Introduction to Passive Income: Beyond the 9-to-5

What if your money worked as hard as you do? What if you could earn income while sleeping, traveling, or spending time with loved ones? This isn’t a fantasy—it’s the reality of passive income, and it’s more accessible than most people realize.

Passive income represents earnings that continue flowing with minimal ongoing effort after an initial investment of time, money, or both. Unlike your salary that stops the moment you stop working, passive income streams can provide financial stability, accelerate your path to financial independence, and ultimately give you something money can’t directly buy: freedom over your time.

This comprehensive guide—the first in our five-part series on building passive income—explores what passive income really means, the different types available to you, realistic expectations, and how to begin your journey toward financial freedom.

Understanding Passive Income: The Foundation

What Passive Income Really Means

Let’s start with what passive income is NOT:

Common Misconceptions:

- “Get rich quick” schemes - Legitimate passive income requires upfront work or capital

- Zero effort income - Even “passive” streams require some maintenance

- Guaranteed returns - All income sources carry some level of risk

- Only for the wealthy - Many streams can be started with modest resources

What Passive Income Actually Is:

Passive income is earnings derived from activities where you’re not actively trading time for money on an ongoing basis. The key characteristics include:

- Front-loaded effort or capital - You invest heavily upfront, then maintain minimally

- Scalable - Income isn’t directly tied to hours worked

- Recurring - Revenue continues without constant active involvement

- Building assets - You create or acquire something that generates ongoing value

The Passive Income Spectrum

Not all passive income is equally passive. Think of it as a spectrum:

Highly Passive (Minimal Ongoing Effort):

- Dividend-paying stock investments

- Interest from bonds or savings

- Royalties from intellectual property

- REITs (Real Estate Investment Trusts)

Moderately Passive (Some Ongoing Effort):

- Rental properties with property management

- Online courses (occasional updates needed)

- Affiliate marketing websites

- Peer-to-peer lending

Semi-Passive (Regular but Limited Effort):

- Self-managed rental properties

- Active blog or content creation

- Selling digital products

- Licensing creative work

Why Passive Income Matters

Financial Security:

- Multiple income streams reduce dependence on single employer

- Protection against job loss, illness, or economic downturns

- Emergency fund supplement without depleting savings

Wealth Acceleration:

- Extra income can be reinvested for compound growth

- Accelerates timeline to financial independence

- Creates options for career changes or early retirement

Life Quality:

- More time for family, hobbies, and health

- Geographic freedom—earn from anywhere

- Reduced financial stress and anxiety

Legacy Building:

- Create assets that can be passed to future generations

- Build businesses that outlive your active involvement

- Establish financial foundations for your family

The Four Main Categories of Passive Income

1. Investment Income

Investment income comes from putting your capital to work in financial markets. This is often the most truly passive form of income.

Types of Investment Income:

Dividends:

- Regular payments from profitable companies

- Can be reinvested for compound growth

- Many established companies pay quarterly

- Dividend aristocrats have increased payments for 25+ years

Interest Income:

- Bonds, CDs, high-yield savings accounts

- Generally lower returns but more predictable

- Important for portfolio stability

- Less affected by market volatility

Capital Gains:

- Profit from selling investments at higher prices

- Can be reinvested or used as income

- Long-term gains typically taxed at lower rates

- Requires selling assets to realize gains

Getting Started:

- Open a brokerage account

- Start with low-cost index funds or ETFs

- Consider dividend-focused funds for income

- Reinvest dividends for compound growth

We’ll explore dividend investing in depth in Part 2 of this series.

2. Digital and Intellectual Property Income

Creating digital assets or intellectual property can generate ongoing royalties and sales with minimal maintenance.

Types of Digital Income:

Online Courses and Education:

- Create once, sell indefinitely

- Platforms like Udemy, Skillshare, or self-hosted

- Can be highly profitable with the right expertise

- Requires periodic updates to stay relevant

Digital Products:

- E-books, templates, printables, software

- Low overhead and instant delivery

- Global market reach

- Scalable without inventory concerns

Content Monetization:

- YouTube ad revenue

- Podcast sponsorships

- Blog advertising and affiliates

- Social media partnerships

Licensing and Royalties:

- Music, photography, writing

- Stock images and video

- Patents and inventions

- Creative work licensing

Getting Started:

- Identify your expertise or creative skills

- Research market demand for your knowledge

- Start with one product and test the market

- Build an audience through content marketing

We’ll cover digital income strategies in detail in Part 3 of this series.

