📚 This is Part 3 of our 7-part series “Complete Money Education for Kids”:

- Part 1: Teaching Kids to Save

- Part 2: Teaching Kids to Spend Wisely ← Previous

- Part 3: Teaching Kids to Earn ← You are here

- Part 4: Teaching Kids About Budgeting ← Next

- Part 5: Teaching Kids About Debt

- Part 6: Teaching Kids About Investing

- Part 7: Teaching Kids About Giving

After teaching children to save money (covered in Part 1) and spend it wisely (Part 2), the next essential skill is understanding how money is earned. Without grasping the connection between work and income, children can develop an entitled mindset or unrealistic expectations about money.

Teaching kids to earn money isn’t just about income—it’s about building work ethic, understanding value creation, developing entrepreneurial thinking, experiencing pride in accomplishment, and learning that money represents exchanged time and effort.

Yet this topic is surprisingly controversial among parents. Should children receive allowance for simply existing or must they earn it? Should you pay them for household chores or are those expected family contributions? At what age should they get jobs outside the home? How do you build work ethic without exploitation or burdening childhood?

This comprehensive guide will help you navigate these questions and teach your children about earning money in age-appropriate, value-building ways.

Why Teaching Earning Matters

Understanding how money is earned shapes children’s entire relationship with work and finances.

Connects Work to Reward: Children who earn money understand it doesn’t appear magically. There’s a clear cause-and-effect: work produces income. This fundamental understanding prevents entitlement.

Builds Work Ethic: The habits developed through early earning experiences—showing up, completing tasks, doing quality work, meeting commitments—transfer to school, career, and life.

Teaches Value Creation: Earning teaches that income comes from providing value to others. Whether it’s completing chores, mowing lawns, or starting a business, they learn to ask: “How can I help? What do people need?”

Develops Appreciation: Kids appreciate money more when they’ve worked for it. That toy purchased with money they earned gets treated better than one simply given.

Prevents Learned Helplessness: Children who only receive money passively may develop the belief that their financial situation is beyond their control. Earning teaches agency: “I can improve my situation through my efforts.”

Introduces Career Concepts: Early earning experiences introduce job concepts: applications, interviews, punctuality, customer service, problem-solving, negotiation, feedback, and improvement.

Builds Self-Esteem: Earning your own money, especially as a young person, creates genuine pride and confidence. “I did this myself” is a powerful feeling.

The Great Allowance Debate: Philosophical Approaches

Before diving into age-specific strategies, let’s address the allowance question. There are three main philosophical approaches, each with merits:

Approach 1: Unconditional Allowance

The concept: Children receive a set amount weekly/monthly simply as family members, with no work required.

Rationale:

- Adults don’t get paid for household chores; chores are family contributions everyone makes

- Allowance provides money for teaching financial management (saving, spending, budgeting)

- Separating chores from pay prevents negotiations about family responsibilities

- Teaches that family members support each other without financial transactions

Challenges:

- May not teach work-reward connection

- Children might not appreciate money they didn’t earn

- Doesn’t prepare them for the reality that income requires work

Best for: Families who prioritize teaching financial management skills (budgeting, saving, etc.) over the earning connection, and who strongly believe chores are non-negotiable family duties.

Approach 2: Earned Allowance

The concept: Children earn money by completing chores and tasks. No work = no allowance.

Rationale:

- Directly connects work with income

- Teaches that money must be earned

- Provides motivation for completing chores

- Mirrors real-world employment

- Prevents entitlement

Challenges:

- Family responsibilities become transactional

- Children might refuse chores if they don’t need money

- Can create a “what will you pay me?” mentality for everything

- May undermine intrinsic motivation to help the family

Best for: Families who prioritize teaching work ethic and the direct connection between effort and reward.

Approach 3: Hybrid Model (Recommended by Many Experts)

The concept: Separate family responsibilities from earning opportunities.

