Dividend Investing for Steady Income: Building Wealth That Pays You

Imagine receiving regular payments simply for owning pieces of successful companies. No extra work required. No second job. Just consistent cash deposits landing in your account while you sleep, travel, or spend time with loved ones.

This is the reality of dividend investing—one of the most reliable and time-tested methods for building passive income. Unlike speculating on stock prices, dividend investing focuses on owning profitable businesses that share their earnings with shareholders. It’s how generations of investors have built lasting wealth and financial independence.

This guide—the second in our five-part series on building passive income—explores everything you need to know about dividend investing: how it works, strategies for building your portfolio, the power of reinvestment, and navigating the tax implications.

How Dividend Investing Works

Understanding Dividends

A dividend is a portion of a company’s profits distributed to shareholders. When a company generates more profit than it needs for growth and operations, it can return that excess to the people who own the company—its shareholders.

The Dividend Process:

- Company earns profits from business operations

- Board of directors declares dividend (amount per share)

- Ex-dividend date set (you must own shares before this date)

- Record date confirms eligible shareholders

- Payment date delivers cash to your account

Key Dividend Terms:

- Dividend per share - The amount paid for each share you own

- Dividend yield - Annual dividend divided by share price (percentage)

- Payout ratio - Percentage of earnings paid as dividends

- Ex-dividend date - Cutoff date for receiving upcoming dividend

- Dividend frequency - How often payments occur (monthly, quarterly, annually)

Why Companies Pay Dividends

Shareholder Returns:

- Provides tangible return on investment

- Attracts income-focused investors

- Demonstrates financial strength and stability

- Shows confidence in continued profitability

Companies That Typically Pay Dividends:

- Mature businesses with stable cash flows

- Utilities, consumer staples, healthcare

- Established financial institutions

- Companies with limited growth reinvestment needs

Companies That Usually Don’t Pay Dividends:

- High-growth companies reinvesting all profits

- Tech startups needing capital for expansion

- Cyclical businesses with irregular profits

- Companies with significant debt obligations

The Mathematics of Dividend Investing

Understanding Dividend Yield:

Dividend Yield = Annual Dividend per Share / Share Price × 100Example:

- Share price: $100

- Annual dividend: $4

- Dividend yield: 4%

Important: Yield changes with price. A falling stock price increases yield (which can signal trouble), while a rising price decreases yield.

Understanding Yield on Cost:

Yield on Cost = Annual Dividend / Your Purchase Price × 100Example:

- You bought at $50 per share

- Current dividend: $4 annually

- Your yield on cost: 8%

This explains why long-term dividend investors often enjoy yields far higher than current market rates.

Dividend Investment Strategies

Strategy 1: Dividend Growth Investing

Dividend growth investing focuses on companies that consistently increase their dividends over time, even if current yields are modest.

Philosophy:

- Prioritize dividend growth rate over current yield

- Focus on quality companies with strong fundamentals

- Accept lower initial income for higher future income

- Benefit from both dividend growth and capital appreciation

Characteristics of Dividend Growers:

- Strong competitive advantages (economic moats)

- Consistent earnings growth

- Manageable debt levels

- History of raising dividends annually

- Payout ratios leaving room for growth

The Dividend Aristocrats:

Dividend Aristocrats are S&P 500 companies that have increased dividends for at least 25 consecutive years. Examples include:

- Procter & Gamble (consumer goods)

- Johnson & Johnson (healthcare)

- Coca-Cola (beverages)

- 3M (industrial)

- Realty Income (real estate)

Dividend Kings:

Even more elite, Dividend Kings have increased dividends for 50+ consecutive years.

Growth Math Example:

| Year | Starting Yield | Annual Increase | Effective Yield |

|---|---|---|---|

| 1 | 2.5% | - | 2.5% |

| 5 | 2.5% | 7%/year | 3.5% |

| 10 | 2.5% | 7%/year | 4.9% |

| 20 | 2.5% | 7%/year | 9.7% |

| 30 | 2.5% | 7%/year | 19.0% |

A 2.5% yield growing at 7% annually becomes a 19% yield on cost after 30 years.

Strategy 2: High-Yield Investing

High-yield investing prioritizes maximizing current income, typically targeting yields of 4-8% or higher.

