Index Funds vs ETFs vs Mutual Funds: Complete Beginner’s Guide to Low-Cost Investing

Three simple investment options. One choice could save you $50,000 or more over 30 years of investing.

If you’re new to investing, you’ve probably encountered terms like “index funds,” “ETFs,” and “mutual funds” and wondered what they actually mean—and more importantly, which one is right for you. While these investment vehicles might seem complex, understanding their differences is crucial for building wealth efficiently.

This comprehensive guide will demystify these three popular investment options, helping you understand their costs, benefits, and which might work best for your financial goals. Whether you’re just starting your investment journey or looking to optimize your existing portfolio, you’ll learn everything needed to make an informed decision.

Understanding the Basics

Before diving into comparisons, let’s establish what each investment type actually is and how they work.

What Are Mutual Funds?

A mutual fund is an investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. When you invest in a mutual fund, you’re buying shares of the fund, and your money is combined with that of other investors.

How Mutual Funds Work:

- Professional Management: Fund managers research and select investments

- Pooled Resources: Your money combines with other investors’ money

- Diversification: Fund buys hundreds or thousands of individual securities

- Proportional Ownership: You own a percentage of the entire fund based on your investment

Types of Mutual Funds:

- Actively Managed: Fund managers actively buy and sell securities trying to beat the market

- Index Funds: Passively track a specific market index like the S&P 500

- Target-Date Funds: Automatically adjust investment mix based on target retirement date

- Sector Funds: Focus on specific industries or market sectors

What Are ETFs (Exchange-Traded Funds)?

ETFs are similar to mutual funds in that they pool investor money to buy a diversified portfolio of securities. However, ETFs trade on stock exchanges like individual stocks, giving them unique characteristics.

How ETFs Work:

- Exchange Trading: Buy and sell throughout the day at market prices

- Creation/Redemption: Large institutions can create or redeem ETF shares

- Underlying Holdings: Track indexes, sectors, commodities, or strategies

- Real-Time Pricing: Prices fluctuate throughout trading hours

Types of ETFs:

- Index ETFs: Track market indexes (most common type)

- Sector ETFs: Focus on specific industries

- International ETFs: Invest in foreign markets

- Bond ETFs: Hold various types of bonds

- Commodity ETFs: Track prices of gold, oil, agricultural products

- Actively Managed ETFs: Fund managers make active investment decisions

What Are Index Funds?

Index funds are actually a subset of mutual funds, but they deserve special attention because they’ve revolutionized investing for ordinary people. An index fund is designed to track the performance of a specific market index.

How Index Funds Work:

- Passive Management: No fund manager trying to pick winners

- Index Tracking: Holds the same securities as a chosen index in the same proportions

- Low Costs: Minimal management fees due to passive strategy

- Broad Diversification: Instant exposure to hundreds or thousands of companies

Popular Indexes Tracked:

- S&P 500: 500 largest U.S. companies

- Total Stock Market: Nearly all U.S. publicly traded companies

- FTSE Developed Markets: International developed market stocks

- Emerging Markets: Stocks from developing countries

- Bond Indexes: Various bond market segments

Detailed Comparison: Costs, Features, and Accessibility

Cost Comparison

Investment costs can dramatically impact your long-term returns. Even small differences in fees compound significantly over decades.

Expense Ratios

Index Funds:

- Range: 0.03% - 0.20% annually

- Example: Vanguard S&P 500 Index Fund (VFIAX): 0.04%

- Why Low: Passive management requires minimal oversight

ETFs:

- Range: 0.03% - 0.75% annually

- Example: SPDR S&P 500 ETF (SPY): 0.0945%

- Why Varies: Index ETFs are cheapest, specialty ETFs cost more

Actively Managed Mutual Funds:

- Range: 0.50% - 2.00% annually

- Example: Average actively managed fund: 0.71%

- Why Higher: Fund managers, research teams, marketing costs

Additional Fees

Transaction Costs:

- Index Funds: Usually no transaction fees with fund company

- ETFs: Brokerage commissions (many brokers now offer commission-free ETF trading)

- Mutual Funds: May have sales loads (front-end or back-end fees)

Minimum Investments:

- Index Funds: Often $1,000 - $3,000 minimum initial investment

- ETFs: Can buy single shares (price of one share)

- Mutual Funds: Varies widely, $500 - $10,000+ minimums

Real-World Cost Impact:

Investing $10,000 annually for 30 years, assuming 7% annual returns before fees:

- Index Fund (0.04% fee): Final value: $944,608

- ETF (0.09% fee): Final value: $939,490

- Active Fund (0.71% fee): Final value: $881,382

Difference: The index fund outperforms the active fund by $63,226 over 30 years, purely due to lower fees.