How it works:

- Base responsibilities (unpaid): Age-appropriate chores expected from all family members (making bed, cleaning own room, clearing dishes, helping with family tasks)

- Base allowance (modest): Small unconditional amount for basic financial management practice

- Earning opportunities (paid): Optional extra tasks beyond base responsibilities where children can earn additional money

Example:

- 10-year-old receives $5/week base allowance

- Expected unpaid chores: make bed, clean room, set table, clear dishes

- Can earn extra: $5 for washing car, $3 for yard work, $5 for deep-cleaning garage, etc.

Rationale:

- Teaches that family members contribute without pay (good citizenship)

- Provides money for financial education (saving, spending, budgeting)

- Creates opportunities to earn more through extra effort (entrepreneurial mindset)

- Avoids negotiations about basic family responsibilities

- Mirrors adult reality: base necessities covered, extras require extra work

Best for: Most families seeking balanced approach teaching both family responsibility and work-income connection.

Age-Appropriate Earning Education

Let’s explore specific strategies for each developmental stage.

Ages 3-5: Introduction to Work-Reward Connection

At this age, children can begin understanding that work produces results.

Concepts to Introduce:

- Work means doing helpful things

- When you work, you help the family

- Sometimes work earns rewards

Activities:

Simple Task-Reward Systems: Create a basic sticker chart:

- Complete task → Get sticker

- 5 stickers → Small reward (treat, privilege, or tiny amount of money)

Tasks might include:

- Putting toys away

- Helping set the table

- Feeding the pet

- Watering plants

The “Helper” Identity: Frame work positively as being helpful:

- “You’re such a good helper! Thank you for putting your toys away.”

- “Helpers make the family happy. You’re a wonderful helper.”

This builds pride in contributing.

Pretend Work: Play work-themed games:

- Restaurant (taking orders, serving food)

- Store (selling items, handling play money)

- Post office (delivering mail)

- Doctor’s office (helping patients)

These games introduce work concepts safely.

Parent Work Discussion: Talk simply about how parents work:

- “Mommy goes to work and helps people, and they give her money”

- “Daddy works at his computer to do his job”

- “Work is how grownups earn money for our family”

Ages 6-9: Establishing Allowance and Household Contributions

This is the ideal age to establish a formal system.

Allowance Implementation:

Amount: A common guideline is $1-2 per year of age per week (so a 7-year-old receives $7-14 weekly). Adjust for your family’s financial situation and local costs.

Delivery: Make it consistent (same day, same time weekly). Inconsistency teaches that work doesn’t reliably produce income.

Method: Consider paying in cash rather than tracking digitally. Physical money is more tangible and meaningful at this age.

Required Family Responsibilities (Unpaid): Establish age-appropriate expectations:

Ages 6-7:

- Make bed

- Put away toys and belongings

- Put dirty clothes in hamper

- Clear own dishes after meals

- Help set table

- Simple pet care (with supervision)

Ages 8-9:

- Everything above plus:

- Clean own room weekly

- Help with meal prep (wash vegetables, etc.)

- Take out bathroom trash

- Bring in mail

- Help with grocery unloading

- Basic pet care independently

Extra Earning Opportunities: Create a menu of tasks they can do for extra money:

| Task | Payment | Frequency |

|---|---|---|

| Wash car | $5 | Weekly |

| Weed garden | $3 | Weekly |

| Sort recycling | $2 | Weekly |

| Wash windows | $5 | Monthly |

| Deep-clean room | $3 | Monthly |

| Help with yard work | $5 | As needed |

The Job Board System: Create a visual board with cards for each extra job:

- Job description

- Payment amount

- Who’s currently assigned (or open)

- Due date

Kids can “claim” jobs they want to do.

Quality Standards: Introduce the concept that work must meet standards:

- “Let’s check if this job is done well enough to earn payment”

- If not done well, they redo it (teaching that work quality matters)

- Praise good work: “This is excellent work! You earned this money.”

