📚 This is Part 6 of our 7-part series “Complete Money Education for Kids”:

- Part 1: Teaching Kids to Save

- Part 2: Teaching Kids to Spend Wisely

- Part 3: Teaching Kids to Earn

- Part 4: Teaching Kids About Budgeting

- Part 5: Teaching Kids About Debt ← Previous

- Part 6: Teaching Kids About Investing ← You are here

- Part 7: Teaching Kids About Giving ← Next

After teaching children to save (Part 1), spend wisely (Part 2), earn (Part 3), budget (Part 4), and understand debt (Part 5), there’s one more powerful concept that can transform their financial future: investing.

Investing is how wealth is truly built. While saving preserves money, investing grows it. The difference is profound: $10,000 saved for 40 years remains $10,000 (actually loses value to inflation). That same $10,000 invested at 8% annual returns becomes $217,000. Same money, vastly different outcome.

Yet most people never learn to invest until they’re decades into adulthood—if at all. They miss the most powerful years of compound growth. A teenager who invests $1,000 at age 15 will have more at retirement than someone who invests $10,000 at age 45, assuming similar returns. Time is the most valuable investing asset, and your children have more of it than they’ll ever have again.

This comprehensive guide will teach you how to introduce investing concepts at every age, from simple growth ideas for young children to sophisticated portfolio management for teenagers, giving them a decades-long head start on wealth building.

Why Teaching Investing Matters

Investing education is perhaps the most impactful financial gift you can give.

Harnesses Compound Growth: Einstein allegedly called compound interest “the eighth wonder of the world.” Starting early transforms modest amounts into substantial wealth.

Builds True Wealth: While earned income pays bills, invested money creates wealth that works for you. This is how financial independence happens.

Reduces Retirement Anxiety: Adults who invest consistently report significantly less retirement anxiety than those who don’t. Teaching this early creates lifetime security.

Teaches Long-Term Thinking: Investing requires patience, perspective, and delayed gratification—valuable life skills beyond finance.

Creates Economic Literacy: Understanding markets, companies, and economies makes them informed citizens and better decision-makers.

Provides Options: Wealth creates options—career changes, entrepreneurship, early retirement, generosity, leaving a legacy. Investing builds this capacity.

Breaks Wealth Inequality: Investing is how wealth compounds generationally. Teaching your children breaks cycles and creates advantages.

Understanding Investment Fundamentals

Before teaching children, ensure you understand core concepts.

What Is Investing?

Investing is using money to buy assets that you expect will increase in value or generate income over time.

Key difference from saving:

- Saving: Preserves money with minimal risk and minimal growth (savings accounts, certificates of deposit)

- Investing: Grows money with some risk and potential for significant growth (stocks, bonds, real estate, businesses)

The Risk-Return Relationship

A fundamental investing principle: Higher potential returns require accepting higher risk.

Lower Risk, Lower Returns:

- Savings accounts: ~0.5-2% annually, very safe

- Government bonds: ~2-4% annually, very safe

- Corporate bonds: ~3-6% annually, relatively safe

Higher Risk, Higher Returns:

- Stock index funds: ~8-10% annually (historical average), moderate risk

- Individual stocks: Highly variable, higher risk

- Real estate: Variable, moderate-high risk

- Small businesses: Potentially very high or negative, very high risk

The key is matching risk to timeline and goals.

Compound Interest: The Magic

Compound growth means your money earns returns, then those returns earn returns, creating exponential growth.

Example: $1,000 invested at 8% annually

- Year 1: $1,080 (earned $80)

- Year 5: $1,469 (earned $469 total)

- Year 10: $2,159 (more than doubled)

- Year 20: $4,661 (more than quadrupled)

- Year 30: $10,063 (10x original)

- Year 40: $21,725 (20x original)

The same $1,000 deposited 10 years later only reaches $10,063—half as much despite being invested for 30 years. Time is more valuable than amount.

