An emergency fund is your financial safety net—the buffer that stands between you and financial disaster when life throws you a curveball. Yet studies show that nearly 40% of Americans couldn’t cover a $400 emergency expense without borrowing money or selling something.

If you’re among those without adequate emergency savings, you’re not alone, and it’s not too late to start. This comprehensive guide will show you exactly how to build an emergency fund that provides real financial security.

What Is an Emergency Fund?

An emergency fund is money set aside specifically for unexpected expenses or financial emergencies. It’s not for planned expenses, wants, or opportunities—it’s strictly for true emergencies that threaten your financial stability.

What Qualifies as an Emergency?

True emergencies:

- Job loss or significant income reduction

- Major medical expenses not covered by insurance

- Essential home repairs (roof leak, HVAC failure, plumbing emergency)

- Car repairs needed for work transportation

- Family emergencies requiring travel or financial support

NOT emergencies:

- Vacation opportunities

- Holiday or birthday gifts

- Home renovations or upgrades

- Shopping sales or “deals”

- Investment opportunities

How Much Should You Save?

The standard advice is to save 3-6 months of expenses, but the right amount depends on your specific situation.

The Progressive Approach

Phase 1: Starter Emergency Fund ($500-$1,000) Your first goal should be a small starter fund to handle minor emergencies without using credit cards. This prevents small problems from becoming debt spirals.

Phase 2: Basic Emergency Fund (1 month of expenses) Calculate your essential monthly expenses and save one month’s worth. This covers short-term income disruptions.

Phase 3: Standard Emergency Fund (3-6 months of expenses) The traditional recommendation that covers most job searches and extended emergencies.

Phase 4: Extended Emergency Fund (6-12+ months) For those with variable income, health issues, or high-risk situations.

Calculating Your Target Amount

Step 1: List essential monthly expenses

- Housing (rent/mortgage, utilities, insurance)

- Food and groceries

- Transportation (car payment, gas, insurance)

- Minimum debt payments

- Healthcare costs

- Basic clothing

- Essential subscriptions (phone, internet)

Step 2: Multiply by your target months

- Conservative: 6 months

- Moderate: 3-4 months

- Aggressive: 1-2 months (not recommended for most)

Example calculation:

- Essential monthly expenses: $3,500

- Target: 6 months

- Emergency fund goal: $21,000

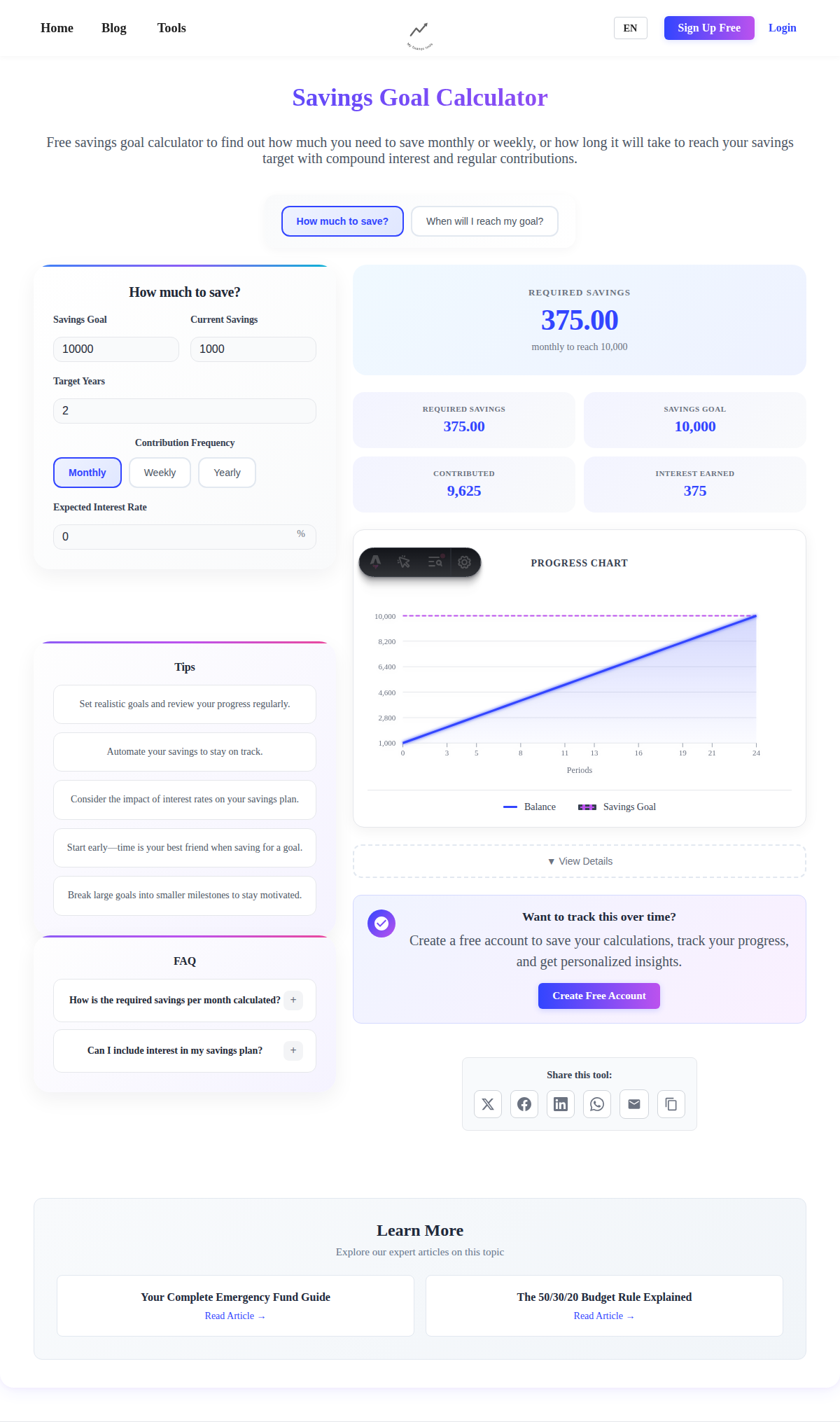

💡 Get Your Personalized Recommendation: Use our Emergency Fund Calculator to determine your ideal emergency fund size based on your specific situation, including employment type, dependents, and risk factors. The calculator also shows you exactly how long it will take to reach your goal and tracks your progress along the way.

Who Needs More (or Less) Than 6 Months

Save 8-12 months if you have:

- Variable income (freelancers, commissioned sales, seasonal work)

- Single income household with dependents

- Health issues that could affect work ability

- Specialized career with limited job opportunities

- Economic uncertainty in your industry

- Self-employment or business ownership

3-4 months might be sufficient if you have:

- Dual-income household with stable jobs

- High job security (tenured positions, government jobs)

- Marketable skills with quick re-employment prospects

- Strong family support system as backup

- Disability insurance that covers extended income loss

Special circumstances:

- High debt: Start with $1,000, then focus on debt payoff

- Extremely low income: Even $250 is better than nothing

- High net worth: May need larger fund due to lifestyle costs

Where to Keep Your Emergency Fund

Your emergency fund needs to be liquid, safe, and separate from your daily spending accounts.

Best Options

High-Yield Savings Accounts

- Pros: FDIC insured, competitive rates (4-5% APY), easy access

- Cons: Rates can change, may have minimum balance requirements

- Best for: Most people’s primary emergency fund location

Money Market Accounts

- Pros: Higher rates than traditional savings, FDIC insured, check-writing ability

- Cons: Higher minimum balances, limited transactions

- Best for: Larger emergency funds ($10,000+)

Short-Term CDs (3-12 months)

- Pros: Guaranteed returns, FDIC insured, prevents impulsive spending

- Cons: Penalties for early withdrawal, lower liquidity

- Best for: Portion of large emergency funds

Avoid These Options

Checking Accounts

- Too accessible for non-emergencies

- Very low or no interest

- Better for monthly expenses, not emergency savings

Stock Market Investments

- Value can drop when you need money most

- Not guaranteed available when needed

- Better for long-term wealth building

Retirement Accounts

- Penalties and taxes for early withdrawal

- Reduces retirement security

- Should be last resort only

Crypto or Speculative Investments

- Extremely volatile

- Could lose significant value quickly

- Not appropriate for emergency funds

Building Your Emergency Fund: Step-by-Step Strategy

Step 1: Set Your Initial Goal ($500-$1,000)

Start small to build momentum and avoid feeling overwhelmed.

Quick funding strategies:

- Sell items you don’t need

- Pick up extra shifts or freelance work

- Use tax refund or work bonus

- Cut non-essential expenses for 1-2 months

Step 2: Automate Your Savings

Set up automatic transfers:

- From checking to emergency fund savings

- Right after payday (pay yourself first)

- Start with any amount—even $25/week helps

Example progression:

- Week 1-4: $25/week = $100

- Month 2-3: $50/week = $400

- Month 4+: $75/week = $300/month

Step 3: Find Extra Money

Reduce expenses temporarily:

- Cancel subscriptions you don’t use

- Cook at home instead of eating out

- Use generic brands for groceries

- Reduce entertainment spending

Increase income:

- Freelance or part-time work

- Sell unused items

- Cash back apps and rewards

- Ask for overtime at work

Use windfalls:

- Tax refunds

- Work bonuses

- Gifts or inheritance

- Insurance claim payments

Step 4: Optimize Your Approach

The 50/30/20 Budget Emergency Modification:

- 50% needs

- 20% emergency fund (instead of general savings)

- 30% wants

The Debt-Emergency Balance: If you have high-interest debt, consider this approach:

- Save $1,000 emergency fund first

- Focus on paying off high-interest debt

- Return to building full emergency fund

Common Emergency Fund Mistakes

Mistake #1: Keeping It Too Accessible

Problem: Money in checking account gets spent on non-emergencies Solution: Separate bank account, preferably different institution

Mistake #2: Investing Emergency Funds

Problem: Market crashes when you need the money most Solution: Stick to guaranteed, liquid savings options

