Student loan debt affects over 45 million Americans, with the average borrower owing more than $30,000. If you’re feeling overwhelmed by student loan payments that seem to drag on forever, you’re not alone—but you’re also not stuck. There are proven strategies to accelerate your payoff and save thousands in interest.

Building on the debt elimination principles we covered in our debt snowball vs avalanche guide, student loans present unique opportunities and challenges that require specialized strategies.

Understanding Your Student Loan Landscape

Types of Student Loans

Federal Student Loans:

- Direct Subsidized Loans: Government pays interest while in school

- Direct Unsubsidized Loans: Interest accrues from disbursement

- PLUS Loans: Higher limits, higher rates for parents and graduate students

- Perkins Loans: Low-rate loans (discontinued but some still exist)

Private Student Loans:

- Bank/credit union loans: Rates based on creditworthiness

- Variable vs. fixed rates: Different risk profiles

- Limited protections: Fewer forgiveness and deferment options

Key Differences That Affect Payoff Strategy

Federal loan advantages:

- Income-driven repayment plans: Payments based on income

- Forgiveness programs: Public Service Loan Forgiveness (PSLF), teacher forgiveness

- Flexible deferment/forbearance: More options during financial hardship

- Death/disability discharge: Loans forgiven in extreme circumstances

Private loan characteristics:

- Credit-based rates: Can refinance for better terms with good credit

- Fewer protections: Limited payment flexibility

- Co-signer release: May be possible after payment history established

Use our debt payoff calculator to compare how different strategies affect your specific loan portfolio.

Strategy #1: The Extra Payment Power Play

How Extra Payments Accelerate Payoff

The mathematics of extra payments:

- Interest calculation: Daily simple interest on outstanding balance

- Principal reduction: Every extra dollar directly reduces balance

- Compound effect: Lower balance means less daily interest accumulation

Real-world example:

- Loan balance: $25,000 at 6% interest

- Standard 10-year payment: $277/month

- With extra $100/month: $377/month

- Time saved: 2.5 years

- Interest saved: $3,847

Smart Extra Payment Strategies

Target highest interest rate loans first: Following the avalanche method from our debt strategy guide, prioritize loans with rates above 6-7%.

Apply windfalls strategically:

- Tax refunds: Average refund is $2,800—applies to loan principal

- Work bonuses: Even small bonuses can shave months off payoff

- Side hustle income: Designate gig work earnings for loans

- Gifts/inheritance: Consider loan payoff vs. other financial goals

Automate extra payments:

- Bi-weekly payments: 26 payments = 13 monthly payments annually

- Round-up programs: Round monthly payment to nearest $50 or $100

- Automatic increases: Increase payment by $25-50 every six months

When Extra Payments Make the Most Sense

Prioritize extra payments if:

- ✅ You have adequate emergency fund (3-6 months expenses)

- ✅ You’re getting full employer 401(k) match

- ✅ Your loan interest rates exceed 6-7%

- ✅ You have no higher-interest debt (credit cards)

- ✅ You’re not eligible for forgiveness programs

Strategy #2: Refinancing for Better Terms

Student Loan Refinancing Basics

What is refinancing? A private lender pays off your existing loans and issues a new loan with different terms—ideally a lower interest rate.

Potential benefits:

- Lower interest rates: Can reduce from 8%+ to 3-5% with good credit

- Simplified payments: Multiple loans combined into one

- Choose your term: 5, 10, 15, or 20-year options

- Remove co-signers: Some lenders offer co-signer release

What you give up (federal loans only):

- Income-driven repayment plans

- Loan forgiveness programs

- Flexible deferment options

- Interest subsidies (if applicable)

When Refinancing Makes Sense

Ideal refinancing candidates:

- Good credit score: 650+ (better rates with 720+)

- Stable income: Steady employment history

- High interest rates: Current rates above 6-7%

- No forgiveness eligibility: Not pursuing PSLF or other programs

- Private loans: Already lack federal protections

Refinancing rate comparison:

- Original federal loans: 6.8% average

- Refinanced rate: 4.5% (with good credit)

- $50,000 balance: Saves $15,000+ in interest over 10 years

Refinancing Strategies

Rate shopping approach:

- Check rates with multiple lenders: Soft credit pulls won’t hurt score

- Compare total costs: Not just interest rate, but fees and terms

- Consider fixed vs. variable: Variable starts lower but can increase

- Time your application: Apply when credit score is highest

Top refinancing lenders (rates change frequently):

- SoFi: Competitive rates, unemployment protection

- Earnest: Customizable terms, skip-a-payment options

- CommonBond: Good customer service, social impact mission

- Laurel Road: Focused on professionals, competitive rates

Variable vs. fixed rate decision:

- Variable rates: Start 0.5-1% lower, can increase over time

- Fixed rates: Stability and predictability

- Rate environment: Rising rate environment favors fixed, falling rates favor variable

Strategy #3: Employer Student Loan Benefits

Growing Employer Assistance Programs

Types of employer help:

- Direct payment assistance: Employer pays portion of monthly payment

- Lump sum payments: Annual contribution toward loan balance

- Refinancing partnerships: Access to employer-negotiated rates

- Tax-advantaged programs: Some structured to minimize tax impact

Major companies offering assistance:

- Tech companies: Google, Facebook, Microsoft

- Consulting: Deloitte, PwC, EY

- Financial services: Aetna, Fidelity, Goldman Sachs

- Healthcare: Many hospital systems and practices

How to Maximize Employer Benefits

Research your benefits:

- HR consultation: Understand all available programs

- Vesting schedules: Some benefits require employment commitment

- Tax implications: Benefits may be taxable income

- Coordination with other strategies: How benefits work with refinancing

Negotiating for benefits: If your employer doesn’t offer student loan assistance:

- Propose during salary negotiations: Equivalent value to salary increase

- Business case: Employee retention and recruitment advantages

- Tax benefits: Employers can deduct contributions as business expense

Strategy #4: Income-Driven Repayment Optimization

Federal Income-Driven Plans

Income-Based Repayment (IBR):

- Payment: 10-15% of discretionary income

- Term: 20-25 years

- Forgiveness: Remaining balance forgiven after term

Pay As You Earn (PAYE):

- Payment: 10% of discretionary income

- Cap: Never more than standard 10-year payment

- Term: 20 years

Revised Pay As You Earn (REPAYE):

- Payment: 10% of discretionary income

- No payment cap: Can exceed standard payment if income is high

- Interest subsidy: Government pays portion of unpaid interest

Income-Contingent Repayment (ICR):

- Payment: 20% of discretionary income or fixed 12-year payment

- Term: 25 years

- Availability: All federal loans eligible

Strategic Use of Income-Driven Plans

When income-driven plans make sense:

- Temporary low income: Recent graduation, job search, career change

- High debt-to-income ratio: Payments would be unmanageable otherwise

- PSLF pursuit: Required for Public Service Loan Forgiveness

- Cash flow management: Free up money for other financial priorities

Potential drawbacks:

- Longer repayment: More interest paid over time

- Tax bomb: Forgiven balance may be taxable income

- Annual recertification: Must update income information yearly

- Negative amortization: Balance may grow if payments don’t cover interest

Income-Driven Plan Optimization

Strategies to minimize total cost:

- Make extra payments to principal: When financially able

- Target highest rate loans: If you have multiple loan types

- Plan for tax implications: Save for potential forgiveness tax bill

- Annual recertification timing: File right after low-income periods

Strategy #5: Public Service Loan Forgiveness (PSLF)

PSLF Program Details

Eligibility requirements:

- Employment: Full-time with qualifying employer (government, 501(c)(3) nonprofit)

- Loan type: Direct federal loans only

- Payment plan: Income-driven repayment plan required

- Payment count: 120 qualifying monthly payments

- Tax treatment: Forgiven amount is not taxable income

Qualifying employers:

- Government: Federal, state, local, tribal

- Nonprofits: 501(c)(3) tax-exempt organizations

- Other nonprofits: Some 501(c)(3) organizations providing public services

- AmeriCorps/Peace Corps: Service years count toward 120 payments

PSLF Strategy Optimization

Maximizing forgiveness amount:

- Choose REPAYE or IBR: Often results in lowest payments

- Minimize AGI: Max out 401(k), HSA, traditional IRA contributions

- File taxes separately: If married, may result in lower payments

- Don’t refinance: Would disqualify from PSLF

PSLF timeline strategy:

- Years 1-3: Focus on qualifying employment and payment plan

- Years 4-7: Optimize income and payment minimization

- Years 8-10: Plan for post-forgiveness financial strategy

- After forgiveness: Redirect payment amounts to other financial goals

Common PSLF Mistakes

Documentation failures:

- Employment certification: Submit annually to track progress

- Payment tracking: Verify qualifying payments with servicer

- Loan consolidation: May reset payment count to zero

Plan selection errors:

- Wrong payment plan: Standard plans don’t maximize forgiveness

- Refinancing mistake: Eliminates PSLF eligibility permanently

Strategy #6: State-Specific Forgiveness and Assistance Programs

State Loan Repayment Programs

Professional-specific programs:

- Healthcare workers: Many states offer loan forgiveness for rural/underserved areas

- Teachers: State-specific programs beyond federal teacher forgiveness

- Lawyers: Programs for public defenders, prosecutors, legal aid attorneys

- STEM professionals: Some states incentivize science and technology careers

Geographic incentive programs:

- Rural development: Loan forgiveness for moving to underserved areas

- Economic development: Programs to attract professionals to specific regions

- Military service: State-specific benefits for National Guard/reserves

Tax Credit and Deduction Programs

State tax benefits:

- Interest deduction: Some states provide additional deduction beyond federal

- Tax credits: Direct credits for student loan payments

- Education savings programs: 529 plans that can be used for loan payments

Example state programs:

- Kansas: Rural opportunity zones loan forgiveness

- Maryland: SmartBuy program for home buyers with student loans

- Louisiana: Various professional loan forgiveness programs

Strategy #7: Tax Optimization Strategies

Student Loan Interest Deduction

Federal tax deduction:

- Maximum deduction: $2,500 per year

- Income limits: Phases out at higher income levels

- Timing strategy: May influence when to pay loans vs. other debt

State tax considerations:

- State deduction: Some states offer additional deductions

- SALT deduction: May affect overall tax strategy

Strategic Tax Planning

Coordinate with retirement savings:

- Traditional IRA/401(k): Reduces AGI for income-driven payment calculations

- Roth vs. Traditional: Consider impact on future loan payments

- HSA contributions: Triple tax advantage plus AGI reduction

Income timing strategies:

- Bonus timing: May want to defer income to minimize loan payments

- Self-employment income: Timing of invoicing/collections

- Capital gains realization: Impact on AGI and payment calculations

Strategy #8: The Psychological and Lifestyle Approach

Behavioral Strategies for Success

Automate everything possible:

- Automatic payments: Often provides 0.25% interest rate reduction

- Separate loan payment account: Keeps loan money separate from spending money

- Round-up programs: Automatically invest “spare change” toward loans

Gamification techniques:

- Progress tracking: Visual representations of payoff progress

- Milestone rewards: Celebrate major balance reductions

- Public commitment: Share goals with friends/family for accountability

Lifestyle Optimization

Housing strategies:

- Live with roommates: Reduce largest expense to accelerate payoff

- House hacking: Rent out rooms to offset housing costs

- Geographic arbitrage: Move to lower cost-of-living area

Income optimization:

- Side hustles: Gig work, freelancing, part-time employment

- Career advancement: Professional development for higher income

- Skills development: Increase earning potential long-term

Expense reduction:

- Temporary lifestyle reduction: Cut non-essential expenses during aggressive payoff

