DeFi Fundamentals: Lending, Liquidity, and Risk Management

This is Part 3 of our comprehensive cryptocurrency series. Read Part 1: Cryptocurrency Basics and Part 2: Investment Strategies for foundational knowledge.

Decentralized Finance (DeFi) represents one of the most innovative developments in the cryptocurrency space, offering traditional financial services without intermediaries. However, with potentially higher yields comes significantly increased complexity and risk. This guide provides a practical introduction to DeFi fundamentals, focusing on lending, liquidity provision, and comprehensive risk management strategies.

Unlike the centralized finance (CeFi) options discussed in Part 2, DeFi protocols operate through smart contracts on blockchains, primarily Ethereum. While this eliminates counterparty risk from centralized platforms, it introduces new risks including smart contract vulnerabilities, impermanent loss, and regulatory uncertainty.

Understanding Decentralized Finance (DeFi)

What Makes DeFi Different

DeFi protocols recreate traditional financial services using smart contracts instead of centralized institutions:

No Intermediaries: Direct peer-to-peer or peer-to-protocol interactions Open Source: Most protocols have publicly auditable code Composability: DeFi protocols can interact with each other, creating complex financial products Global Access: Available 24/7 to anyone with an internet connection and compatible wallet Transparency: All transactions are publicly visible on the blockchain

Key DeFi Categories

Lending and Borrowing: Platforms like Aave, Compound, and MakerDAO Decentralized Exchanges (DEXs): Uniswap, SushiSwap, Curve Yield Aggregators: Yearn Finance, Harvest Finance Synthetic Assets: Synthetix, Mirror Protocol Insurance: Nexus Mutual, Cover Protocol Derivatives: dYdX, Perpetual Protocol

DeFi vs Traditional Finance

| Aspect | Traditional Finance | DeFi |

|---|---|---|

| Access | Requires bank accounts, credit checks | Wallet and crypto holdings only |

| Hours | Business hours only | 24/7/365 |

| Geographical Limits | Restricted by jurisdiction | Global access |

| Transparency | Limited visibility | Fully transparent |

| Control | Intermediary controlled | Self-custodial |

| Risk | Institutional backing | Smart contract risk |

DeFi Lending: Earning Interest on Your Crypto

How DeFi Lending Works

DeFi lending protocols create liquidity pools where users can:

- Lend: Deposit crypto to earn interest from borrowers

- Borrow: Take loans using crypto as collateral

- Earn: Receive interest payments and often protocol tokens as rewards

Major Lending Platforms

Aave:

- Supports 20+ assets across multiple blockchains

- Features like flash loans and credit delegation

- Typically 2-8% APY for major stablecoins

Compound:

- Algorithmic money market protocol

- Automatic interest rate adjustments based on supply/demand

- Users receive cTokens representing their deposits

MakerDAO:

- Focused on DAI stablecoin generation

- Vault-based system for borrowing against ETH and other assets

- Decentralized governance through MKR token

Risk Assessment for DeFi Lending

Smart Contract Risk: Bugs or vulnerabilities could lead to fund loss

Liquidation Risk: If borrowing, collateral may be liquidated during market downturns

Regulatory Risk: Changing regulations could affect protocol operations

Governance Risk: Token holders make protocol decisions that could impact your investments

Getting Started with DeFi Lending

Step 1: Wallet Setup

- Use hardware wallets for significant amounts

- Popular options: MetaMask, Ledger, Trezor

- Ensure you control your private keys

Step 2: Platform Research

- Check protocol audits and security track records

- Understand fee structures and withdrawal terms

- Start with established protocols (Aave, Compound)

Step 3: Risk Management

- Begin with small amounts to learn the interface

- Focus on blue-chip assets (ETH, USDC, DAI)

- Monitor positions regularly for changes in rates or risks

Liquidity Provision and Automated Market Makers (AMMs)

Understanding Liquidity Pools

Liquidity pools are smart contracts containing two or more tokens that enable decentralized trading. Liquidity providers (LPs) deposit tokens and earn fees from trades.

How It Works:

- Deposit equal dollar values of two tokens (e.g., $500 ETH + $500 USDC)

- Receive LP tokens representing your share of the pool

- Earn trading fees (typically 0.25-1% per trade)

- May receive additional rewards in protocol tokens

Popular AMM Platforms

Uniswap V3:

- Concentrated liquidity allows capital efficiency improvements

- Fee tiers: 0.05%, 0.3%, and 1%

- Supports major token pairs across multiple chains

Curve Finance:

- Specializes in stablecoin and similar asset swaps

- Lower slippage for correlated assets

- Often offers additional CRV token rewards

Balancer:

- Multi-token pools (not just pairs)

- Customizable pool weights and fees

- Automated portfolio rebalancing

Understanding Impermanent Loss

Impermanent loss occurs when the price ratio of your deposited tokens changes compared to when you deposited them.