Tax Efficiency

Taxes can significantly impact your investment returns, especially in taxable accounts (non-retirement accounts).

How Mutual Funds Create Tax Inefficiency

Capital Gains Distributions: When mutual fund managers sell securities for gains, they must distribute those gains to shareholders, creating taxable events even if you didn’t sell your shares.

Example Scenario:

- You own shares in an actively managed mutual fund

- Fund manager sells profitable stocks

- You receive capital gains distribution and owe taxes

- This happens even if the fund’s overall value declined during the year

ETF Tax Advantages

In-Kind Redemptions: ETFs can eliminate capital gains through a process called “in-kind redemption,” where they transfer securities to redeeming institutions rather than selling them.

Lower Turnover: Index ETFs typically have lower portfolio turnover, reducing taxable events.

Index Fund Tax Efficiency

Low Turnover: Index funds rarely sell holdings, minimizing capital gains distributions Tax-Loss Harvesting: Some fund companies offer tax-loss harvesting in their index funds

Tax Efficiency Rankings (Best to Worst):

- Index ETFs - Most tax-efficient

- Index Mutual Funds - Very tax-efficient

- Actively Managed ETFs - Moderately tax-efficient

- Actively Managed Mutual Funds - Least tax-efficient

Liquidity and Trading

When You Can Buy and Sell

ETFs:

- Trading Hours: During market hours (9:30 AM - 4:00 PM ET in the US)

- Real-Time Pricing: Prices change throughout the day

- Instant Execution: Trades execute immediately at current market price

Mutual Funds (Including Index Funds):

- Once Daily: Trades execute after market close

- NAV Pricing: You get the net asset value calculated at day’s end

- Cut-off Times: Orders must be placed before market close (usually 4:00 PM ET)

Trading Flexibility

ETF Advantages:

- Buy and sell anytime during market hours

- Use limit orders, stop-losses, and other order types

- Short selling capabilities (advanced strategy)

Mutual Fund Advantages:

- No need to worry about intraday price fluctuations

- Automatic dividend reinvestment typically available

- Systematic investment plans (automatic monthly investing)

Dividend Handling

Dividend Distributions

ETFs:

- Quarterly Distribution: Most ETFs pay dividends quarterly

- Manual Reinvestment: You must manually reinvest dividends or set up automatic reinvestment

- Cash Settlement: Dividends deposited as cash in your account

Mutual Funds:

- Automatic Reinvestment: Dividends typically reinvest automatically in additional fund shares

- No Cash Drag: Money immediately goes back to work

- Fractional Shares: Can reinvest exact dividend amount, including partial shares

Performance Comparison

Do Active Funds Beat Index Funds?

The evidence overwhelmingly favors index funds and ETFs over actively managed mutual funds:

Academic Research

SPIVA Scorecard (S&P Indices Versus Active):

- Over 15 years, about 90% of actively managed U.S. equity funds underperform their benchmark index

- International funds and bond funds show similar underperformance

- Even funds that outperform in some periods often underperform over longer periods

Why Active Management Struggles

High Fees: Average active fund expense ratio of 0.71% creates a significant hurdle Market Efficiency: Stock prices reflect available information quickly, making it hard to find undervalued securities Turnover Costs: Frequent trading creates transaction costs and tax inefficiency Manager Risk: Fund performance depends heavily on individual manager skill and decision-making

Survivorship Bias

Many studies understate active fund underperformance because poorly performing funds get closed or merged, removing them from long-term performance data.

Index Fund and ETF Performance

Since index funds and ETFs tracking the same index hold identical securities, their performance should be nearly identical before fees. Differences come from:

Expense Ratios: Lower fees lead to better net returns Tracking Error: How closely the fund matches its index Cash Drag: Holding small amounts of cash can slightly reduce returns Securities Lending: Some funds lend securities to short sellers, generating additional income

Global Availability and Accessibility

Regional Differences

United States

Advantages:

- Largest selection of index funds and ETFs

- Extremely competitive fees

- Tax-advantaged accounts (401k, IRA, Roth IRA)

- Commission-free trading widely available

Popular Providers:

- Vanguard, Fidelity, Schwab (index funds and ETFs)