- Meal planning: Significant savings on food costs

- Transportation optimization: Consider car alternatives

Combining Strategies: The Integrated Approach

The Sequential Strategy

Phase 1: Foundation (Months 1-6)

- Build $1,000 emergency fund

- Get full employer 401(k) match

- Research all available programs and benefits

Phase 2: Optimization (Months 6-12)

- Refinance if beneficial

- Enroll in appropriate repayment plan

- Begin extra payments to highest-rate loans

Phase 3: Acceleration (Year 2+)

- Implement lifestyle optimizations

- Apply all windfalls to loans

- Consider advanced strategies based on career path

The Parallel Strategy

Simultaneous approach:

- 20% of extra money: Emergency fund until 6 months expenses

- 60% of extra money: Student loan extra payments

- 20% of extra money: Retirement savings beyond employer match

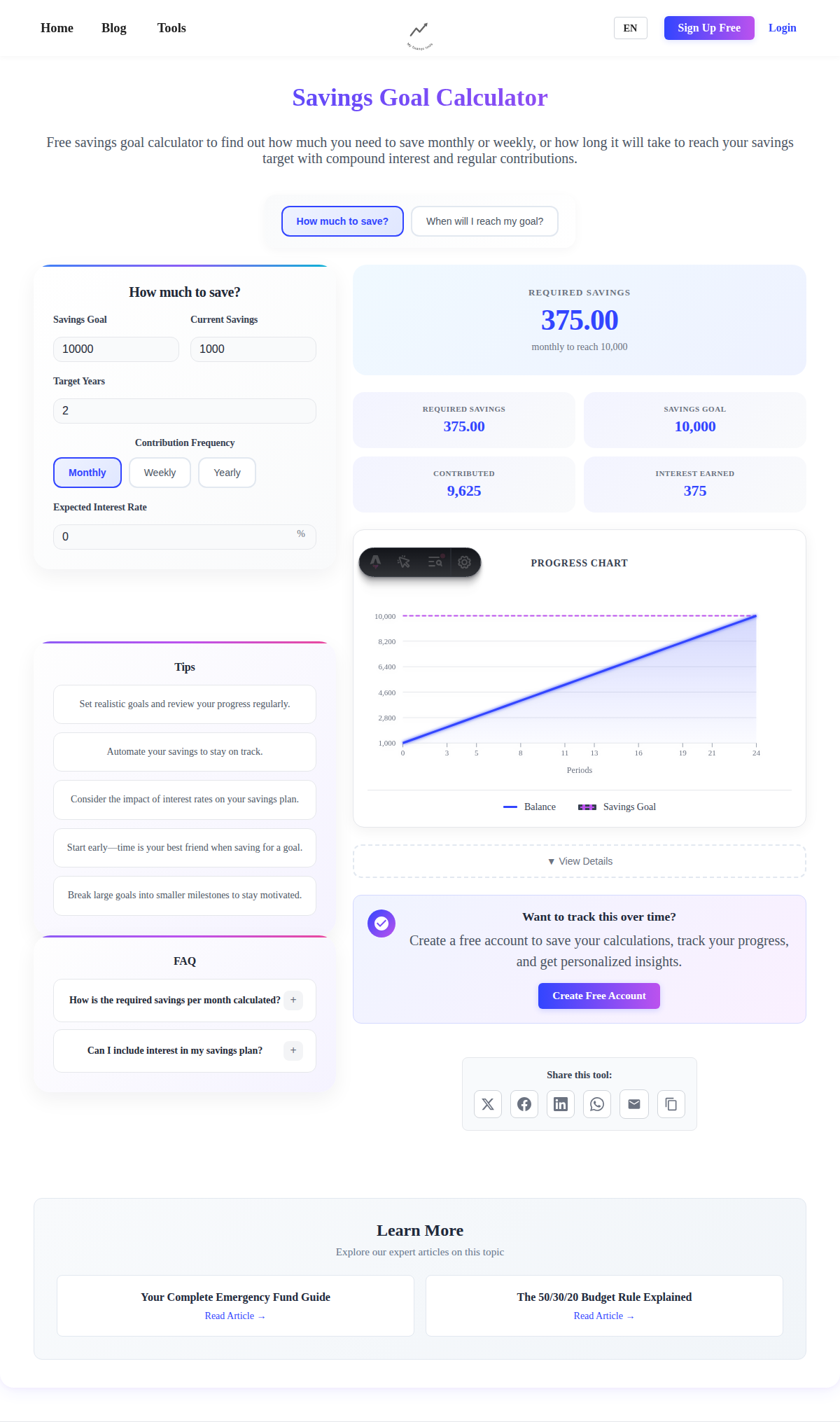

Track your progress with our savings goal calculator to balance loan payoff with other financial goals.

Common Mistakes That Cost Thousands

Mistake #1: Ignoring Interest Rates

Problem: Treating all loans equally regardless of rate Solution: Always prioritize highest-rate loans for extra payments

Mistake #2: Refinancing Without Research

Problem: Refinancing federal loans without understanding lost benefits Solution: Comprehensive analysis of trade-offs before refinancing

Mistake #3: Not Maximizing Employer Benefits

Problem: Leaving money on the table from employer assistance programs Solution: Thorough review of all employee benefits

Mistake #4: PSLF Documentation Failures

Problem: Not properly tracking qualifying payments and employment Solution: Annual employment certification and payment verification

Mistake #5: Lifestyle Inflation

Problem: Increasing spending instead of applying raises to loans Solution: Direct salary increases immediately to loan payments

Decision Framework: Which Strategy Is Right for You?

High-Interest Rate Focus (7%+ rates)

Primary strategy: Extra payments or refinancing Secondary: Employer benefits if available Avoid: Extended repayment plans that increase total interest

Public Service Career Path

Primary strategy: PSLF optimization Secondary: Income-driven repayment minimization Avoid: Refinancing or extra payments that reduce forgiveness

High Income, Good Credit

Primary strategy: Refinancing for lower rates Secondary: Extra payments to principal Timeline: Aggressive 5-7 year payoff

