📚 This is Part 7 of our 7-part series “Complete Money Education for Kids”:

- Part 1: Teaching Kids to Save

- Part 2: Teaching Kids to Spend Wisely

- Part 3: Teaching Kids to Earn

- Part 4: Teaching Kids About Budgeting

- Part 5: Teaching Kids About Debt

- Part 6: Teaching Kids About Investing ← Previous

- Part 7: Teaching Kids About Giving ← You are here

We’ve covered the essential financial skills: saving (Part 1), spending wisely (Part 2), earning (Part 3), budgeting (Part 4), managing debt (Part 5), and investing (Part 6). These skills build wealth and security.

But there’s one more essential element that completes financial education: giving. Teaching children to use money to help others, support causes they believe in, and contribute to something larger than themselves transforms money from a purely personal resource into a tool for positive impact.

Generosity isn’t just morally valuable—it’s psychologically beneficial. Research consistently shows that people who give regularly report higher life satisfaction, greater happiness, stronger sense of purpose, and even better physical health than those who don’t. Giving creates meaning.

Moreover, children who learn generosity develop empathy, perspective, gratitude, and social responsibility—character traits that enhance every aspect of life. They understand their place in a larger community and their capacity to make a difference.

This final part of our series will teach you how to introduce giving concepts at every age, from simple sharing with young children to sophisticated charitable planning with teenagers, creating adults who use money not just for personal benefit, but for broader good.

Why Teaching Giving Matters

Generosity education shapes character and worldview.

Builds Empathy: Understanding others’ needs and situations develops compassion and perspective-taking abilities.

Creates Purpose: Money becomes meaningful when it serves purposes beyond consumption. Contributing to causes creates sense of purpose.

Develops Gratitude: Seeing others’ struggles and helping address them builds appreciation for what you have.

Prevents Materialism: Children focused only on acquiring become entitled and unsatisfied. Those who give maintain healthier relationships with money and possessions.

Teaches Impact: Understanding that individual actions matter—your donation feeds families, funds research, protects environment—builds agency and responsibility.

Connects to Community: Giving creates connections beyond immediate family, building social bonds and sense of belonging.

Models Values: How we use money reveals what we truly value. Teaching giving aligns money use with family values and ethics.

Builds Character: Generosity, compassion, social responsibility—these character traits developed through giving transfer to all relationships and situations.

Enhances Happiness: Counter-intuitively, giving money away (within reason) creates more happiness than spending it on yourself. This lesson is invaluable.

Understanding Giving Fundamentals

Before teaching children, understand core concepts.

Types of Giving

Financial Giving:

- One-time donations

- Recurring contributions

- Major gifts for specific purposes

- Planned giving (including in estate plans)

Time Giving:

- Volunteering

- Service projects

- Skills-based support (tutoring, consulting, building)

- Activism and advocacy

Resource Giving:

- Donating items (clothes, food, toys, equipment)

- Sharing skills and knowledge

- Lending support and encouragement

- Using privilege to amplify others’ voices

All forms are valuable. Children can participate in all three.

Giving Philosophies

Different families approach giving differently. Consider your philosophy:

Religious/Spiritual Giving:

- Many traditions prescribe giving (tithing, zakat, tzedakah, dana)

- Typically 10% of income

- Often to religious institutions, but can be broader

Effective Altruism:

- Maximize positive impact per dollar

- Evidence-based charity selection

- Focus on measurable outcomes

- “Do the most good possible”

Local Focus:

- Support immediate community

- Visible, tangible impact

- Build local relationships

- “Help your neighbors”

Cause-Based:

- Support specific issues you’re passionate about

- Education, environment, health, animals, arts, etc.

- Deep engagement with specific problems

Balanced Approach:

- Combine several philosophies

- Some local, some global

- Some heart-driven, some evidence-driven

- Diversified impact

There’s no single “right” approach. What matters is intentionality and consistency.

How Much to Give?

Traditional guideline: 10% of income (tithe)

Modern variations:

- 1% of income (starting point)

- 5-10% (substantial commitment)

- 10%+ (significant generosity)

- Progressive giving (percentage increases with income)

For children learning:

- Young kids: 10% of allowance/gifts

- Older kids: 10% of all income

- Teens with jobs: 5-15% depending on other obligations

The specific percentage matters less than establishing the habit.

