbers

- “If you put $100 in a savings account that pays 5% interest, in one year you’d have $105 without doing anything!”

- Explain: “Banks pay you to save with them”

Savings Automations If they have a bank account, set up automatic transfers:

- A small amount moves from checking to savings each week

- This teaches the “pay yourself first” principle

- They’ll be amazed at how savings grow without thinking about it

Earning to Save Faster At this age, kids can connect earning extra money with achieving goals faster:

- Extra chores for extra money

- Selling old toys or books

- Simple neighborhood services (with supervision)

Ages 13-18: Advanced Saving and Financial Planning

The Budget System Teenagers should create and manage their own budgets:

- Track all income sources

- List all expenses

- Allocate a saving percentage (at least 20%)

- Review monthly and adjust

Long-Term Goal Planning Help them save for significant goals:

- A car

- College expenses

- First apartment deposit

- Travel experiences

- Technology upgrades

Use our Savings Goal Calculator to show how much they need to save monthly to reach these goals.

The Bank Account Upgrade Consider opening:

- A checking account for spending

- A high-yield savings account for goals

- Possibly a first investment account (with your supervision)

Teach them to transfer a set percentage to savings each time money arrives.

Real-World Financial Discussions Include them in family financial conversations:

- How you budget household expenses

- Why you’re saving for specific goals

- How you make major purchasing decisions

- The importance of emergency funds

The Emergency Fund Concept Introduce the idea of saving for the unexpected:

- Explain that adults save 3-6 months of expenses for emergencies

- Help them create their own mini emergency fund (maybe $100-500)

- Discuss what counts as an emergency (phone breaks) vs. what doesn’t (new game release)

- Show them our Emergency Fund Calculator

Investment Introduction If they have substantial savings, consider introducing basic investing:

- Explain stocks, bonds, and index funds simply

- Perhaps open a custodial investment account

- Let them choose a few stocks of companies they know

- Emphasize long-term thinking and patience

- Use our Compound Interest Calculator to show 40-year growth scenarios

Part-Time Job Savings If they get a part-time job:

- Establish a clear saving percentage (30-50% is common)

- Help them set up automatic transfers to savings

- Teach them about taxes and take-home pay

- Celebrate their growing financial independence

Making Saving Fun and Rewarding

The key to successful saving education is making it enjoyable rather than feeling like deprivation.

Gamification Strategies

Savings Challenges

- “No-spend weekend”: See if you can spend nothing for two days

- “Dollar-a-day”: Save at least $1 every day for a month

- “Spare change challenge”: Save all coins for a month and see the total

- “Match-me challenge”: You match whatever they save this month

Progress Visualization

- Create colorful charts

- Use apps with progress bars and badges

- Take photos of growing savings

- Create a “savings wall of fame” with achieved goals

Savings Competitions If you have multiple children:

- Who can save the highest percentage this month?

- Who reaches their goal first?

- Make it collaborative: “Together, can we save $200 as a family this month?”

Reward Systems

Milestone Rewards When they hit saving milestones, offer small rewards:

- 25% of goal: choose a special dessert

- 50% of goal: extra screen time or special activity

- 75% of goal: small treat or prize

- 100% of goal: proud celebration and they get their saved item

Matching Contributions Like an employer 401(k) match, offer to match their savings:

- “For every $10 you save, I’ll add $2”

- This accelerates their progress and makes saving feel lucrative

Interest Payments If they don’t yet have a bank account, you can play bank:

- Pay them “interest” on their savings monthly

- Start with something noticeable like 5% per month

- This teaches the power of compound growth

Making the Goal Tangible

The Vision Board Create a physical or digital board with:

- Pictures of what they’re saving for

- Progress tracker

- Motivational quotes

- Timeline showing when they’ll reach their goal

The Shopping Trip (Without Buying) Periodically visit the store to see the item they’re saving for:

- Let them hold it, examine it, get excited

- This reinforces the goal and maintains motivation

- Remind them how close they are: “Just two more weeks of saving!”