- BlackRock (iShares ETFs)

- State Street (SPDR ETFs)

European Union

Advantages:

- Growing selection of UCITS ETFs

- ISAs in UK, similar tax-advantaged accounts in other countries

- Increasing fee competition

Considerations:

- UCITS regulations limit some investment options

- Dividend taxation varies by country

- Currency hedging options available

Popular Providers:

- iShares, Vanguard, Xtrackers, Amundi

Asia-Pacific

Australia:

- Strong selection of ETFs on ASX

- Superannuation (retirement) accounts offer tax advantages

- Local providers: VanEck, BetaShares, Vanguard Australia

Japan:

- Growing ETF market

- NISA tax-advantaged accounts

- Local and international providers

Developing Markets

Challenges:

- Limited local index fund/ETF options

- Higher fees due to smaller markets

- Currency and political risks

- Less regulatory protection

Solutions:

- International brokers offering global access

- Focus on broad, diversified international funds

- Consider currency hedging

Choosing a Broker or Fund Company

Key Factors to Consider

Investment Minimums:

- ETFs: Usually one share minimum

- Index Funds: Often $1,000-$3,000 minimum

- Some providers offer lower minimums

Trading Fees:

- Many brokers now offer commission-free ETF trading

- Mutual fund transaction fees vary widely

- Watch for hidden fees in fine print

Fund Selection:

- Number of available index funds and ETFs

- International investment options

- Specialty funds (REITs, commodities, sectors)

Account Features:

- Automatic investing capabilities

- Dividend reinvestment options

- Tax-loss harvesting

- Research and educational tools

Building Your First Portfolio

Core Portfolio Principles

Start Simple

Three-Fund Portfolio:

- Total Stock Market Index (60-70%)

- International Stock Index (20-30%)

- Bond Index (10-20%)

This simple allocation provides global diversification across asset classes.

Age-Based Allocation

Rule of Thumb: Bond percentage = your age

- Age 25: 25% bonds, 75% stocks

- Age 40: 40% bonds, 60% stocks

- Age 60: 60% bonds, 40% stocks

Modern Approach: Many experts suggest lower bond allocations due to historically low interest rates.

Sample Portfolios by Investment Type

ETF Portfolio

- VTI (Vanguard Total Stock Market): 60%

- VTIAX (Vanguard Total International Stock): 25%

- BND (Vanguard Total Bond Market): 15%

Total Annual Expense Ratio: Approximately 0.08%

Index Fund Portfolio (Vanguard)

- VTSAX (Total Stock Market Index): 60%

- VTIAX (Total International Stock Index): 25%

- VBTLX (Total Bond Market Index): 15%

Total Annual Expense Ratio: Approximately 0.06%

Target-Date Fund Alternative

- Single Target-Date Fund: 100%

- Example: Vanguard Target Retirement 2055 Fund

Benefits: Automatic rebalancing and age-appropriate allocation Expense Ratio: Typically 0.10-0.15%

Rebalancing Strategies

When to Rebalance

Time-Based: Rebalance annually or quarterly Threshold-Based: Rebalance when allocations drift more than 5-10% from targets Combination: Set calendar reminders but also monitor for large drifts

How to Rebalance

With New Money: Direct new investments to underweight asset classes Tax-Advantaged Accounts: Sell overweight assets, buy underweight assets Taxable Accounts: Consider tax implications of selling appreciated assets

Advanced Considerations

Tax-Loss Harvesting

What It Is: Selling investments at a loss to offset taxable gains elsewhere in your portfolio.

ETF Advantages:

- More precise control over timing of sales

- Can harvest losses while maintaining market exposure through similar funds

Index Fund Considerations:

- Some fund companies offer automatic tax-loss harvesting

- Less control over timing of tax events

Factor Investing

Beyond Market-Cap Weighting: Traditional index funds weight companies by market capitalization, but research suggests other factors may improve returns:

- Value: Companies with low price-to-earnings ratios

- Small Cap: Smaller companies historically outperform large companies

- Momentum: Companies with strong recent performance

- Quality: Companies with strong fundamentals

- Low Volatility: Less volatile stocks often provide better risk-adjusted returns

Factor ETFs and Index Funds: Many providers now offer funds targeting these factors, though they typically have higher expense ratios than broad market funds.