Strategic Giving

Teach that effective giving requires thought:

Questions to ask:

- What problem does this organization solve?

- How effectively do they use donations?

- What percentage goes to programs vs. overhead?

- Can they demonstrate impact?

- Are there better alternatives for this cause?

Resources:

- Charity Navigator (rates nonprofits)

- GiveWell (identifies highly effective charities)

- Charity Watch (evaluates efficiency)

- Nonprofit financial statements (public information)

Teaching research and evaluation makes giving thoughtful, not just emotional.

Age-Appropriate Giving Education

Ages 3-5: Introduction to Helping

Very young children can grasp sharing and helping.

The Sharing Foundation

Activities:

- Share toys with siblings, friends

- Give hugs and comfort when someone is sad

- Help family members with tasks

- Include others in play

Discussion:

- “When you share, how does your friend feel?”

- “How do you feel when someone shares with you?”

- “Helping others feels good, doesn’t it?”

The Toy Donation Experience

Process:

- Go through toys together

- Identify ones they’ve outgrown or don’t play with

- Explain these will go to children who don’t have many toys

- Let them choose which ones to donate

- Visit donation center together

- Discuss how children receiving them will feel

What they learn: Things you don’t need can help others who do need them.

The “Give” Jar Introduction

Implementation:

- Three-jar system: Spend, Save, Give

- When receiving money, put portion in Give jar

- When jar reaches certain amount, choose where to donate

- Make donation together (online or in-person)

Simple allocation:

- $5 allowance: $2.50 spend, $2 save, $0.50 give

- Over year: $26 to give—meaningful amount!

The Helper Identity

Cultivate the identity:

- “You’re such a good helper!”

- “You made that person happy by helping!”

- “Our family helps others—that’s important to us”

Identity is powerful. Children who see themselves as helpful people act accordingly.

Ages 6-9: Understanding Needs

Elementary children can grasp that some people have less and need help.

The Privilege and Need Discussion

Age-appropriate conversation:

- “Some families don’t have enough food. The food bank helps them.”

- “Some kids don’t have warm clothes for winter. Donations help them.”

- “Some people are sick and can’t afford medicine. Charities help them.”

- “We’re lucky to have what we need. Not everyone does.”

Key balance: Build awareness without creating guilt or fear.

The Cause Connection

Help them identify causes they care about:

Questions:

- “What makes you sad or worried in the world?”

- “If you could solve one problem, what would it be?”

- “What kinds of people or animals need help?”

Common childhood causes:

- Animals (shelters, wildlife conservation)

- Environment (ocean cleanup, tree planting)

- Sick children (hospitals, research)

- Hungry people (food banks, meal programs)

- Disasters (emergency relief)

Let their passions guide giving choices.

The Birthday Giving Project

Alternative to more toys:

Approach:

- “You have lots of toys. For your birthday, what if friends donated to [cause you chose] instead of gifts?”

- Or: “Half gifts, half donations”

- Or: “Choose one charity, guests bring donations instead of gifts”

Example: Child loves animals, asks for pet shelter donations instead of birthday presents. Shelter receives $200 in their name.

Impact: Creates memorable birthday, teaches celebration can include generosity, makes them feel important and capable.

The Volunteer Introduction

Age-appropriate service:

- Package meals at food bank (with adult supervision)

- Pick up litter in parks (community cleanup)

- Make cards for nursing home residents

- Collect donations for animal shelter

- Participate in charity walks/runs

Discussion afterward:

- “How did that feel?”

- “Who did we help?”

- “What did you notice?”

- “Would you want to do that again?”

Key lesson: Giving isn’t just money—it’s time and action.