Workplace Skills Introduction: Teach basic skills:

- Commitment: If you accept a job, you must complete it

- Timeline: Jobs have deadlines

- Quality: Work must be done well, not just quickly

- Problem-solving: If you can’t complete it, communicate early

Ages 10-12: Entrepreneurial Thinking and Outside Opportunities

Pre-teens can handle more sophisticated earning concepts and opportunities outside the home.

Advanced Home Earning:

Expand earning opportunities to more substantial tasks:

- Babysitting younger siblings ($5-10/hour)

- Cooking family meals ($10-15)

- Deep cleaning tasks (bathrooms, garage, basement: $10-20)

- Home organization projects ($15-30)

- Tech help for parents ($5-10)

- Lawn mowing and gardening ($10-15)

Neighborhood Earning Opportunities:

With parent supervision and approval, pre-teens can start offering services:

Classic Options:

- Lawn mowing ($15-30 per lawn)

- Leaf raking ($15-25)

- Snow shoveling ($10-20 per driveway)

- Dog walking ($10-15 per walk)

- Pet sitting ($15-25/day)

- Car washing ($10-15 per car)

Implementation:

- Help them create simple flyers

- Deliver to neighbors you know and trust

- Establish clear safety rules (which houses, what times, parent check-ins)

- Consider parent supervision initially

- Discuss appropriate pricing

- Teach customer service

First Entrepreneurial Ventures:

Support simple business ideas:

The Lemonade Stand (or Modern Version):

- Calculate costs (supplies, time)

- Set pricing

- Handle customers

- Count profits

- Discuss what worked/didn’t work

Digital Services:

- Creating birthday cards or art for family/neighbors

- Simple website help for small businesses (with your supervision)

- Social media help for grandparents or neighbors

- Tutoring younger children in subjects they excel at

Product Sales:

- Homemade crafts

- Baked goods (check local laws)

- Garden produce

- Art or handmade items

The Business Planning Exercise:

Help them think through basic business concepts:

“You want to start a dog-walking business. Let’s plan:

- What will you charge? ($15/walk)

- What are your costs? (dog treats, bags, time)

- How will people find out about your service? (flyers, tell neighbors)

- What days/times can you work?

- How many dogs can you walk per week?

- What will your weekly income be?”

This introduces:

- Pricing

- Marketing

- Capacity planning

- Income projection

Money Management Discussion:

When they start earning more substantial amounts, teach basic money management:

- Save a percentage (30-50%)

- Spend some (30-50%)

- Give some (10-20%)

