Advanced Crypto Portfolio Optimization and Market Analysis

This is Part 4, the final installment of our comprehensive cryptocurrency series. Read Part 1: Cryptocurrency Basics, Part 2: Investment Strategies, and Part 3: DeFi Fundamentals for complete foundational knowledge.

After mastering the fundamentals, investment strategies, and DeFi protocols, the final step in sophisticated cryptocurrency investing is optimization and market analysis. This advanced guide covers on-chain metrics interpretation, market cycle analysis, systematic rebalancing strategies, and intelligent profit-taking techniques that can significantly enhance long-term portfolio performance.

Unlike traditional assets, cryptocurrency markets provide unprecedented transparency through blockchain data, enabling sophisticated analysis that was previously impossible. However, this wealth of data requires careful interpretation and systematic application to avoid information overload and emotional decision-making.

Understanding On-Chain Metrics

Fundamental On-Chain Indicators

On-chain metrics analyze blockchain transaction data to provide insights into network health, adoption, and market sentiment beyond simple price movements.

Network Value to Transactions (NVT) Ratio:

- Similar to P/E ratio for stocks

- High NVT may indicate overvaluation

- Formula: Market Cap / Daily Transaction Volume

- Useful for identifying bubble conditions

Realized Cap vs Market Cap:

- Realized cap weights each coin by its last transaction price

- Market cap divided by realized cap shows if holders are in profit

- Values above 3.0 historically indicate bubble territory

Exchange Flows:

- Large inflows often precede selling pressure

- Large outflows suggest accumulation for holding

- Monitor both absolute amounts and exchange reserves

Active Addresses and Transaction Count:

- Growing active addresses indicate adoption

- Declining metrics may signal reduced interest

- Important to normalize for price movements

Bitcoin-Specific Metrics

Stock-to-Flow Model:

- Measures scarcity by comparing existing supply to new production

- Historically correlated with price cycles

- Less reliable post-2021 but still referenced

MVRV (Market Value to Realized Value):

- Shows average profit/loss of all Bitcoin holders

- MVRV > 3.7 historically indicates cycle tops

- MVRV < 1.0 suggests cycle bottoms

Puell Multiple:

- Daily coin issuance value / 365-day moving average

- Values > 4.0 indicate potential cycle peaks

- Values < 0.5 suggest potential bottoms

Difficulty Ribbon:

- Multiple moving averages of mining difficulty

- Compression indicates miner capitulation

- Expansion suggests network health

Ethereum-Specific Metrics

Gas Usage and Fees:

- High gas fees indicate network demand

- Sustained low usage may signal bear market

- Important for DeFi activity assessment

ETH Staked Percentage:

- Higher staking reduces liquid supply

- Monitors adoption of Proof-of-Stake

- Affects available supply for trading

DeFi TVL (Total Value Locked):

- Measures capital deployed in DeFi protocols

- Growth indicates ecosystem expansion

- Decline may signal market retreat

Market Cycle Analysis

Understanding Crypto Market Cycles

Cryptocurrency markets exhibit cyclical behavior driven by adoption waves, regulatory clarity, technological improvements, and macroeconomic factors.

Typical Cycle Phases:

-

Accumulation (6-18 months):

- Prices consolidate at lower levels

- Institutional buying increases

- Media attention minimal

- Strong hands accumulate from weak hands

-

Mark-Up (6-12 months):

- Prices begin sustained upward movement

- Media coverage increases

- New investors enter market

- FOMO (Fear of Missing Out) builds

-

Distribution (3-6 months):

- Prices reach euphoric highs

- Mainstream media coverage peaks

- New investors flood the market

- Smart money begins selling to newcomers

-

Mark-Down (6-18 months):

- Prices decline rapidly then slowly

- Media coverage turns negative

- Panic selling and despair

- Weak hands sell to strong hands

Historical Cycle Patterns

Bitcoin Halving Cycles:

- Historically, major bull runs follow halving events

- Next halving: 2028 (approximately)

- Pattern may weaken as market matures

- Still influential for long-term planning

Altcoin Seasons:

- Periods when altcoins outperform Bitcoin

- Usually occur during Bitcoin consolidation phases

- Often preceded by Bitcoin dominance reaching extremes

- Important for portfolio allocation timing

Macro-Economic Integration

Correlation with Traditional Markets:

- Crypto increasingly correlates with tech stocks

- Fed policy and interest rates impact crypto

- Inflation concerns can drive crypto adoption

- Monitor traditional market indicators

Regulatory Cycle Impact:

- Regulatory clarity often drives adoption waves

- FUD (Fear, Uncertainty, Doubt) can extend bear markets

- Elections and policy changes affect sentiment

- Global regulatory coordination increasing

Advanced Portfolio Rebalancing Strategies

Dynamic Allocation Models

Traditional static allocation (e.g., 60/40 stocks/bonds) doesn’t capture cryptocurrency’s volatility and cyclical nature. Advanced strategies adapt allocation based on market conditions.

Momentum-Based Rebalancing:

- Increase crypto allocation during confirmed uptrends

- Reduce allocation during confirmed downtrends

- Use technical indicators like moving averages

- Requires discipline to avoid emotional decisions

Volatility-Adjusted Allocation:

- Reduce crypto allocation when volatility increases

- Increase allocation when volatility normalizes

- Use VIX-equivalent metrics for crypto

- Helps manage portfolio risk during turbulent periods

Market Cycle-Based Allocation:

- Maximum allocation during accumulation phases

- Gradual reduction during mark-up phases

- Minimum allocation during distribution phases

- Increased allocation during mark-down phases

Multi-Asset Crypto Rebalancing

Correlation-Based Rebalancing:

- Monitor correlations between crypto assets

- Rebalance when correlations reach extremes

- Diversify across uncorrelated assets

- Adjust based on market regime changes

Risk Parity Approaches:

- Allocate based on risk contribution, not dollar amounts

- Volatile assets get smaller allocations

- More stable assets get larger allocations

- Regular rebalancing maintains target risk levels

Momentum and Mean Reversion Hybrid:

- Allow momentum strategies during strong trends

- Apply mean reversion during ranging markets

- Use technical indicators to identify regime changes

- Combine systematic rules with discretionary judgment

Rebalancing Frequency Optimization

Calendar-Based Rebalancing:

- Monthly: Good balance of costs vs. benefits

- Quarterly: Lower costs, suitable for large portfolios

- Annual: Minimal costs but may miss opportunities

- Choose based on portfolio size and transaction costs

Threshold-Based Rebalancing:

- Rebalance when allocations deviate by 5-10%

- Higher thresholds for volatile assets

- Lower thresholds for stable assets

- Combine with maximum time limits

Volatility-Adjusted Frequency:

- More frequent rebalancing during high volatility

- Less frequent during low volatility periods

- Use volatility indicators to determine timing

- Helps capture volatility-driven opportunities

Systematic Profit-Taking Strategies

Percentage-Based Strategies

Fixed Percentage Method:

- Sell fixed percentage at predetermined price levels

- Example: 20% at 2x, 30% at 5x, 50% at 10x

- Simple to implement and emotionally manageable

- May miss optimal exit points but ensures profits

Fibonacci Retracement Levels:

- Take profits at 38.2%, 50%, and 61.8% retracements

- Based on technical analysis principles

- Combines mathematical precision with market psychology

- Useful for swing trading and position management

Logarithmic Scale Targets:

- Set targets on logarithmic charts for long-term holds

- Accounts for diminishing returns at higher valuations

- Better suited for mature cryptocurrencies

- Helps avoid premature exits during exponential growth

Time-Based Strategies

Calendar Rebalancing with Profit-Taking:

- Take profits during scheduled rebalancing

- Systematic approach reduces emotional decisions

- Can be combined with tax optimization

- Works well with long-term investment strategies

Seasonal Patterns:

- Historical patterns show stronger Q4 performance

- “Sell in May and go away” less reliable for crypto

- Consider year-end tax planning implications

- Combine with fundamental analysis for best results

Cycle-Based Timing:

- Increase selling during distribution phases

- Minimal selling during accumulation phases

- Use multiple indicators to confirm cycle phase

- Requires patience and discipline to execute

Market-Condition Strategies

Euphoria Indicators:

- Social media sentiment extremely bullish

- Mainstream media coverage peaks

- New investors entering rapidly

- Perfect time for systematic selling

Fear and Greed Index Integration:

- Sell when greed reaches extreme levels

- Buy when fear reaches extreme levels

- Use as confirmation rather than primary signal

- Combine with other technical and fundamental analysis

Volatility-Based Exits:

- Increase selling during high volatility periods

- Reduce selling during low volatility periods

- Use trailing stops during volatile conditions

- Adjust position sizes based on volatility regime

Tax-Efficient Portfolio Management

Harvest Loss Strategies

Tax-Loss Harvesting:

- Realize losses to offset gains

- No wash sale rules for crypto in many jurisdictions

- Maintain market exposure through similar assets

- Time harvesting around year-end for maximum benefit

Strategic Loss Realization:

- Plan loss harvesting around major portfolio changes

- Use losses to offset DeFi yield income

- Consider holding period implications

- Coordinate with overall tax planning strategy

Geographic Tax Optimization

Cross-Border Considerations:

- Different countries treat crypto differently

- Some jurisdictions offer tax-advantaged structures

- Professional advice essential for optimization

- Compliance requirements vary significantly

Timing Strategies by Jurisdiction:

- Long-term vs. short-term holding periods

- Income vs. capital gains treatment

- Staking and DeFi yield implications

- International reporting requirements

Risk Management and Portfolio Protection

Downside Protection Strategies

Systematic Stop Losses:

- Trailing stops during uptrends

- Fixed stops during downtrends

- Volatility-adjusted stop distances

- Position size adjustments based on stops

Options and Derivatives:

- Put options for portfolio protection

- Futures for hedging large positions

- Covered calls for income generation

- Complex strategies require sophisticated understanding

Correlation Monitoring:

- Monitor correlations with traditional assets

- Adjust portfolio when correlations increase

- Diversify across uncorrelated assets

- Consider macro-economic factors

Position Sizing Optimization

Kelly Criterion Application:

- Mathematical approach to position sizing

- Considers probability of success and payoff ratio

- Helps avoid over-leveraging

- Requires accurate probability estimates

Risk Parity Principles:

- Equal risk contribution from each position

- Smaller positions in volatile assets

- Regular rebalancing to maintain risk balance

- Focus on risk-adjusted returns

Volatility-Based Sizing:

- Inverse relationship between volatility and position size

- Adjust positions as volatility changes

- Maintain consistent portfolio volatility

- Use volatility forecasting models

Performance Measurement and Analysis

Risk-Adjusted Return Metrics

Sharpe Ratio:

- Return per unit of risk

- Compare different crypto investments

- Benchmark against traditional assets

- Consider risk-free rate changes

Maximum Drawdown Analysis:

- Largest peak-to-trough decline

- Important for psychological preparation

- Compare across different time periods

- Use to calibrate position sizes

Calmar Ratio:

- Annual return divided by maximum drawdown

- Better measure for asymmetric return distributions

- Particularly relevant for crypto investments

- Helps evaluate strategy effectiveness

Attribution Analysis

Asset Allocation Impact:

- How much return came from asset selection

- How much from market timing

- Compare to benchmark portfolios

- Identify areas for improvement

Rebalancing Contribution:

- Measure value added by rebalancing

- Compare different rebalancing strategies

- Account for transaction costs

- Optimize frequency and thresholds

Strategy Performance Breakdown:

- DCA performance vs. lump sum

- Active vs. passive management

- Various profit-taking strategies

- Learn from both successes and failures

Tools and Resources for Advanced Analysis

On-Chain Analytics Platforms

Glassnode:

- Comprehensive on-chain metrics

- Professional-grade analysis tools

- Custom alerts and notifications

- Historical data for backtesting

CryptoQuant:

- Exchange flow analysis

- Miner behavior tracking

- Institutional activity monitoring

- API access for automated strategies

Messari:

- Fundamental analysis focus

- Protocol financial metrics

- Research reports and insights

- Standardized data across projects

Portfolio Management Tools

CoinTracker:

- Automated portfolio tracking

- Tax reporting integration

- Performance analytics

- Multi-exchange connectivity

Blockfolio/FTX App:

- Real-time portfolio monitoring

- News and market data integration

- Price alerts and notifications

- Social features for community insights

Custom Spreadsheets:

- Flexible for unique strategies

- Complete control over calculations

- Integration with calculator tools

- Regular backup and version control

Technical Analysis Software

TradingView:

- Professional charting platform

- Custom indicator development

- Strategy backtesting capabilities

- Social trading and idea sharing

Coinigy:

- Multi-exchange trading interface

- Advanced charting tools

- Portfolio management features

- API integration capabilities

Integration with Overall Investment Strategy

Portfolio Context and Sizing

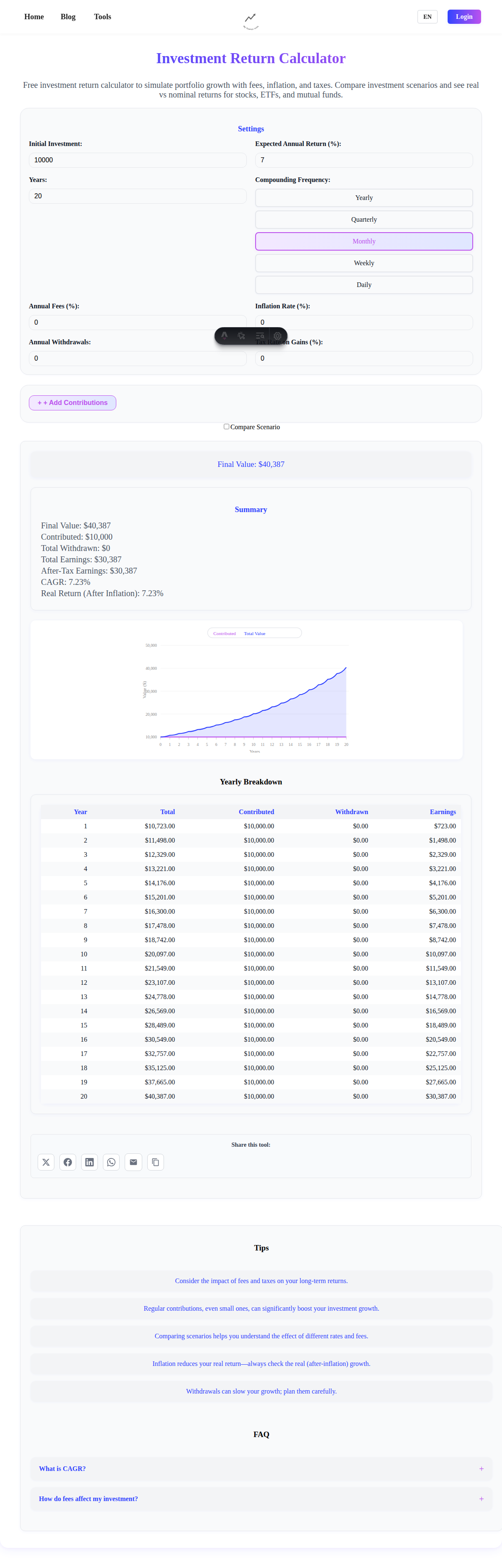

Use our Investment Return Calculator to model how advanced crypto strategies integrate with your overall investment portfolio:

Conservative Integration (5-10% total portfolio):

- Focus on Bitcoin and Ethereum

- Simple rebalancing strategies

- Conservative profit-taking approaches

- Emphasis on risk management

Moderate Integration (10-20% total portfolio):

- Diversified crypto allocation

- Active rebalancing strategies

- Systematic profit-taking

- Some DeFi exposure

Aggressive Integration (20%+ total portfolio):

- Full crypto ecosystem exposure

- Advanced strategies implementation

- Active trading components

- Significant DeFi allocation

Coordination with Traditional Assets

Correlation Management:

- Monitor crypto-stock correlations

- Adjust crypto allocation when correlations increase

- Use crypto as portfolio diversifier

- Consider macro-economic factors

Rebalancing Coordination:

- Coordinate crypto and traditional rebalancing

- Tax-efficient cross-asset harvesting

- Maintain overall portfolio risk targets

- Consider transaction costs across asset classes

Future-Proofing Your Crypto Strategy

Adapting to Market Evolution

Institutional Adoption Impact:

- Reduced volatility over time

- Different cycle patterns

- New investment products

- Regulatory framework development

Technology Evolution:

- New blockchain architectures

- Scaling solutions impact

- Central bank digital currencies

- Cross-chain interoperability

Market Structure Changes:

- Traditional finance integration

- Derivative market development

- Market making improvements

- Regulatory standardization

Continuous Learning and Adaptation

Strategy Evolution:

- Regular strategy reviews and updates

- Backtesting with new data

- Learning from market changes

- Adapting to new opportunities

Risk Management Updates:

- New risk factors identification

- Updated correlation assumptions

- Regulatory change adaptation

- Technology risk assessment

Performance Optimization:

- Transaction cost minimization

- Tax efficiency improvements

- Tool and platform updates

- Process automation where possible

Building Your Advanced Implementation Plan

Phase 1: Foundation (Months 1-2)

- Set up advanced analytics tools

- Establish performance measurement systems

- Create systematic rebalancing rules

- Implement basic profit-taking strategies

Phase 2: Optimization (Months 3-6)

- Refine rebalancing based on experience

- Implement on-chain analysis integration

- Develop tax-efficient strategies

- Begin advanced risk management

Phase 3: Mastery (Months 6+)

- Fully systematic approach implementation

- Regular strategy review and optimization

- Integration with overall financial planning

- Teaching and sharing experiences

Key Success Factors

Discipline and Consistency:

- Stick to systematic approaches

- Avoid emotional decision-making

- Regular review and adjustment

- Patient long-term perspective

Continuous Education:

- Stay updated on market developments

- Learn from both successes and failures

- Engage with knowledgeable communities

- Adapt strategies based on new information

Risk Management Priority:

- Capital preservation over profit maximization

- Appropriate position sizing

- Diversification across strategies and assets

- Regular stress testing of approaches

Conclusion: Mastering Advanced Crypto Portfolio Management

Advanced cryptocurrency portfolio optimization represents the culmination of systematic thinking, disciplined execution, and continuous learning. By integrating on-chain analysis, market cycle awareness, sophisticated rebalancing strategies, and systematic profit-taking approaches, investors can potentially enhance returns while managing the unique risks of cryptocurrency markets.

The key principles for advanced crypto portfolio management include:

- Data-Driven Decisions: Use on-chain metrics and market analysis to inform strategy

- Systematic Approaches: Develop repeatable processes that remove emotion from decisions

- Risk Management First: Prioritize capital preservation and appropriate position sizing

- Continuous Optimization: Regularly review and refine strategies based on performance

- Integration Perspective: Consider crypto within the context of overall portfolio strategy

- Long-Term Focus: Maintain patience and discipline despite short-term market volatility

Remember that even advanced strategies cannot eliminate the inherent risks of cryptocurrency investing. Market conditions can change rapidly, correlations can shift unexpectedly, and new technologies can disrupt existing assumptions. The most sophisticated approach combines systematic methodology with the flexibility to adapt when conditions change.

Series Conclusion: This completes our comprehensive four-part cryptocurrency series, taking you from basic understanding through advanced optimization techniques. Whether you choose to implement simple DCA strategies or sophisticated portfolio optimization approaches, the key to success lies in matching your strategy to your knowledge level, risk tolerance, and investment objectives.

Use our financial calculators to model and optimize your chosen strategies:

- Budget Calculator for determining appropriate crypto allocations

- Investment Return Calculator for strategy comparison and optimization

- Compound Interest Calculator for long-term growth projections

Your cryptocurrency investment journey should be one of continuous learning, disciplined execution, and gradual sophistication as your knowledge and experience grow.

The information provided in this article is for educational purposes only and should not be considered as personalized financial advice. Advanced cryptocurrency strategies involve significant complexity and risk, including the potential for total loss of invested capital. Past performance does not guarantee future results, and market conditions can change rapidly. Consider consulting with qualified financial professionals before implementing sophisticated investment strategies.