📚 This is Part 5 of our 7-part series “Complete Money Education for Kids”:

- Part 1: Teaching Kids to Save

- Part 2: Teaching Kids to Spend Wisely

- Part 3: Teaching Kids to Earn

- Part 4: Teaching Kids About Budgeting ← Previous

- Part 5: Teaching Kids About Debt ← You are here

- Part 6: Teaching Kids About Investing ← Next

- Part 7: Teaching Kids About Giving

After teaching children to save (Part 1), spend wisely (Part 2), earn (Part 3), and budget (Part 4), there’s one more critical financial concept they need to understand: debt.

Debt is perhaps the most dangerous financial tool—powerful when used correctly, destructive when misused. The difference between adults who thrive financially and those who struggle often comes down to their relationship with debt.

Statistics are sobering: average credit card debt, student loans reaching hundreds of thousands, car loans at predatory rates, and people trapped in cycles of minimum payments for decades. Yet most people never received education about debt as children. They learned through painful experience, accumulating damage before understanding the rules.

Your children don’t have to learn this way. With proper education starting early, they can understand how debt works, when it’s appropriate, how to avoid traps, and how to use credit responsibly when needed.

This comprehensive guide will teach you how to explain debt concepts at every age, from simple borrowing lessons with young children to sophisticated credit management with teenagers, creating a foundation for healthy financial decision-making around borrowing and credit.

Why Teaching About Debt Matters

Debt education is protective and empowering.

Prevents Financial Disasters: Most serious financial problems stem from debt misuse. Education provides immunity against the worst mistakes.

Builds Critical Thinking: Understanding interest, compound growth (in reverse), and long-term costs develops analytical thinking applicable beyond finance.

Enables Opportunity: Some debt is valuable (mortgages, education, business). Understanding good debt vs. bad debt helps them seize opportunities appropriately.

Protects Against Manipulation: Credit card companies, predatory lenders, and “easy payment” schemes target young people. Education provides defense.

Reduces Stress: Debt is a leading cause of anxiety and depression. People who understand and manage debt report significantly better mental health.

Breaks Cycles: Financial struggles often pass generationally. Teaching debt management breaks negative cycles and creates positive ones.

Understanding Debt Fundamentals

Before teaching children, ensure you understand the core concepts.

What Is Debt?

Debt is borrowed money that must be repaid, usually with interest (additional cost for borrowing).

Core components:

- Principal: The amount borrowed

- Interest: The cost of borrowing, usually a percentage

- Term: How long until it must be repaid

- Payment: Regular amounts paid toward principal + interest

How Interest Works

Interest is rent on money. The longer you borrow, the more rent you pay.

Simple interest: Interest on principal only

- Borrow $100 at 10% annual simple interest for 3 years

- Interest = $100 × 10% × 3 = $30

- Total repayment = $130

Compound interest: Interest on principal + accumulated interest

- Borrow $100 at 10% annual compound interest for 3 years

- Year 1: $100 + $10 (10% of $100) = $110

- Year 2: $110 + $11 (10% of $110) = $121

- Year 3: $121 + $12.10 (10% of $121) = $133.10

- Total repayment = $133.10

Most debt uses compound interest, which grows faster than borrowers expect.

Good Debt vs. Bad Debt

Good debt:

- Finances something that increases in value or income

- Has manageable interest rates

- Fits within your budget

- Examples: mortgage (home equity), student loans (earning potential), business loans (revenue generation)

Bad debt:

- Finances consumption or depreciating assets

- High interest rates

- Doesn’t fit budget (leading to financial stress)

- Examples: high-interest credit cards for wants, payday loans, excessive car loans

The same debt type can be good or bad depending on terms and usage.

The Debt Trap

The cycle that destroys finances:

- Overspend on credit (living beyond means)

- Make minimum payments (interest accumulates)

- Balance grows despite payments

- Need more credit for emergencies (no savings due to debt payments)

- Debt grows faster than income

- Financial crisis

Breaking this cycle requires understanding how it works—best learned before entering it.

Age-Appropriate Debt Education

Ages 3-5: Introduction to Borrowing

Very young children can grasp basic borrowing concepts.

The Toy Borrowing Lesson

Activity: Let them borrow a toy from a sibling or friend.

Discussion:

- “When you borrow something, it still belongs to the other person”

- “You must give it back, and you must take care of it”

- “If you break it, you need to fix or replace it”

Concept: Borrowing comes with responsibility.

