Building Your Passive Income Portfolio: A Complete Strategy Guide

You’ve explored dividend investing, digital products, and real estate income. Each stream has its own characteristics, requirements, and potential. But the real power comes from combining multiple streams into a diversified portfolio that generates income from various sources while protecting against any single point of failure.

This final guide in our five-part series brings everything together. You’ll learn how to assess your resources, allocate across different income streams, balance time and capital investments, optimize for taxes, and build a portfolio that grows over time. The goal: creating a passive income ecosystem that supports your financial independence journey.

The Philosophy of Passive Income Diversification

Why Multiple Streams Matter

Just as you wouldn’t put all your investments in a single stock, relying on one passive income source creates unnecessary risk:

Single Stream Vulnerabilities:

- Dividend cuts during market downturns

- Digital product sales affected by algorithm changes

- Real estate values impacted by local market conditions

- Platform failures affecting crowdfunding investments

Diversified Portfolio Benefits:

- One source declining while others continue

- Different economic sensitivities

- Various income timings

- Multiple growth trajectories

- Reduced overall volatility

The Portfolio Mindset

Think of passive income like an investment portfolio:

Asset Allocation Principles Apply:

- Spread across different “asset classes” (income types)

- Balance risk and return expectations

- Align with time horizon and goals

- Rebalance periodically

Compound Growth Across Streams:

- Reinvest early income into growing streams

- Each stream’s growth accelerates the whole

- Time multiplies efforts across all sources

- Network effects between streams possible

Assessing Your Resources

Capital Assessment

Before building your portfolio, honestly evaluate your financial resources:

Investable Capital Categories:

Tier 1: Emergency Fund Protected Ensure 3-6 months expenses are set aside before investing in passive income streams.

Tier 2: Readily Investable Money you can invest without affecting financial security:

- Excess savings beyond emergency fund

- Surplus monthly income

- Windfalls or bonuses

Tier 3: Long-Term Capital Money you won’t need for 5+ years:

- Retirement account contributions

- Long-term savings goals

- Inheritance or large windfalls

Capital Matching to Strategies:

| Capital Level | Suitable Strategies |

|---|---|

| $0-$1,000 | Digital products, content creation, low-minimum REITs |

| $1,000-$10,000 | Dividend investing, REIT ETFs, digital products |

| $10,000-$50,000 | Add real estate crowdfunding, larger dividend portfolio |

| $50,000+ | Full range including syndications |

Time Assessment

Time is often more valuable than capital for passive income:

Weekly Hours Available:

5 hours or less:

- Focus on truly passive (dividends, REITs)

- Outsource creation if building digital products

- Automated systems essential

5-10 hours:

- Can create digital products over time

- Content creation possible with consistency

- Some active real estate research

10-20 hours:

- Significant digital product development

- Content platforms buildable

- More complex real estate analysis

20+ hours:

- Full passive income business possible

- Multiple digital products

- Active deal sourcing and analysis

Time Concentration vs. Distribution:

Consider whether you have:

- Concentrated blocks (weekends, evenings): Better for creation projects

- Scattered minutes (lunch breaks, commutes): Better for research, learning, monitoring

Skills Assessment

Your existing skills determine which streams come most naturally:

Financial/Analytical:

- Dividend stock analysis

- Real estate deal evaluation

- Crowdfunding due diligence

Technical:

- Software development for SaaS

- Website/app development

- Automation and systems

Creative:

- Content creation

- Course development

- Digital product design

Teaching/Communication:

- Online courses

- Coaching programs

- Content marketing

Professional Expertise:

- Industry-specific digital products

- Consulting productization

- Professional templates

Risk Tolerance Assessment

Different streams carry different risks:

Lower Risk Tolerance:

- Focus on dividend aristocrats and blue chips

- REIT ETFs over individual REITs

- Debt-based real estate investments

- Established content platforms

Moderate Risk Tolerance:

- Individual dividend stock selection

- Real estate crowdfunding mix

- Digital product creation

- Building new content platforms

Higher Risk Tolerance:

- Growth stocks with emerging dividends

- Value-add real estate syndications

- New digital product categories

- Speculative opportunities

Portfolio Construction Strategies

The Core and Satellite Approach

Build a foundation of reliable income, then add higher-potential satellites:

Core Holdings (60-80% of effort/capital):

- Dividend ETFs and established stocks

- REIT funds for diversified real estate

- Proven digital products

- Established content platforms

Satellite Holdings (20-40%):

- Individual dividend growth stocks

- Real estate crowdfunding deals

- New digital product experiments

- Emerging platform opportunities

Benefits:

- Core provides stability and base income

- Satellites offer growth potential

- Limited downside from failed experiments

- Room for learning and expansion

The Life Stage Approach

Adjust your passive income portfolio based on life stage:

Early Career (20s-30s):

- Maximize time-based streams (digital products, content)

- Reinvest all dividend income

- Accept higher risk for growth

- Focus on learning and building skills

Mid Career (30s-40s):

- Balance time and capital streams

- Build significant dividend positions

- Diversify real estate holdings

- Begin transitioning digital products to passive

Pre-Retirement (50s):

- Shift toward capital-based streams

- Increase dividend yield focus

- More conservative real estate

- Optimize existing digital products

Retirement (60s+):

- Focus on income generation

- Reduced risk across all streams

- Maintain some growth for inflation protection

- Simplify management requirements

The Income Goal Approach

Structure your portfolio around target income levels:

Goal: $500/month ($6,000/year)

- $150,000 in dividends at 4% yield, OR

- $75,000 in dividends + $250/month digital products, OR

- Mix of smaller amounts across more streams

Goal: $2,000/month ($24,000/year)

- $600,000 in dividends at 4% yield, OR

- $300,000 dividends + $1,000 digital + $250 real estate, OR

- More aggressive diversification across streams

Goal: $5,000/month ($60,000/year)

- $1,500,000 in dividends at 4% yield, OR

- $750,000 dividends + $2,000 digital + $750 real estate + other streams

- Requires significant portfolio and multiple substantial streams

Sample Portfolio Allocations

Portfolio A: Capital-Rich, Time-Poor

Profile: Professional with high income, limited free time Resources: $200,000 capital, 5 hours/week

Allocation:

| Stream | Allocation | Target Income |

|---|---|---|

| Dividend ETFs | 40% | $3,200/year |

| Individual Dividend Stocks | 20% | $1,600/year |

| REIT ETFs | 15% | $1,200/year |

| Real Estate Crowdfunding | 15% | $1,800/year |

| Notes/Debt Investments | 10% | $1,000/year |

Total Target Income: $8,800/year ($733/month) Time Required: 2-3 hours/month for monitoring

Portfolio B: Time-Rich, Capital-Moderate

Profile: Side hustle builder with skills to monetize Resources: $30,000 capital, 15 hours/week

Allocation:

| Stream | Focus | Target Income |

|---|---|---|

| Digital Products | 40% time | $1,000/month (building) |

| Dividend Investing | $20,000 | $800/year |

| Content Platform | 30% time | $500/month (building) |

| REIT ETFs | $10,000 | $400/year |

Year 1 Target: $1,500/month from digital + $100/month from investments Growth Path: Reinvest digital profits into dividend portfolio

Portfolio C: Balanced Builder

Profile: Moderate capital and time, balanced approach Resources: $75,000 capital, 10 hours/week

Allocation:

| Stream | Allocation | Target Income |

|---|---|---|

| Dividend Portfolio | $40,000 | $1,600/year |

| REIT ETFs | $15,000 | $600/year |

| Real Estate Crowdfunding | $10,000 | $800/year |

| One Digital Product | 60% time | $500/month goal |

| Content Building | 40% time | $200/month goal |

Year 1 Target: $3,000/year investments + $8,400/year digital Growth Path: Scale digital while building investment base

Portfolio D: Pre-Retirement Income Focus

Profile: Late career, building retirement income bridge Resources: $500,000 capital, 8 hours/week