Philosophy:

- Maximize immediate cash flow

- Accept slower dividend growth

- Suitable for those needing current income

- Often used closer to or during retirement

High-Yield Sectors:

Real Estate Investment Trusts (REITs):

- Required to distribute 90% of taxable income

- Yields often 4-8%

- Various property types (residential, commercial, healthcare)

- Tax considerations differ from regular dividends

Business Development Companies (BDCs):

- Lend to small and mid-sized businesses

- High yields often 8-12%

- Higher risk than traditional dividend stocks

- Sensitive to interest rates and credit conditions

Master Limited Partnerships (MLPs):

- Focus on energy infrastructure

- Historically high yields

- Complex tax reporting (K-1 forms)

- Tax-advantaged distributions

Utilities:

- Stable, regulated businesses

- Yields often 3-5%

- Limited growth but consistent income

- Defensive during market downturns

Caution with High Yields:

Exceptionally high yields (10%+) often signal:

- Unsustainable payout ratios

- Declining stock prices (yield rises as price falls)

- Business deterioration

- Dividend cut risk

Always investigate why yield is unusually high before investing.

Strategy 3: Dividend ETFs and Funds

For simplicity and diversification, dividend-focused ETFs and mutual funds offer exposure to dividend-paying stocks through a single investment.

Types of Dividend ETFs:

Dividend Growth ETFs:

- Focus on companies with dividend growth history

- Examples: NOBL (Dividend Aristocrats), VIG (Dividend Appreciation)

- Lower current yield, higher growth potential

High-Yield ETFs:

- Maximize current income

- Examples: HDV (High Dividend), SPHD (High Dividend Low Volatility)

- Higher current yield, less growth focus

International Dividend ETFs:

- Global dividend exposure

- Examples: VIGI (International Dividend Growth), IDV (International High Dividend)

- Currency and political risk considerations

Sector-Specific Dividend ETFs:

- REITs: VNQ, SCHH

- Utilities: XLU, VPU

- Financials: VFH, XLF

Advantages of Dividend ETFs:

- Instant diversification

- Low expense ratios

- No individual stock analysis needed

- Automatic rebalancing

- Easy to start with small amounts

Disadvantages:

- Less control over holdings

- May include stocks you’d avoid

- Expense ratios reduce returns

- Less tax efficiency than individual stocks

Building Your Dividend Portfolio

Step 1: Determine Your Goals

Before buying dividend stocks, clarify your objectives:

Questions to Answer:

- Do you need income now or are you building for the future?

- What’s your investment timeline?

- How much volatility can you tolerate?

- Will you reinvest dividends or spend them?

- What’s your target passive income amount?

Goal-Based Strategy Selection:

| Goal | Timeline | Strategy | Target Yield |

|---|---|---|---|

| Future income | 20+ years | Dividend growth | 2-3% |

| Balanced | 10-20 years | Hybrid approach | 3-4% |

| Current income | Now | High-yield | 4-6% |

| Maximum income | Retirement | High-yield + growth | 4-7% |

Step 2: Decide on Structure

Individual Stocks vs. ETFs:

Choose individual stocks if you:

- Enjoy researching companies

- Want maximum control

- Can analyze financial statements

- Have time for ongoing monitoring

- Want to optimize tax efficiency

Choose ETFs if you:

- Prefer simplicity

- Have limited time for research

- Want instant diversification

- Are just starting out

- Prefer hands-off approach

Hybrid Approach: Many investors use ETFs for their core holdings while adding individual dividend stocks they’ve researched and believe in.

Step 3: Portfolio Construction

Diversification Guidelines:

By Sector:

- No single sector should exceed 25% of portfolio

- Include defensive sectors (utilities, consumer staples, healthcare)

- Balance cyclical and non-cyclical holdings

By Geography:

- Consider international dividend payers

- Currency diversification

- Different economic cycle exposure

By Company Size:

- Large-cap for stability

- Mid-cap for growth potential

- Smaller allocations to higher-risk, higher-yield

Sample Dividend Portfolio Allocation:

| Category | Allocation | Purpose |

|---|---|---|

| Dividend Growth Stocks | 40% | Long-term income growth |

| Dividend ETFs | 25% | Diversification and stability |

| REITs | 15% | High yield and real estate exposure |

| International Dividends | 10% | Geographic diversification |

| High-Yield Positions | 10% | Income boost |

Step 4: Stock Selection Criteria

When selecting individual dividend stocks, evaluate:

Financial Health:

- Consistent revenue and earnings growth

- Manageable debt levels (debt-to-equity ratio)