The Parent Loan System

Scenario: They want something but don’t have enough money.

Offer: “I can lend you the money, but you’ll need to pay me back from your allowance.”

Example: They want a $6 toy but only have $3.

- You lend $3

- They repay $1 per week for 3 weeks from allowance

- Simple, no interest at this age

What they learn:

- Borrowing lets you get something now

- But you have less money later when repaying

- Sometimes it’s better to wait and save

The “Free Today, Pay Tomorrow” Game

Activity: Play pretend store where they can “buy now, pay later.”

Process:

- They “buy” toy with IOU

- Later, collect payment from their play money

- Show how they have less to spend after paying back

Lesson: Borrowing from future self.

Ages 6-9: Interest Introduction

Elementary-age children can understand that borrowing has a cost.

The Simple Interest Lesson

Scenario: They want to borrow $10 from you for a toy.

Offer: “I’ll lend you $10, but borrowing money costs money. You’ll need to repay $11—the $10 you borrowed plus $1 for interest.”

Discussion:

- “Interest is what you pay to use someone else’s money”

- “The longer you take to repay, the more interest you pay”

- “This is why saving first is usually better than borrowing”

The Growing Debt Visualization

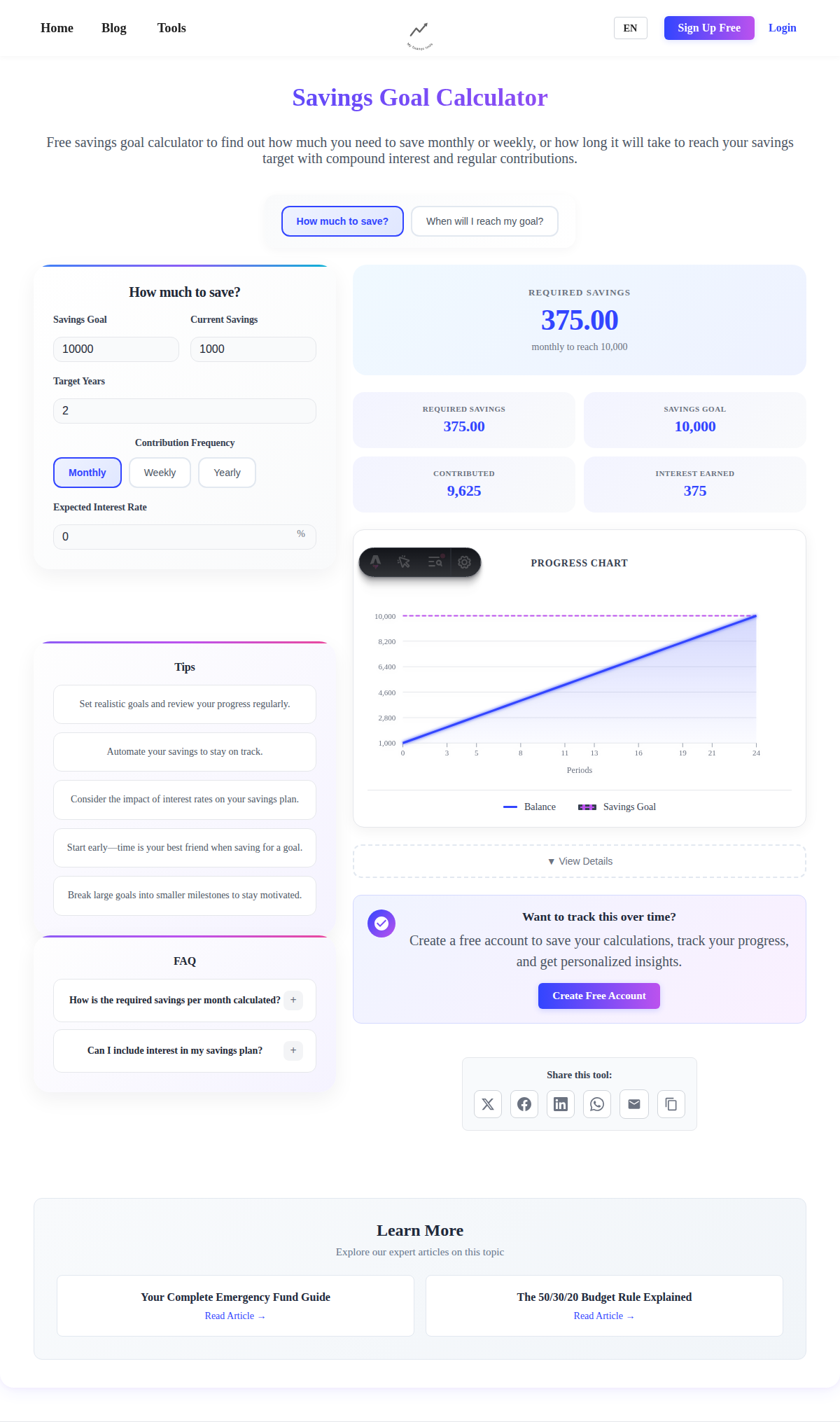

Activity: Use our Compound Interest Calculator in reverse (debt mode).

Show:

- Borrow $100

- Interest rate 20% annually (credit card rate)

- If making no payments, how it grows:

- Year 1: $120

- Year 2: $144

- Year 3: $173

- Year 5: $249

Reaction: “You borrowed $100 and now owe $249?!”

Lesson: Debt grows if you don’t pay it back. The bigger it gets, the faster it grows.

The Minimum Payment Trap

Simplified example: They borrow $20.

- Minimum payment is $2/week

- But interest adds $1/week

- Net progress: only $1/week toward principal

- Takes 20 weeks instead of 10 if paying full $2 toward principal

Show: Making minimum payments means debt lasts forever.

The Two Paths Story

Tell a story:

“Two friends both want a $50 toy.

Friend A saves $5/week for 10 weeks, then buys it. Total cost: $50, owns toy free and clear.

Friend B borrows $50 from parents at 10% interest, buys it immediately, pays back $5/week plus interest. Total cost: $55, and has 11 weeks of payments.

Who made the better choice?”

Discussion: Waiting to save costs less than borrowing, plus you appreciate it more when you’ve saved for it.

The Credit Card Introduction

Around age 8-9, introduce the concept of credit cards (not using them, just understanding).