Asset Types

Stocks (Equities):

- Ownership shares in companies

- Value rises and falls with company performance and market sentiment

- Long-term average return: ~10% annually

- Can lose value short-term

- Best for long-term goals (10+ years)

Bonds (Fixed Income):

- Loans to companies or governments

- Pay fixed interest

- Lower returns than stocks (~3-5% annually)

- Less volatile

- Better for shorter timelines or stability

Mutual Funds:

- Pool of money from many investors buying many stocks/bonds

- Professional management

- Instant diversification

- Often have fees

Index Funds:

- Type of mutual fund tracking a market index (like S&P 500)

- Minimal management (just follows the index)

- Very low fees

- Historically strong returns

- Recommended for most investors

ETFs (Exchange-Traded Funds):

- Similar to index funds but trade like stocks

- Low fees

- Flexible

- Popular for long-term investing

Diversification

“Don’t put all eggs in one basket.” Spreading investments across different assets reduces risk.

Example of diversification value:

- Invest $10,000 in one company: If that company fails, lose everything

- Invest $10,000 across 500 companies: If one fails, you lose $20; others likely offset the loss

This is why index funds (automatic diversification) are often recommended over individual stocks.

Age-Appropriate Investing Education

Ages 3-5: Growth Concepts

Very young children can grasp that things grow over time.

The Plant Analogy

Activity: Plant seeds together.

Discussion:

- “We plant this tiny seed”

- “We water it and give it sunlight”

- “Slowly it grows bigger and bigger”

- “Eventually it becomes a big plant or even a tree”

- “Money can grow like plants. When we invest, our money grows over time”

What they learn: Growth takes time and the right conditions.

The Toy Company Game

Activity: Play pretend business.

Scenario:

- “This toy store is a company”

- “People can own part of the company (stocks)”

- “When the store makes money, owners get some of that money”

- “If the store becomes more popular, owning part of it becomes more valuable”

What they learn: Companies are owned by people, and ownership has value.

The Growth Jar

Visual demonstration:

Week 1: Put $1 in a jar labeled “Growing Money” Week 2: Add 10¢ “because it grew.” Now $1.10 Week 3: Add 11¢ “because $1.10 grew.” Now $1.21 Week 4: Add 12¢ “because $1.21 grew.” Now $1.33

Explain: “This is how investing works. Your money makes more money, and then that money makes more money!”

Ages 6-9: Introduction to Real Investing

Elementary-age children can understand actual investment concepts.

The Stock Market Explanation

Simple terms:

- “The stock market is where people buy and sell small pieces of companies”

- “When you own stock, you own a tiny part of that company”

- “If the company does well and makes money, your stock becomes more valuable”

- “If the company struggles, your stock becomes less valuable”

- “Over long periods, most companies grow, so stocks generally go up”

Relatable example: “You know [favorite toy company]? That’s a real company. People can buy stock in it. If lots of people buy their toys and the company makes money, the stock value goes up. People who own the stock make money!”