Allocation:

| Stream | Allocation | Target Income |

|---|---|---|

| High-Yield Dividend ETFs | $200,000 | $8,000/year |

| Dividend Growth Stocks | $150,000 | $4,500/year |

| REIT Portfolio | $100,000 | $4,500/year |

| Real Estate Crowdfunding | $50,000 | $4,000/year |

Total Target Income: $21,000/year ($1,750/month) Focus: Income optimization with moderate growth

Implementation Timeline

Phase 1: Foundation (Months 1-3)

Capital Allocation:

- Establish emergency fund if not complete

- Open necessary accounts (brokerage, platforms)

- Begin automatic dividend investment

- Research crowdfunding platforms

Time Investment:

- Assess skills and interests

- Choose one digital product to develop

- Begin content creation if pursuing that path

- Build learning routine

Goals:

- First dividend investments made

- Digital product concept validated

- Platform accounts established

- Clear 12-month plan created

Phase 2: Building (Months 4-12)

Capital Activities:

- Consistent monthly dividend contributions

- First crowdfunding investment if appropriate

- REIT position established

- Reinvest all income received

Time Activities:

- Complete first digital product

- Launch and gather feedback

- Consistent content schedule

- Refine processes

Goals:

- $50-200/month passive income

- One digital product launched

- Portfolio foundation established

- Systems and tracking in place

Phase 3: Scaling (Year 2)

Capital Focus:

- Larger positions in proven holdings

- Additional real estate investments

- Diversify across more positions

- Compound growth accelerating

Time Focus:

- Additional digital products

- Outsource where valuable

- Optimize marketing and sales

- Build audience/platform

Goals:

- $500-1,500/month passive income

- Multiple income streams active

- Clear growth trajectory

- Sustainable systems

Phase 4: Optimization (Year 3+)

Activities:

- Rebalance based on performance

- Eliminate underperformers

- Double down on winners

- Increase tax efficiency

Goals:

- $2,000+/month passive income

- Truly passive systems

- Financial independence progress

- Legacy building begun

Tax Optimization Strategies

Account Location Strategy

Place investments in accounts that minimize taxes:

Tax-Advantaged Accounts (401(k), IRA):

- REITs (ordinary income dividends)

- High-turnover investments

- Bonds and debt investments

- Investments you’ll trade frequently

Taxable Accounts:

- Qualified dividend stocks

- Long-term growth investments

- Tax-efficient index funds

- Investments for near-term income needs

Consider Roth vs. Traditional:

- Roth: Tax-free growth and withdrawals

- Traditional: Tax deduction now, taxed later

- Balance based on current vs. future tax rates

Digital Income Tax Planning

Digital products have unique tax considerations:

Business Structure:

- Sole proprietorship (simplest)

- LLC (liability protection)

- S-Corp (potential tax savings at higher income)

Deductible Expenses:

- Software and tools

- Marketing costs

- Professional services

- Home office (if qualifying)

Estimated Taxes:

- Self-employment income requires quarterly payments

- Plan for 25-30% tax obligation

- Track all business expenses

Real Estate Tax Benefits

Real estate offers significant tax advantages:

Depreciation:

- Paper loss that reduces taxable income

- Recaptured upon sale

Pass-Through Deductions:

- Some structures qualify for additional deductions

- Complex rules apply

Professional Guidance: Consider working with a tax professional experienced in passive income and real estate taxes.

Managing Your Portfolio

Regular Review Schedule

Monthly Reviews:

- Track income received

- Monitor digital product performance

- Review content/platform metrics

- Update tracking spreadsheet

Quarterly Reviews:

- Assess investment performance

- Read real estate investor updates

- Evaluate digital product trends

- Consider rebalancing needs

Annual Reviews:

- Full portfolio analysis

- Tax planning and preparation

- Strategy adjustments

- Goal progress assessment

Key Metrics to Track

Income Metrics:

- Total passive income (monthly/annual)

- Income by stream

- Growth rate of income

- Yield on invested capital

Growth Metrics:

- Portfolio value growth

- Audience/platform growth

- Digital product sales trends

- Real estate appreciation

Efficiency Metrics:

- Income per hour invested

- Return on capital

- Time to break-even on new streams

- Conversion rates (digital)

When to Adjust

Add to Winners:

- Stream performing above expectations

- Market opportunity expanding

- Skills/systems proving effective

- Capacity to scale exists

Reduce or Eliminate:

- Consistent underperformance

- Excessive time requirements

- Market deterioration

- Better opportunities elsewhere

Caution Before Major Changes:

- Distinguish noise from signal

- Give streams adequate time (12+ months usually)

- Consider opportunity costs

- Don’t chase short-term performance

Common Mistakes to Avoid

Mistake 1: Starting Too Many Streams

Problem: Spreading too thin, none succeed Solution: Master one or two streams before adding more. Better to have two strong streams than five weak ones.

Mistake 2: Unrealistic Timelines

Problem: Expecting significant income in months Solution: Plan in years, not months. First year is foundation; meaningful income typically takes 2-3+ years.

Mistake 3: Ignoring Maintenance

Problem: Assuming “passive” means zero effort Solution: Budget time for monitoring, updates, and optimization. Even passive streams need attention.

Mistake 4: Over-Optimizing Early

Problem: Trying to perfect before launching Solution: Start simple, iterate based on results. Progress beats perfection.

Mistake 5: Neglecting Tax Planning

Problem: Surprised by tax obligations Solution: Understand tax implications before investing. Structure efficiently from the start.

Mistake 6: No Reinvestment Strategy

Problem: Spending income instead of growing it Solution: Plan to reinvest most income initially. Compound growth requires feeding the machine.

The Long-Term Vision

Building Generational Income

Passive income can extend beyond your lifetime:

Investment Portfolio:

- Can be inherited with stepped-up basis

- Trusts can manage ongoing distributions

- Legacy of financial security

Digital Assets:

- Can transfer ownership to family

- Ongoing royalties possible

- Built systems continue producing

Real Estate:

- Properties can transfer to heirs

- Trusts for ongoing management

- Long-term family wealth

Financial Independence Intersection

Passive income accelerates financial independence:

Traditional FIRE:

- Save 25x expenses in investments

- Withdraw 4% annually

- Single dependency on investment returns

Enhanced with Passive Income:

- Multiple income sources reduce portfolio needs

- Each $1,000/month passive income = $300,000 less needed

- More flexibility and security

Example:

- Goal: $60,000/year expenses

- Traditional: Need $1,500,000 portfolio

- With $2,000/month passive income: Need only $900,000 portfolio

Your Passive Income Journey

Building passive income is a marathon, not a sprint:

Year 1: Plant seeds, build foundations Year 2: See first meaningful growth Year 3: Compound effects visible Year 5: Significant income possible Year 10: Potentially life-changing income

The key is starting now and staying consistent. Every dollar of passive income you build is a dollar of future freedom.

Key Takeaways from This Series

-

Passive income requires upfront investment of time, money, or both—but pays dividends forever

-

Diversification across streams reduces risk and increases stability

-

Match your strategy to your resources—capital, time, skills, and risk tolerance

-

Start with one stream and master it before expanding

-

Compound growth is powerful across all streams—reinvest early income

-

Tax efficiency matters—structure properly from the start

-

Think in years, not months—meaningful passive income takes time

-

Each passive income dollar reduces your financial independence target

Your Next Steps

You’ve completed our five-part series on building passive income. Here’s how to take action:

This Week:

- Complete your resource assessment (capital, time, skills, risk)