Explanation:

- “A credit card lets adults buy things without cash right away”

- “But you’re really borrowing money from the bank”

- “If you don’t pay it all back quickly, you owe lots of extra money (interest)”

- “Many adults get into trouble by using credit cards for things they can’t afford”

Key message: Credit cards aren’t “free money”—they’re loans.

Ages 10-12: Complex Concepts

Pre-teens can grasp sophisticated debt concepts.

The Good Debt vs. Bad Debt Discussion

Teach the distinction:

Bad debt example: Borrowing $500 at 20% interest for a video game system.

- Item value: $500 (and depreciating)

- Cost after interest: $600+

- You’re paying extra for something losing value

Good debt example: Borrowing $20,000 at 4% interest for education.

- Investment in earning potential

- Increases lifetime income significantly

- Reasonable interest rate

- Manageable repayment plan

Discussion: “Not all debt is bad. Some debt helps you build wealth or opportunity. The key is understanding which is which.”

The Real Cost Calculator

Activity: Calculate true cost of purchases with debt.

Example: $1,000 laptop on credit card at 18% APR, paying $50/month.

Use our Debt Payoff Calculator:

- Payback time: 24 months

- Total paid: $1,196

- Interest cost: $196

Discussion: “That laptop actually cost $1,196 because of borrowing. Was it worth the extra $196?”

The Student Loan Conversation

Around age 11-12, introduce student loans (relevant to their future):

Discussion points:

- College can be expensive

- Many people borrow to pay for it (student loans)

- These loans must be repaid after graduation

- Amount borrowed affects career choices (need higher salary to repay loans)

- Why planning ahead matters: saving now = less borrowing later

Example: “If you borrow $50,000 for college at 5% interest:

- Monthly payment: approximately $530 for 10 years

- Total repayment: $63,639

- You’ll pay $13,639 just for the privilege of borrowing”

Alternative: “If we save $200/month from now until college, you’ll have $28,800 saved, meaning you only need to borrow $21,200 instead—much easier to repay.”

The Debt Snowball vs. Avalanche Lesson

If they have multiple small debts to you (borrowed for different things), teach repayment strategies:

Debt Snowball: Pay smallest debt first (psychological wins) Debt Avalanche: Pay highest interest rate first (mathematically optimal)

Let them choose a strategy and execute it. This hands-on experience with multiple debts is invaluable.

