Retirement Execution in Your 60s+: Making Your Money Last a Lifetime

Congratulations—you’ve reached the finish line of your working career and the starting line of retirement. After decades of saving, investing, and planning, it’s time to shift from building wealth to preserving and spending it wisely.

This transition from accumulation to distribution is one of the most challenging financial phases of your life. You’re no longer receiving a regular paycheck, market volatility can feel more threatening, and the specter of outliving your money becomes real. But with proper planning and execution, your retirement years can be the most financially secure and personally fulfilling of your life.

The New Financial Reality of Retirement

The Longevity Challenge: Modern retirement can last 20-30+ years. Someone retiring at 65 today has a good chance of living to 90 or beyond. This means your money needs to last potentially longer than your entire working career.

Life Expectancy by Region (2024):

- Japan: 84.8 years average

- Switzerland: 83.4 years average

- Australia: 83.2 years average

- Germany: 81.2 years average

- United States: 78.9 years average

- Global average: 73.16 years

The Inflation Reality: Even modest 2-3% annual inflation significantly erodes purchasing power over 20-30 years. What costs $1,000 today will cost $1,800+ in 20 years with 3% inflation.

Healthcare Cost Escalation: Healthcare expenses typically increase with age and often exceed general inflation rates. In the US, the average retiree spends $300,000+ on healthcare during retirement.

The Four Phases of Retirement

Phase 1: Early Retirement (Ages 60-70)

- Active lifestyle with higher spending on travel and activities

- Transition period from work to full retirement

- Health generally good with lower medical expenses

- Higher withdrawal rates often sustainable

Phase 2: Active Retirement (Ages 70-80)

- Established routine with moderate spending

- More home-based activities and local travel

- Increasing healthcare needs but still manageable

- Standard withdrawal rates recommended

Phase 3: Passive Retirement (Ages 80-90)

- Reduced activity levels and lower discretionary spending

- Significantly higher healthcare costs

- Potential long-term care needs

- Conservative withdrawal strategies essential

Phase 4: Care-Dependent (Ages 90+)

- Minimal discretionary spending

- Maximum healthcare and care costs

- Estate planning becomes primary focus

- Wealth preservation for care and legacy

Withdrawal Strategies: Making Your Money Last

The Classic 4% Rule

The traditional approach suggests withdrawing 4% of your portfolio in the first year of retirement, then adjusting annually for inflation.

Example:

- $1 million portfolio: $40,000 first-year withdrawal

- Year 2 with 3% inflation: $41,200 withdrawal

- Year 3: $42,436 withdrawal

Pros of the 4% Rule:

- Simple to understand and implement

- Based on historical market data

- Provides predictable income

Cons of the 4% Rule:

- Doesn’t adapt to market conditions

- May be too conservative in bull markets

- May be too aggressive in bear markets

- Doesn’t account for sequence of returns risk

Dynamic Withdrawal Strategies

More sophisticated approaches adjust withdrawals based on market performance and portfolio values.

The Bucket Strategy: Divide your portfolio into three “buckets”:

Bucket 1 (Years 1-5 expenses):

- Conservative investments: High-yield savings, CDs, short-term bonds

- Purpose: Immediate income needs

- Protection: From market volatility

Bucket 2 (Years 6-15 expenses):

- Moderate investments: Balanced funds, dividend stocks, intermediate bonds

- Purpose: Medium-term growth and income

- Balance: Growth and stability

Bucket 3 (Years 16+ expenses):

- Growth investments: Stock index funds, international stocks

- Purpose: Long-term growth to combat inflation

- Risk tolerance: Higher for long-term needs

The Guardrails Strategy: Set upper and lower withdrawal limits based on portfolio performance:

- Portfolio up 20%+: Increase withdrawals by 10%

- Portfolio down 20%+: Decrease withdrawals by 10%

- Normal years: Maintain standard withdrawal rate

Global Withdrawal Considerations

Tax-Efficient Withdrawal Sequencing:

- Required minimum distributions (where applicable)

- Taxable accounts (capital gains treatment)

- Tax-deferred accounts (traditional IRAs, 401ks)

- Tax-free accounts (Roth IRAs, tax-free savings)

International Tax Implications:

- Tax treaties between countries may affect withdrawal taxation

- Foreign tax credits for international investments

- Residency changes can significantly impact tax obligations

- Professional advice essential for complex international situations

Healthcare Planning and Costs

Healthcare becomes the largest variable expense in retirement, requiring careful planning and adequate resources.

