Cryptocurrency in Your Personal Finance Strategy: A Balanced Approach to Digital Assets

Cryptocurrency has evolved from an obscure technological experiment to a mainstream financial asset class that’s impossible to ignore. With Bitcoin ETFs approved, major corporations adding crypto to their balance sheets, and central banks exploring digital currencies, the question is no longer whether cryptocurrency belongs in financial discussions, but how to approach it responsibly.

This comprehensive guide takes a balanced, educational approach to cryptocurrency within the context of personal finance. We’ll explore how digital assets can fit into a diversified portfolio, examine the risks and opportunities, and provide practical guidance for those considering crypto as part of their financial strategy.

Understanding Cryptocurrency in the Modern Financial Landscape

What Makes Cryptocurrency Different

Cryptocurrency represents a fundamentally new type of asset that combines characteristics of currencies, commodities, and technology investments. Unlike traditional assets, cryptocurrencies are:

Decentralized: No single authority controls most cryptocurrencies, making them resistant to government interference but also lacking traditional safety nets.

Digital-Native: Existing purely in digital form, cryptocurrencies operate 24/7 across global markets without traditional banking infrastructure.

Programmable: Many cryptocurrencies enable smart contracts and decentralized applications, creating utility beyond simple value transfer.

Limited Supply: Most cryptocurrencies have fixed or predictable supply schedules, contrasting with fiat currencies that can be printed indefinitely.

The Evolution of Digital Assets

The cryptocurrency ecosystem has expanded far beyond Bitcoin to include:

Bitcoin (BTC): Often called “digital gold,” primarily viewed as a store of value and inflation hedge.

Ethereum (ETH): A programmable blockchain enabling smart contracts and decentralized applications.

Stablecoins: Cryptocurrencies pegged to traditional assets like the US dollar, designed to minimize volatility.

Central Bank Digital Currencies (CBDCs): Government-issued digital currencies that combine crypto technology with traditional monetary policy.

Utility Tokens: Cryptocurrencies that provide access to specific platforms or services within blockchain ecosystems.

Risk Assessment: Understanding What You’re Getting Into

Volatility and Market Risk

Cryptocurrency markets are notoriously volatile. Bitcoin, the most established cryptocurrency, has experienced price swings of 80% or more within single years. This volatility presents both opportunity and risk:

Opportunity: Potential for significant returns during bull markets Risk: Possibility of substantial losses, sometimes very quickly

Historical Context: Bitcoin has experienced several “crypto winters” where prices declined 70-90% from peak levels, taking years to recover.

Regulatory and Legal Risks

The regulatory landscape for cryptocurrency varies dramatically worldwide and continues evolving:

United States: Generally treats cryptocurrencies as commodities (Bitcoin, Ethereum) or securities (many altcoins), with ongoing regulatory clarification.

European Union: Implementing comprehensive crypto regulation through the Markets in Crypto-Assets (MiCA) framework.

Asia: Mixed approach, with some countries embracing crypto (Japan, South Korea) while others impose restrictions (China’s mining ban).

Developing Nations: Some embrace crypto for financial inclusion, while others worry about capital flight and monetary sovereignty.

Technology and Security Risks

Exchange Risk: Centralized exchanges can be hacked, go bankrupt, or freeze funds. The collapse of FTX in 2022 highlighted these risks.

Wallet Security: Self-custody requires technical knowledge. Lost private keys mean permanently lost funds - no customer service can help.

Network Risk: Blockchain networks can experience technical issues, forks, or attacks that affect value and usability.

Scalability Challenges: Many cryptocurrencies face limitations in transaction speed and cost during high demand periods.

Portfolio Integration: Where Does Crypto Fit?

The Case for Small Allocation

Financial advisors increasingly recommend treating cryptocurrency as a small portfolio allocation (1-5%) rather than a major investment:

Diversification Benefits: Crypto often moves independently from traditional stocks and bonds, potentially reducing overall portfolio risk.

Inflation Hedge Potential: Some view Bitcoin as “digital gold” that could protect against currency debasement.

Growth Potential: As an emerging asset class, cryptocurrency could provide outsized returns as adoption increases.

Technological Exposure: Investing in crypto provides exposure to blockchain technology’s potential future impact.