Mistake #3: Using It for Non-Emergencies

Problem: Fund gets depleted for wants or planned expenses Solution: Strict definition of emergencies, separate vacation/wish funds

Mistake #4: Not Replacing Money After Use

Problem: Fund stays depleted after legitimate emergency use Solution: Immediately restart saving plan after emergency expense

Mistake #5: Perfectionism Paralysis

Problem: Waiting for “enough” income to start saving Solution: Start with any amount, build momentum

Advanced Emergency Fund Strategies

The Tiered Approach

Tier 1: $1,000 in high-yield savings (immediate access) Tier 2: 2-3 months expenses in money market account Tier 3: Additional months in short-term CDs or bonds

The Credit Line Backup

Only for disciplined savers:

- Keep smaller cash emergency fund (2-3 months)

- Have unused credit line available as backup

- Risk: Requires discipline not to use credit for non-emergencies

Emergency Fund Laddering

- Divide fund into 3-month CDs with staggered maturity dates

- Always have one CD maturing within 90 days

- Higher returns than savings accounts

- Risk: Penalties if you need money before maturity

When (and How) to Use Your Emergency Fund

Before You Withdraw

Ask these questions:

- Is this a true emergency that threatens my financial stability?

- Have I exhausted other options (family help, payment plans, temporary income)?

- Can this wait until my next paycheck?

- Am I using this to avoid debt, or creating more problems?

Making the Withdrawal

Process:

- Transfer only what you need for the immediate emergency

- Keep receipts and document the expense

- Look for ways to minimize the cost (multiple repair quotes, insurance claims)

- Immediately create plan to replenish the fund

After Using Your Emergency Fund

Recovery plan:

- Assess what caused the emergency (preventable? insurance issue?)

- Restart automatic savings contributions immediately

- Consider temporarily increasing savings rate to rebuild faster

- Review if your emergency fund target amount is adequate

Emergency Fund Success Stories

Case Study 1: Job Loss Protection

Situation: Marketing manager laid off during company restructuring Emergency fund: $18,000 (5 months expenses) Result: Able to take time finding the right job instead of accepting first offer; negotiated 15% salary increase

Case Study 2: Medical Emergency

Situation: Unexpected surgery with $5,000 out-of-pocket costs Emergency fund: $8,000 Result: Paid medical bills without debt, focused on recovery instead of financial stress

Case Study 3: Home Repair Crisis

Situation: HVAC system failed in middle of summer Emergency fund: $3,000 (recently started building) Result: Covered most of $4,500 repair cost, only needed small personal loan instead of high-interest credit card

Building Beyond the Emergency Fund

Once your emergency fund is complete, redirect that automatic savings to other goals:

Next Priority Financial Goals

- Pay off high-interest debt (credit cards, personal loans)

- Increase retirement contributions (aim for 15% of income)

- Save for major goals (house down payment, children’s education)

- Build wealth through investments

The Emergency Fund Graduation

When your net worth grows significantly:

- Consider higher emergency fund target (lifestyle inflation)

- Evaluate if you need other insurance (disability, umbrella policy)

- Look into more sophisticated cash management strategies

Tax Considerations

Emergency Fund Interest is Taxable

- Interest earned on savings accounts is taxable income

- Keep records of interest earned for tax filing

- Consider if tax-advantaged accounts make sense for part of fund

Tax-Advantaged Emergency Strategies

Roth IRA contributions (advanced strategy):

- Can withdraw contributions penalty-free anytime

- Tax-free growth if left for retirement

- Risk: May be tempted to use for non-emergencies

Your Emergency Fund Action Plan

Week 1: Assessment and Setup

- Calculate monthly essential expenses

- Set emergency fund target amount

- Research and open high-yield savings account

- Set up automatic transfer (start with any amount)

Month 1: Build Momentum

- Reach first mini-goal ($250-$500)

- Review and cut unnecessary expenses

- Sell unused items for extra funding

- Celebrate small wins to stay motivated

Months 2-6: Steady Building

- Increase automatic savings amount when possible

- Use windfalls (tax refund, bonuses) for fund

- Track progress monthly

- Resist temptation to use for non-emergencies

Month 6+: Maintenance and Growth

- Reach target emergency fund amount

- Review and adjust target annually

- Redirect savings to other financial goals

- Maintain fund discipline for true emergencies only

The Bottom Line: Start Today

An emergency fund isn’t just about money—it’s about peace of mind, options, and financial freedom. It’s the difference between a temporary setback and a financial catastrophe.

Key takeaways:

- Start now with any amount you can afford

- Automate your savings to build consistency

- Keep it separate from daily spending accounts

- Stay liquid with high-yield savings, not investments

- Be strict about what qualifies as an emergency

- Replenish immediately after any withdrawals

Remember: The best emergency fund is the one you have when you need it. Whether you start with $25 or $250, the important thing is to start.

Ready to build your emergency fund? Use our savings goal calculator to create your personalized savings plan and see exactly when you’ll reach your target. Your future self will thank you for starting today!