Countdown Calendar Create a calendar showing:

- How many weeks until they can purchase their goal

- Mark saving days

- Cross off each week

- The visual countdown builds excitement

Common Mistakes to Avoid

Even with the best intentions, parents often make mistakes that undermine saving education.

Mistake #1: Making Goals Too Distant

The Problem: Asking a 6-year-old to save for six months is cognitively too difficult. They can’t conceptualize that time period, and their motivation will evaporate.

The Solution: Make initial goals achievable within their developmental attention span. Young kids need 1-2 week goals. Older kids can handle months. Teens can plan for years.

Mistake #2: Bailing Them Out

The Problem: When your child wants something but hasn’t saved enough, you buy it anyway “just this once.” This teaches that saving is optional because someone will always rescue them.

The Solution: Hold firm. If they haven’t saved enough, they don’t get the item yet. This is one of life’s most valuable lessons. The disappointment they feel will motivate better saving next time.

Mistake #3: No Spending Allowed

The Problem: If children never get to spend any money, saving becomes associated with deprivation and punishment rather than achievement.

The Solution: Use a split system. Let them spend some money freely while saving the rest. The “three jar system” (spend/save/share) balances immediate gratification with longer-term goals.

Mistake #4: Forgetting to Celebrate

The Problem: Your child finally saves enough and buys their goal, but you barely acknowledge it. The accomplishment feels hollow.

The Solution: Celebrate achievements! Take photos, tell grandparents, make it special. This positive reinforcement strengthens the save-accomplish-celebrate cycle.

Mistake #5: No Modeling

The Problem: You tell kids to save but never demonstrate your own saving behavior. “Do as I say, not as I do” rarely works.

The Solution: Model saving behavior transparently. Talk about your own savings goals, show them when you choose to save rather than spend, and let them see you achieve savings milestones.

Mistake #6: Focusing Only on the Money

The Problem: Making saving purely about accumulating money can feel hollow and materialistic.

The Solution: Connect saving to values and goals. Emphasize what the savings will enable: experiences, helping others, security, freedom, achieving dreams.

Mistake #7: Making It Complicated

The Problem: Creating elaborate saving systems with complex rules and tracking that becomes a chore.

The Solution: Keep it simple, especially starting out. A clear jar and a goal chart are enough for young kids. Add complexity gradually as they mature.

Tools and Resources for Teaching Saving

Physical Tools

Savings Banks and Jars

- Clear jars or containers (can see money growing)

- Traditional piggy banks (for the classics)

- Multi-compartment banks (for spend/save/share divisions)

- Goal-specific banks (themed around what they’re saving for)

Tracking Tools

- Printable savings goal charts (free online templates)

- Sticker charts for younger kids

- Whiteboards for tracking multiple goals

- Envelopes labeled by savings goal

Digital Tools and Apps

For Younger Kids (with parent supervision):

- PiggyBot - Virtual piggy bank with allowance tracking

- Bankaroo - Simple virtual bank for kids

- iAllowance - Chore and allowance management

For Older Kids and Teens:

- Greenlight - Debit card for kids with parental controls and savings goals

- gohenry - Similar to Greenlight with money missions and savings features

- FamZoo - Virtual family bank with customizable features

- Mint - For older teens, introduction to adult budgeting tools

Educational Apps and Games:

- Bankaroo - Teaches saving through goal tracking

- Savings Spree - Game teaching saving and spending decisions

- Money Metropolis - World Bank’s money management game

Books for Different Ages

Ages 3-5:

- “The Berenstain Bears’ Trouble with Money”

- “A Chair for My Mother”

- “Bunny Money”

Ages 6-9:

- “Alexander, Who Used to Be Rich Last Sunday”

- “The Money Tree” by Sarah Stewart

- “One Cent, Two Cents, Old Cent, New Cent”

Ages 10-12:

- “The Kids’ Money Book” by Jamie Kyle McGillian

- “Money Ninja” by Mary Nhin

- “Growing Money: A Complete Investing Guide for Kids”

Ages 13+:

- “The Opposite of Spoiled” by Ron Lieber (actually for parents, but teens can read it too)

- “How to Turn $100 into $1,000,000” by James McKenna

- “The Richest Man in Babylon” (timeless classic, simplified for teens)

Online Calculators

Help kids visualize their savings growth:

- Savings Goal Calculator - Shows how long it takes to reach a goal

- Compound Interest Calculator - Demonstrates how money grows over time

- Emergency Fund Calculator - Helps older kids understand safety nets

Real-World Success Stories

Case Study 1: Emma’s Tablet (Age 8)

Emma wanted a tablet that cost $300. Her parents gave her a $10 weekly allowance.