- Strong cash flow generation

- Healthy interest coverage ratio

Dividend Quality:

- Dividend history (years of payments and increases)

- Payout ratio (sustainable level varies by industry)

- Free cash flow coverage of dividend

- Management commitment to dividend policy

Valuation:

- Price-to-earnings ratio vs. historical average

- Dividend yield vs. historical range

- Comparison to sector peers

- Growth prospects justify valuation

Competitive Position:

- Strong brand or market position

- Barriers to entry in industry

- Pricing power

- Ability to withstand economic downturns

Step 5: Ongoing Management

Regular Review Schedule:

Quarterly:

- Review earnings reports

- Check dividend announcements

- Monitor payout ratio changes

- Assess overall portfolio balance

Annually:

- Rebalance if needed

- Review investment thesis for each holding

- Evaluate tax-loss harvesting opportunities

- Adjust strategy if goals have changed

Red Flags to Watch:

- Dividend cuts or freezes

- Payout ratio exceeding 100%

- Declining revenue or earnings

- Management changes affecting dividend policy

- Debt levels increasing significantly

The Power of Dividend Reinvestment

Understanding DRIPs

A Dividend Reinvestment Plan (DRIP) automatically uses dividend payments to purchase additional shares, creating a powerful compounding effect.

How DRIPs Work:

- Company pays dividend

- Instead of cash, dividend buys more shares

- More shares mean more dividends next time

- Cycle repeats, accelerating growth

DRIP Benefits:

- Automatic compounding

- Dollar-cost averaging

- Often commission-free

- Fractional share purchases

- Hands-off wealth building

The Compound Effect

The true power of dividend reinvestment becomes clear over long periods:

Example: $10,000 Initial Investment

- Stock: 3% dividend yield

- Dividend growth: 6% annually

- Stock price growth: 4% annually

| Year | Without DRIP | With DRIP | Difference |

|---|---|---|---|

| 5 | $12,167 | $13,842 | +$1,675 |

| 10 | $14,802 | $19,772 | +$4,970 |

| 20 | $21,911 | $42,478 | +$20,567 |

| 30 | $32,434 | $94,637 | +$62,203 |

After 30 years, dividend reinvestment nearly triples the ending value.

When to Stop Reinvesting

Eventually, you may want dividends as income rather than reinvested:

Consider Taking Dividends as Cash When:

- Approaching retirement or financial independence

- You need the income for living expenses

- Better investment opportunities exist elsewhere

- Portfolio is sufficiently large

Transition Strategy: Many investors gradually shift from reinvestment to income over several years, maintaining some reinvestment for continued growth while drawing income from a portion.

Tax Considerations for Dividend Investors

Types of Dividend Taxation

Qualified Dividends:

- Taxed at long-term capital gains rates (0%, 15%, or 20%)

- Must hold stock for 60+ days around ex-dividend date

- Most common for U.S. company dividends

Non-Qualified (Ordinary) Dividends:

- Taxed at your regular income tax rate

- Includes REITs, many foreign dividends, short-term holdings

- Often higher tax burden

Tax-Efficient Strategies

Account Location:

Place investments in accounts that minimize tax impact:

Tax-Advantaged Accounts (401(k), IRA, ISA):

- REITs (ordinary income dividends)

- High-yield investments

- Frequently traded positions

- Bonds and bond funds

Taxable Accounts:

- Qualified dividend stocks

- Long-term hold positions

- Investments you’ll hold for years

- Tax-efficient index funds

Tax-Loss Harvesting:

- Sell losing positions to offset gains

- Replace with similar (not identical) investments

- Wash sale rule: Can’t repurchase same security within 30 days

- Carry forward unused losses

International Dividend Taxation

Foreign Tax Withholding: Many countries withhold tax on dividends paid to foreign investors (often 15-30%).

Tax Treaty Benefits: Tax treaties between countries may reduce withholding rates.

Foreign Tax Credit: You may be able to claim credit for foreign taxes paid, reducing your U.S. tax liability.

Best Practice: Hold international dividend stocks in taxable accounts to utilize foreign tax credits.