Asset Allocation Frameworks

Conservative Approach (1-2% allocation):

- 60% Stocks (domestic and international)

- 30% Bonds and fixed income

- 8% Real estate and REITs

- 2% Cryptocurrency (Bitcoin and Ethereum focus)

Moderate Approach (3-5% allocation):

- 65% Stocks

- 25% Bonds

- 7% Real estate

- 3% Commodities and precious metals

- 5% Cryptocurrency (diversified across major coins)

Aggressive Approach (5-10% allocation):

- 70% Stocks (including crypto-related stocks)

- 15% Bonds

- 5% Real estate

- 10% Alternative investments including cryptocurrency

Dollar-Cost Averaging Strategy

Rather than making lump-sum investments, consider dollar-cost averaging into cryptocurrency:

Benefits: Reduces impact of volatility, removes emotion from timing decisions Implementation: Set aside a fixed amount monthly for crypto purchases Timeline: Consider at least 2-3 years to smooth out market cycles

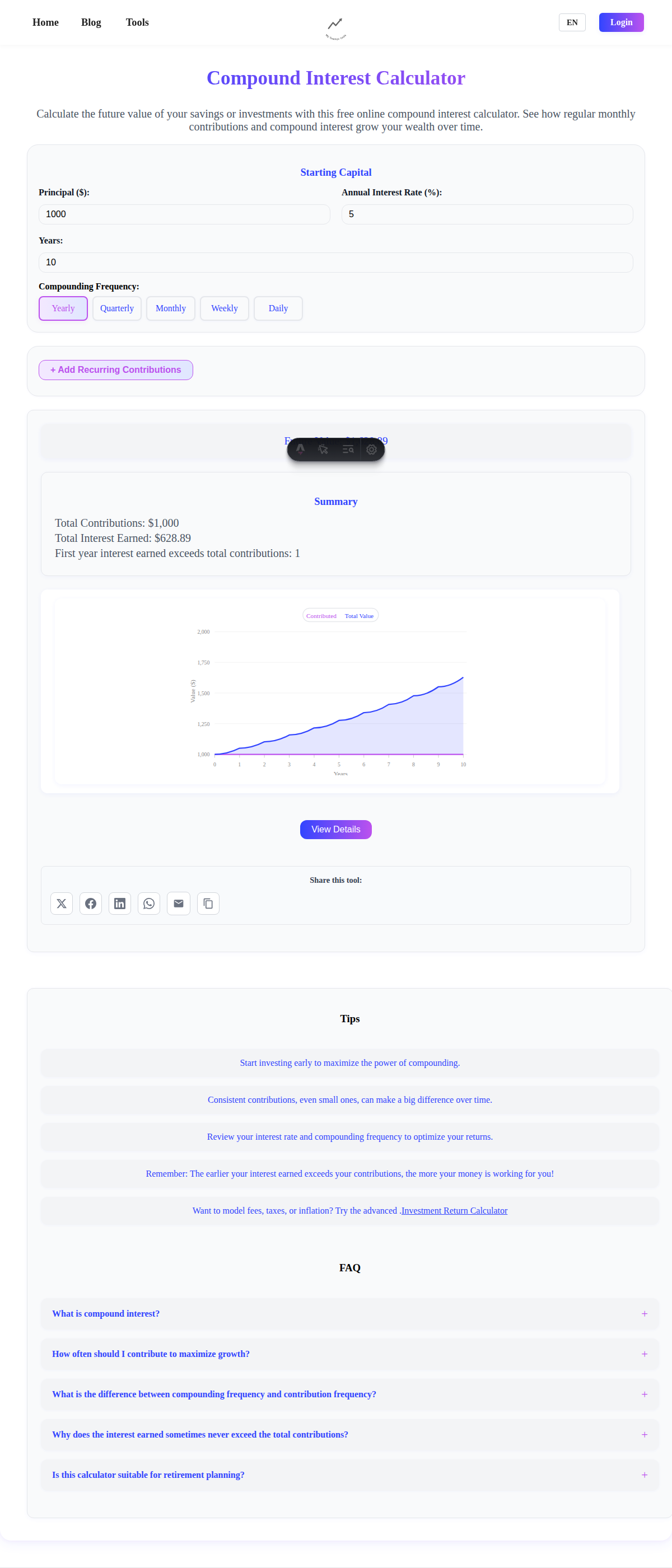

Use our Investment Return Calculator to model how different DCA strategies might perform under various scenarios.

Global Regulatory Landscape and Tax Implications

Major Regulatory Frameworks

United States:

- IRS treats crypto as property for tax purposes

- Capital gains tax applies to crypto sales

- Reporting required for transactions over $10,000

European Union:

- MiCA regulation provides comprehensive framework

- Varies by member state for taxation

- Generally treated as capital gains

United Kingdom:

- Crypto gains subject to capital gains tax

- Different rules for personal vs. business use

- HMRC provides detailed guidance

Canada:

- Generally treated as commodity for tax purposes

- Capital gains/losses apply

- Business use taxed as income

Australia:

- Personal use exemption for amounts under AUD $10,000

- Capital gains tax applies to investments

- Clear ATO guidelines available

Tax Planning Strategies

Record Keeping: Maintain detailed records of all crypto transactions, including dates, amounts, and fair market values.

Tax-Loss Harvesting: Unlike stocks, crypto doesn’t have wash-sale rules in many jurisdictions, allowing strategic loss realization.