The approach:

- Created a visual chart with 30 boxes (one per $10)

- Emma saved $8 per week (80% of allowance), spending $2

- Parents matched 25% of her savings

- She completed small chores for bonus money

Result: Emma bought her tablet in 6 months. She took exceptional care of it because she’d worked so hard for it. Her parents noted she became much more thoughtful about other purchases afterward.

Key lesson: The goal was ambitious but achievable. The matching contribution maintained motivation. The pride she felt was worth more than the tablet itself.

Case Study 2: The Rodriguez Brothers’ Summer Goal (Ages 12 and 14)

Two brothers wanted to go to a week-long summer camp that cost $800 per person ($1,600 total).

The approach:

- Parents agreed to pay half if the boys saved the other half

- Started saving 10 months before summer

- Boys needed to save $80/month total

- Both got allowance and took on extra chores

- Older brother did neighborhood lawn mowing

- Younger brother walked dogs

Result: The boys exceeded their goal, saving $1,000. They used the extra for spending money at camp. The experience taught them about working toward major goals and the satisfaction of earning something big.

Key lesson: A shared goal built teamwork. Parents’ 50% contribution made a big goal achievable without making it too easy. The timeline was long enough to be challenging but not so long they lost sight of it.

Case Study 3: Aisha’s Car Fund (Age 15)

Aisha wanted to buy a used car when she turned 16 (one year away). The goal: $3,000.

The approach:

- Got a part-time job working 10 hours/week at $12/hour

- Committed to saving 60% of every paycheck

- Opened a high-yield savings account

- Parents matched 10% of her savings

- Created a detailed budget tracking all income and expenses

Result: After 12 months, Aisha had saved $3,400. She bought a reliable used car and had money left for insurance and gas. She learned about taxes, budgeting, and the power of consistent saving.

Key lesson: The combination of meaningful work, disciplined saving, parental support, and a clear deadline taught comprehensive financial skills. The pride of buying her own car (rather than being given one) was invaluable.

Troubleshooting Common Challenges

”My child keeps raiding their savings”

Problem: They save for a few days, then spend it all impulsively.

Solutions:

- Make the savings less accessible (bank account rather than jar in their room)

- Implement a “waiting rule”: wait 48 hours before any purchase over $10

- Ensure they have some “free spending” money so saving doesn’t feel like complete deprivation

- Check if the goal is too distant—shorter goals might work better initially

”They’re not motivated to save”

Problem: Your child shows no interest in saving, preferring to spend immediately.

Solutions:

- Connect saving to something they really want—find what truly motivates them

- Make early goals very short (young kids) so they experience success quickly

- Gamify it with challenges and rewards

- Model your own saving more visibly

- Consider if you’re making it too complicated or joyless

- Try the matching game to accelerate progress

”They’re saving too much and never enjoying anything”

Problem: Your child becomes excessively frugal, refusing to spend on anything.

Solutions:

- This is rare but can happen! Gently encourage some spending

- Explain that money is a tool for both future goals and present enjoyment

- Set a “must spend” portion of allowance

- Demonstrate balanced financial behavior yourself

- Ensure they’re not stressed about family finances (kids sometimes oversave if they sense money worries)

“Siblings at different ages make it complicated”

Problem: You have a 6-year-old and a 14-year-old with vastly different savings capacities and goals.

Solutions:

- Individualize approaches—don’t force the same system on different ages

- Give age-appropriate allowances and savings goals

- Avoid comparing siblings’ savings success

- Do teach them to respect each other’s savings efforts

- Family savings challenges can be structured so each child has age-appropriate targets

”They reached their goal and now won’t save again”

Problem: After achieving one savings goal, they refuse to start another.