Example:

- Deposit: $1,000 (500 USDC + $500 ETH at $2,000/ETH)

- Price Change: ETH rises to $4,000

- Result: Your pool now contains more USDC, less ETH

- Loss: You have less total value than if you held tokens separately

Mitigation Strategies:

- Choose correlated pairs (USDC/DAI, ETH/stETH)

- Focus on high-fee pools to offset potential losses

- Consider impermanent loss protection protocols

- Monitor and exit positions during extreme volatility

Calculating LP Returns

Total LP returns include:

- Trading Fees: Your share of all swap fees

- Token Rewards: Additional protocol tokens (often 2-20% APR)

- Impermanent Loss: Potential reduction in token amounts

Use DeFi analytics tools to track:

- APR from fees and rewards

- Impermanent loss in real-time

- Historical performance of pools

Advanced DeFi Strategies

Yield Farming Basics

Yield farming involves moving funds between protocols to maximize returns through:

Liquidity Mining: Providing liquidity to earn protocol tokens Reward Stacking: Earning multiple types of rewards simultaneously Protocol Hopping: Moving between protocols as yields change Leverage Strategies: Borrowing to amplify LP positions (high risk)

Multi-Protocol Strategies

Stable Yield Strategy:

- Deposit USDC in Aave (3% APY)

- Borrow DAI against USDC (2% APR)

- Provide USDC/DAI liquidity on Curve (5% APY + CRV rewards)

- Net positive yield while maintaining stablecoin exposure

ETH Maximize Strategy:

- Deposit ETH in Compound

- Borrow stablecoins (at lower rate than ETH staking yield)

- Buy more ETH with borrowed funds

- Repeat (carefully managing liquidation risk)

Risk-Adjusted Returns

When evaluating DeFi strategies, consider:

Time Investment: Active management requirements Gas Costs: Ethereum network fees can be substantial Complexity Risk: More steps = more potential failure points Opportunity Cost: Compare to simpler staking strategies

Comprehensive Risk Management in DeFi

Smart Contract Risks

Code Audits: Only use protocols with multiple professional audits Time in Market: Prefer protocols operating successfully for 12+ months Total Value Locked (TVL): Higher TVL suggests market confidence Bug Bounties: Programs incentivizing security researchers

Due Diligence Checklist:

- Review audit reports from reputable firms

- Check if protocol is immutable or has admin keys

- Understand governance processes and token distribution

- Research team backgrounds and previous projects

Liquidity and Market Risks

Pool Concentration: Avoid putting large percentages in single pools Slippage Risk: Large positions may be difficult to exit quickly Correlation Risk: Choose uncorrelated assets when possible Market Timing: Consider overall crypto market conditions

Operational Risks

Wallet Security: Use hardware wallets and follow security best practices Gas Management: Monitor network congestion and optimize transaction timing MEV Protection: Be aware of maximum extractable value risks Frontend Risk: Verify you’re using official protocol interfaces

Regulatory and Compliance Risks

Tax Implications: Track all DeFi activities for tax reporting Regulatory Changes: Stay informed about evolving DeFi regulations Geographic Restrictions: Some protocols may restrict access by location Professional Advice: Consider consulting crypto-savvy tax professionals

DeFi Security Best Practices

Wallet and Key Management

Hardware Wallets: Essential for significant DeFi exposure Multi-Signature Wallets: For larger amounts or team management Seed Phrase Security: Secure offline storage with multiple backups Regular Security Audits: Review and update security practices quarterly

Transaction Security

Double-Check Addresses: Always verify recipient addresses Approve Limits: Set appropriate spending allowances for contracts Revoke Permissions: Regularly audit and revoke unused approvals Simulation Tools: Use transaction simulators before confirming

Protocol Interaction Guidelines

Start Small: Begin with minimal amounts to learn interfaces Test Transactions: Send small amounts first to verify functionality Monitor Positions: Regular check-ins on all active positions Emergency Plans: Know how to quickly exit positions if needed

DeFi Across Different Blockchains

Ethereum DeFi Ecosystem

Advantages: Most mature, highest TVL, best composability Disadvantages: High gas fees, network congestion Best For: Large positions where fees are proportionally smaller

