Cryptocurrency Investment Strategies: DCA, Staking, and Yield Generation

This is Part 2 of our comprehensive cryptocurrency series. If you haven’t read Part 1: Cryptocurrency Basics, we recommend starting there for foundational knowledge.

Once you’ve established a basic understanding of cryptocurrency and determined your appropriate allocation, the next step is implementing sophisticated investment strategies that can optimize your returns while managing risk. This guide explores advanced dollar-cost averaging techniques, proof-of-stake staking for passive income generation, and various yield-earning opportunities in the cryptocurrency ecosystem.

Unlike traditional investments, cryptocurrency offers unique opportunities to earn yield on your holdings through various mechanisms. However, these strategies come with their own risks and tax implications that vary significantly across jurisdictions.

Advanced Dollar-Cost Averaging Strategies

Beyond Basic DCA: Optimization Techniques

While our first article covered basic dollar-cost averaging, there are several advanced techniques that can improve your DCA performance:

Value Averaging: Instead of investing a fixed amount, you invest whatever amount is needed to reach a target portfolio value increase. This means investing more during dips and less during peaks.

Momentum-Based DCA: Adjusting your DCA frequency based on market volatility. During high volatility periods, increase frequency to capture more price points.

Multi-Asset DCA: Rather than DCA into just Bitcoin, spread your allocation across multiple cryptocurrencies based on predetermined percentages.

DCA Frequency Optimization

Weekly vs. Monthly vs. Daily: Research suggests weekly DCA often provides the best balance between minimizing fees and reducing volatility impact. Daily DCA can be optimal during highly volatile periods but increases transaction costs.

Market Condition Adjustments:

- Bear Markets: Consider increasing DCA frequency and amounts

- Bull Markets: Maintain consistent schedule but consider taking some profits

- Sideways Markets: Standard DCA works well

Example DCA Strategy:

- Base allocation: €200 monthly

- Bear market adjustment: €300 monthly + weekly small purchases

- Bull market adjustment: €150 monthly + 25% profit taking quarterly

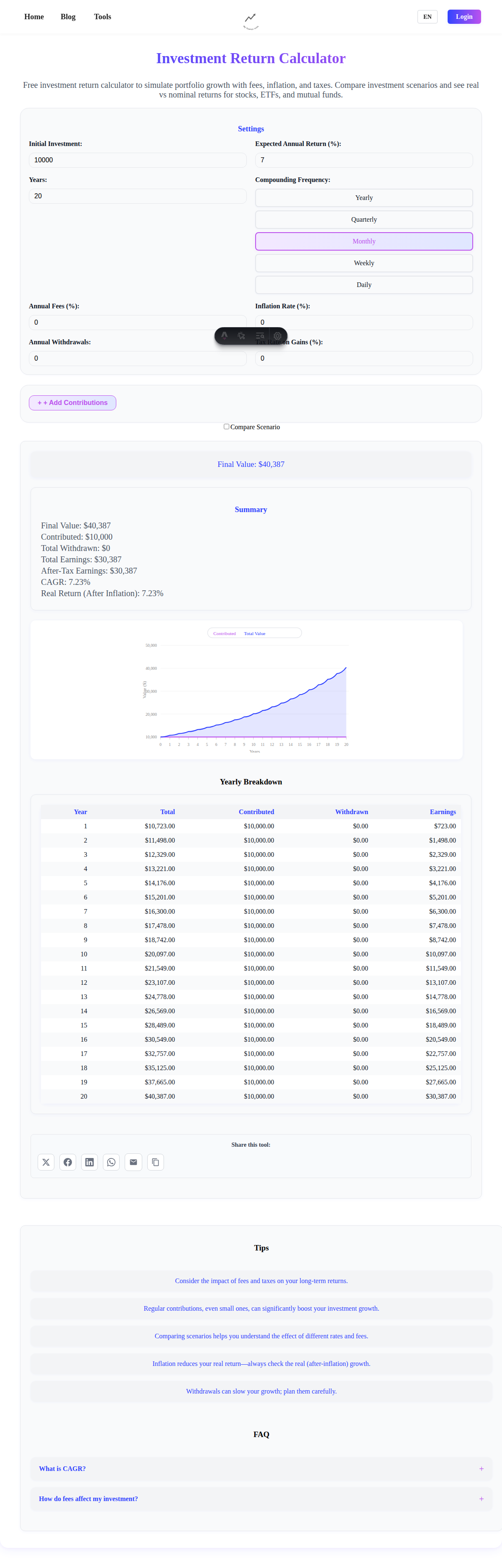

Use our Investment Return Calculator to model how different DCA frequencies and amounts might impact your long-term returns under various market scenarios.

Tax-Efficient DCA Implementation

Timing Considerations:

- End-of-year planning: Time purchases to optimize tax loss harvesting

- Long-term holding: Ensure purchases qualify for favorable long-term capital gains treatment

- Geographic considerations: Some countries don’t have wash sale rules for crypto, allowing strategic tax planning

Record Keeping for DCA:

- Track cost basis for each purchase

- Maintain detailed transaction logs

- Consider crypto tax software for automated tracking

- Separate personal vs. business crypto activities

Understanding Proof-of-Stake Staking

What is Staking?

Staking involves holding and “locking up” certain cryptocurrencies to support network operations and earn rewards. Unlike Bitcoin’s energy-intensive mining, staking is more environmentally friendly and accessible to regular investors.

How Staking Works:

- You hold proof-of-stake cryptocurrencies

- You delegate or directly stake these tokens

- You help validate network transactions

- You earn staking rewards (typically 3-15% annually)

Major Stakeable Cryptocurrencies

Ethereum (ETH): Since “The Merge” in 2022, Ethereum uses proof-of-stake with approximately 4-6% annual rewards.

Cardano (ADA): Offers around 4-5% annual rewards with no lock-up period.

Solana (SOL): Provides approximately 6-8% annual rewards with various staking options.

Polkadot (DOT): Offers around 10-12% annual rewards but requires a 28-day unbonding period.

Cosmos (ATOM): Provides approximately 8-10% annual rewards through various validators.

Staking Methods and Considerations

Exchange Staking:

- Pros: Easy to set up, no technical knowledge required, often liquid staking options

- Cons: Counterparty risk, typically lower rewards, less control

Native Staking:

- Pros: Higher rewards, full control, direct network participation

- Cons: Technical complexity, lock-up periods, slashing risks

Liquid Staking Protocols:

- Pros: Earn staking rewards while maintaining liquidity

- Cons: Additional smart contract risks, slightly lower rewards

Staking Pool Considerations:

- Validator reputation and track record

- Commission rates and fee structures

- Geographic distribution and decentralization

- Uptime and performance history

Staking Risks and Mitigation

Slashing Risk: Some networks penalize validators for malicious behavior or extended downtime. Choose reputable validators with strong track records.

Lock-up Risk: Many staking mechanisms require locking funds for specific periods. Plan your liquidity needs accordingly.

Validator Risk: If staking through pools, validator performance directly impacts your rewards. Diversify across multiple validators when possible.

Technical Risk: Native staking may involve running software or managing keys. Ensure proper security practices.

Yield Generation Strategies

Centralized Finance (CeFi) Yield Options

Crypto Savings Accounts: Many platforms offer interest on crypto deposits, typically ranging from 1-8% annually depending on the asset and platform.

Popular Platforms by Region:

- Global: BlockFi, Celsius (note: verify current operational status), Nexo

- Europe: Bitvavo, Kraken, Binance

- Regulated Options: Coinbase Earn, Gemini Earn

Risk Assessment for CeFi Platforms:

- Regulatory compliance in your jurisdiction

- Insurance coverage and asset segregation

- Financial health and transparency

- Historical track record and security measures

Understanding Yield Sources

Lending: Your crypto is lent to institutional borrowers, margin traders, or other users.

Market Making: Your funds provide liquidity for trading pairs on exchanges.

Staking Services: Platforms stake your tokens and share rewards with you.