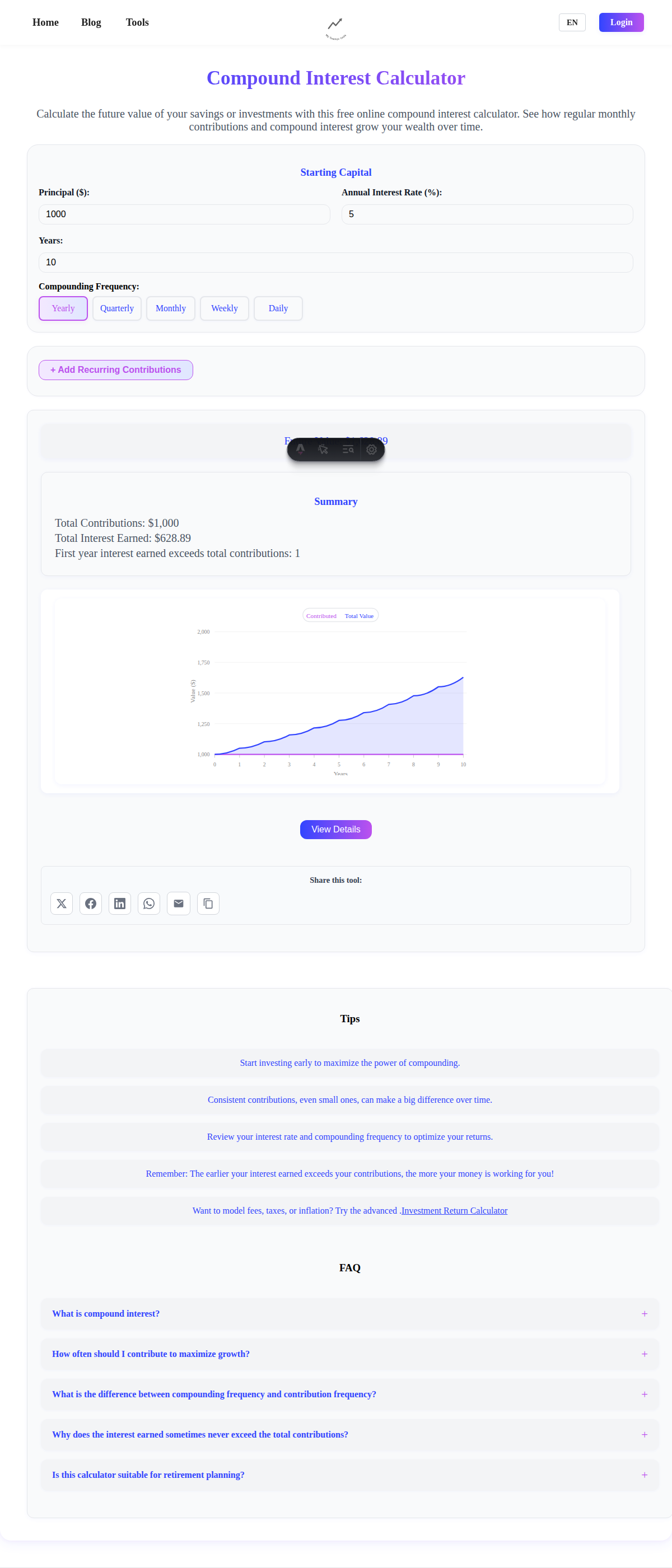

The Compound Interest Demo

Use our Compound Interest Calculator with simple numbers:

Show them:

- Start with $100

- Add $10 every month

- Grow at 8% per year

- After 10 years: $1,836 (they added $1,200, growth added $636)

- After 20 years: $5,886 (they added $2,400, growth added $3,486)

Reaction: “Wait, the growth added more than we did?!”

Lesson: “This is the magic of investing. Over time, growth does more work than you do!”

The First Stock Purchase

Around age 8-9, consider buying one share of stock in a company they know:

Process:

- Discuss companies they interact with (Disney, Apple, Nike, etc.)

- Research together: What does this company do? Is it successful?

- Buy one share through a custodial account

- Check the value together periodically

- Discuss why it goes up or down

Purpose: Makes investing real and tangible, not abstract.

Cost: ~$50-200 for one share plus any fees.

The Long-Term Perspective

Story approach:

“If your grandparents had invested $1,000 when you were born and never added more, by the time you’re 18 it might be worth $4,000. By the time you’re 30, maybe $10,000. By the time you retire at 65, maybe $90,000! And they only put in $1,000 once.”

Key message: Starting early is incredibly powerful.

Ages 10-12: Sophisticated Concepts

Pre-teens can grasp more complex investment ideas.

The Detailed Stock Market Education

Topics to cover:

How stock prices are determined:

- Supply and demand

- Company performance

- Investor sentiment

- Economic conditions

- Future expectations

Why stocks go up and down:

- Short-term: News, emotions, speculation (often unpredictable)

- Long-term: Company profits, economic growth (generally upward)

- “Daily changes are noise. Long-term trends matter.”

Market indices:

- S&P 500: 500 largest US companies

- Dow Jones: 30 large companies

- NASDAQ: Tech-focused

- These track overall market health

The Bull vs. Bear Market Lesson

Definitions:

- Bull market: Prices rising, optimism (bull charges upward)

- Bear market: Prices falling 20%+, pessimism (bear swipes downward)

Key lesson: “Markets go through cycles. Both are normal. Stay invested through both. People who panic and sell during bear markets miss the recovery.”

