Albert Einstein reportedly called compound interest “the eighth wonder of the world,” saying “He who understands it, earns it; he who doesn’t, pays it.” Whether or not Einstein actually said this, the sentiment is absolutely true – compound interest is one of the most powerful forces in personal finance.

What is Compound Interest?

Compound interest is interest earned on both your initial investment (principal) and the interest that has already been added to your account. Unlike simple interest, which only earns returns on your original investment, compound interest creates a snowball effect where your money grows exponentially over time.

Simple vs. Compound Interest Example

Simple Interest:

- Initial investment: $1,000

- Interest rate: 5% annually

- After 10 years: $1,000 + ($1,000 × 5% × 10 years) = $1,500

Compound Interest:

- Initial investment: $1,000

- Interest rate: 5% annually, compounded annually

- After 10 years: $1,000 × (1.05)^10 = $1,628.89

The difference? $128.89 in extra growth just from compounding, and this gap grows dramatically over longer periods.

The Magic of Time: Compounding in Action

The true power of compound interest becomes apparent over longer time periods. Let’s look at a more dramatic example:

Investment Scenario:

- Monthly contribution: $500

- Annual return: 7%

- Time periods compared: 10 years vs. 30 years

10-Year Results:

- Total contributions: $60,000

- Final balance: $82,846

- Interest earned: $22,846

30-Year Results:

- Total contributions: $180,000

- Final balance: $612,433

- Interest earned: $432,433

The 20 extra years tripled your contributions but increased your interest earnings by nearly 20 times!

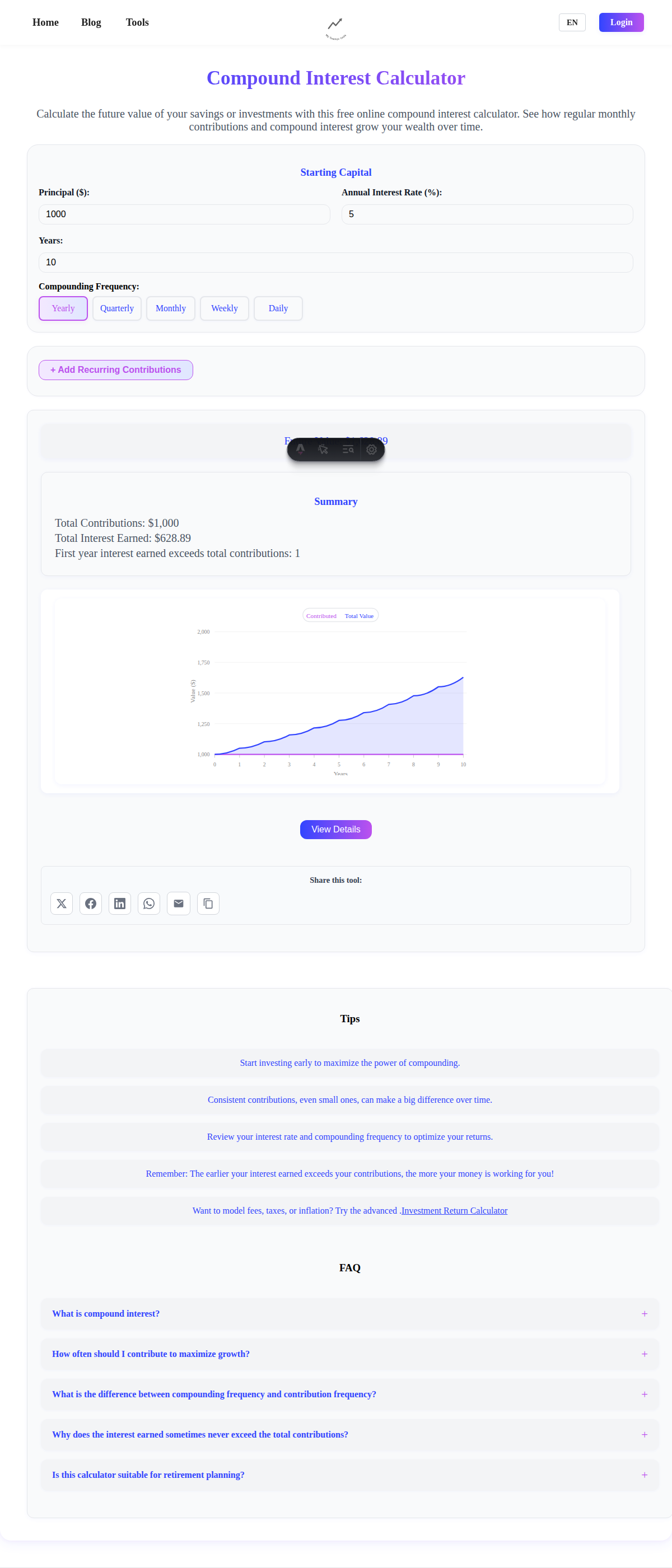

Try these calculations yourself with our compound interest calculator to see how different scenarios affect your wealth building.

The Four Factors That Affect Compound Growth

1. Principal (Starting Amount)

The more you start with, the more you’ll end up with. However, don’t let a small starting amount discourage you – time can compensate for a modest beginning.

2. Interest Rate (Rate of Return)

Higher returns lead to dramatically more wealth over time. A 2% difference in returns can mean hundreds of thousands more in retirement savings.

Example over 30 years with $500/month:

- 5% return: $416,129

- 7% return: $612,433

- 9% return: $917,433

3. Time Horizon

Time is the most crucial factor. Starting early, even with small amounts, often beats starting later with larger amounts.