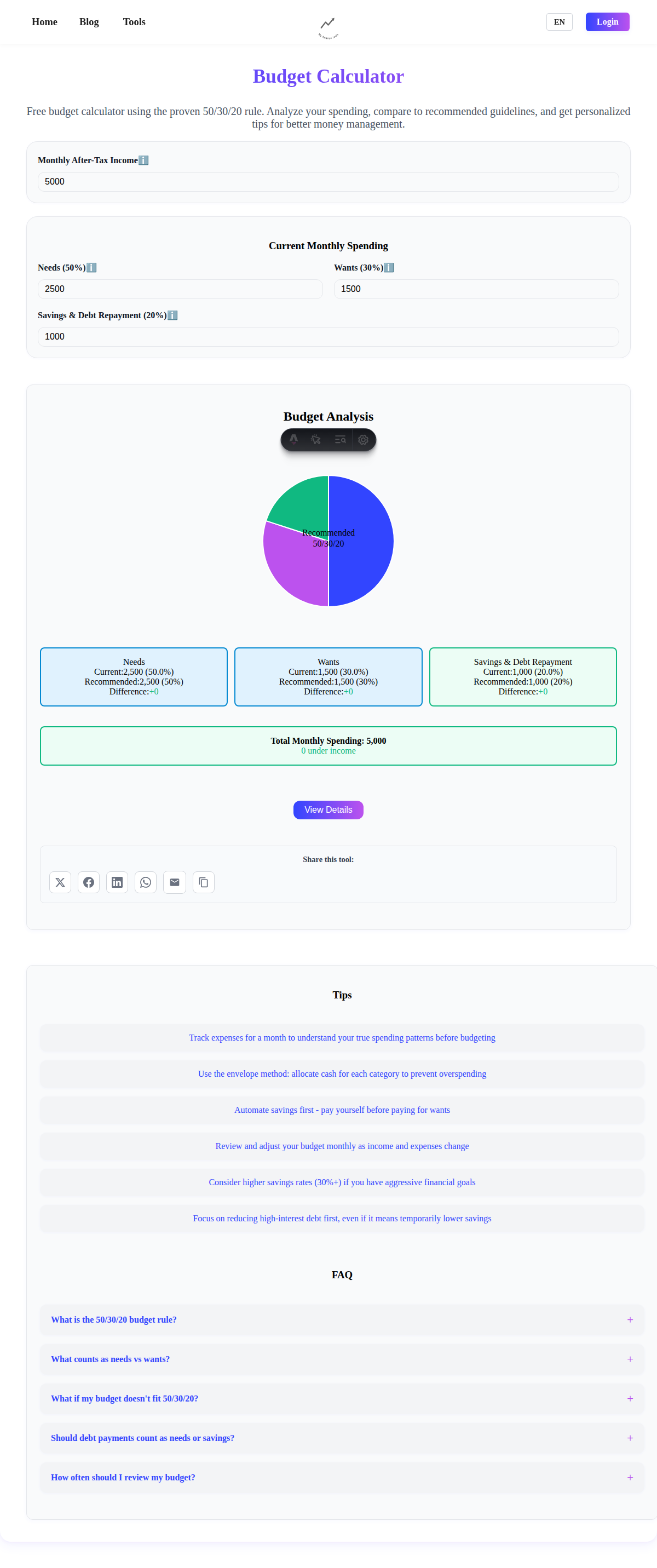

Use our Budget Calculator to plan their income allocation.

Work Hours and Limits: Ensure earning doesn’t overwhelm childhood:

- Limit earning activities to 5-8 hours/week maximum

- School and play remain priorities

- Work should feel empowering, not burdensome

Ages 13-18: Real Jobs and Advanced Earning

Teenagers can handle formal employment and sophisticated entrepreneurial ventures.

Formal Employment:

Age 13-14: Limited formal options (varies by country/region), but possible:

- Babysitting

- Tutoring

- Camp counselor

- Parent’s office helper (filing, organizing)

- Family business work

- Referee for youth sports

- Newspaper delivery

Age 15-16: More opportunities open:

- Retail positions

- Food service

- Grocery stores

- Movie theaters

- Recreation facilities

- Lifeguarding (with certification)

- Restaurant hosting/bussing

Age 17-18: Nearly full adult employment options:

- Any of the above

- Internships in fields of interest

- Skilled positions (if qualified)

- Increased responsibility in existing jobs

Supporting Their Job Search:

Help them with the process:

Resume Creation: Even with no experience, create a resume highlighting:

- Education

- Volunteer work

- Skills

- Activities and leadership

- References (teachers, coaches, mentors)

Application Practice:

- Help them fill out applications thoroughly

- Emphasize attention to detail

- Discuss common application questions

Interview Prep:

- Practice common questions

- Discuss appropriate dress

- Teach firm handshake and eye contact

- Role-play the interview

- Discuss how to follow up

First Job Lessons:

Use their first job as comprehensive teaching opportunity:

Understanding Pay:

- Discuss hourly rate vs. actual take-home

- Explain taxes, deductions

- Calculate actual hourly rate after costs (transportation, meals, etc.)