Historical example:

- 2008-2009: Market fell ~50% (scary!)

- 2009-2020: Market rose ~400% (recovery!)

- Those who stayed invested recovered and gained significantly

- Those who sold locked in losses

The Index Fund vs. Individual Stocks Discussion

Present both options:

Individual stocks:

- Pick specific companies

- Higher risk (one company can fail)

- Requires research and monitoring

- Potentially higher returns if you pick well

- Most professional investors can’t beat the market consistently

Index funds:

- Own tiny pieces of hundreds or thousands of companies automatically

- Diversified (if one fails, others compensate)

- No stock picking needed

- Match market returns (historically very good)

- Very low fees

- Recommended for most investors

Conclusion: “Most experts recommend index funds for normal people. Let the whole economy work for you instead of trying to pick winners.”

The Fee Impact Lesson

Show how fees compound in reverse:

Scenario: $10,000 invested for 30 years at 8% annual return

- With 0.1% fee (index fund): $96,627

- With 1% fee (actively managed fund): $76,123

- Difference: $20,504 lost to fees!

Message: “Fees seem small but compound just like returns. Low fees matter enormously.”

The Risk Tolerance Discussion

Explain: “Different people are comfortable with different risk levels.”

Questions to explore:

- “If your investment dropped 20% in a month, how would you feel?”

- “Would you sell, hold, or buy more?”

- “Can you ignore short-term drops and focus on long-term goals?”

Teach: “Your comfort with risk should match your investment timeline:

- Need money in 1-2 years? Lower risk (bonds, savings)

- Don’t need it for 10+ years? Can handle higher risk (stocks)

- Retirement is 50+ years away for you? Time to recover from drops means stocks make sense”

The Real Account

Consider opening a custodial investment account (UGMA/UTMA in US, similar elsewhere):

Purpose: Real investing experience with real money (even if small amounts)

Approach:

- Start with modest amount ($100-500)

- Let them research investment options

- Discuss choices together

- Make investment decisions jointly

- Review quarterly

- Add more over time

What they learn: Real-world investing, patience, handling ups and downs.

Ages 13-18: Advanced Investment Education

Teenagers should understand investing at near-adult levels.

The Complete Investment Universe

Comprehensive overview:

Stocks:

- Individual: Ownership in single companies

- Index funds: Ownership in market segments

- International: Companies outside home country

- Growth vs. Value vs. Dividend strategies

Bonds:

- Government: Safest, lowest returns

- Corporate: Higher returns, some risk

- Municipal: Tax advantages

- International: Currency risk added

Real Estate:

- Physical property: Can generate rental income

- REITs: Real estate investment trusts (trade like stocks)

- Crowdfunding: Pooled real estate investing

Alternative investments:

- Commodities: Gold, oil, agricultural products

- Cryptocurrency: Digital currencies (high risk, speculative)

- Collectibles: Art, antiques (illiquid, speculative)

Retirement Accounts:

- 401(k): Employer retirement account (often with matching)

- IRA: Individual retirement account

- Roth IRA: Tax-free growth (contributions after tax)

- Tax advantages make these powerful tools

The Asset Allocation Strategy

Teach portfolio construction:

Common allocation by age:

- Teens-20s: 90-100% stocks (time to recover from drops)

- 30s-40s: 80-90% stocks, 10-20% bonds

- 50s: 70-80% stocks, 20-30% bonds

- 60s+: 60-70% stocks, 30-40% bonds

Rule of thumb: Bond percentage ≈ your age (flexible guideline)

Diversification within stocks:

- US large companies: 40%

- US small companies: 10%

- International companies: 25%

- Emerging markets: 5%

- Real estate (REITs): 10%

- Bonds: 10%

The Power of Time

Use our Investment Return Calculator for powerful demonstrations:

Scenario 1: Start at age 15

- Invest $100/month from age 15-25 (10 years)

- Total invested: $12,000

- Stop contributing, let it grow until age 65

- At 8% return: $379,000

Scenario 2: Start at age 35

- Invest $100/month from age 35-65 (30 years)

- Total invested: $36,000

- At 8% return: $150,000

The shocking lesson: Investing $12,000 in your teens beats investing $36,000 in your 30s-60s. Starting early is THAT powerful.