Global Healthcare Systems

Universal Healthcare Countries (UK, Canada, Germany, France):

- Basic coverage provided by government systems

- Supplemental insurance for enhanced services

- Prescription drug coverage varies by country

- Long-term care often requires additional planning

Private Healthcare Countries (US, Switzerland):

- Medicare planning (US) for basic coverage

- Supplemental insurance essential for comprehensive coverage

- Health Savings Accounts provide tax-advantaged healthcare funding

- International insurance for global retirees

Healthcare Cost Planning

Annual Healthcare Spending by Age:

- Ages 65-74: $18,000-25,000 annually (US example)

- Ages 75-84: $25,000-35,000 annually

- Ages 85+: $35,000-50,000+ annually

Long-Term Care Costs:

- Home care: $25-35/hour for aide services

- Adult day care: $70-100/day

- Assisted living: $3,000-6,000/month

- Nursing home: $6,000-12,000+/month

Global Cost Variations: Healthcare costs vary dramatically by country and region:

- Southeast Asia: 50-80% lower than Western countries

- Eastern Europe: 60-70% lower than Western Europe

- Latin America: 40-70% lower than North America

- Western Europe/North America: Highest costs globally

Healthcare Funding Strategies

Health Savings Accounts (HSAs): Where available, HSAs provide triple tax advantages:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

Long-Term Care Insurance:

- Purchased in 50s: Lower premiums, better health qualification

- Hybrid policies: Life insurance with long-term care riders

- International coverage: Important for global retirees

Healthcare Emergency Fund: Separate from general emergency fund:

- Target: $50,000-100,000 for major medical events

- Investment: Conservative, easily accessible funds

- Replenishment: Plan for ongoing healthcare inflation

Social Security and Government Benefits Optimization

Most countries provide some form of government retirement benefits that require strategic optimization.

United States Social Security

Claiming Strategies:

- Early claiming (62): Permanent 25-30% reduction in benefits

- Full retirement age (66-67): 100% of calculated benefits

- Delayed claiming (70): 8% annual increase until age 70

Spousal Benefits:

- Spousal benefit: Up to 50% of higher earner’s benefit

- Survivor benefits: Up to 100% of deceased spouse’s benefit

- Claiming strategies: Coordinate timing for maximum household benefits

International Government Benefits

United Kingdom:

- State Pension: Full pension requires 35 years of contributions

- Private pensions: Workplace and personal pensions

- Pension Credit: Means-tested benefit for low-income retirees

Canada:

- Canada Pension Plan (CPP): Based on contributions during working years

- Old Age Security (OAS): Available to most Canadian residents

- Guaranteed Income Supplement (GIS): For low-income seniors

Australia:

- Age Pension: Means-tested government benefit

- Superannuation: Mandatory employer contribution system

- Self-managed super funds: For hands-on investment management

Germany:

- Statutory pension: Based on contribution points during working years

- Company pensions: Employer-sponsored retirement benefits

- Private pension (Riester): Government-subsidized private retirement savings

Investment Strategy Evolution in Retirement

Your investment approach must balance income generation, growth, and capital preservation.

Age-Appropriate Asset Allocation

Early Retirement (60-70):

- 40% stocks / 50% bonds / 10% alternatives

- Still need growth to combat inflation

- Reduce volatility for peace of mind

Mid-Retirement (70-80):

- 30% stocks / 60% bonds / 10% alternatives

- Focus shifts to income and preservation

- Maintain some growth for longevity

Late Retirement (80+):

- 20% stocks / 70% bonds / 10% alternatives

- Preservation and liquidity become paramount

- Simplified portfolio for easier management

Income-Focused Investing

Dividend Strategies:

- Dividend growth stocks: Companies with history of increasing dividends

- Dividend ETFs: Diversified exposure to dividend-paying companies

- International dividends: Geographic diversification of income

- Tax implications: Consider tax treatment of dividends

Bond Laddering: Create predictable income through systematic bond purchases:

- Buy bonds with staggered maturity dates

- Receive principal back at regular intervals

- Reinvest in new bonds at current rates

- Inflation protection: Through regular reinvestment

Real Estate Investment Trusts (REITs):

- High dividend yields: Often 3-6% annually

- Inflation hedge: Real estate typically increases with inflation

- Diversification: Different from stocks and bonds

- Tax considerations: REIT dividends often taxed as ordinary income

Global Investment Considerations

Currency Hedging: Protect against currency fluctuations:

- Home currency bias: Keep majority of investments in retirement currency

- Diversification: Some international exposure for opportunities

- Hedged funds: Currency-hedged international investments

- Natural hedging: International real estate in retirement locations

Tax-Efficient Global Investing:

- Tax-advantaged accounts: Maximize use of retirement accounts

- Tax treaties: Understand implications for international investments

- Withholding taxes: Foreign tax credits for international dividends

- Professional advice: Essential for complex international portfolios

Estate Planning and Legacy Management

Your 60s and beyond are when estate planning becomes critically important, both for your security and your legacy.