- Use our Salary Breakdown Calculator

Workplace Behaviors:

- Punctuality is non-negotiable

- Appearance matters

- Attitude affects everything

- Taking initiative earns advancement

- Asking questions shows intelligence, not ignorance

- Nobody succeeds alone—build relationships

Dealing with Challenges:

- Difficult customers or coworkers

- Unfair situations

- Mistakes and how to address them

- When to speak up vs. let things go

- How to give notice properly if leaving

Money Management with Real Income:

When they’re earning substantial money ($500+/month), teach serious financial management:

Immediate Saving Rule: Establish that a significant percentage (30-50%) goes straight to savings:

- Set up automatic transfer to savings account

- Discuss long-term goals (car, college, first apartment)

- Show compound growth using our Compound Interest Calculator

The Budget Conversation: Help them create a real budget:

- Income (after taxes)

- Necessary expenses (phone, transportation, school costs)

- Discretionary spending (entertainment, eating out, clothes)

- Savings goals

- Charitable giving

The Car Discussion: Many teens work primarily to afford a car. Use this motivation educationally:

Calculate total costs:

- Purchase price

- Insurance (often $100-300/month for teens)

- Gas ($50-150/month)

- Maintenance ($50-100/month)

- Registration

- Repairs

Total: Often $5,000-10,000/year

Show them how many work hours this represents: If they earn $12/hour: 10,000 / 12 = 833 hours of work = 16 hours/week year-round

This makes the true cost of ownership clear.

Advanced Entrepreneurial Ventures:

Teenagers can run sophisticated businesses:

Digital Services:

- Web design

- Social media management for small businesses

- Graphic design

- Video editing

- Photography

- Tutoring (online or in-person)

Service Businesses:

- Lawn care/landscaping service

- House cleaning service

- Tech support for seniors

- Event planning assistance

- Personal shopping/errand service

Product Businesses:

- Handmade goods (Etsy, craft fairs)

- Reselling (thrift store finds, collectibles)

- Print-on-demand designs

- Digital products (templates, graphics, planners)

The Business Education Opportunity:

If they’re interested in a business, use it as comprehensive education:

Business Planning:

- Market research: Who are customers? What do they need?

- Competitive analysis: Who else does this? What’s your advantage?

- Pricing strategy: What should you charge?

- Marketing plan: How will customers find you?

- Financial projections: What will you earn? What will it cost?

Legal and Practical Considerations:

- Do you need a business license?

- What about taxes?

- Insurance needs?

- Business bank account?

Execution:

- Launch

- Collect customer feedback

- Adjust based on learning

- Track metrics (customers, revenue, costs, profit)

Reflection: Regularly discuss:

- What’s working well?

- What’s challenging?

- What are you learning?

- How could you improve?

- Is this worth your time?

This is an MBA-level education in real life.

Teaching Work Ethic Beyond Earning

While money is a motivator, the deeper goal is instilling work ethic—the belief that hard work is valuable in itself.

The Character Connection

Connect work to character, not just money:

Persistence: “You kept working even when it was hard. That shows real strength.”

Responsibility: “You committed to mowing Mr. Johnson’s lawn, and you followed through even though your friends wanted to play. That’s being responsible.”

Excellence: “You could have done a quick job, but you took time to do it really well. That’s the mark of a quality person.”

Integrity: “Nobody was watching, but you did it right anyway. That’s integrity.”

Frame work as building who they are, not just what they have.

The “See What Needs Doing” Mindset

Teach them to notice what needs doing without being told:

“When you get home, before playing or relaxing, look around. What needs to be done? Then do it without being asked.”

This develops initiative—one of the most valuable traits in employment and life.

The Satisfaction of Completion

Help them notice how good completion feels:

“Look at the clean garage. How does that feel? You did that. That feeling is satisfaction from work completed well.”

Connect work to positive feelings beyond just payment.

The Service Mindset

Frame work as service:

“When you mow Mrs. Chen’s lawn, you’re helping her. She’s older and can’t do it herself. You’re providing a valuable service while earning money.”

This prevents work from feeling purely selfish and connects earning to helping.