Long-Term Holding: Many countries offer preferential tax rates for assets held over one year.

Professional Guidance: Consider consulting tax professionals familiar with cryptocurrency regulations in your jurisdiction.

Security Best Practices and Implementation

Wallet Types and Security

Hot Wallets (Connected to Internet):

- Convenient for frequent trading

- More vulnerable to hacks

- Examples: Exchange wallets, mobile apps

Cold Wallets (Offline Storage):

- Maximum security for long-term storage

- Less convenient for frequent access

- Examples: Hardware wallets, paper wallets

Exchange Selection Criteria

Regulatory Compliance: Choose exchanges licensed in your jurisdiction Security Track Record: Research the exchange’s history of security incidents Insurance Coverage: Some exchanges insure customer funds Liquidity: Ensure adequate trading volume for your needs

Recommended Security Practices

- Never invest more than you can afford to lose

- Use reputable exchanges with strong security records

- Enable two-factor authentication on all accounts

- Consider hardware wallets for significant holdings

- Keep private keys secure and backed up

- Be wary of phishing attempts and scams

Alternative Cryptocurrency Exposure

Traditional Investment Vehicles

For those wanting crypto exposure without direct ownership:

Bitcoin ETFs: Available in many countries, providing regulated exposure to Bitcoin price movements Cryptocurrency Stocks: Companies like MicroStrategy, Coinbase, or mining companies provide indirect exposure Blockchain ETFs: Funds investing in companies developing blockchain technology

Benefits of Indirect Exposure

- Familiar regulatory environment

- Traditional brokerage account compatibility

- Professional management

- No need for crypto wallets or security management

Limitations

- May not perfectly track cryptocurrency prices

- Management fees reduce returns

- Less control over timing and specific asset selection

Building Your Cryptocurrency Strategy

Step 1: Education and Research

Before investing, thoroughly understand:

- Basic blockchain technology

- Specific cryptocurrencies you’re considering

- Regulatory environment in your location

- Tax implications of crypto investments

Step 2: Risk Assessment

Evaluate your:

- Risk tolerance

- Investment timeline

- Financial goals

- Existing portfolio composition

Use our Budget Calculator to determine how much you can comfortably allocate to high-risk investments like cryptocurrency.

Step 3: Start Small and Scale Gradually

Begin with a minimal allocation (1% of portfolio) and increase only as you gain experience and comfort with the technology and markets.

Step 4: Implement Dollar-Cost Averaging

Rather than trying to time the market, implement a consistent purchase schedule:

- Choose a fixed dollar amount

- Select a regular schedule (weekly/monthly)

- Stick to the plan regardless of price movements

Step 5: Regular Review and Rebalancing

Cryptocurrency’s volatility means allocations can quickly drift from targets:

- Review portfolio allocation quarterly

- Rebalance when crypto allocation exceeds target by 2-3%

- Consider taking profits during major bull runs

Common Mistakes to Avoid

FOMO and Emotional Investing

The Mistake: Making investment decisions based on fear of missing out or social media hype The Solution: Stick to predetermined allocation limits and investment schedules

Ignoring Taxes

The Mistake: Not tracking crypto transactions for tax reporting The Solution: Use crypto tax software or consult professionals from the beginning

Inadequate Security

The Mistake: Leaving significant amounts on exchanges or using weak passwords The Solution: Implement proper security practices from day one

Leverage and Speculation

The Mistake: Using borrowed money or futures contracts to amplify crypto exposure The Solution: Only invest funds you own and can afford to lose

Lack of Diversification

The Mistake: Putting all crypto allocation into a single asset or related assets The Solution: Diversify across established cryptocurrencies and consider indirect exposure

The Psychology of Crypto Investing

Managing Volatility Stress

Cryptocurrency’s extreme volatility can trigger strong emotional responses:

Preparation: Understand that 50% drawdowns are common and possibly inevitable Perspective: Focus on long-term adoption trends rather than daily price movements Support: Consider joining educational communities rather than speculative forums

Avoiding the Echo Chamber

The cryptocurrency community can become self-reinforcing, leading to overconfidence:

Balance: Seek perspectives from traditional finance as well as crypto enthusiasts Critical Thinking: Question bullish predictions and understand bear cases Realistic Expectations: Understand that past performance doesn’t guarantee future results

Global Adoption and Future Considerations

Institutional Adoption Trends

Corporate Treasury: Companies like Tesla and MicroStrategy have added Bitcoin to balance sheets Investment Products: Bitcoin ETFs and crypto index funds increase institutional access Payment Integration: Major payment processors adding crypto support Central Bank Interest: Development of CBDCs worldwide

Developing Market Use Cases

Financial Inclusion: Crypto providing banking services where traditional systems fail Remittances: Lower-cost international money transfers Inflation Hedge: Store of value in countries with currency instability Technological Infrastructure: Building blocks for future financial innovation

Potential Challenges

Regulatory Uncertainty: Future government actions could significantly impact crypto markets Environmental Concerns: Energy consumption of proof-of-work cryptocurrencies Technological Evolution: Newer technologies could make current cryptocurrencies obsolete Market Maturation: Returns may moderate as markets mature and volatility decreases

Integration with Existing Financial Goals

Emergency Fund Considerations

Never use cryptocurrency as your primary emergency fund due to volatility. However, small crypto holdings might serve as a secondary emergency resource in extreme scenarios.