The Car Loan Reality

Pre-teens start thinking about cars. Use this motivation:

Scenario: Car costs $15,000.

Option A - Save: Save $250/month for 60 months = $15,000, buy cash Option B - Loan: Borrow $15,000 at 7% for 60 months = $297/month, total cost $17,822

Difference: $2,822 paid in interest—almost 20% more.

Discussion: “Is getting the car 5 years earlier worth $2,822? Sometimes yes (need it for work), sometimes no (just want it sooner). The key is making that choice consciously.”

The Payday Loan Warning

Introduce the concept of predatory lending:

Explain: “Some lenders target people in emergencies with terrible loans:

- Borrow $500

- Repay $575 in two weeks

- That’s 15% interest in two weeks!

- If you can’t repay, roll it over and owe even more

- People get trapped paying hundreds in interest on small loans”

Message: “This is why emergency savings (from Part 1) are so critical—they prevent needing predatory loans.”

Ages 13-18: Real-World Debt Management

Teenagers should understand debt at adult levels.

The Credit Score Introduction

Around age 13-14, explain credit scores:

What it is: A number (300-850) representing how reliably you repay debt.

Why it matters:

- Affects loan approval

- Affects interest rates (higher score = lower rates)

- Can affect job applications, rental applications, insurance rates

- Built over time through responsible credit use

How to build it:

- Pay bills on time, always

- Keep credit card balances low

- Don’t apply for too much credit at once

- Maintain accounts long-term

- Mix of credit types (credit cards, loans)

Key message: “Your credit score follows you for decades. Build it carefully.”

The Credit Card Deep Dive

Ages 15-16, comprehensive credit card education:

How they work:

- Credit limit (maximum you can borrow)

- Statement (monthly bill of all purchases)

- Due date (when payment is required)

- Minimum payment (smallest amount accepted—the trap!)

- Grace period (time before interest charges—usually 21-25 days)

- APR (annual percentage rate—the interest rate)

Two ways to use credit cards:

Method 1 - Responsible (this is the only acceptable method):

- Buy only what you can afford

- Pay full balance every month

- Never pay interest

- Build credit score

- Earn rewards

Method 2 - Destructive (show them what not to do):

- Buy what you can’t afford

- Pay minimum payment only

- Interest accumulates

- Balance grows

- Pay thousands in interest over years

- Damage credit score

- Stress and financial problems

Real example: Show them a credit card statement and explain every line item.

The Student Loan Planning Session

Ages 16-18, serious planning for college costs:

Research together:

- Cost of schools they’re interested in

- Expected aid (grants, scholarships)

- Expected family contribution

- Gap that might require loans

- Projected career salary

- Affordable monthly loan payment (10-15% of expected income)

Calculate maximum affordable debt:

If expecting $45,000 starting salary:

- Affordable payment: $450-675/month (10-15% of income)

- With $450/month at 5% for 10 years, can afford ~$43,000 in loans

- If school requires more debt than this, it’s financially dangerous

Message: “Choose schools you can afford. Prestigious schools aren’t worth financially crippling debt.”

The Mortgage Introduction

Older teens can understand mortgages (future relevant):

Explain:

- Most people can’t buy homes with cash

- Mortgages let you borrow to buy, using the home as collateral

- Typical terms: 15-30 years, 3-7% interest

- You build equity (ownership) as you pay down principal

Example: $300,000 mortgage at 6% for 30 years

- Monthly payment: $1,799

- Total paid over 30 years: $647,515

- Interest paid: $347,515

Reaction: “You paid more in interest than the house cost?!”

Discussion: “This is why interest rates matter. A 1% difference in rate changes total cost by tens of thousands of dollars. This is also why making extra payments to principal saves enormous money.”

Use our Mortgage Calculator to explore different scenarios.

The Debt-to-Income Ratio

Teach this critical concept:

Formula: Total monthly debt payments ÷ Monthly gross income

Example:

- Monthly income: $4,000

- Student loan payment: $400

- Car payment: $300

- Credit card minimum: $100

- Total debt payments: $800

- Debt-to-income ratio: $800 ÷ $4,000 = 20%

Guideline:

- Under 20%: Healthy

- 20-36%: Manageable but limiting

- Over 36%: Problematic

- Over 50%: Financial crisis

Message: “This ratio determines what you can afford. High debt payments limit your options for everything else—housing, saving, enjoying life. Keep this ratio low.”