International Investing

Currency Hedging

Unhedged Funds: Exposed to currency fluctuations Hedged Funds: Use derivatives to minimize currency risk

Considerations:

- Hedging costs money (higher expense ratios)

- Currency movements can help or hurt returns

- Long-term investors often choose unhedged for simplicity

Emerging Markets

Higher Risk, Higher Potential Return:

- Greater economic and political instability

- Currency risk

- Less liquid markets

- Potential for higher long-term growth

Allocation Suggestions:

- 5-15% of international allocation to emerging markets

- Available through dedicated EM index funds or ETFs

ESG and Sustainable Investing

Environmental, Social, and Governance (ESG) Investing

What It Is: Investing based on environmental, social, and governance criteria in addition to financial returns.

Available Options:

- ESG index funds and ETFs

- Socially responsible index funds

- Impact investing funds

Considerations:

- Typically higher expense ratios than traditional index funds

- May exclude certain sectors (oil, tobacco, weapons)

- Performance may differ from broad market indexes

Common Mistakes and How to Avoid Them

Mistake 1: Chasing Performance

The Problem: Switching investments based on recent performance The Solution: Stick to your long-term strategy and avoid timing the market

Mistake 2: Over-Diversification

The Problem: Buying too many overlapping funds The Solution: A few broad index funds provide sufficient diversification

Mistake 3: Ignoring Costs

The Problem: Focusing only on returns while ignoring expense ratios The Solution: Always consider costs in your investment decisions

Mistake 4: Market Timing

The Problem: Trying to time market tops and bottoms The Solution: Invest consistently regardless of market conditions

Mistake 5: Neglecting International Diversification

The Problem: Investing only in domestic markets The Solution: Include international stocks for global diversification

Mistake 6: Emotional Investing

The Problem: Making investment decisions based on fear or greed The Solution: Automate investing and stick to your predetermined strategy

Robo-Advisors vs. DIY Investing

What Are Robo-Advisors?

Robo-advisors are automated investment platforms that create and manage portfolios using algorithms, typically investing in ETFs or index funds.

Popular Robo-Advisors

- Betterment: 0.25% annual fee

- Wealthfront: 0.25% annual fee

- Vanguard Personal Advisor Services: 0.30% annual fee

- Schwab Intelligent Portfolios: No advisory fee but higher cash allocation

Robo-Advisor Advantages

- Automatic Rebalancing: Maintains target allocations without your intervention

- Tax-Loss Harvesting: Automated for taxable accounts

- Goal-Based Investing: Helps align investments with specific financial goals

- Professional Management: Takes emotion out of investment decisions

Robo-Advisor Disadvantages

- Additional Fees: 0.25-0.50% annually on top of fund expenses

- Less Control: Limited ability to customize investments

- Generic Advice: May not consider your specific financial situation

DIY Investing Advantages

Lower Costs: Avoid robo-advisor fees Full Control: Choose exactly which funds to buy Flexibility: Adjust strategy as needed Learning Experience: Understand your investments better

When to Choose Each Approach

Choose Robo-Advisors If:

- You want hands-off investing

- You value automatic rebalancing and tax-loss harvesting

- You’re comfortable paying for convenience

- You want goal-based planning tools

Choose DIY If:

- You want to minimize costs

- You enjoy managing your investments

- You have strong investing discipline

- You want maximum control over your portfolio

Getting Started: Action Steps

Step 1: Determine Your Investment Goals

Questions to Ask:

- What are you investing for? (retirement, house down payment, general wealth building)

- What’s your time horizon?

- How much risk can you tolerate?

- How much can you invest monthly?

Step 2: Choose Your Account Type

Tax-Advantaged Accounts (Priority):

- 401(k) or employer retirement plan (especially with matching)

- IRA or Roth IRA

- HSA (if available)

Taxable Accounts:

- For goals beyond retirement

- After maximizing tax-advantaged space

Step 3: Select a Provider

Consider:

- Investment minimums

- Available funds and ETFs

- Trading fees

- Account features

- Customer service

Popular Options:

- Vanguard: Known for low-cost index funds

- Fidelity: Zero-fee index funds and competitive ETFs

- Schwab: Comprehensive platform with low costs

- Online Brokers: M1 Finance, TD Ameritrade, E*TRADE

Step 4: Start Simple

Beginner-Friendly Options:

- Target-date fund (set it and forget it)

- Three-fund portfolio (total stock market, international, bonds)

- Robo-advisor (automated management)

Step 5: Automate and Stay Consistent

Set Up Automatic Investing:

- Monthly transfers from checking to investment account

- Automatic investment in chosen funds

- Automatic dividend reinvestment

Step 6: Monitor and Adjust

Annual Review:

- Rebalance if necessary

- Increase contributions when possible

- Adjust allocation as goals or age change

Conclusion

The choice between index funds, ETFs, and actively managed mutual funds doesn’t have to be complicated. For most investors, the evidence clearly favors low-cost index funds and ETFs over expensive actively managed funds.