Yield Farming: More complex strategies involving multiple DeFi protocols (covered in Part 3 of this series).

Risk-Return Analysis for Different Yield Strategies

Low Risk (1-4% annual):

- Major exchange savings accounts

- Government-regulated crypto lending

- Blue-chip staking (ETH, ADA)

Medium Risk (4-8% annual):

- Established CeFi lending platforms

- Validator staking with lock-ups

- Liquid staking protocols

High Risk (8%+ annual):

- Newer platforms or tokens

- Complex yield farming strategies

- Algorithmic stablecoins

Global Tax Implications of Crypto Yield

Staking Rewards Taxation

United States: Staking rewards taxed as ordinary income at fair market value when received.

United Kingdom: Staking rewards generally taxed as income, with potential capital gains on disposal.

Germany: Staking rewards may extend the tax-free holding period from 1 to 10 years for the underlying asset.

European Union: Varies by member state, with some treating staking as income and others as capital gains.

Australia: ATO generally treats staking rewards as assessable income.

Interest and Lending Income

Most jurisdictions treat crypto interest and lending rewards as taxable income at the time of receipt. Key considerations:

- Track fair market value at time of receipt

- Consider quarterly estimated tax payments for significant yields

- Maintain detailed records of all yield-generating activities

- Understand how yield affects capital gains calculations

Tax Optimization Strategies

Geographic Arbitrage: Some jurisdictions offer more favorable crypto tax treatment, though this requires careful legal planning.

Timing Strategies: In jurisdictions without wash sale rules, strategic loss harvesting while maintaining yield positions.

Corporate Structures: For significant crypto activities, some investors establish corporate entities in crypto-friendly jurisdictions.

Retirement Accounts: Where permitted, holding yield-generating crypto in tax-advantaged accounts.

Building a Yield-Focused Crypto Portfolio

Asset Allocation for Yield

Conservative Yield Portfolio (3-5% target annual yield):

- 40% Ethereum (staked)

- 30% Stablecoins in regulated lending platforms

- 20% Cardano or similar established PoS tokens

- 10% Exchange savings accounts (Bitcoin, major altcoins)

Moderate Yield Portfolio (5-8% target annual yield):

- 35% Mixed staking (ETH, SOL, DOT, ATOM)

- 25% Stablecoins across multiple platforms

- 25% Liquid staking derivatives

- 15% CeFi lending platforms

Aggressive Yield Portfolio (8%+ target annual yield):

- 30% High-yield staking (newer PoS networks)

- 30% DeFi yield farming (covered in Part 3)

- 20% Liquid staking and derivatives

- 20% Alternative yield strategies

Risk Management in Yield Generation

Platform Diversification: Never put all yield-generating assets on a single platform.

Geographic Diversification: Use platforms regulated in different jurisdictions.

Yield Sustainability Analysis: Be skeptical of unsustainably high yields—they often indicate high risk.

Liquidity Management: Maintain some liquid crypto for rebalancing and opportunities.

Monitoring and Optimization

Regular Platform Assessment: Quarterly review of platform security, yields, and regulatory status.

Yield Tracking: Monitor actual vs. advertised yields, accounting for fees and taxes.

Market Condition Adjustments: Modify strategies based on overall crypto market conditions.

Compounding Optimization: Reinvest rewards efficiently, considering transaction costs and tax implications.

Advanced DCA and Yield Combination Strategies

DCA into Yield-Generating Assets

Instead of simple spot purchases, consider DCAing directly into yield-generating positions:

Staking DCA: Automatically stake purchases of proof-of-stake tokens Yield Platform DCA: Direct DCA purchases to earn yield immediately Compound DCA: Reinvest yield earnings back into DCA schedule

Yield-Enhanced Portfolio Rebalancing

Use yield earnings to rebalance your portfolio without additional capital:

- Direct yield to underweight positions

- Use staking rewards for portfolio rebalancing

- Compound yield into momentum positions during bull markets

Tax-Loss Harvesting with Yield Positions

Advanced strategy combining tax optimization with yield generation:

- Harvest losses on spot positions

- Maintain market exposure through yield-generating positions

- Repurchase spot positions after wash sale period (where applicable)

Security Considerations for Yield Strategies

Platform Security Assessment

Regulatory Compliance: Verify platform licensing and regulatory status Insurance Coverage: Understand what protections exist for your funds Security Track Record: Research historical security incidents Fund Segregation: Ensure customer assets are properly segregated

Operational Security

Multi-Platform Strategy: Distribute funds across multiple reputable platforms Regular Monitoring: Set up alerts for unusual account activity Withdrawal Testing: Regularly test withdrawal processes with small amounts Emergency Procedures: Have plans for quickly moving funds if needed

Future-Proofing Your Crypto Yield Strategy

Regulatory Evolution

Stay informed about evolving regulations affecting crypto yield:

- Staking reward classification changes

- New reporting requirements

- Platform licensing requirements

- Cross-border tax treaty implications

Technology Developments

Monitor technological changes that could impact yields:

- Network upgrades affecting staking rewards

- New consensus mechanisms

- Liquid staking innovations

- Cross-chain yield opportunities

Market Maturation Effects

As crypto markets mature, expect:

- Generally lower but more stable yields

- Increased regulatory compliance requirements

- More sophisticated yield products

- Greater integration with traditional finance

Practical Implementation Guide

Month 1: Foundation Setup

- Choose Initial Staking Positions: Start with established networks (ETH, ADA)

- Set Up DCA Optimization: Implement weekly DCA with momentum adjustments

- Tax Preparation: Set up tracking systems for all yield activities

- Security Setup: Enable all security features on chosen platforms

Month 2-3: Diversification

- Add CeFi Yield Positions: Start with regulated platforms in your jurisdiction

- Implement Multi-Asset DCA: Expand beyond Bitcoin to include stakeable assets

- Monitor and Adjust: Track actual yields vs. expectations

- Record Keeping: Ensure all activities are properly documented

Ongoing Optimization

- Quarterly Reviews: Assess platform performance and security

- Tax Planning: Optimize timing of activities for tax efficiency

- Yield Reinvestment: Develop systematic approach to compounding

- Risk Assessment: Regularly evaluate and adjust risk exposure

Calculator Tools for Strategy Planning

Use our financial calculators to optimize your crypto yield strategies:

Investment Return Calculator: Model different DCA frequencies and yield scenarios using our Investment Return Calculator.

Compound Interest Calculator: Calculate the long-term impact of reinvesting staking rewards with our Compound Interest Calculator.

Budget Calculator: Determine appropriate DCA amounts and yield targets with our Budget Calculator.

Conclusion: Building Sustainable Crypto Yield

Advanced cryptocurrency investment strategies offer significant opportunities for enhanced returns through staking, yield generation, and optimized dollar-cost averaging. However, success requires careful attention to risk management, tax implications, and security practices.

The key principles for sustainable crypto yield generation include:

- Start Conservatively: Begin with established staking networks and regulated platforms

- Diversify Extensively: Spread risk across platforms, assets, and strategies

- Stay Informed: Regulatory and technological landscapes evolve rapidly

- Maintain Security: Never compromise security for yield

- Plan for Taxes: Understand and prepare for tax implications in your jurisdiction

Remember that while yield generation can significantly enhance your crypto returns, the underlying volatility of cryptocurrency markets remains the primary driver of portfolio performance. Always maintain appropriate position sizing within your overall investment portfolio.

Coming Next: In Part 3 of our cryptocurrency series, we’ll explore “DeFi Fundamentals: Lending, Liquidity, and Risk Management,” where we’ll dive into decentralized finance protocols, liquidity providing, and advanced risk assessment techniques.

The information provided in this article is for educational purposes only and should not be considered as personalized financial advice. Cryptocurrency investments and yield generation strategies carry significant risks, including the potential for total loss. Tax implications vary by jurisdiction and individual circumstances. Consider consulting with qualified financial and tax professionals before implementing these strategies.