Essential Estate Planning Documents

Will and Testament:

- Asset distribution according to your wishes

- Guardian designation for dependents

- Executor appointment for estate management

- Regular updates for life changes

Power of Attorney:

- Financial power of attorney: For financial decision-making

- Healthcare power of attorney: For medical decisions

- Durable provisions: Effective even if you become incapacitated

- Trusted individuals: Choose reliable, financially responsible agents

Healthcare Directives:

- Living will: End-of-life care preferences

- Do not resuscitate (DNR): If desired

- Organ donation: Wishes clearly stated

- Communication: Discuss preferences with family

Trust Structures:

- Revocable trusts: Flexibility with probate avoidance

- Irrevocable trusts: Tax benefits with reduced control

- Special needs trusts: For disabled beneficiaries

- Charitable trusts: For philanthropic goals

Wealth Transfer Strategies

Annual Gifting: Most countries allow tax-free annual gifts:

- United States: $17,000 per recipient annually (2023)

- United Kingdom: £3,000 annually plus other allowances

- Germany: €20,000 to children every 10 years

- Canada: No annual limit, but may trigger tax for recipient

Education Funding:

- 529 plans (US): Tax-advantaged education savings

- Direct tuition payments: Often unlimited gift tax exclusion

- Education trusts: For ongoing education support

- International schools: Consider global education options

Charitable Giving:

- Tax deductions: For charitable contributions

- Donor-advised funds: Flexible charitable giving accounts

- Charitable remainder trusts: Income for life, remainder to charity

- Legacy planning: Meaningful impact beyond your lifetime

International Estate Planning

Cross-Border Considerations:

- Multiple wills: For assets in different countries

- Tax treaties: Prevent double taxation of estates

- Professional advice: Essential for international estates

- Asset location: Strategic placement for tax efficiency

Managing Financial Anxiety in Retirement

Common Retirement Financial Fears

Outliving Your Money:

- Longevity planning: Plan for 90+ years of life

- Conservative withdrawal rates: Start with 3-3.5% if concerned

- Part-time work options: Maintain some earning capability

- Social safety nets: Understand government benefit programs

Market Volatility:

- Diversification: Reduce portfolio volatility

- Emergency funds: Larger cash reserves for peace of mind

- Flexible spending: Ability to reduce expenses during downturns

- Historical perspective: Markets recover over time

Healthcare Costs:

- Comprehensive insurance: Adequate coverage for major expenses

- Healthcare savings: Dedicated funds for medical costs

- Healthy lifestyle: Preventive measures to reduce future costs

- Location planning: Consider healthcare costs in location decisions

Psychological Aspects of Spending in Retirement

Permission to Spend: Many retirees struggle with shifting from saving to spending:

- Mindset shift: Your money is meant to support your retirement

- Budgeting: Create retirement spending plans

- Guilt-free categories: Designate money for enjoyment

- Regular reviews: Ensure spending aligns with resources

Activity and Purpose: Financial security enables meaningful retirement activities:

- Volunteer work: Contributing to causes you care about

- Learning: Classes, workshops, new skills

- Travel: Exploring places you’ve always wanted to visit

- Family time: Creating memories with loved ones

Technology and Retirement Financial Management

Digital Tools for Retirees

Financial Management Apps:

- Portfolio tracking: Monitor all investment accounts

- Budgeting tools: Track retirement spending

- Bill pay automation: Simplify routine financial tasks

- Security features: Protect against fraud and identity theft

Healthcare Management:

- Health records: Digital storage of medical information

- Insurance navigation: Understanding coverage and claims

- Prescription management: Track medications and costs

- Telehealth: Remote healthcare access

Communication Tools:

- Family coordination: Share financial information with trusted family

- Professional communication: Video calls with advisors

- Document storage: Secure cloud storage for important documents

- Emergency access: Systems for family to access information if needed

Cybersecurity for Seniors

Common Threats:

- Phishing emails: Fake messages requesting personal information

- Investment scams: Too-good-to-be-true investment opportunities

- Romance scams: Online relationship scams targeting lonely seniors

- Tech support scams: Fake computer repair services

Protection Strategies:

- Strong passwords: Unique passwords for all financial accounts

- Two-factor authentication: Extra security for sensitive accounts

- Regular monitoring: Check all accounts for unauthorized activity

- Family involvement: Trusted family members who can help verify suspicious activity

Global Retirement Lifestyle Considerations

Cost of Living Arbitrage

Many retirees discover their money goes further in certain locations:

Popular Low-Cost Retirement Destinations:

Latin America:

- Mexico: 40-60% lower costs, good healthcare, proximity to US/Canada

- Costa Rica: Stable democracy, good healthcare, biodiversity

- Panama: US dollar currency, pensioner benefits, infrastructure

Southeast Asia:

- Malaysia: Modern infrastructure, English-speaking, low costs

- Thailand: Cultural richness, excellent healthcare, warm climate

- Philippines: English-speaking, island lifestyle, very low costs

Europe:

- Portugal: EU membership, good healthcare, mild climate

- Greece: Lower costs than Western Europe, island options

- Eastern Europe: Very low costs, improving infrastructure

Retirement Visa and Residency Options

Common Retirement Visa Programs:

- Portugal D7 Visa: For retirees with passive income

- Spain Non-Lucrative Visa: For financially independent retirees

- Malaysia MM2H: Long-term residency for foreign retiires

- Panama Pensioner Visa: Discounts and benefits for retirees

Considerations for International Retirement:

- Healthcare access: Quality and cost of medical care

- Language barriers: Communication in daily life and emergencies

- Cultural adaptation: Adjustment to different lifestyle and customs

- Tax implications: Impact on retirement income and estate planning

Creating Your Retirement Execution Plan

Phase 1: Transition Planning (Ages 60-65)

Financial Preparation:

- Withdrawal strategy development and testing

- Healthcare coverage transition from employer plans

- Social Security/pension claiming optimization

- Tax strategy for retirement income

Lifestyle Preparation:

- Activity planning for fulfillment and purpose

- Social connections development outside of work

- Health optimization for active retirement

- Location decisions for retirement years

Phase 2: Early Retirement Implementation (Ages 65-75)

Income Optimization:

- Government benefits claiming at optimal times

- Withdrawal sequencing from various account types

- Tax planning for retirement income streams

- Investment strategy adjustment for income focus

Lifestyle Establishment:

- Retirement routine development

- Activity engagement in hobbies and interests

- Social network maintenance and expansion

- Health maintenance through preventive care

Phase 3: Mid-Retirement Adjustments (Ages 75-85)

Strategy Refinement:

- Withdrawal rates adjustment based on portfolio performance

- Healthcare planning for increasing medical needs

- Investment simplification for easier management

- Estate planning updates for current circumstances

Lifestyle Adaptation:

- Activity modification for changing physical abilities

- Home modifications for aging in place

- Support system development for assistance needs

- Legacy planning for wealth transfer and values

Phase 4: Late Retirement Management (Ages 85+)

Simplified Management:

- Portfolio simplification for easier oversight

- Professional management consideration for complex situations

- Family involvement in financial oversight

- Care planning for potential assistance needs

Legacy Implementation:

- Wealth transfer execution according to estate plans

- Charitable giving implementation

- Family financial education for next generation

- Value transmission beyond financial assets

Emergency Planning for Retirees

Financial Emergencies

Market Downturns:

- Larger cash reserves: 12-24 months expenses in cash

- Flexible spending: Ability to reduce discretionary expenses

- Alternative income: Part-time work or consulting capabilities

- Professional guidance: Financial advisor for crisis management

Health Emergencies:

- Comprehensive insurance: Adequate coverage for major medical events

- Healthcare emergency fund: Separate from general emergency funds

- Care coordination: Family or professional care management

- Advanced directives: Clear healthcare wishes documented

Family Emergencies

Adult Children Crises:

- Predetermined limits: How much support you can provide

- Emergency protocols: Systems for urgent family financial needs

- Professional coordination: Involving financial advisors in family crises

- Boundary maintenance: Protecting your own financial security

Taking Action for Retirement Success

Your retirement execution strategy should be as carefully planned as your wealth accumulation was.

Immediate Action Items:

- Calculate your withdrawal rate based on current portfolio and expenses

- Optimize government benefit claiming strategies

- Review and update all estate planning documents

- Establish healthcare and long-term care funding strategies

First Year Goals:

- Implement your withdrawal and income strategy

- Establish retirement lifestyle routines and activities

- Monitor and adjust financial strategies based on actual experience

- Build support systems for ongoing financial and life management

Ongoing Management:

- Annual strategy reviews with financial professionals

- Quarterly portfolio and withdrawal rate assessments

- Regular healthcare and insurance coverage reviews

- Estate planning updates for changing circumstances and laws

The Keys to Retirement Financial Success

Flexibility: Your retirement will likely last 20-30 years. Your strategies need to adapt to changing markets, health, and life circumstances.