The Tax-Advantaged Account Education

Explain retirement accounts:

Traditional IRA/401(k):

- Contributions reduce current taxes

- Money grows tax-free

- Pay taxes when withdrawing in retirement

- Good if you expect lower tax rate in retirement

Roth IRA/401(k):

- Contributions with after-tax money (no current tax benefit)

- Money grows tax-free

- Withdrawals in retirement are completely tax-free

- Excellent if you expect higher tax rate later (likely for young people)

Example power: $10,000 invested at age 18 in Roth IRA growing at 8%:

- Age 68: $469,000

- Completely tax-free withdrawal!

- In traditional account, might owe $100,000+ in taxes

Message: “Opening a Roth IRA when you get your first job is one of the smartest financial moves you can make.”

The Employer Match

When they get jobs offering 401(k):

Teach: “Some employers match contributions. This is FREE MONEY.”

Example:

- You contribute 5% of salary: $2,500/year

- Employer matches 100% up to 5%: $2,500/year

- You invested $2,500, account receives $5,000

- That’s an instant 100% return before any market growth!

Golden rule: “Always contribute enough to get full employer match. It’s a guaranteed return you’ll never beat elsewhere.”

The Market Timing Myth

Explain why timing doesn’t work:

The belief: “I’ll invest when the market is low and sell when it’s high.”

The reality:

- No one consistently predicts market movements

- Missing the 10 best market days over 30 years reduces returns by 50%+

- Those best days often come right after worst days (hard to time)

- Transaction costs and taxes from frequent trading eat profits

The better approach: “Time IN the market beats timing the market. Invest consistently regardless of market levels. Dollar-cost averaging means you buy more shares when prices are low, fewer when high—automatic optimization.”

The Growth vs. Dividend Discussion

Use our Growth vs. Dividend Calculator:

Compare strategies:

Growth investing:

- Buy companies that reinvest profits to grow

- No dividends

- Value increases over time

- Pay capital gains tax only when you sell

Dividend investing:

- Buy companies that pay dividends

- Receive regular income

- Value may grow more slowly

- Pay tax on dividends annually

Conclusion for young people: “Growth strategies usually make more sense early in life. You don’t need income now, and growth typically produces higher long-term returns. Dividend investing makes more sense when you need income in retirement.”

The Rebalancing Concept

Teach portfolio maintenance:

What happens: Over time, different investments grow at different rates, changing your intended allocation.

Example:

- Start: 80% stocks, 20% bonds

- Stocks grow faster

- After 2 years: 85% stocks, 15% bonds (more risk than intended)

Rebalancing: Sell some stocks, buy bonds, return to 80/20.

Benefits:

- Maintains risk level

- Forces “sell high, buy low” behavior

- Simple discipline

Frequency: Annually or when allocation drifts 5%+ from target.

The Real Portfolio Management

By age 16-17, if they have earned income, seriously consider:

- Opening a Roth IRA (they need earned income to contribute)

- Starting with age-appropriate amount ($500-1,000)

- Choosing investments together (likely a simple index fund)

- Contributing regularly (even $25-50/month compounds significantly)

- Reviewing quarterly

- Adding more as they earn more

This real experience is invaluable education and gives them a decades-long head start.

The Cryptocurrency Discussion

Balanced approach (neither dismissive nor hyping):

What it is: Digital currency using blockchain technology.

Characteristics:

- Extremely volatile (can gain or lose 50% in weeks)

- No underlying company or asset

- Value based entirely on what others will pay

- Limited regulation

- Some see as future of money, others as speculation

Appropriate allocation: If investing at all (many experts recommend none), perhaps 1-5% of portfolio maximum—amount you could afford to lose completely.