The Bankruptcy Discussion

Around age 17-18, explain the nuclear option:

What it is: Legal process to eliminate or restructure debts when overwhelmed.

Consequences:

- Some debts eliminated (credit cards, medical bills)

- Some remain (student loans, taxes, child support)

- Credit score destroyed (stays on record 7-10 years)

- Difficulty renting, borrowing, sometimes getting jobs

- Lose many assets

- Not an easy escape—serious consequences

Message: “Bankruptcy exists as a last resort, but it’s devastating. The way to avoid it is never getting into overwhelming debt in the first place—which is why everything we’ve learned matters.”

The First Credit Card Decision

If they’re getting their first credit card (usually age 18, sometimes earlier as authorized user):

Rules to establish:

- Pay full balance every month, no exceptions

- Treat it exactly like a debit card (only charge what you already have money for)

- Set up automatic payment for full balance

- Check account weekly

- Keep utilization under 30% of credit limit (for credit score)

- Never use it for cash advances (extremely high fees)

- Understand all fees (annual fee, late fee, over-limit fee)

Starting recommendation: Low credit limit ($500-1,000) to limit potential damage while learning.

The Loan Agreement Role-Play

Have them read actual loan agreements:

Activity:

- Get real credit card or loan agreement (yours, or request from bank)

- Read through it together

- Identify: APR, fees, penalties, terms, fine print dangers

Discussion: “This is what you’re agreeing to when you borrow. Most people never read these. You will, always.”

Teaching Practical Debt Avoidance

Beyond understanding debt, teach how to avoid needing it.

Strategy 1: The Emergency Fund Priority

Teach: “The #1 debt prevention tool is an emergency fund.”

Explain:

- Unexpected expenses are guaranteed (car repairs, medical, etc.)

- Without savings, emergencies force debt

- With savings, pay cash and move on

- This is why we covered saving first (Part 1)

Use our Emergency Fund Calculator to determine appropriate amounts.

Strategy 2: The 30-Day Rule for Large Purchases

Rule: Never finance any purchase without waiting 30 days.

Process:

- See something you want

- Wait 30 days

- If you still want it AND can afford it (cash), consider buying

- If you still want it but can’t afford it, save until you can

Why it works: Most desires fade within 30 days. This prevents debt for impulse purchases.

Strategy 3: The Total Cost Question

Before any debt, ask: “What’s the total cost including all interest and fees?”

Examples:

- Phone financing: “$30/month” sounds small, but $30 × 24 months = $720 for a $600 phone

- Furniture “no interest for 24 months”: Calculate what you’ll actually pay if you miss the deadline (often retroactive interest)

- Car lease: Total of all payments plus end-of-lease costs

Rule: If you can’t quickly calculate total cost, don’t borrow.

Strategy 4: The Income-Based Limit

Teach: “Never borrow more than you can comfortably repay from income.”

Guideline: Monthly debt payments shouldn’t exceed 20% of income (lower is better).

Example: Income is $3,000/month. Maximum debt payments: $600/month.

Consequence: This limits how much you can borrow, preventing over-extension.

Strategy 5: The Delayed Gratification Advantage

Explain: “Every time you wait and save instead of borrowing:

- You pay less (no interest)

- You appreciate it more (earned it)

- You strengthen your financial position

- You prove you can achieve goals through patience”

Challenge: “Can you go your whole life never paying consumer debt interest? That would save tens or hundreds of thousands of dollars.”

Red Flags and Warnings

Teach them to recognize predatory and dangerous debt.

Red Flag #1: “No Credit Check” or “Bad Credit OK”

Warning: This usually means extremely high interest rates and predatory terms.

Why: Legitimate lenders assess creditworthiness. Those who don’t care about credit are charging interest so high they profit even from defaults.

Red Flag #2: Pressure Tactics

Examples:

- “This offer expires today!”

- “You’re pre-approved!”

- “Everyone gets accepted!”

- “Exclusive special financing!”

Truth: Legitimate credit is available tomorrow, next week, next month. Pressure is manipulation.

Red Flag #3: Focusing on Payment Not Total Cost

Example: “Just $299/month!” (ignoring 72-month term = $21,528 total)

Warning: When they emphasize payment size not total cost, they’re hiding something.