Key Takeaways:

- Costs Matter: Even small differences in expense ratios compound significantly over decades

- Simplicity Wins: A few broad index funds provide excellent diversification

- Consistency Beats Timing: Regular investing outperforms attempts to time the market

- Start Now: Time in the market is more important than timing the market

- Stay the Course: Avoid emotional decisions and stick to your long-term strategy

Which Option to Choose:

- New Investors: Start with target-date funds or simple three-fund portfolios

- Cost-Conscious: Index funds typically have the lowest expense ratios

- Active Traders: ETFs offer more trading flexibility

- Hands-Off Investors: Consider robo-advisors or target-date funds

- Tax-Conscious: ETFs and index funds are more tax-efficient than active funds

The most important decision isn’t which specific fund to choose—it’s to start investing consistently in low-cost, diversified funds. Whether you choose index funds, ETFs, or a combination of both, you’ll be well ahead of those paying high fees for actively managed funds or avoiding investing altogether.

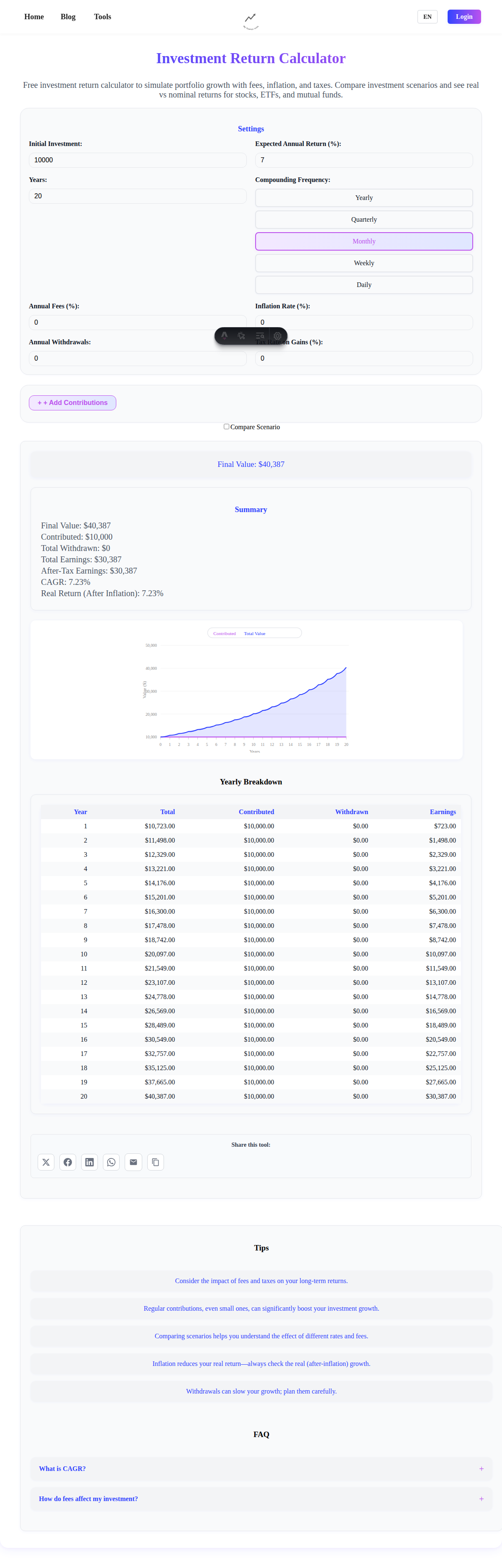

Use our Investment Return Calculator to see how different expense ratios impact your long-term wealth, and start building your portfolio today. The best time to start investing was yesterday; the second-best time is now.

Remember: investing is a marathon, not a sprint. Choose investments you can stick with for decades, keep costs low, and let compound growth work its magic over time.

This article provides general information about investment options and should not be considered personalized investment advice. Investment performance can vary significantly, and all investing involves risk of loss. Consider your individual circumstances and consult with qualified financial professionals before making investment decisions.