Solutions:

- This is normal! Let them enjoy their purchase for a while

- Don’t immediately push a new savings goal

- After a few weeks, casually ask what they might want to save for next

- Consider introducing ongoing habit saving (like 10% of all money received) separate from specific goals

- Make the next goal their idea, not yours

Advancing from Saving to Investing

As children get older (typically high school age), you can begin transitioning some of their savings education toward investing.

When They’re Ready

Signs your teenager is ready to learn about investing:

- They’ve successfully saved for multiple goals

- They understand delayed gratification

- They have savings beyond immediate goals ($500+)

- They’re asking questions about how money grows

- They’re thinking about long-term goals (college, car, future)

Starting Simple

Begin with education:

- Explain that investing is “saving with growth potential”

- Use our Compound Interest Calculator to show 30-40 year growth scenarios

- Explain stocks, bonds, and mutual funds in simple terms

- Discuss risk and reward

Consider a custodial investment account:

- UGMA/UTMA accounts (US) or similar in your country

- Start with index funds for simplicity and diversification

- Let them make some decisions about what to invest in

- Review the account quarterly together

Keep some money liquid:

- Not all savings should be invested

- Maintain an emergency fund and short-term savings in regular accounts

- Only invest money they won’t need for 5+ years

Connecting Saving to Other Money Skills

Saving doesn’t exist in isolation. It’s part of a broader financial ecosystem your children need to understand.

Link to Our Complete Series:

While saving is the foundation, it’s just the beginning. Throughout this 7-part series, we’ll cover all essential money skills:

- Spending wisely (Part 2): Making thoughtful purchase decisions and understanding value

- Earning money (Part 3): Developing work ethic and understanding income

- Budgeting (Part 4): Planning and allocating money effectively

- Understanding debt (Part 5): Learning about borrowing and interest

- Investing (Part 6): Growing wealth through compound interest

- Giving and generosity (Part 7): Using money to help others and contribute to society

Each skill reinforces the others, creating a comprehensive financial education.

The Long-Term Impact of Saving Education

The goal of teaching children to save isn’t just about money—it’s about building character traits that lead to success in all areas of life.

Skills developed through saving education:

- Delayed gratification

- Goal-setting and achievement

- Planning and foresight

- Self-control and discipline

- Resilience (bouncing back from setbacks)

- Pride in accomplishment

- Resource management

- Long-term thinking

Research consistently shows that children who learn to save early:

- Experience less financial stress as adults

- Are more likely to achieve major life goals

- Have better emergency preparedness

- Show lower rates of problematic debt

- Report higher life satisfaction

- Demonstrate stronger executive function skills

Perhaps most importantly, children who learn to save develop a sense of agency—the understanding that their actions today shape their possibilities tomorrow. This fundamental insight serves them in education, career, relationships, and every aspect of adult life.

Taking Action Today

Teaching kids to save is one of the most valuable gifts you can give them. Here’s how to start today:

For Young Children (3-5):

- Get a clear jar or container today

- Start giving a small weekly allowance (even $2-3)

- Help them choose something to save for (under $20)

- Make depositing money a weekly ceremony

For Elementary Age (6-9):

- Create a savings goal chart for something they really want

- Institute the three-jar system (spend/save/share)

- Consider opening their first savings account

- Use our Savings Goal Calculator together

For Pre-Teens (10-12):

- Help them set three savings goals: short, medium, and long-term

- Teach percentage-based saving (20% of everything)

- Show them how to use our Compound Interest Calculator

- Start discussing opportunity costs before purchases

For Teenagers (13+):

- Help them open checking and savings accounts

- Create a complete budget together

- Discuss emergency funds using our Emergency Fund Calculator

- Consider introducing basic investing concepts

Conclusion

Teaching kids to save is a journey, not a destination. It starts with simple piggy banks and grows into sophisticated financial planning. Along the way, you’re not just teaching about money—you’re teaching patience, goal-setting, planning, and the satisfaction of achievement.