The Quality Standard

Teach that mediocre work isn’t worth doing:

“If you’re going to do something, do it well. Half-effort work isn’t something to be proud of.”

Set clear standards and hold them to it. If work doesn’t meet standards, it must be redone.

Common Challenges and Solutions

Challenge #1: “They’re Not Motivated to Earn”

Problem: Your child shows no interest in earning money.

Solutions:

- Connect earning to something they really want that you won’t buy for them

- Start with very small, simple tasks with immediate payment

- Make early wins easy to build confidence

- Ensure the payment rate is appealing enough

- Consider if you’re providing so much that they have no need to earn

- Some kids are content with less—this isn’t necessarily a problem

Challenge #2: “They Start Then Quit”

Problem: They take on a job/task with enthusiasm, then abandon it.

Solutions:

- Start with smaller commitments (one-time jobs before ongoing commitments)

- Discuss commitment before they accept: “Once you agree, you must finish. Are you sure?”

- If they quit, there are consequences: no payment, loss of trust for future opportunities

- Help them understand the impact: “Mr. Johnson was counting on you. How do you think he feels?”

- Consider if you gave them too much too soon

Challenge #3: “They Rush Through and Do Poor Work”

Problem: Work is careless, incomplete, or sloppy.

Solutions:

- Set clear quality standards before they begin

- Inspect work together before payment

- If it doesn’t meet standards, they must redo it (teaching that poor work doesn’t pay)

- Discuss: “If you paid someone to wash your car and they did a bad job, would you be happy?”

- Praise excellent work enthusiastically

- Consider if payment is appropriate for time required (too low pay encourages rushing)

Challenge #4: “Everything Becomes About Money”

Problem: They won’t help with anything without asking “What will you pay me?”

Solutions:

- Clearly distinguish between family responsibilities (unpaid) and earning opportunities (paid)

- For family responsibilities: “This isn’t a paid job. Everyone in the family contributes.”

- Emphasize values: “We help each other because we love each other, not for money.”

- Ensure base chores are truly unpaid and non-negotiable

- Consider if you inadvertently created this by paying for things that should be family expectations

Challenge #5: “They Earn Then Immediately Spend Everything”

Problem: All earned money disappears instantly.

Solutions:

- Institute mandatory saving percentage: “Of every dollar earned, 30 cents goes to savings automatically”

- Set up automatic transfers to savings account

- Discuss long-term goals that require sustained saving

- Let them experience not having money when they want something (natural consequence)

- Use our Savings Goal Calculator to visualize goals

Challenge #6: “Sibling Conflicts Over Jobs”

Problem: Multiple children want the same earning opportunities.

Solutions:

- Create job rotation systems

- Have enough earning opportunities for everyone

- Age-appropriate job assignments (older kids get more complex/higher-paying jobs)

- “First claim” system (whoever signs up first gets it)

- Some jobs split payment if done together

- Avoid comparing siblings’ earnings

Challenge #7: “First Job is Overwhelming”

Problem: Teen gets first real job and struggles with demands, stress, or school balance.

Solutions:

- Start with part-time (10-15 hours/week maximum during school)

- Regular check-ins: “How’s work going? What’s hard? What’s good?”

- Help them manage time and homework

- Discuss if hours need reduction

- Support them through challenges but don’t rescue them

- Recognize this is valuable learning even if difficult

- Be prepared to help them quit gracefully if truly overwhelming

The Parent’s Role in Earning Education

Your role is crucial in teaching earning lessons effectively.

Model Strong Work Ethic

Children learn more from what they observe than what they’re told:

- Talk about your own work positively (not just complaining)

- Demonstrate pride in work done well

- Show persistence through difficult projects

- Model balance between work and life

- Discuss career decisions and growth

- Show respect for all types of work

Create Opportunities

Don’t wait for them to ask. Create structured opportunities:

- Establish the earning opportunity menu

- Point out needs: “The garage needs organizing. That could be a earning opportunity.”