3. Real Estate Income

Real estate has created more millionaires than any other asset class, and there are ways to participate without becoming a landlord.

Types of Real Estate Income:

REITs (Real Estate Investment Trusts):

- Invest in real estate through stock market

- Required to distribute 90% of taxable income as dividends

- Diversified across many properties

- Highly liquid compared to physical property

Real Estate Crowdfunding:

- Pool money with other investors for larger deals

- Access commercial properties with smaller investments

- Platforms vet and manage deals

- Various risk and return profiles available

Property Syndications:

- Partner with professional operators

- Larger minimum investments (typically $25,000+)

- Potential for higher returns

- Tax advantages through depreciation

Rental Properties:

- Direct ownership with more control

- Can hire property management for passive approach

- Appreciation potential plus cash flow

- Significant capital and knowledge required

Getting Started:

- Begin with REITs in a brokerage account

- Research crowdfunding platforms

- Educate yourself on real estate fundamentals

- Consider your risk tolerance and capital availability

We’ll explore hands-off real estate strategies in Part 4 of this series.

4. Business and Systems Income

Building business systems that operate without your constant involvement can create significant passive income.

Types of Business Income:

Automated Online Businesses:

- E-commerce with dropshipping or fulfillment services

- Subscription-based services

- Software as a Service (SaaS)

- Membership sites

Franchise Ownership:

- Buy into proven business models

- Management can be delegated

- Significant upfront investment required

- Brand recognition and support systems

Silent Partnerships:

- Invest capital in businesses run by others

- Share in profits without operational involvement

- High risk but potentially high reward

- Requires strong due diligence

Vending and ATM Businesses:

- Physical assets that generate ongoing income

- Requires periodic maintenance and restocking

- Can start small and scale

- Location is critical to success

Getting Started:

- Start with skills and interests you already have

- Begin as a side project while employed

- Focus on systems and automation from the start

- Reinvest profits to grow and diversify

We’ll discuss building a passive income portfolio in Part 5 of this series.

Realistic Expectations: The Truth About Passive Income

Time Investment Reality

The Front-Loading Principle:

Every passive income stream requires significant upfront investment. Here’s what to realistically expect:

| Income Stream | Initial Time Investment | Ongoing Maintenance |

|---|---|---|

| Dividend Portfolio | Research + monthly contributions | Quarterly review |

| Online Course | 100-500 hours to create | 2-5 hours/month updates |

| Rental Property | 50-200 hours to acquire | 2-10 hours/month (managed) |

| Blog/Content Site | 500+ hours to establish | 5-20 hours/month |

| REITs | 5-20 hours research | 1-2 hours/quarter |

Capital Requirements

Different passive income streams have vastly different capital requirements:

Low Capital Required ($0-$1,000):

- Starting a blog or YouTube channel

- Writing an e-book

- Creating digital products

- Building affiliate websites

Moderate Capital Required ($1,000-$25,000):

- Building dividend portfolio (for meaningful income)

- Creating comprehensive online courses

- Real estate crowdfunding

- Starting small online businesses

Higher Capital Required ($25,000+):

- Rental properties (down payment + reserves)

- Property syndications

- Established business acquisitions

- Large dividend portfolios for living expenses

Income Timeline Expectations

Year 1: Foundation Building

- Focus on learning and starting

- Income likely minimal

- Building assets and systems

- Expect $0-$500/month from new streams

Years 2-3: Growth Phase

- Assets begin generating meaningful income

- Reinvestment compounds growth

- Multiple streams developing

- Potential for $500-$2,000/month

Years 4-5: Acceleration

- Compound growth becomes visible

- Systems refined and optimized

- New streams easier to launch

- Potential for $2,000-$5,000+/month

Years 5+: Maturity

- Significant income replacement possible

- Streams become truly passive

- Focus shifts to optimization

- Financial independence achievable

The Honest Truth

What Social Media Doesn’t Show:

- The years of work before success

- Failed attempts and lost investments

- Ongoing maintenance and problem-solving

- Tax complexities and legal considerations

What Actually Works:

- Consistent effort over long periods

- Multiple streams for stability

- Continuous learning and adaptation

- Patience and realistic expectations

Getting Started: Your First Steps

Step 1: Assess Your Resources

Before choosing a passive income path, honestly evaluate:

Your Available Capital:

- How much can you invest without affecting emergency fund?