For young people: “Understand it, watch it, maybe invest tiny amounts to learn. But building wealth happens through boring index funds, not cryptocurrency speculation.”

Practical Investing Strategies to Teach

Strategy 1: Start Immediately

Rule: “The best time to start investing was 10 years ago. The second best time is today.”

Action: Open accounts and invest something now, even if small. Time is more valuable than amount.

Strategy 2: Invest Consistently

Rule: “Invest a set amount regularly, regardless of market conditions.”

Method: Automatic monthly transfers to investment accounts.

Benefit: Removes emotion, creates discipline, dollar-cost averages.

Strategy 3: Increase Contributions with Income

Rule: “Whenever income increases, increase investment contributions before lifestyle.”

Example: Get a raise? Invest 50% of the raise before increasing spending.

Result: Lifestyle stays modest while wealth builds rapidly.

Strategy 4: Ignore Daily Fluctuations

Rule: “Don’t check investments daily. Check quarterly or annually.”

Reason: Daily changes are meaningless noise that triggers emotional decisions.

Better: Focus on long-term trends and stay the course.

Strategy 5: Never Sell in a Panic

Rule: “When markets drop significantly, hold or buy more. Never panic sell.”

History lesson: Every major market drop has been followed by recovery and new highs.

The investors who win: Those who stayed invested or bought during downturns.

Common Challenges

Challenge #1: “Investing Seems Complicated”

Solution: Start simple. One index fund in one account. Complexity can come later. Most successful investors use simple strategies.

Challenge #2: “I Don’t Have Much to Invest”

Solution: Amount doesn’t matter at this age—time does. $25/month for 50 years beats $500/month for 10 years.

Challenge #3: “The Market Might Crash”

Solution: It will, repeatedly. That’s normal. Crashes are buying opportunities for long-term investors. Those who stay invested through crashes build the most wealth.

Challenge #4: “I Want to Pick Individual Stocks”

Solution: Understand that 80%+ of professional investors can’t beat index funds over time. If you want to try, invest 90% in index funds and “play” with 10% in individual stocks for learning.

Challenge #5: “Should I Wait Until I Have More Money?”

Solution: No. The cost of waiting is enormous. Open accounts with whatever you have. Increase contributions as income grows.

Taking Action Today

For Young Children (3-5):

- Plant seeds and discuss growth taking time

- Play toy company ownership game

- Demonstrate the “growth jar” where money grows each week

For Elementary Age (6-9):

- Explain stock market in simple terms

- Show compound interest with our Compound Interest Calculator

- Consider buying one share of stock they recognize

- Start investment conversations

For Pre-Teens (10-12):

- Explain bull/bear markets and market cycles

- Teach index funds vs. individual stocks

- Show fee impact on long-term returns

- Open custodial investment account with small amount

For Teenagers (13+):

- Complete investment education covering all asset types

- Open Roth IRA when they have earned income

- Demonstrate power of starting early with real calculations

- Help them make first real investments

- Establish automatic monthly contributions

Conclusion

Investment education may be the single highest-return gift you can give your children financially. The difference between a teen who invests early and one who waits until their 30s is literally hundreds of thousands of dollars—or millions over a lifetime.

But beyond the money, investing education teaches patience, long-term thinking, handling uncertainty, and the power of consistent discipline—lessons that enhance every aspect of life.

Start the conversations early. Make investing real by opening accounts together. Teach the principles: diversification, consistency, long-term focus, low fees, avoiding emotion. Model good investing behavior in your own life.

The children who learn to invest young don’t just build wealth—they build confidence, security, and options. They enter adulthood understanding that wealth is built systematically over time, not through luck or lottery. They have the most valuable investing asset: decades of time.

Give them that head start. Their future selves will thank you beyond measure.

Continue Your Journey

Ready to complete your child’s financial education? Continue with Part 7: Teaching Kids About Giving to help them understand using money to help others and contribute to causes they care about.

Frequently Asked Questions

At what age should children start actually investing real money?