Start where your child is developmentally. Keep it simple. Make it visual. Celebrate successes. Model the behavior yourself. Be patient when they stumble. And remember that every small lesson compounds over time, just like the savings themselves.

The children who learn to save don’t just accumulate money—they accumulate confidence, capability, and the power to shape their own futures. That’s a gift that will serve them for a lifetime.

Continue Your Journey

Ready to teach your kids about making smart spending decisions? Continue with Part 2: Teaching Kids to Spend Wisely to learn about decision-making, understanding value, and avoiding impulse purchases.

Frequently Asked Questions

When should I start teaching my child to save?

You can introduce basic saving concepts as early as age 3. At this age, use a clear jar so they can see money accumulating, and keep goals very short (1-2 weeks). The key is matching the complexity to their developmental stage. By age 5-6, most children can understand the concept of saving for something they want. The earlier you start with age-appropriate lessons, the more natural saving becomes.

How much allowance should I give, and what percentage should they save?

Allowance amounts vary widely by family, location, and philosophy. A common guideline is $1-2 per year of age per week (so a 7-year-old might get $7-14 weekly). Regarding saving percentages, the “50/40/10 rule” works well for younger kids: 50% for spending, 40% for saving, 10% for giving. Older children and teens might aim for 20-30% savings. The specific amounts matter less than establishing the habit and being consistent.

Should I pay interest on my child’s savings?

Paying interest can be a powerful teaching tool, especially for younger children who don’t yet have bank accounts. Consider paying an attention-grabbing rate like 5% monthly on their piggy bank savings. This demonstrates how money grows and makes saving more appealing. Use our Compound Interest Calculator to show them how this works with real numbers. Once they have a real savings account, the bank’s interest (though much smaller) takes over this lesson.

My child wants to spend all their money immediately. What should I do?

This is normal, especially for younger children. Start by implementing a mandatory split: they must save at least some percentage (maybe 30-40%) before spending the rest. This ensures they’re building savings while not feeling completely deprived. Also, connect saving to something they really want but can’t afford immediately—motivation increases dramatically when the goal is their idea. Consider offering matching contributions to accelerate their progress and maintain enthusiasm.

What if my child wants to buy something I think is a waste of money?

This is a tough but important lesson. If they’ve saved their own money, generally let them make the purchase (within age-appropriate boundaries and family values). Experiencing “buyer’s remorse” when something doesn’t live up to expectations is a valuable lesson that sticks. You can gently ask questions beforehand (“Are you sure this is what you want most?” “Will you still enjoy this next month?”) but ultimately let them learn from their choices. The lessons from mistakes made with their $30 will prevent bigger mistakes with their $3,000 later.

Should savings be “locked away” or easily accessible?

This depends on the goal and your child’s age. For young children learning the habit, accessible savings (like a clear jar) provide important visual feedback. For older children saving for longer-term goals, less accessible savings (bank account, or savings kept by parents) can prevent impulsive raids on the fund. A good compromise is the three-jar system: “Spend” money is freely accessible, “Save” money for specific goals is somewhat protected, and long-term savings might be in a bank account. The key is matching accessibility to your child’s self-control development.

How do I teach saving when we’re struggling financially ourselves?

This is challenging but still valuable. Even if you can’t provide allowance, children can save money from gifts, small jobs, or found change. Focus on the habit and decision-making rather than the amounts. Be honest at an age-appropriate level: “We need to be careful with money right now, which is exactly why saving is so important.” Model your own saving behavior, even if the amounts are small. Children who see parents save despite hardship often develop strong saving habits themselves. Use free tools like jar systems and printable charts rather than apps or expensive tracking systems.

What’s the best age to open a bank account for my child?

Most banks offer custodial savings accounts starting around age 7-8, though some allow younger. Good times to open accounts include: when they’ve successfully saved in a piggy bank and are ready for the next level (usually ages 7-9), when they’re receiving regular allowance or earning money (ages 8-10), or when they’re interested and asking questions about banks. Make opening the account an event—visit the bank together, let them make the first deposit, and show them how to check their balance. This transforms banking from abstract to real.