Alternative Blockchain DeFi

Binance Smart Chain (BSC):

- Lower fees but more centralized

- Popular protocols: PancakeSwap, Venus

Polygon:

- Ethereum-compatible with lower costs

- Growing ecosystem with major protocol deployments

Arbitrum/Optimism:

- Ethereum Layer 2 solutions

- Lower fees while maintaining Ethereum security

Solana:

- High-speed blockchain with growing DeFi ecosystem

- Protocols like Raydium, Marinade

Cross-Chain Considerations

Bridge Risks: Moving assets between chains introduces additional risks Liquidity Fragmentation: Smaller pools on alternative chains Security Trade-offs: Newer chains may have less battle-tested security Gas Token Requirements: Need native tokens for transaction fees

Taxation and Record Keeping for DeFi

Tax Implications by Activity

Lending: Interest earned typically taxed as income Liquidity Provision: Complex calculations involving fees, rewards, and impermanent loss Yield Farming: Multiple taxable events from token swaps and rewards Token Rewards: Often taxed as income when received

Record Keeping Requirements

Transaction Logs: Detailed records of all DeFi interactions Fair Market Values: USD values at time of each transaction Pool Positions: Entry/exit prices and LP token amounts Gas Fees: Potentially deductible as investment expenses

DeFi Tax Tools

DeFi-Specific Solutions:

- Rotki: Open-source portfolio tracking

- CoinTracker: Automated DeFi transaction import

- TokenTax: Specialized crypto tax software

Manual Tracking:

- Spreadsheet templates for DeFi activities

- Regular snapshots of positions and values

- Documentation of strategy changes and reasoning

Building a DeFi Allocation Strategy

Portfolio Integration

Conservative Approach (1-3% of crypto allocation):

- Blue-chip lending on established protocols

- Stablecoin pairs with minimal impermanent loss

- Focus on earning yield while learning DeFi basics

Moderate Approach (5-10% of crypto allocation):

- Mix of lending and LP positions

- Some exposure to newer but audited protocols

- Basic yield farming strategies

Aggressive Approach (10%+ of crypto allocation):

- Active yield farming and strategy optimization

- Multi-chain exposure and advanced strategies

- Higher risk/reward protocol participation

Risk-Adjusted Allocation

Consider your:

- Technical Expertise: DeFi requires ongoing learning and monitoring

- Time Availability: Active strategies require regular attention

- Risk Tolerance: Smart contract risks are different from traditional market risks

- Capital Size: Gas fees may make small positions uneconomical

Monitoring and Performance Tracking

Key Metrics to Track

Yield Metrics:

- APY from fees and rewards

- Impermanent loss in real-time

- Gas costs as percentage of returns

- Risk-adjusted returns vs. simple holding

Risk Metrics:

- Protocol health and TVL trends

- Smart contract audit status

- Liquidation ratios for borrowing positions

- Overall DeFi exposure as portfolio percentage

Tools and Resources

Portfolio Tracking:

- DeBank: Multi-chain DeFi portfolio tracker

- Zapper: Position management and yield optimization

- DeFi Pulse: Protocol rankings and analytics

Research Resources:

- DeFiLlama: TVL and protocol analytics

- Token Terminal: DeFi protocol financials

- Messari: In-depth protocol research

Integration with Traditional Investment Strategy

DeFi as Portfolio Diversifier

DeFi can serve as:

- Alternative Yield Source: Potentially higher returns than traditional fixed income