Simple exposure can start at any age (toy stock ownership, growth jars at age 5-6). Real money in stocks might start around age 8-10 with a single share in a custodial account. More serious investing can begin at age 12-14 with small amounts in a custodial investment account. If they have earned income at age 15+, opening a Roth IRA is ideal. The key is starting with age-appropriate amounts: $50-100 for young children, $500-1000 for pre-teens, and whatever they can consistently contribute for teenagers with jobs. Don’t wait for “enough” money—time is more valuable than amount.

Should I let my child pick stocks or stick to index funds?

For the core investment portfolio, index funds are strongly recommended even for adults—they’re simpler, safer through diversification, and historically outperform most stock-pickers including professionals. However, letting them “play” with a small portion (maybe 5-10% of invested money) in individual stocks they research can be valuable education. The likely outcome is they’ll learn that stock-picking is harder than it looks, and they’ll appreciate the wisdom of index investing. This hands-on lesson is worth the potential small loss.

How do I explain market crashes without scaring them away from investing?

Frame crashes as normal, expected, and ultimately beneficial for long-term investors. Analogy: “Imagine everything in your favorite store went on sale for 50% off. Would you be scared or excited? Market crashes are sales on stocks. Scary if you need to sell right away, but excellent if you’re buying or holding long-term.” Show historical charts: every crash has been followed by recovery and new highs. Emphasize: “Your timeline is 50+ years. You’ll see many crashes. Those who stay invested through crashes build the most wealth. Crashes are features, not bugs.”

What if my family can’t afford to invest much?

Amount doesn’t matter—time and habits do. If you can invest $25/month from age 15-25 then stop, that will grow into more than $250/month from age 45-65. The key is starting and creating the habit. Use free or low-minimum platforms (many now allow fractional shares starting at $1). Focus on the education and behavior, not the amounts. Children who learn investing principles with tiny amounts have a lifetime advantage over those who never learn regardless of income. Additionally, automatic investing ($10/month) builds discipline more than occasional large amounts.

Should I open a custodial account or wait until they’re 18?

Open a custodial account earlier (age 10-14) if possible. Benefits: (1) Much longer time for compound growth, (2) Real experience managing investments before adulthood, (3) Learning from small mistakes with small amounts before large stakes, (4) Building the habit early. Concern: Money becomes legally theirs at 18-21 depending on location. Mitigation: Use accounts for intentional teaching, discuss expectations, and raise them to be responsible. Most children who’ve been involved in investment education make reasonable decisions. The learning value usually outweighs the risk.

How do I teach about investing when I don’t invest myself?

Start learning together. Say: “I wish I’d learned this sooner. Let’s both learn now.” Resources: Library books on investing for beginners, low-cost online courses, financial websites, and use our calculators to explore scenarios. Consider: Open a small investment account for yourself while opening one for them—model the learning process. They benefit from seeing you grow, make decisions, and handle uncertainty. You don’t need expertise to teach principles: invest consistently, diversify through index funds, think long-term, ignore short-term noise, keep fees low. These basic principles beat most sophisticated strategies.

What about college savings accounts (529 plans) vs. custodial investment accounts?

Both serve different purposes: 529 plans: Tax-advantaged for education expenses, parents control it, can change beneficiary, limited investment options, penalties if not used for education. Custodial accounts: Flexible use, child controls at 18-21, unlimited investment options, less tax advantage. Consider: Use 529s for parents to save for child’s education (parental control, tax benefits). Use custodial accounts for teaching children to invest (educational value, child agency, flexibility). You can have both. Or if child will earn income, Roth IRA might be best (can withdraw contributions penalty-free for education, or leave for retirement compounding).

Should teenagers invest or focus on saving for near-term goals?

Both! Budget should include categories for both: (1) Short-term savings (checking/savings accounts) for goals within 1-3 years—car, college expenses, moving out, (2) Long-term investing (Roth IRA, custodial account) for retirement and distant future. A reasonable split: 50% short-term savings, 30% long-term investing, 20% current spending. However, prioritize: Emergency fund first ($1,000+), then split between short and long-term. They need both the immediate security of liquid savings and the long-term wealth-building of investments. This is excellent practice for adult financial management.