The Giving Circle

Family giving tradition:

Process:

- Each family member nominates a charity

- Research them together

- Discuss which to support and why

- Vote or rotate

- Make donation together

- Track impact (some charities send updates)

What this teaches:

- Democratic decision-making

- Research and evaluation

- Respecting different priorities

- Collective action

The Impact Visualization

Make giving concrete:

Examples:

- “$25 feeds a family for a week at the food bank”

- “$50 vaccinates 10 children”

- “$100 provides school supplies for 5 kids”

- “$30 supports shelter dog for a month”

Activity: Calculate what their annual giving accomplishes:

- “$2/week × 52 weeks = $104”

- “$104 provides… [specific impact]”

- “Your generosity did that!”

Pride in impact motivates continued giving.

Ages 10-12: Deepening Understanding

Pre-teens can grasp more complex social issues and giving strategies.

The Systems Thinking Introduction

Discuss root causes:

Example: Homelessness

- Surface: People need shelter

- Deeper: Why are they homeless? (job loss, mental health, addiction, domestic violence, systemic inequality)

- Solutions: Emergency shelter (immediate) + job training, healthcare, affordable housing (systemic)

Lesson: Some charities address symptoms, others address causes. Both matter.

The Charity Evaluation Practice

Research organizations together:

Questions to explore:

- What’s their mission?

- What programs do they run?

- What percentage of donations go to programs vs. overhead/fundraising?

- Can they demonstrate impact? (statistics, stories, outcomes)

- Do experts recommend them?

- What do beneficiaries say?

Use resources:

- Charity Navigator ratings

- Organization websites

- News articles about their work

- Financial statements

Exercise: Compare two similar organizations. Which uses donations more effectively?

The Percentage Principle

Teach systematic giving:

Explain: “Many people give a percentage of all income to charity, not just leftover amounts.”

Common approaches:

- 10% (traditional tithe)

- 5% (moderate commitment)

- 1% (starting point)

Calculate their giving:

- Monthly allowance: $20

- Additional earnings: $10/month average

- Total income: $30/month

- At 10%: $3/month = $36/year

- At 5%: $1.50/month = $18/year

Implement: Include “giving” line item in their budget (from Part 4).

The Disaster Response Experience

When disasters occur:

Process:

- Discuss what happened

- Talk about what people need

- Research response organizations

- Donate together from their giving fund

- Follow news to see impact

Example: Hurricane destroys homes

- Immediate need: Food, water, shelter

- Short-term: Clean-up supplies, temporary housing

- Long-term: Rebuilding

Organizations respond at different stages. Discuss which to support and why.

The Social Enterprise Introduction

Explain businesses that create social impact:

Examples:

- TOMS (shoes): Buy one, donate one model

- Warby Parker (glasses): Similar model

- Fair trade coffee: Ensures farmers get fair wages

- B Corporations: Certified social impact businesses

Discuss: “When you buy from these companies, part of your purchase helps others. That’s one way to integrate giving into everyday spending.”

The Giving Time vs. Money Discussion

Compare:

- Donate $100 to food bank

- Volunteer 10 hours at food bank

Questions:

- “Which helps more?”

- “Depends on what they need—funding or volunteers”

- “Sometimes time is more valuable than money”

- “Often both matter”

- “You can give both!”

Lesson: Generosity takes multiple forms. Assess what’s most needed and what you can offer.

Ages 13-18: Sophisticated Giving

Teenagers can engage with giving at adult levels.

The Values-Based Giving Plan

Help them create personal giving strategy:

Step 1: Identify core values

- What matters most to you? (environment, education, equality, health, animals, arts, etc.)

- Why do these matter?

- What change do you want to see?

Step 2: Research aligned organizations

- Find 3-5 organizations working on your priority issues

- Evaluate their effectiveness

- Select 1-3 to support regularly

Step 3: Determine giving amount

- What percentage of income will you give?

- How will you divide it among causes?

- One-time or recurring donations?

Step 4: Budget for giving

- Include in regular budget (from Part 4)

- Automatic monthly donations if possible

- Track annually

Step 5: Stay engaged

- Follow organizations’ work

- Participate in events or volunteering

- Learn about the issues

- Advocate for the causes

The Effective Altruism Exploration

Introduce the concept:

Core idea: Use evidence and reason to determine how to help others as much as possible with your resources.

Example comparisons:

- $100 to guide dog organization: Helps one person significantly

- $100 to prevent blindness in developing countries: Saves 10-20 people from blindness

- Both are good, but one helps more people per dollar

Organizations like GiveWell research to identify highest-impact charities.