- Connect them with neighbors who might need help

- Support business ideas rather than dismissing them

- Provide initial resources (materials for lemonade stand, business cards for lawn service, etc.)

Provide Guidance Without Takeover

Balance support with independence:

- Help them plan but let them execute

- Answer questions but don’t do it for them

- Let them make mistakes and learn

- Resist fixing everything

- Celebrate effort and growth, not just outcomes

Celebrate Earnings and Work

Make earning an event:

- Acknowledge hard work: “You worked really hard on that. I’m proud.”

- Celebrate milestones: First dollar earned, first $100 saved, first paycheck

- Share their accomplishments with family

- Take photos of completed projects

- Create a “work portfolio” showing their growing capabilities

Teach Financial Management

Earning is just the first step. Teach what to do with earnings:

- Saving strategies

- Spending decisions

- Giving opportunities

- Investment basics (for older kids)

- Tax understanding (for employed teens)

Use our tools:

- Budget Calculator for income allocation

- Savings Goal Calculator for goal planning

- Salary Breakdown Calculator for understanding paychecks

Connecting Earning to Other Money Skills

Earning doesn’t exist in isolation. It connects to every other financial skill:

- Saving (Part 1): Earning provides money to save. Saved money represents hours worked.

- Spending (Part 2): Understanding earning helps them spend more thoughtfully—“This costs three hours of work. Worth it?”

- Budgeting (Part 4): Income from earning gets allocated through budgeting.

- Debt (Part 5): Understanding earning helps them grasp how debt costs future earnings.

- Investing (Part 6): Earned money can be invested for growth.

- Giving (Part 7): Earned money enables charitable giving.

Taking Action Today

Ready to start teaching earning? Here’s where to begin:

For Young Children (3-5):

- Start a simple sticker chart for helping tasks

- Play work-themed pretend games

- Talk about how parents earn money

- Praise being a “good helper”

For Elementary Age (6-9):

- Establish formal allowance (decide on your philosophical approach)

- Create clear list of family responsibilities (unpaid)

- Make a menu of extra earning opportunities

- Ensure payment is consistent and reliable

For Pre-Teens (10-12):

- Expand earning opportunities to more substantial tasks

- Discuss simple neighborhood jobs (with safety parameters)

- Support a first small business idea

- Teach basic money management with earnings

For Teenagers (13+):

- Support their first real job application process

- Discuss workplace expectations and professional behavior

- Establish serious saving habits with real income

- Use our Salary Breakdown Calculator to understand their paycheck

- Consider advanced entrepreneurial ventures

Conclusion

Teaching children about earning money is about far more than income. It’s about building work ethic, developing pride in accomplishment, understanding value creation, experiencing the satisfaction of effort rewarded, and learning that they can improve their circumstances through their own actions.

Start early with simple concepts. Build gradually toward real employment and entrepreneurial ventures. Create opportunities without forcing. Support without rescuing. Celebrate effort and growth.

The children who learn to earn don’t just have more money—they have more confidence, capability, self-reliance, and understanding of how the world works. They approach problems with a solution-oriented mindset: “What can I do about this?” They see opportunities where others see obstacles. They understand that success requires effort, that value must be created, and that they control their own outcomes.

That’s a lesson worth more than any amount of money.

Continue Your Journey

Ready to help your kids organize their saving, spending, and earning into a cohesive system? Continue with Part 4: Teaching Kids About Budgeting to learn about planning, tracking, and allocating money effectively.

Frequently Asked Questions

Should I pay my child for household chores or are those expected family contributions?

This depends on your family philosophy. Three approaches work: (1) Unconditional allowance with unpaid chores as family duty, (2) Earned allowance where chores are paid, or (3) Hybrid model with basic family responsibilities unpaid plus extra earning opportunities. Most experts recommend the hybrid: certain age-appropriate tasks are expected unpaid contributions (making bed, cleaning own room, clearing dishes), while additional tasks beyond these basics can be paid. This teaches both family citizenship and work-reward connection. Whatever you choose, be consistent and clear about expectations.