Diversification: Multiple income sources, geographic diversification, and varied investment types provide security and opportunity.

Professional Support: Complex retirement financial management often benefits from professional guidance for tax, investment, estate, and healthcare planning.

Family Communication: Clear communication with family about your financial situation, wishes, and emergency procedures protects everyone involved.

Purpose and Meaning: Financial security is a means to an end—living a fulfilling, meaningful retirement that reflects your values and dreams.

Remember: you’ve spent decades building wealth for this phase of life. With proper planning and execution, your retirement years can be financially secure and personally rewarding. Your money is meant to support the life you want to live—now is the time to live it.

The transition from wealth building to wealth spending is challenging, but with the right strategies and mindset, your golden years can truly be golden.

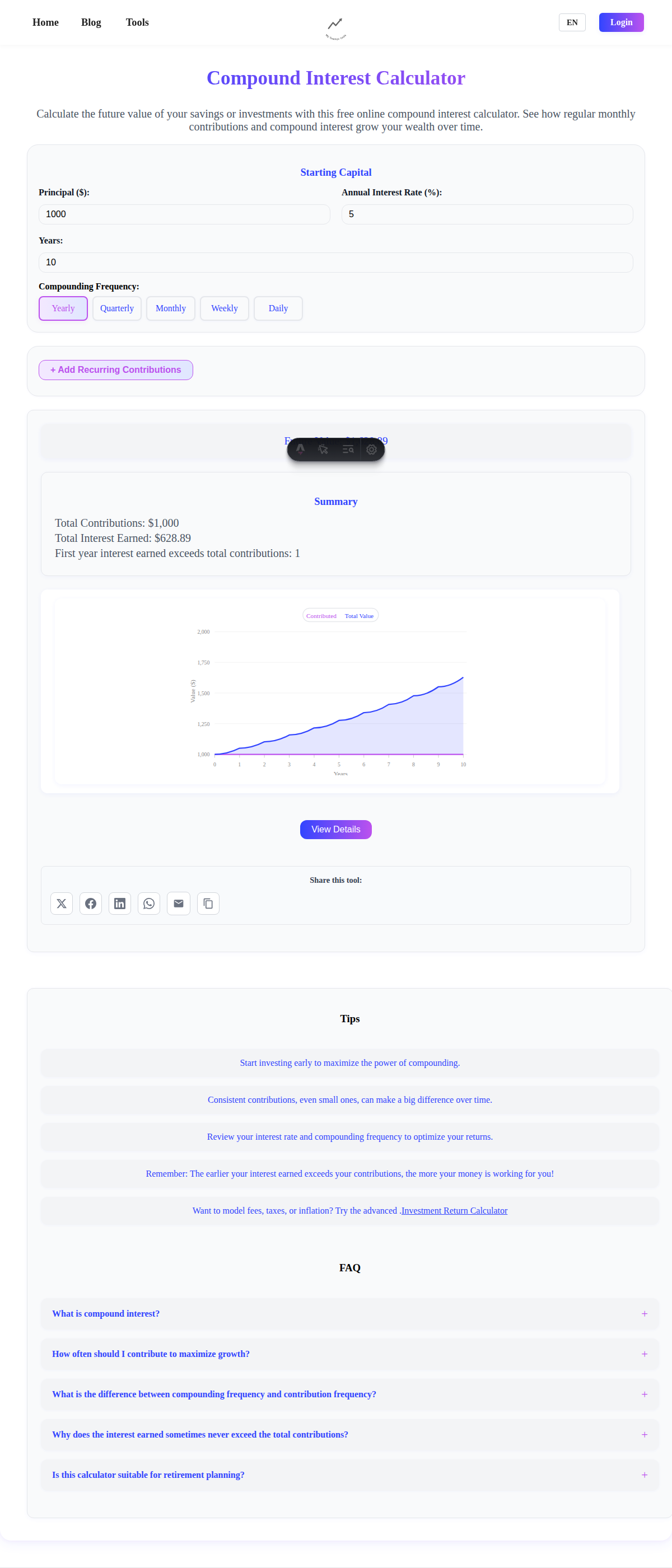

Ready to execute your retirement strategy? Use our financial calculators to model different withdrawal strategies and create your personalized plan for making your money last a lifetime.