- Choose your first passive income stream

- Open necessary accounts

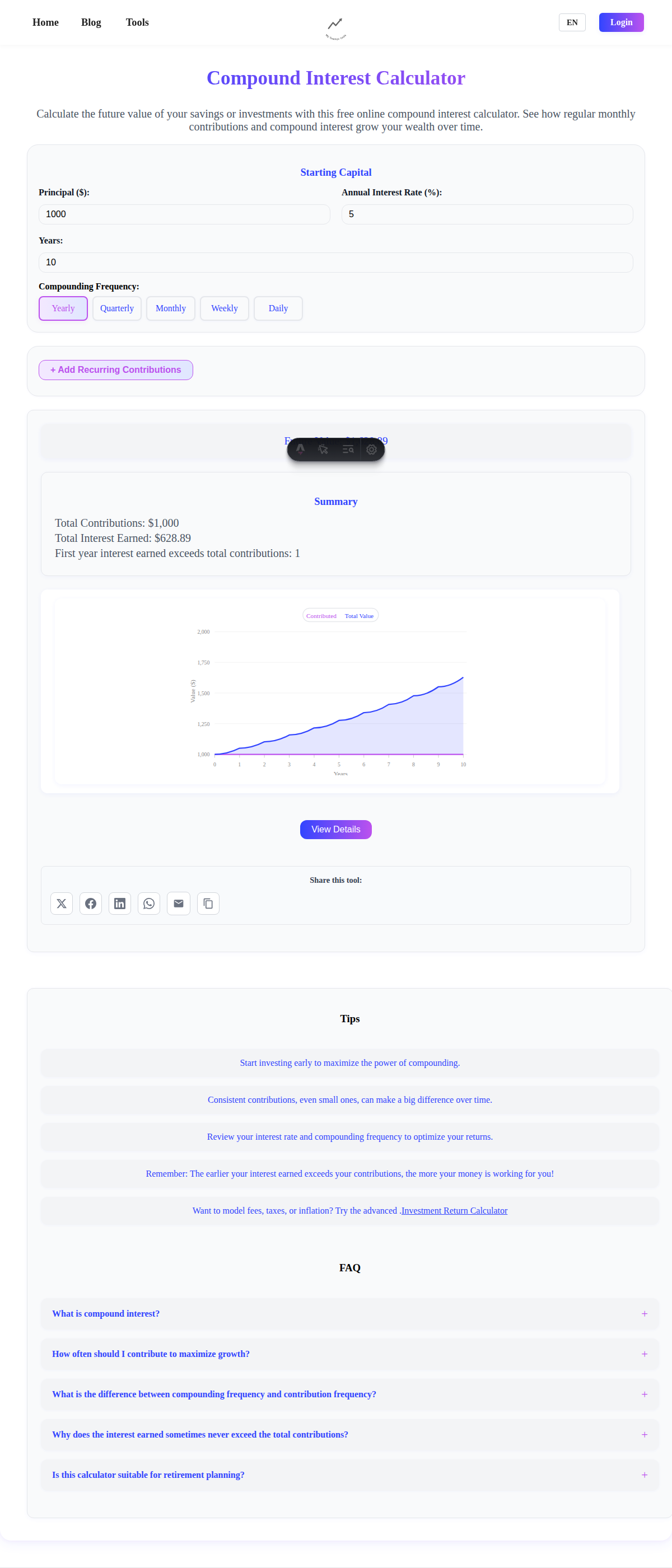

- Use our Investment Return Calculator to project growth

This Month:

- Make your first passive income investment

- Begin your first digital product or content strategy

- Set up tracking systems

- Schedule monthly review

This Quarter:

- Establish consistent contribution/creation schedule

- Add second stream if first is progressing

- Review and adjust strategy

- Connect with others on similar journey

This Year:

- Build foundation across chosen streams

- Reinvest all passive income

- Learn from results and optimize

- Plan expansion for year two

Series Complete

Thank you for reading our Building Passive Income Streams series. You now have the knowledge to begin your passive income journey across multiple streams.

Series Navigation:

- Part 1: Introduction to Passive Income

- Part 2: Dividend Investing for Steady Income

- Part 3: Digital Products and Online Income

- Part 4: Real Estate Income Without Being a Landlord

- Part 5: Building Your Passive Income Portfolio (You are here)

Related Resources:

Your passive income journey begins with a single step. That step is today.

This guide provides general information about building passive income and should not be considered personalized financial advice. All investments and business ventures carry risk. Consider consulting with qualified professionals for guidance specific to your situation.