Building a Dividend Income Stream: Practical Examples

Example 1: Young Investor Building Wealth

Profile:

- Age: 30

- Timeline: 30+ years to retirement

- Monthly investment: $500

- Goal: Build future passive income

Strategy:

- 70% Dividend Growth ETF (VIG)

- 20% International Dividend ETF (VIGI)

- 10% High-Yield ETF (VYM)

- All dividends reinvested (DRIP)

Projected Outcome (30 years, 8% average return):

- Total invested: $180,000

- Projected value: $680,000+

- Annual dividend income: $20,000+ (withdrawing)

Example 2: Mid-Career Investor

Profile:

- Age: 45

- Timeline: 15-20 years to retirement

- Lump sum: $100,000 + $1,000/month

- Goal: Balance growth and income

Strategy:

- 40% Individual dividend growth stocks

- 30% Dividend Growth ETF

- 15% REITs

- 15% High-Yield positions

- Reinvest all dividends

Projected Outcome (20 years):

- Total invested: $340,000

- Projected value: $900,000+

- Annual dividend income: $36,000+ (at retirement)

Example 3: Retiree Seeking Income

Profile:

- Age: 60

- Timeline: Immediate income needed

- Portfolio: $500,000

- Goal: Maximize sustainable income

Strategy:

- 30% High-Yield ETFs

- 25% Dividend Growth stocks

- 25% REITs

- 20% Bond funds/Preferred stocks

- Take all dividends as income

Income Generation:

- 4.5% average yield

- Annual income: $22,500

- Monthly income: $1,875

- Plus Social Security and other sources

Common Dividend Investing Mistakes to Avoid

Mistake 1: Chasing Yield

The Problem: Buying stocks solely because of high yields without investigating why yield is elevated.

The Reality: Exceptionally high yields often indicate:

- Stock price has collapsed (trouble ahead)

- Dividend is unsustainable

- Company is in decline

The Solution: Focus on total return (dividends + growth) and dividend sustainability, not just current yield.

Mistake 2: Ignoring Dividend Safety

The Problem: Assuming dividends will continue just because they’ve been paid before.

The Reality: Dividends can be cut or eliminated when:

- Earnings decline significantly

- Debt becomes unmanageable

- Industry disruption occurs

- Economic conditions deteriorate

The Solution: Monitor payout ratios, free cash flow, and company fundamentals. Diversify across many dividend payers.

Mistake 3: Lack of Diversification

The Problem: Concentrating in a few high-yield sectors like energy or REITs.

The Reality: Sector concentration increases risk. When energy crashed in 2020, many dividend investors faced multiple cuts simultaneously.

The Solution: Diversify across sectors, geographies, and company sizes. No single position should exceed 5% of portfolio.

Mistake 4: Overlooking Total Return

The Problem: Focusing only on dividend income while ignoring capital appreciation or depreciation.

The Reality: A 6% dividend means nothing if the stock falls 20%. Total return matters.

The Solution: Track total return (dividends + price change). Don’t sacrifice growth for yield.

Mistake 5: Impatience

The Problem: Expecting significant income from a small portfolio immediately.

The Reality: Building meaningful dividend income takes time and consistent investment.

The Math:

- $100,000 at 4% yield = $4,000/year ($333/month)

- $500,000 at 4% yield = $20,000/year ($1,667/month)

- $1,000,000 at 4% yield = $40,000/year ($3,333/month)

The Solution: Set realistic expectations. Focus on building your portfolio while dividends compound.

Getting Started Today

Your Dividend Investing Action Plan

Week 1: Foundation

- Open brokerage account if needed

- Research dividend ETFs for beginners

- Decide on initial investment amount

- Enable DRIP on your account

Month 1: First Investments

- Purchase first dividend ETF or stocks

- Set up automatic monthly investment

- Start tracking dividends received

- Begin researching individual stocks

Quarter 1: Building

- Maintain consistent monthly contributions

- Reinvest all dividends received

- Evaluate portfolio balance

- Research additional holdings

Year 1: Establishing

- Review portfolio performance

- Assess dividend growth

- Rebalance if needed

- Plan for year two

Tools and Resources

Tracking:

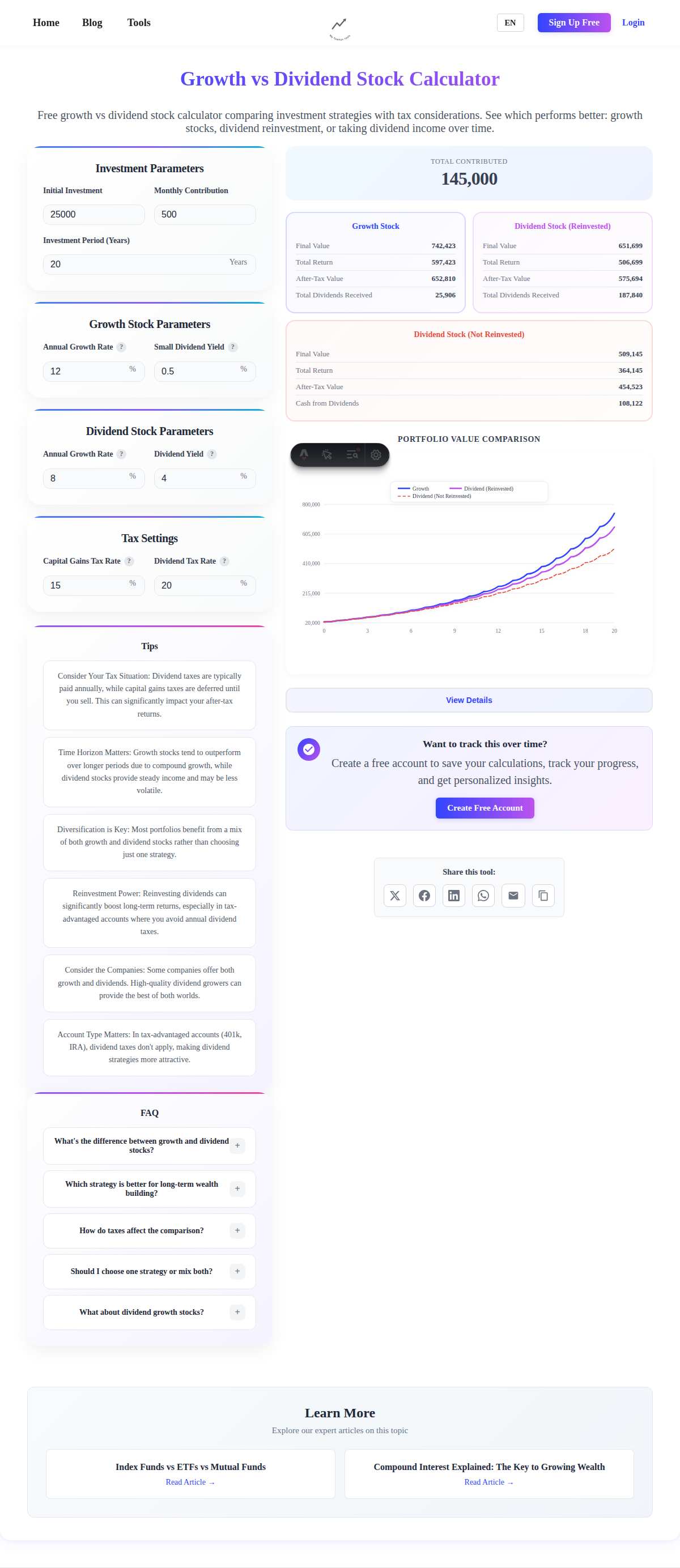

- Use our Investment Return Calculator to project growth

- Track dividends with spreadsheet or portfolio app

- Monitor yield on cost over time

Research:

- Company annual reports and investor presentations

- Dividend history databases

- Financial news sources

- Stock screeners for dividend criteria

Key Takeaways

-

Dividend investing provides truly passive income from profitable companies sharing their earnings

-

Two main strategies exist: dividend growth (lower yield, higher growth) and high-yield (more income now)

-

Dividend reinvestment compounds wealth exponentially over long time periods

-

Diversification across sectors and geographies reduces risk of dividend cuts

-

Tax efficiency matters: place different investments in appropriate account types

-

Patience is essential: meaningful dividend income requires time to build

-

Focus on total return, not just dividend yield—both income and growth matter

What’s Next

Continue building your passive income knowledge with the next article in our series:

Part 3: Digital Products and Online Income Streams (Coming Soon) will explore how to create and monetize digital assets for ongoing passive income.

Series Navigation:

- Part 1: Introduction to Passive Income

- Part 2: Dividend Investing for Steady Income (You are here)

- Part 3: Digital Products and Online Income Streams

- Part 4: Real Estate Income Without Being a Landlord

- Part 5: Building Your Passive Income Portfolio

This guide provides general information about dividend investing and should not be considered personalized financial advice. All investments carry risk, including possible loss of principal. Past dividend performance does not guarantee future payments. Consider consulting with qualified financial professionals for guidance specific to your situation.