Variable Income or Financial Uncertainty

Primary strategy: Income-driven repayment for flexibility Secondary: Extra payments when income allows Safety net: Maintain larger emergency fund

Recent Graduate, Entry-Level Income

Primary strategy: Income-driven repayment initially Growth strategy: Increase payments as income grows Long-term: Transition to aggressive payoff or refinancing

Tools and Resources

Essential Calculators

- Debt Payoff Calculator: Compare different payoff strategies

- Compound Interest Calculator: See opportunity cost of debt vs. investing

- Savings Goal Calculator: Balance loan payoff with other goals

Government Resources

- Federal Student Aid: Official information on federal programs

- NSLDS: National Student Loan Data System for loan details

- Loan servicer websites: Payment history and plan options

Private Tools and Services

- Student loan refinancing calculators: Compare offers from multiple lenders

- PSLF tracking tools: Help document qualifying payments

- Budgeting apps: Track spending and identify money for loan payments

The Bottom Line

Student loan debt doesn’t have to control your financial future. With the right combination of strategies tailored to your situation, you can eliminate your loans faster and save thousands in interest.

Key takeaways:

- Know your loan types: Federal vs. private loans have different optimal strategies

- Interest rates matter: Focus extra payments on highest-rate loans first

- Employer benefits: Don’t leave money on the table

- PSLF requires planning: If pursuing forgiveness, optimize from day one

- Refinancing trade-offs: Understand what you’re giving up with federal loans

- Automate for success: Remove decision-making from the process

The most important step: Start with any strategy rather than being paralyzed by options. You can always adjust your approach as your situation changes, but the sooner you begin attacking your loans strategically, the more you’ll save.

Whether you choose aggressive extra payments, strategic refinancing, or optimized forgiveness programs, the key is consistency and commitment to your chosen strategy.

Ready to accelerate your student loan payoff? Use our debt payoff calculator to see exactly how different strategies affect your timeline and total interest costs. Small changes in approach can save you years of payments and thousands of dollars.