- Technology Investment: Exposure to financial innovation

- Hedge Against Traditional Finance: Uncorrelated return source

Risk Management Integration

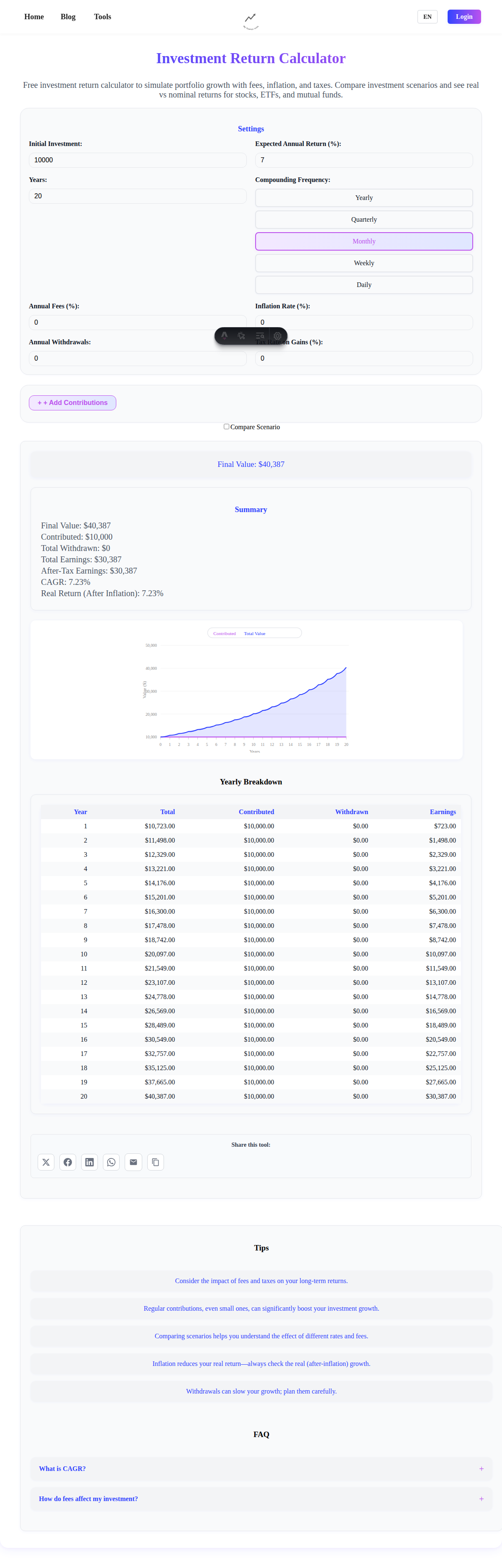

Use our Investment Return Calculator to model DeFi scenarios alongside traditional investments, factoring in:

- Higher volatility than traditional assets

- Additional complexity and time requirements

- Potential for both higher returns and total loss

Gradual Implementation Approach

Phase 1 (Month 1-2): Learn fundamentals with small amounts Phase 2 (Month 3-4): Implement basic lending strategies Phase 3 (Month 5-6): Add liquidity provision with stable pairs Phase 4 (Ongoing): Optimize strategies based on experience and market conditions

Future of DeFi and Strategic Considerations

Emerging Trends

Institutional DeFi: Traditional institutions exploring DeFi integration Regulatory Frameworks: Clearer rules may increase adoption and reduce risks Layer 2 Scaling: Reduced costs making DeFi accessible to smaller investors Cross-Chain Protocols: Seamless asset movement between blockchains

Long-Term Strategic Thinking

Skill Development: DeFi literacy may become valuable financial skill Network Effects: Early users may benefit from protocol growth Technology Risk: Current protocols may become obsolete Regulatory Impact: Future regulations could significantly alter the landscape

Preparing for Evolution

Stay Informed: Follow DeFi news and developments Maintain Flexibility: Be ready to adapt strategies as markets evolve Build Gradually: Develop expertise over time rather than rushing in Risk Management First: Prioritize capital preservation over yield maximization

Conclusion: Responsible DeFi Participation

DeFi represents a paradigm shift in financial services, offering unprecedented opportunities for yield generation and financial innovation. However, these opportunities come with commensurate risks that require careful study, gradual implementation, and ongoing vigilance.

The key principles for successful DeFi participation include:

- Education First: Thoroughly understand protocols before depositing funds

- Start Small: Begin with amounts you can afford to lose completely

- Diversify Extensively: Spread risk across protocols, chains, and strategies

- Maintain Security: Never compromise on wallet and operational security

- Track Everything: Maintain detailed records for taxes and performance analysis

- Stay Informed: The DeFi space evolves rapidly; continuous learning is essential

Remember that DeFi is still experimental technology. Smart contract bugs, economic exploits, and regulatory changes can result in partial or total loss of funds. Always consider DeFi as a high-risk, high-reward component of a diversified cryptocurrency allocation.

Coming Next: In Part 4 of our cryptocurrency series, we’ll explore “Advanced Crypto Portfolio Optimization and Market Analysis,” covering on-chain metrics, advanced portfolio rebalancing, market cycle analysis, and sophisticated exit strategies.

Use our Budget Calculator to determine appropriate DeFi allocation amounts, and consider how DeFi yields might impact your overall investment strategy with our Compound Interest Calculator.

The information provided in this article is for educational purposes only and should not be considered as personalized financial advice. DeFi protocols are experimental and carry significant risks including the potential for total loss of funds. Smart contract vulnerabilities, impermanent loss, and regulatory changes can substantially impact returns. Consider consulting with qualified financial professionals familiar with DeFi risks before participating in these protocols.