Discussion:

- “Should impact per dollar be the only consideration?”

- “What about causes that matter to you personally?”

- “How do you balance head (effectiveness) and heart (passion)?”

Many people blend approaches: Some giving to highly effective charities, some to personal passions.

The Advocacy and Activism Discussion

Explain giving beyond money:

Forms of activism:

- Volunteering time

- Raising awareness (social media, conversations)

- Participating in demonstrations

- Contacting elected officials

- Organizing community action

- Using skills professionally for impact (pro bono work)

Example: Passionate about climate change?

- Donate to environmental organizations (money)

- Volunteer for local conservation projects (time)

- Reduce personal environmental footprint (action)

- Advocate for policy changes (activism)

- Choose career in sustainability (lifetime impact)

Comprehensive engagement multiplies impact.

The Tax Deduction Education

Explain financial benefits of giving (where applicable in your country):

How it works:

- Donate to qualified charitable organization

- Keep receipt

- Deduct donation from taxable income

- Reduces taxes owed

Example:

- Income: $50,000

- Tax rate: 20%

- Donate $5,000

- Taxable income reduced to $45,000

- Tax savings: $1,000

- Effective cost of donation: $4,000 (gave $5,000, saved $1,000 in taxes)

Lesson: “Government incentivizes charitable giving through tax policy. Giving costs less than face value for those who itemize deductions.”

Important: Primary reason for giving should be impact, not tax benefits. But understanding the system is smart.

The Donor-Advised Fund Introduction

For teens with significant income (jobs, businesses):

What it is: Special charitable account

- Donate money, get immediate tax deduction

- Money invested and grows tax-free

- Recommend grants to charities over time

- Commonly offered by Fidelity, Schwab, Vanguard

Benefits:

- Separate giving timing from tax timing

- Donations grow before being granted

- Central place to manage charitable giving

- Can involve family in grant decisions

Example: Earn $10,000 from summer job

- Contribute $1,000 to donor-advised fund

- Receive tax deduction now

- Invest in fund (grows tax-free)

- Grant to charities over next few years as you research and decide

Appropriate for teens seriously engaged in giving with meaningful income.

The Social Impact Career Discussion

Explore purpose-driven career paths:

Options:

- Direct service: Teaching, healthcare, social work, counseling

- Nonprofit sector: Program management, fundraising, advocacy

- Government/Policy: Creating systemic change through policy

- Social enterprise: Businesses solving social problems

- “Earning to give”: High-income career to fund significant giving

- Pro bono work: Use professional skills to help nonprofits

Discussion:

- “How much does making an impact through work matter to you?”

- “What’s the right balance between income and mission?”

- “Different people find different paths—what feels right for you?”

Key message: Career choices can be part of giving back to society.

The Philanthropy Project

Experiential learning assignment:

Give them $100-500 to donate (your money, their research and decision):

Requirements:

- Research at least 5 charitable organizations

- Evaluate them on mission, effectiveness, financial health, impact

- Write analysis of each

- Decide how to allocate the money (one or several organizations)

- Make donations

- Write reflection on the experience

What they learn:

- Research skills

- Critical evaluation

- Decision-making with real stakes

- Responsibility of resources

- Impact of philanthropy

This hands-on experience is invaluable education.

Teaching Balanced Giving

Principle 1: Give from Abundance, Not Scarcity

Teach: “Give what you can comfortably give. Giving shouldn’t create financial problems for you.”

Example: If struggling to pay bills, focus on financial stability first. When stable, then give.

Balance: Financial security enables sustained, substantial giving. Don’t sacrifice your own needs.

Principle 2: Heart and Head

Teach: “Give to some causes you’re passionate about (heart) and some that are highly effective (head).”

Example allocation:

- 50% to causes you love (animal shelter because you love animals)

- 50% to highly effective charities (malaria prevention because it saves many lives per dollar)

Balance: Passion maintains motivation; effectiveness maximizes impact.

Principle 3: Local and Global

Teach: “Some giving helps your immediate community. Some helps people far away. Both matter.”