Response: “What’s the total amount I’ll pay including all interest and fees?”

Red Flag #4: Fees Exceeding the Loan

Examples:

- Payday loans with 400% APR

- Title loans where you can lose your car

- Pawn shop loans with extreme interest

Warning: Any loan where fees/interest approach or exceed the borrowed amount is predatory.

Red Flag #5: “Borrow More, Save More”

Example: “Approved for $10,000! Why borrow less?”

Truth: More debt = more cost, more risk, more payments. Borrow only what you need, not what they’ll lend.

Common Challenges

Challenge #1: “They Want to Borrow Rather Than Wait”

Problem: Instant gratification desire overrides lessons.

Solutions:

- Let them experience consequences at small scale (borrow small amount, struggle with repayment)

- Show calculations of total cost including interest

- Offer matching: “If you save instead of borrowing, I’ll match 20% of your savings”

- Connect to goals: “Debt payments prevent progress toward bigger goals”

Challenge #2: “They Don’t Think Debt Could Happen to Them”

Problem: “I’d never get in debt trouble” (overconfidence).

Solutions:

- Share real stories (with permission) of people who thought the same

- Show statistics: “80% of Americans have debt, most didn’t plan to”

- Role-play scenarios where debt creeps up

- Explain that debt rarely happens from one decision but many small ones

Challenge #3: “They See Friends’ Families Using Debt Casually”

Problem: “But everyone has credit card debt, car payments, etc.”

Solutions:

- “Just because it’s common doesn’t mean it’s good. Most people struggle financially.”

- “You can’t see their stress, struggles, or what they gave up because of debt”

- “You’re learning to do better than ‘normal’—aim for exceptional”

- Model debt-free or minimal-debt life

Challenge #4: “Student Loans Feel Inevitable”

Problem: Acceptance that massive student debt is required.

Solutions:

- Show alternatives: community college first, in-state schools, schools with merit aid

- Calculate affordability before applying

- Discuss career paths that don’t require expensive degrees

- Explore scholarship opportunities actively

- Consider work-study and part-time work

- Plan: Some debt may be necessary, but minimize it

Taking Action Today

Ready to start teaching about debt? Here’s where to begin:

For Young Children (3-5):

- Practice toy borrowing (borrow from sibling, return in good condition)

- Offer small no-interest parent loans with repayment from allowance

- Emphasize: “Borrowed things must be returned”

For Elementary Age (6-9):

- Introduce simple interest on parent loans ($10 loan requires $11 repayment)

- Show how debt grows using our Compound Interest Calculator in debt mode

- Tell “two paths” stories (saving vs. borrowing)

- Explain credit cards aren’t free money

For Pre-Teens (10-12):

- Teach good debt vs. bad debt distinction

- Calculate true costs of purchases with debt using Debt Payoff Calculator

- Introduce student loan concept and planning

- Discuss emergency fund as debt prevention

For Teenagers (13+):

- Explain credit scores and how they’re built

- Comprehensive credit card education (before they get one)

- Student loan planning with real numbers

- Teach debt-to-income ratios and healthy limits

- Review actual loan agreements together

Conclusion

Debt education might be the most protective gift you can give your children financially. Unlike saving or budgeting where mistakes are learning opportunities, debt mistakes can take decades to recover from. A young person who understands debt before they have access to credit has enormous advantage over those learning through painful experience.

Teach early, teach clearly, teach repeatedly. Use real examples, real numbers, real consequences. Model healthy relationships with debt in your own life. Make the lessons tangible through small-scale experiences.

The children who understand debt don’t just avoid financial traps—they have freedom. Freedom to choose careers based on passion rather than debt payments. Freedom to take opportunities without being chained to loans. Freedom from the stress that debt creates.

That freedom is worth every conversation, every lesson, every warning you give them.

Continue Your Journey

Ready to teach your kids how money can grow through investing and compound interest? Continue with Part 6: Teaching Kids About Investing to help them understand wealth-building through investing.

Frequently Asked Questions

At what age should I start teaching kids about debt?

Start with basic borrowing concepts as early as age 4-5 (borrowing toys, returning them). Introduce interest around age 7-8 with small parent loans. By ages 10-12, teach good debt vs. bad debt and calculate real costs. Teenagers should understand credit scores, credit cards, and major loans before they have access to credit (typically age 18). The key is making it age-appropriate: young children need simple concepts, teenagers need comprehensive education before real-world exposure.