Our Emergency Fund Calculator can help you determine appropriate traditional emergency fund amounts before considering any crypto allocation.

Retirement Planning Integration

401(k) and IRAs: Some retirement accounts now allow crypto investments Time Horizon: Long retirement timelines may justify slightly higher crypto allocations Risk Capacity: Consider reducing crypto allocation as you approach retirement

Debt Payoff vs. Crypto Investment

Generally prioritize:

- High-interest debt payoff

- Emergency fund establishment

- Traditional investment account funding

- Cryptocurrency allocation

Use our Debt Payoff Calculator to understand whether paying down debt or investing (including in crypto) makes more financial sense.

Practical Implementation Guide

Getting Started Checklist

-

Education Phase (1-2 months):

- Read foundational materials

- Understand basic blockchain technology

- Research regulatory environment

- Learn about wallet and security basics

-

Setup Phase (2-4 weeks):

- Choose reputable exchange

- Complete verification process

- Set up security measures (2FA, strong passwords)

- Consider hardware wallet for larger amounts

-

Investment Phase:

- Start with 1% portfolio allocation

- Implement dollar-cost averaging schedule

- Focus on established cryptocurrencies (Bitcoin, Ethereum)

- Keep detailed records for taxes

-

Monitoring Phase:

- Review allocation quarterly

- Rebalance when necessary

- Stay informed on regulatory changes

- Continue education on evolving technology

Recommended Resource Allocation

For a $100,000 investment portfolio with 3% crypto allocation:

Initial Setup: $3,000

- 50% Bitcoin ($1,500)

- 30% Ethereum ($900)

- 20% Diversified altcoins or crypto ETF ($600)

Monthly DCA: $150-300

- Continue proportional allocation

- Adjust based on market conditions

- Maintain security practices

Monitoring and Performance Evaluation

Key Metrics to Track

Portfolio Allocation: Ensure crypto allocation stays within target range Cost Basis: Track average purchase price through DCA strategy Risk-Adjusted Returns: Compare crypto returns to overall portfolio performance Correlation: Monitor how crypto moves relative to traditional assets

Rebalancing Triggers

Upward Drift: If crypto allocation exceeds target by 50% (e.g., 4.5% when target is 3%) Downward Drift: Less critical, but consider increasing purchases if allocation falls significantly Time-Based: Review quarterly regardless of performance

Exit Strategy Planning

Profit Taking: Consider gradual profit-taking during major bull runs Loss Limits: Determine maximum acceptable loss levels Goal Achievement: Plan for reducing allocation as you approach major financial goals Market Conditions: Prepare for extended bear markets

Conclusion: A Balanced Approach to Digital Assets

Cryptocurrency represents both an opportunity and a risk within modern personal finance. While the potential for significant returns exists, so does the possibility of substantial losses. The key to successful crypto integration lies in treating it as a small component of a well-diversified portfolio rather than a path to quick riches.

Remember these fundamental principles:

- Never invest more than you can afford to lose

- Start small and scale gradually as you learn

- Prioritize security and regulatory compliance

- Maintain perspective during both bull and bear markets

- Continue learning as the technology and markets evolve

The cryptocurrency landscape will continue evolving rapidly. Regulations will develop, technology will improve, and market dynamics will shift. Success requires staying informed, maintaining discipline, and adapting strategies as conditions change.

Most importantly, cryptocurrency should complement, not replace, traditional financial planning. Continue building your emergency fund, paying down high-interest debt, and investing in diversified traditional assets. Crypto can be part of your financial journey, but it shouldn’t be the entire map.

Whether you choose to invest in cryptocurrency directly, through traditional investment vehicles, or not at all, understanding digital assets has become essential financial literacy in the modern world. Make your decision based on careful research, honest risk assessment, and alignment with your overall financial goals.

Start by assessing your current financial foundation with our Budget Calculator, then explore how different investment scenarios might play out using our Investment Return Calculator. Your financial future depends not on any single investment, but on consistent, disciplined planning across all asset classes.

The information provided in this article is for educational purposes only and should not be considered as personalized financial advice. Cryptocurrency investments carry significant risks, including the potential for total loss. Consider consulting with qualified financial and tax professionals before making significant investment decisions. Past performance does not guarantee future results.