Example allocation:

- 60% local (food bank, school programs, community centers)

- 40% global (international development, disaster relief, global health)

Balance: Connection to local + awareness of global needs.

Principle 4: Symptoms and Systems

Teach: “Some charities provide immediate help (feed hungry people today). Others address root causes (job training to prevent future hunger). Support both.”

Example allocation:

- 40% immediate relief (shelters, food banks, emergency services)

- 60% systemic solutions (education, job training, policy advocacy, research)

Balance: Address urgent suffering while working toward long-term solutions.

Common Challenges

Challenge #1: “I Don’t Have Enough to Give”

Response: “You always have something to give—time, skills, encouragement, even small amounts of money. A child giving $1 learns generosity just as much as an adult giving $1,000. The habit and mindset matter more than the amount.”

Challenge #2: “So Many Problems—Where Do I Start?”

Response: “You can’t solve everything. Pick 1-3 causes that matter most to you. Focus there. Making a difference in one area is better than spreading yourself so thin you make no difference anywhere.”

Challenge #3: “How Do I Know My Donation Actually Helps?”

Response: “Research before giving. Use Charity Navigator, GiveWell, and other evaluators. Look for organizations that measure and report impact, use donations efficiently, and demonstrate results. Avoid those that spend most money on overhead or fundraising.”

Challenge #4: “Giving Feels Like Losing Money”

Reframe: “Research shows givers are happier than non-givers. Giving creates meaning and satisfaction. You’re not losing money—you’re transforming it into impact and purpose. That’s an incredible exchange.”

Challenge #5: “My Family Can’t Agree on What to Support”

Solution: “Rotate decision-making, divide giving among family members’ choices, or use majority vote. Learning to respect different priorities is part of the lesson. Or everyone contributes to personal causes with their own money.”

Creating Family Giving Traditions

Tradition 1: Annual Giving Day

Once per year:

- Review past year’s giving

- Celebrate impact made

- Plan next year’s giving

- Each family member nominates causes

- Discuss and decide together

- Make annual donations as family

Tradition 2: Holiday Giving

During holidays:

- Instead of only receiving, also give

- Each family member chooses a family to sponsor/help

- Buy gifts for children in need

- Volunteer at holiday charitable events

- Donate to causes as part of celebration

Tradition 3: Birthday Giving

Each birthday:

- Donate equal to child’s age ($8 on 8th birthday, $16 on 16th, etc.)

- Or donate percentage of gifts received

- Or volunteer together as birthday celebration

Tradition 4: Matching Programs

Parents match children’s donations:

- Child gives $1, parent gives $1 = $2 donated

- Teaches that giving can be multiplied

- Encourages their giving

- Models generosity

Tradition 5: Volunteer Day

Monthly or quarterly:

- Entire family volunteers together

- Food bank, park cleanup, habitat build, etc.

- Followed by discussion about experience

- Builds family bond through shared service

Taking Action Today

For Young Children (3-5):

- Start three-jar system (Spend, Save, Give)

- Donate outgrown toys together

- Practice sharing with siblings and friends

- Read books about helping others

For Elementary Age (6-9):

- Help them choose a cause they care about

- Allocate 10% of allowance to giving

- Make first charitable donation together

- Volunteer at age-appropriate activity

For Pre-Teens (10-12):

- Research charities together using evaluation sites

- Include giving as budget category

- Discuss social issues and how organizations address them

- Increase volunteer involvement

For Teenagers (13+):

- Help them create personal giving plan

- Set up recurring donations to chosen causes

- Explore effective altruism concepts

- Discuss social impact career options

- Consider giving them budget for philanthropic decisions

Conclusion: Completing the Financial Education Circle

We’ve come full circle in this seven-part series. From saving to spending wisely, from earning to budgeting, from avoiding debt to building wealth through investing, and finally to giving back.

This last lesson—teaching children to give—completes their financial education by ensuring they understand money’s ultimate purpose: not just personal security and comfort, but positive impact on the world.

Children who learn generosity alongside financial skills develop healthy relationships with money. They see it as a tool for good, not just personal consumption. They build wealth but avoid becoming self-centered. They achieve security while maintaining connection to community.