Should I let my child borrow money from me to teach lessons?

Yes, but with clear structure: (1) Make terms explicit (amount, repayment schedule, interest if any), (2) Enforce repayment (otherwise they learn borrowing has no consequences), (3) Keep amounts appropriate to age and income (small enough to be manageable, large enough to feel meaningful), (4) Discuss feelings during repayment (“How does it feel having less allowance because of the payment?”), (5) Review afterward (“Was borrowing worth it? What would you do differently?”). These small-scale experiences teach lessons that prevent large-scale mistakes later.

How do I teach that some debt is good when I’m telling them to avoid debt?

Emphasize the distinction: “Debt for things that increase in value or income potential can be smart. Debt for consumption or depreciating assets is dangerous.” Examples: (Good) mortgage creates home equity and eliminates rent, reasonable student loans increase earning potential, business loans can generate revenue. (Bad) Credit card debt for wants, excessive car loans, payday loans, debt for depreciating items. The key factors: interest rate, what it’s financing, whether payments fit your budget, total cost vs. value gained. Teach: “Some debt is a tool for building wealth. Some debt destroys wealth. Know the difference.”

Should I co-sign loans for my teenager or young adult?

Generally avoid co-signing except for specific situations: (1) First apartment rental (often required, limited risk), (2) Essential first car loan only if they have stable income and you’ve verified they can afford payments, (3) Student loans as last resort if you’ve thoroughly discussed affordability and career plans. Never co-sign for: credit cards, personal loans, luxury purchases, or if they have poor money management history. Remember: Co-signing means you’re legally responsible if they don’t pay, it affects your credit, and it can damage your relationship. If you co-sign, monitor the account and ensure payments are made on time.

How do I handle my own debt while teaching kids debt is bad?

Be honest at age-appropriate levels: (Young kids) Don’t need to know details. (Older kids) “Our family has a mortgage—that’s a loan for our house. It’s an investment that builds equity.” (Teens) Can discuss more: “We have some debt. Here’s what we’re doing to pay it down and why we’re being careful about new debt.” If you have problematic debt, use it as a cautionary tale: “I wish I’d learned these lessons sooner. I’m working to fix my mistakes, and I want you to avoid them.” Teaching isn’t about perfection—it’s about giving them tools you wish you’d had. Your mistakes can be their lessons.

What if they get into debt despite all my teaching?

First, don’t panic or shame them—this creates secrecy and worsens the problem. Instead: (1) Assess the situation calmly (how much, what type, terms, their income), (2) Discuss what happened without judgment (“What led to this?” not “How could you be so stupid?”), (3) Create a repayment plan using Debt Payoff Calculator, (4) Decide your role (emotional support only, financial advice, limited financial help with clear conditions—never just bail them out), (5) Focus on learning (“What will you do differently?”). Remember: Manageable early debt with a good response can teach more than never making mistakes. The goal is building recovery skills, not preventing all failures.

How do I explain interest rates in simple terms?

Use relatable analogies: For young kids: “Interest is the cost of borrowing, like paying rent to use someone’s toy.” For older kids: “If you lend your friend $10 and they give you back $11, that extra $1 is interest—payment for letting them use your money.” For teens: Show real examples with our calculators. Explain: “Interest rate is the percentage of the borrowed amount you pay extra. Higher percentage = more expensive borrowing. Credit cards often charge 15-25% annually—that’s why debt grows fast if you don’t pay it off.” Make it concrete: “$1,000 at 20% for one year costs $200 just for borrowing—that’s an entire week’s paycheck from your job just for the privilege of borrowing.”

Should teenagers have credit cards?

Generally not until they’ve demonstrated strong money management for at least a year (budgeting successfully, saving consistently, spending wisely). When ready, options: (1) Authorized user on your card (builds their credit, you can monitor, you’re ultimately responsible), (2) Secured credit card (they deposit money as collateral, low limit, their responsibility), (3) Student credit card with very low limit ($500-1,000). Establish non-negotiable rules: pay full balance monthly, automatic payments, weekly account reviews, only charge what they already have money for. First violation gets card taken away until they’ve reestablished responsible habits. Credit cards are privilege for those who’ve proven they can handle them, not a right at age 18.