- Can you afford to lose this money entirely?

- What’s your timeline for needing returns?

Your Available Time:

- How many hours per week can you dedicate?

- Do you have concentrated time blocks or scattered moments?

- How long can you maintain this effort?

Your Skills and Knowledge:

- What expertise do you already have?

- What are you genuinely interested in learning?

- Where do your professional skills translate?

Your Risk Tolerance:

- How would you feel losing 50% of an investment?

- Can you handle income volatility?

- Do you need guaranteed returns?

Step 2: Choose Your First Stream

For Those With More Capital Than Time:

- Start with dividend investing or REITs

- Consider real estate crowdfunding

- Focus on truly passive approaches

For Those With More Time Than Capital:

- Create digital products or courses

- Build content websites

- Start with affiliate marketing

For Those With Both:

- Combine investment income with digital creation

- Consider property management

- Build diversified portfolio faster

Step 3: Start Small and Learn

The Pilot Project Approach:

- Choose one stream to focus on initially

- Set a modest goal (e.g., $100/month in 6 months)

- Invest minimally until you understand the mechanics

- Document what works and what doesn’t

- Scale only after proving the concept

Common Beginner Mistakes to Avoid:

- Starting too many streams at once

- Expecting immediate results

- Underestimating time requirements

- Ignoring tax implications

- Giving up too quickly

Step 4: Build Systems and Automate

From day one, think about automation:

Investment Automation:

- Set up automatic monthly investments

- Reinvest dividends automatically

- Use robo-advisors if helpful

Business Automation:

- Email autoresponders for digital products

- Payment processing automation

- Scheduling and publishing tools

Tracking Automation:

- Spreadsheets or apps for income tracking

- Automatic notifications for maintenance needs

- Regular review scheduling

Passive Income and Financial Independence

The FIRE Connection

Passive income is central to the Financial Independence, Retire Early (FIRE) movement. Here’s how they connect:

Traditional FIRE Path:

- Save aggressively (50-70% of income)

- Invest in index funds

- Withdraw 4% annually in retirement

- Primary passive income: investment returns

Enhanced FIRE with Multiple Streams:

- Diversify income beyond investment returns

- Reduce sequence of returns risk

- Achieve independence faster

- More flexibility and security

Calculating Your Number

Use passive income to determine your financial independence number:

Traditional Calculation:

- Annual expenses × 25 = Portfolio needed

- Example: $50,000 × 25 = $1,250,000

With Passive Income Streams:

- Annual expenses - Annual passive income = Gap

- Gap × 25 = Reduced portfolio needed

- Example: $50,000 - $20,000 passive = $30,000 gap

- $30,000 × 25 = $750,000 portfolio needed

The Powerful Implication: Each $1,000 in annual passive income reduces your required portfolio by $25,000.

What’s Coming in This Series

This guide is the first in a five-part series on building passive income:

Part 1: Introduction to Passive Income (You are here)

- Understanding passive income fundamentals

- Types and categories of passive income

- Realistic expectations and getting started

Part 2: Dividend Investing for Steady Income

- Building a dividend portfolio

- Dividend growth vs. high yield strategies

- Reinvestment and compound growth

- Tax considerations for dividend income

Part 3: Digital Products and Online Income Streams

- Creating and selling digital products

- Online course development

- Content monetization strategies

- Building audiences and marketing

Part 4: Real Estate Income Without Being a Landlord

- REITs and real estate ETFs

- Crowdfunding platforms comparison

- Property syndications explained

- Evaluating real estate investments

Part 5: Building Your Passive Income Portfolio

- Diversification strategies

- Balancing time, capital, and risk

- Tax optimization across streams

- Long-term portfolio management

Key Takeaways

-

Passive income requires upfront investment of time, money, or both—there are no shortcuts

-

Different streams suit different situations based on capital, time, skills, and risk tolerance

-

Start with one stream and master it before expanding to others

-

Realistic timelines span years, not weeks—patience is essential

-

Every passive income dollar reduces your financial independence target by $25

-

Automation and systems are crucial from day one

-

Multiple streams provide stability and accelerate progress

Your Next Steps

Ready to start building passive income? Here’s your action plan:

- Assess your resources using the framework above

- Choose your first stream based on your situation

- Set a modest pilot goal to test and learn

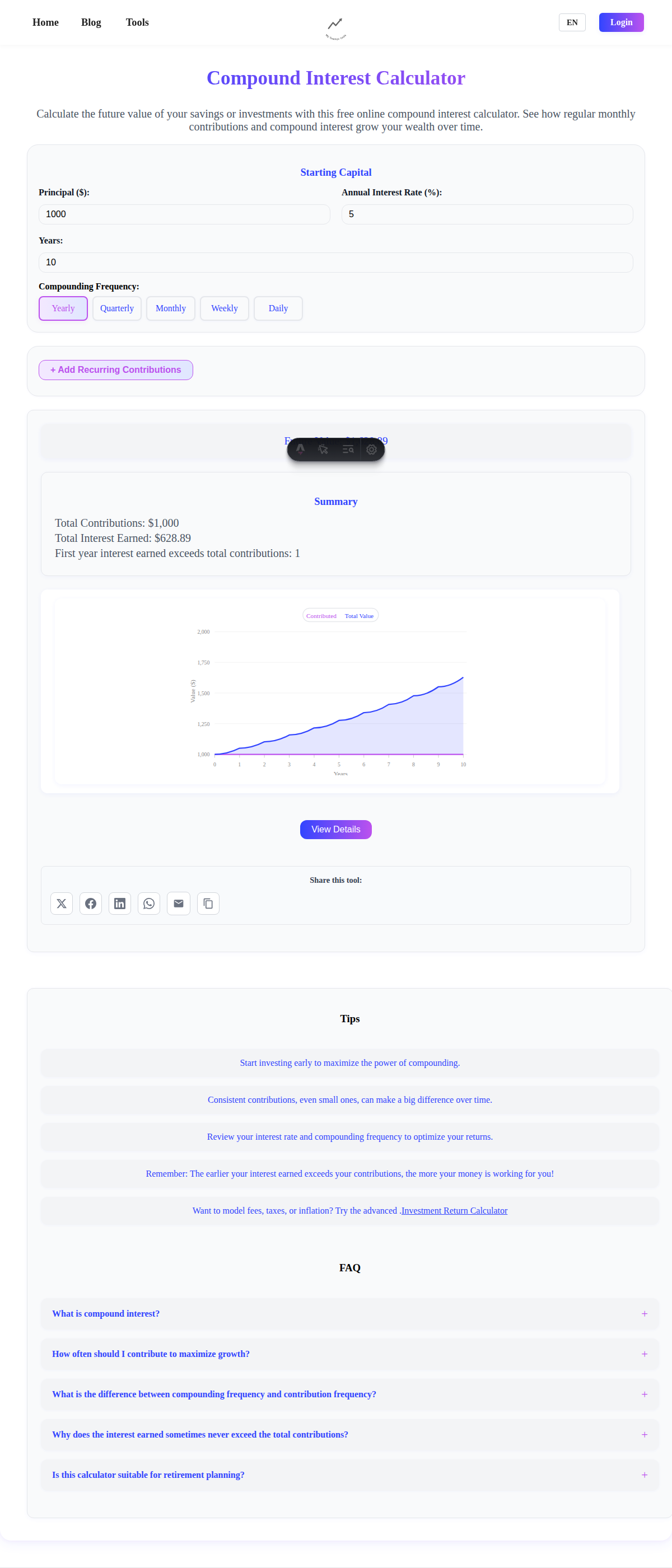

- Use our Investment Return Calculator to project growth

- Continue to Part 2 to learn about dividend investing

- Track progress and adjust your approach as you learn

Building passive income is a journey that transforms not just your finances but your entire relationship with work and time. The best time to start was years ago. The second-best time is today.

The income streams you build now will compound—both financially and in the freedom they provide. Your future self will thank you for starting this journey.

This article is part one of our five-part Building Passive Income Streams series. Continue to Part 2: Dividend Investing for Steady Income for an in-depth look at building income through dividends.

This guide provides general information about passive income strategies and should not be considered personalized financial advice. All investments carry risk, including possible loss of principal. Consider consulting with qualified financial professionals for guidance specific to your situation.