When you’re drowning in debt, choosing the right payoff strategy can mean the difference between financial freedom and years of unnecessary interest payments. The two most popular debt elimination methods are the debt snowball and debt avalanche strategies, and each has distinct advantages.

What is the Debt Snowball Method?

The debt snowball method focuses on psychological momentum by targeting your smallest debts first, regardless of interest rates.

How it works:

- List all your debts from smallest to largest balance

- Make minimum payments on all debts

- Put any extra money toward the smallest debt

- Once the smallest debt is paid off, roll that payment to the next smallest debt

- Repeat until all debts are eliminated

Debt Snowball Example:

- Credit Card A: $500 (18% APR)

- Credit Card B: $2,000 (22% APR)

- Car Loan: $8,000 (5% APR)

With the snowball method, you’d pay off Card A first, then Card B, then the car loan.

What is the Debt Avalanche Method?

The debt avalanche method prioritizes mathematical efficiency by targeting high-interest debts first.

How it works:

- List all your debts from highest to lowest interest rate

- Make minimum payments on all debts

- Put any extra money toward the highest interest rate debt

- Once the highest rate debt is paid off, roll that payment to the next highest rate

- Continue until debt-free

Debt Avalanche Example:

Using the same debts from above, you’d pay off Card B first (22% APR), then Card A (18% APR), then the car loan (5% APR).

Debt Snowball vs Avalanche: The Real Numbers

Let’s compare both methods using a realistic example:

Your Debts:

- Credit Card 1: $3,000 at 24% APR ($75 minimum)

- Credit Card 2: $5,000 at 18% APR ($125 minimum)

- Personal Loan: $8,000 at 12% APR ($200 minimum)

- Extra payment available: $200/month

Snowball Results:

- Time to debt freedom: 34 months

- Total interest paid: $4,891

- Total payments: $20,891

Avalanche Results:

- Time to debt freedom: 32 months

- Total interest paid: $4,156

- Total payments: $20,156

- Interest savings: $735

Want to run your own numbers? Use our free debt payoff calculator to compare both strategies with your actual debts.

Which Strategy Should You Choose?

Choose Debt Snowball If:

- You need quick psychological wins to stay motivated

- You’ve failed at debt payoff attempts before

- You have many small debts creating mental stress

- The interest rate differences are minimal

- You value simplicity and momentum over mathematical optimization

Choose Debt Avalanche If:

- You’re motivated by saving money on interest

- You can stay disciplined with long-term planning

- You have significant differences in interest rates

- You want the mathematically optimal approach

- You’re comfortable with potentially slower initial progress

The Hybrid Approach: Best of Both Worlds

Some financial experts recommend a modified approach:

- Start with snowball for the first 2-3 smallest debts to build momentum

- Switch to avalanche once you have motivation and see progress

- Target any debt over 20% APR immediately, regardless of balance

This gives you early wins while still optimizing for interest savings on larger, high-rate debts.

Common Debt Payoff Mistakes to Avoid

1. Not Having a Written Plan

Track every debt with balances, rates, and minimum payments. Use a spreadsheet or our debt calculator to visualize your progress.

2. Ignoring Emergency Savings

Save $500-$1,000 for emergencies before aggressively paying debt. Otherwise, you might need to use credit cards for unexpected expenses.

3. Only Making Minimum Payments

Even an extra $25/month can save hundreds in interest and months of payments.

4. Closing Credit Cards Too Early

Keep cards open after paying them off to maintain your credit utilization ratio. Just don’t use them.

5. Not Addressing Root Causes

If overspending got you into debt, create a budget and change spending habits or you’ll end up in debt again.

Accelerating Your Debt Payoff

Increase Your Monthly Payment:

- Side hustle: Freelance, drive for rideshare, sell items

- Reduce expenses: Cancel subscriptions, cook at home, negotiate bills

- Windfalls: Tax refunds, bonuses, gifts toward debt

- Debt consolidation: Lower interest rate loans (if you qualify)

The 50-30-20 Debt Modification:

- 50% needs (rent, utilities, groceries)

- 20% debt payoff (instead of savings)

- 30% wants and minimum savings

Tools to Track Your Progress

Free Resources:

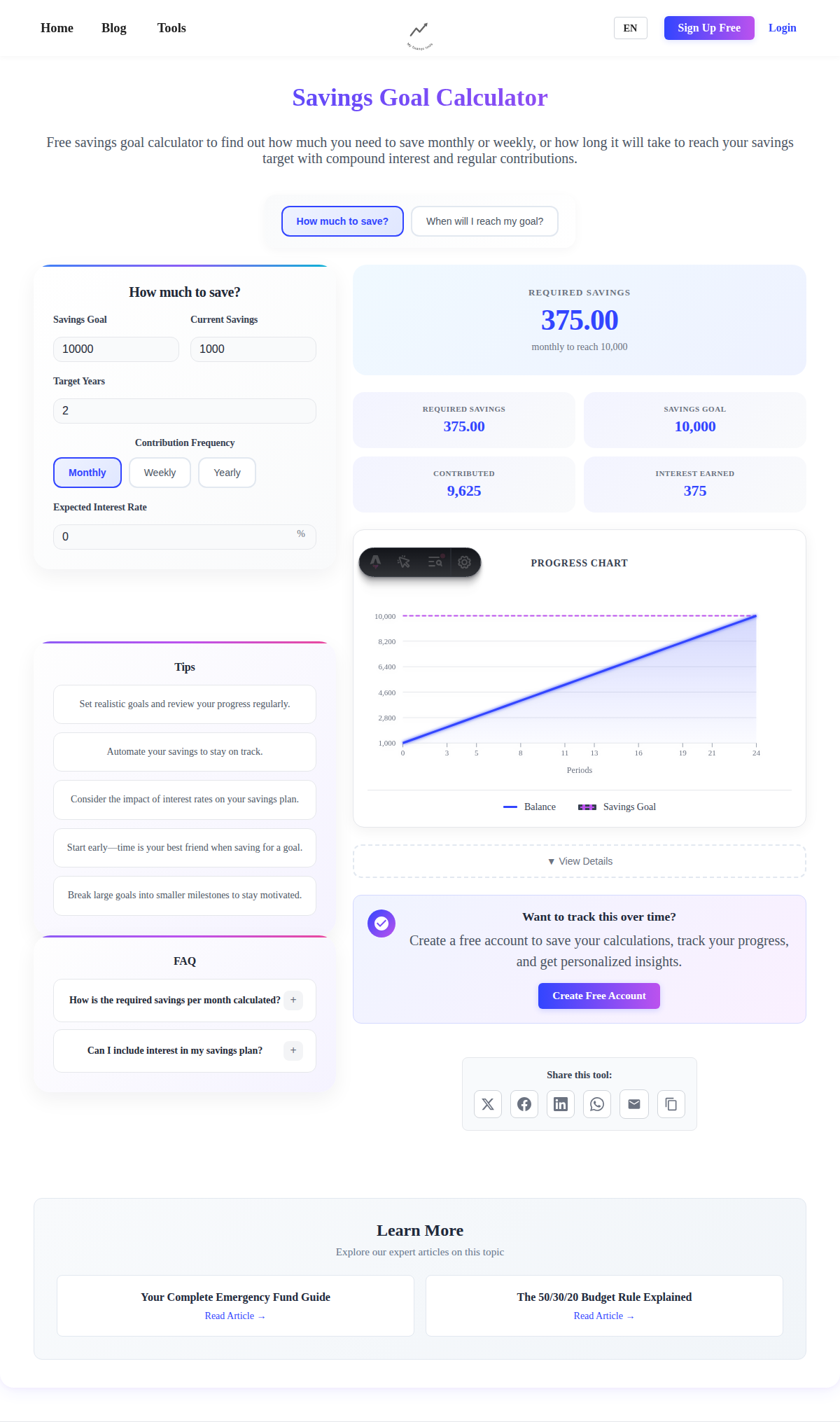

- Debt Payoff Calculator - Compare strategies and see payoff timelines

- Spreadsheet templates - Track payments and progress

- Debt tracking apps - Automate calculations and send reminders

Advanced Planning:

- Compound Interest Calculator - See what you’ll earn once debt-free

- Savings Goal Calculator - Plan your emergency fund

- Budgeting apps - Mint, YNAB, or EveryDollar

The Bottom Line

Both debt snowball and avalanche methods work – the best strategy is the one you’ll actually stick with. The debt avalanche saves more money mathematically, but the debt snowball provides crucial psychological benefits that help many people succeed.

Our recommendation: Start with our debt payoff calculator to see the exact numbers for your situation. If the interest savings from avalanche are significant (over $500), consider that method. If the difference is small, choose snowball for the motivational benefits.

Remember, becoming debt-free is a marathon, not a sprint. The most important step is to start – regardless of which method you choose, you’ll be in a better financial position than doing nothing.

Ready to start your debt-free journey? Try our free debt payoff calculator to create your personalized payoff plan and see exactly when you’ll achieve financial freedom.