What’s an appropriate allowance amount?

A common guideline is $1-2 per year of age per week, so an 8-year-old receives $8-16 weekly. However, adjust this based on: your family’s financial situation, local cost of living, what you expect them to pay for with their allowance (just extras vs. some necessities), and whether it’s unconditional or earned. The specific amount matters less than consistency, appropriateness to their age and responsibilities, and using it as a teaching tool for money management. Start modest—you can always increase it later.

At what age should my child get a job outside the home?

This varies by maturity, local laws, and family needs. Informal jobs (babysitting, lawn mowing, dog walking) can start around age 10-12 with parent supervision. Formal employment is typically 14-16 depending on location and position. Consider: Are they managing school responsibilities well? Do they want a job or are you pushing? Can they handle the added commitment? Start with limited hours (10-15/week maximum during school). A job should feel empowering, not overwhelming. Academic performance and wellbeing should never suffer for employment.

My child wants to start a business. How do I support this without taking over?

Excellent question! Let them lead while providing structure: (1) Ask guiding questions rather than giving answers: “How will people find out about your service?” vs. “You should make flyers,” (2) Provide resources but not labor: fund initial supplies but they do the work, (3) Help with logistics they can’t handle alone: driving to deliver flyers, supervising first customer interaction, (4) Let them make mistakes in low-stakes situations, (5) Discuss what’s working/not working after they’ve tried it. Your role is coach, not co-founder. The business should be truly theirs. Success or failure, they’ll learn invaluable lessons.

How do I teach work ethic when I’m struggling with it myself?

This is honest and common. Consider: (1) Improve together: “I’m working on being more consistent with tasks too. Let’s help each other,” (2) Be transparent about your challenges: “I know I sometimes procrastinate. It’s something I’m working on. Here’s what helps me…,” (3) Focus on what you do well: perhaps you’re persistent, or thorough, or creative—model those aspects, (4) Use your struggles as teaching: “I wish I’d learned these habits younger. I want you to have an easier time than I did,” (5) Fake it slightly: even if you struggle internally, model the behaviors you want them to develop. Children benefit from seeing adults work on improvement, not just perfection.

Should teenagers save most of their earnings or should I let them enjoy it?

Balance both. A recommended split: 30-50% to savings (long-term goals like car, college, future), 30-50% for spending (their discretionary fun money), 10-20% for giving (charity, helping others). This teaches balance: planning for the future while enjoying the present and contributing to others. If they’re earning substantial money, increase the saving percentage. Consider matching their savings to encourage it. The key is establishing the habit early—people who save a portion of every dollar from their first paycheck typically maintain this habit for life.

What if my teenager wants to quit their job because it’s hard?

Distinguish between “hard” and “harmful.” Hard: rude customers, boring tasks, early mornings, tedious work, difficult coworkers. These are valuable learning experiences. Harmful: unsafe conditions, illegal requests, harassment, or truly overwhelming demands destroying school performance or mental health. For “hard” situations, empathize but encourage persistence: “Yes, difficult customers are frustrating. What strategies help you handle them? What are you learning?” Help them develop coping strategies. For harmful situations, support them in quitting professionally (giving notice, explaining reasons). The goal is building resilience through challenges, not suffering through truly bad situations.

How do I handle a child who’s content earning little and living simply?

Not everyone is driven by money, and that’s okay! Some children naturally prefer less rather than working more. Ensure they: (1) Understand basic money management even with limited income, (2) Know how to earn if circumstances change and they need to, (3) Are making conscious choices (not just avoiding work out of laziness), (4) Can support themselves as adults (the concern is long-term dependency). If they’re content with less and can manage their finances accordingly, this might reflect healthy values rather than a problem. Observe whether it’s genuine contentment or avoidance of responsibility—very different things requiring different responses.