Most importantly, they discover what research consistently demonstrates: giving creates happiness. The joy of making a difference, of helping others, of contributing to something larger than yourself—this is what makes life meaningful.

You’ve given your children an incredible gift through this complete financial education. They understand how money works, how to manage it wisely, how to build wealth, and how to use it for good. These skills will serve them for a lifetime, creating security, opportunity, and purpose.

Your investment of time in teaching these lessons will return dividends beyond measure—not just in their bank accounts, but in their character, relationships, and contributions to the world.

Congratulations on completing this journey. Your children are prepared for financial success and meaningful lives.

Series Complete!

You’ve reached the end of our 7-part series on teaching kids about money. You now have comprehensive strategies for teaching every essential financial skill:

- Teaching Kids to Save - Building emergency funds and achieving goals

- Teaching Kids to Spend Wisely - Making smart purchasing decisions

- Teaching Kids to Earn - Building work ethic and understanding income

- Teaching Kids About Budgeting - Planning and tracking money effectively

- Teaching Kids About Debt - Understanding borrowing and credit responsibly

- Teaching Kids About Investing - Building wealth through compound growth

- Teaching Kids About Giving - Using money to help others and create positive impact

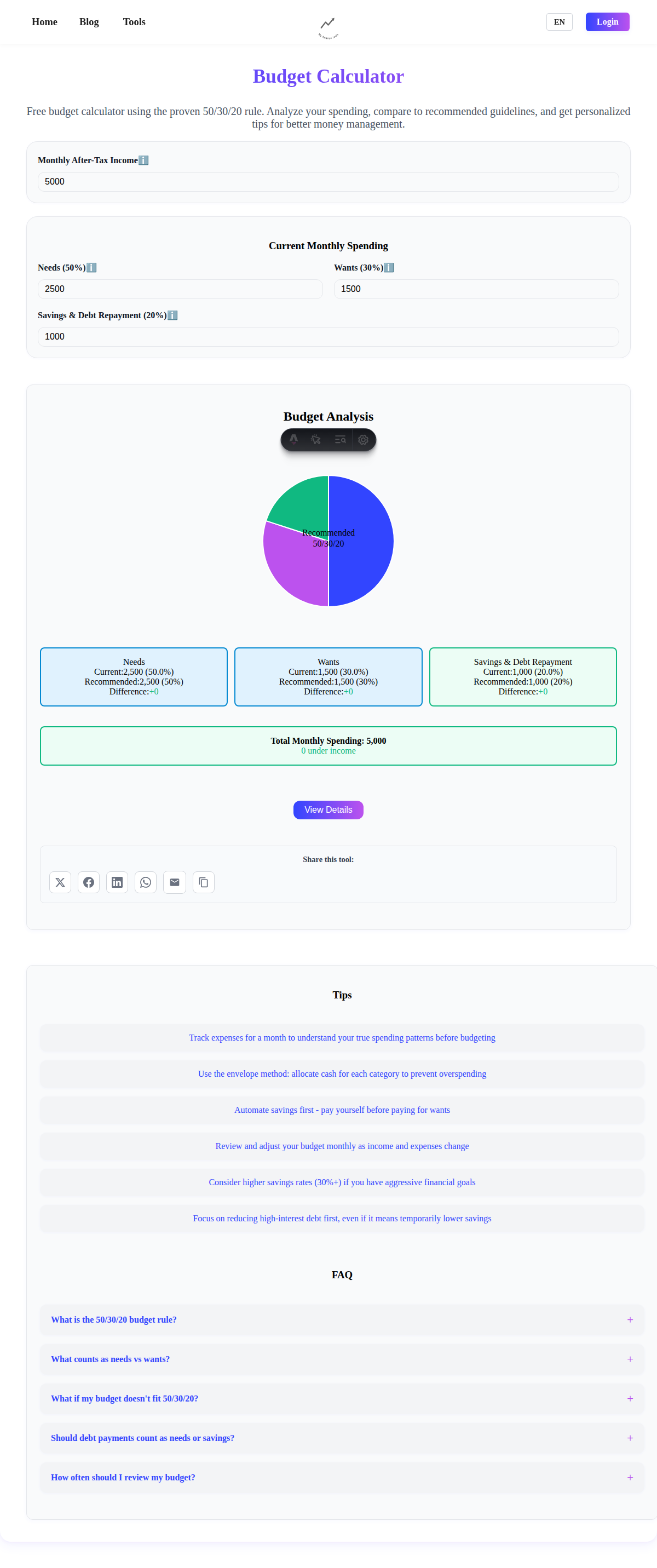

Use our financial calculators to support your teaching:

- Budget Calculator - Plan spending and giving

- Savings Goal Calculator - Track progress toward goals

- Compound Interest Calculator - Demonstrate growth over time

Frequently Asked Questions

At what age should children start giving?

As early as 3-4 years old with simple sharing and toy donations. By ages 5-6, introduce the three-jar system (Spend/Save/Give) with their first allowance. Elementary ages can make actual donations to causes they choose. Pre-teens can research charities. Teenagers can create sophisticated giving plans. The key is age-appropriate engagement from the very beginning. The habit of generosity formed early lasts a lifetime.

How much should kids give from their allowance/earnings?

A common guideline is 10% of all income (traditional tithing), though 5-15% are all reasonable. For young children just learning, even $0.50 from a $5 allowance teaches the principle. What matters most is establishing the habit, not the specific amount. As they earn more (part-time jobs as teens), maintain the percentage. This creates proportional giving that scales with income—excellent preparation for adulthood.

Should I let my child choose any charity or guide their choices?

Balance both approaches. Let them choose causes they care about (builds ownership and passion), but teach evaluation skills (guide them toward effective, legitimate organizations). Avoid: Scam charities, organizations that use donations poorly, extremist groups. Encourage: Well-rated charities, organizations with demonstrated impact, causes aligned with family values. The goal is teaching both passion-driven and evidence-based giving.

What if my child wants to give to causes I don’t agree with?

This requires nuance. If it’s a matter of different priorities (they want to help animals, you prefer human-focused causes), let them choose—part of developing their own values. If it’s an organization you find morally objectionable or potentially harmful, explain your concerns and set boundaries. You can say: “I respect your compassion for [issue], but I’m not comfortable supporting [organization] because [reasons]. Let’s find another organization working on that issue that we both feel good about.”

Is it better to give to many organizations or focus on a few?

For children learning, starting with one organization creates clear connection between their giving and impact. As they mature, 2-4 organizations allows diversification (different causes, local and global) without spreading too thin. Adults might support more, but even then, focused giving to organizations you deeply understand often creates more satisfaction and impact than small amounts to dozens of groups. Teach: Depth of engagement over breadth of distribution.

Should giving be public or private?

Both have value. Public aspects: Making donations together, volunteering visibly, discussing giving in family conversations—these teach and model generosity. Private aspects: Not bragging about donations, avoiding making others feel bad about what they can’t give, maintaining humility. Teach: “We talk about giving within our family to learn from each other. But we don’t brag to others or make them feel less generous. Giving is between us and the causes we support.” Balance transparency with humility.

How do I teach giving when our family is struggling financially?

Emphasize that giving isn’t only financial. Volunteer time, donate items you no longer need, help neighbors, share skills, offer encouragement—these are all forms of giving. Even in financial difficulty, a child giving $1 or volunteering an hour learns generosity. Additionally, being honest: “We’re being very careful with money right now, but we still give what we can because it’s important to us and helps others.” Small consistent giving during hardship can actually help children feel empowered rather than only helpless. Many people who grew up in financial difficulty but learned generosity become generous adults when they achieve stability.

What if my teenager wants to give large amounts that I think are excessive?

This is actually a wonderful “problem”! Praise their generosity, then have a practical conversation: “I love your generous heart. Let’s make sure this is sustainable. What percentage of your income would this represent? Can you still meet your other financial goals (saving for college/car/etc.)? Let’s create a giving plan that you can maintain long-term rather than one dramatic gesture.” Guide them toward balanced giving (5-15% of income) that they can sustain for years rather than one large donation that depletes all savings. Consistent, sustainable generosity creates more lifetime impact than unsustainable bursts.