The Power of Starting Early:

- Person A: Invests $200/month starting at age 25, stops at 35 (only 10 years)

- Person B: Invests $200/month starting at age 35, continues until 65 (30 years)

- Both earn 7% annually

Results at age 65:

- Person A: $367,546 (total invested: $24,000)

- Person B: $244,977 (total invested: $72,000)

Person A invested $48,000 less but ended up with $122,569 more!

4. Compounding Frequency

How often interest is calculated and added to your balance matters:

- Annually: 1 time per year

- Semi-annually: 2 times per year

- Quarterly: 4 times per year

- Monthly: 12 times per year

- Daily: 365 times per year

$10,000 at 5% for 10 years:

- Annual compounding: $16,289

- Monthly compounding: $16,470

- Daily compounding: $16,487

While the difference isn’t huge, every bit helps over long periods.

Where to Find Compound Interest

Investment Accounts

- Stock market investments (historical average ~10% annually)

- Index funds and ETFs (lower fees, diversified)

- Mutual funds (professionally managed)

- 401(k) and IRA accounts (tax advantages)

Savings Accounts

- High-yield savings accounts (currently 4-5% APY)

- Certificates of Deposit (CDs) (fixed rates for guaranteed periods)

- Money market accounts (higher yields with some restrictions)

Bonds and Fixed Income

- Corporate bonds (higher yields, more risk)

- Government bonds (lower yields, very safe)

- Bond funds (diversified bond investments)

Strategies to Maximize Compound Growth

1. Start as Early as Possible

Even $25/month starting in your early 20s can grow to substantial wealth by retirement. Don’t wait for the “perfect” amount to start investing.

2. Automate Your Investments

Set up automatic transfers to investment accounts. You can’t spend what you don’t see, and you’ll never miss a contribution.

3. Increase Contributions Over Time

Raise your investment amount by 1% annually or whenever you get a raise. This “pay yourself first” approach accelerates wealth building.

4. Minimize Fees and Taxes

- Choose low-cost index funds (expense ratios under 0.2%)

- Use tax-advantaged accounts (401k, IRA, Roth IRA)

- Avoid frequent trading and high-fee products

5. Stay Invested During Market Volatility

Market crashes can be scary, but they’re also opportunities. Continuing to invest during downturns means you’re buying more shares at lower prices.

6. Reinvest All Dividends and Interest

Don’t spend the returns – reinvest them to amplify the compounding effect.

Common Compound Interest Mistakes

1. Starting Too Late

Every year you delay investing costs you thousands in potential compound growth. Start with whatever you can afford now.

2. Trying to Time the Market

Time in the market beats timing the market. Consistent investing through all market conditions historically produces better results than trying to buy low and sell high.

3. Cashing Out Early

Withdrawing from investment accounts stops the compounding process and often incurs penalties and taxes.

4. Paying High Fees

A 1% higher fee doesn’t sound like much, but over 30 years it can cost you 20% or more of your total returns.

5. Not Maximizing Employer Matches

If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s free money that immediately boosts your compound growth.

Compound Interest Working Against You

Remember, compound interest works both ways. When you carry debt, especially high-interest debt like credit cards, you’re paying compound interest instead of earning it.

Credit Card Debt Example:

- Balance: $5,000

- Interest rate: 18% APY

- Minimum payment: $100/month

- Time to pay off: 94 months

- Total interest paid: $4,311

This is why it’s crucial to pay off high-interest debt before focusing on investing.

Real-World Compound Interest Success Stories

Warren Buffett’s Berkshire Hathaway

From 1965 to 2021, Berkshire Hathaway stock has compound at about 20% annually, turning $1,000 into over $27 million.

The S&P 500 Index

A $1,000 investment in an S&P 500 index fund in 1993 would be worth approximately $8,000 today (about 7.5% annual compound growth).

Your Future Self

The most important success story is the one you haven’t written yet. Starting today with consistent investing can create substantial wealth over time.

Getting Started: Your Compound Interest Action Plan

Step 1: Calculate Your Current Situation

Use our compound interest calculator to see how your current savings and investment timeline will grow.

Step 2: Open Investment Accounts

- Emergency fund: High-yield savings account

- Long-term investing: Low-cost brokerage account or robo-advisor

- Retirement: 401(k) through employer, IRA for additional savings

Step 3: Automate Everything

Set up automatic transfers and investments so compound interest can work without you having to think about it.

Step 4: Increase Over Time

Plan to increase your investment rate annually, especially after raises or bonuses.

Step 5: Stay the Course

Compound interest requires patience. Resist the urge to constantly check balances or make emotional investment decisions.

Tools to Track Your Progress

Free Calculators:

- Compound Interest Calculator - Basic compound growth projections

- Investment Return Calculator - Advanced scenarios with fees and inflation

- Savings Goal Calculator - Plan specific financial goals

Investment Platforms:

- Fidelity, Vanguard, Schwab - Low-cost brokerages

- Betterment, Wealthfront - Robo-advisors for beginners

- Personal Capital - Free portfolio tracking

The Bottom Line

Compound interest is your most powerful wealth-building tool, but it requires two key ingredients: time and consistency. The earlier you start and the more consistently you invest, the more dramatic your results will be.

Don’t wait for the perfect moment or amount to start investing. Begin today with whatever you can afford, automate the process, and let compound interest work its magic. Your future self will thank you.

Ready to see compound interest in action? Use our free compound interest calculator to model different scenarios and discover how small, consistent investments can grow into life-changing wealth.