The Psychology of Guilt-Free Spending: Why Your Budget Needs a ‘Fun Money’ Category

Here’s a financial truth most budgeting advice won’t tell you: the stricter your budget, the more likely you are to abandon it completely. If you’ve ever stuck to a rigid spending plan for weeks only to blow it on an impulse purchase that left you feeling guilty and defeated, you’re not alone. The solution isn’t more willpower—it’s understanding the psychology of money and building guilt-free spending into your budget from the start.

Successful long-term budgeting isn’t about perfect restriction; it’s about sustainable balance. Just as extreme diets lead to binge eating, extreme budgets lead to spending sprees that can derail months of financial progress. This comprehensive guide will show you why guilt-free spending money isn’t a luxury—it’s a psychological necessity for financial success.

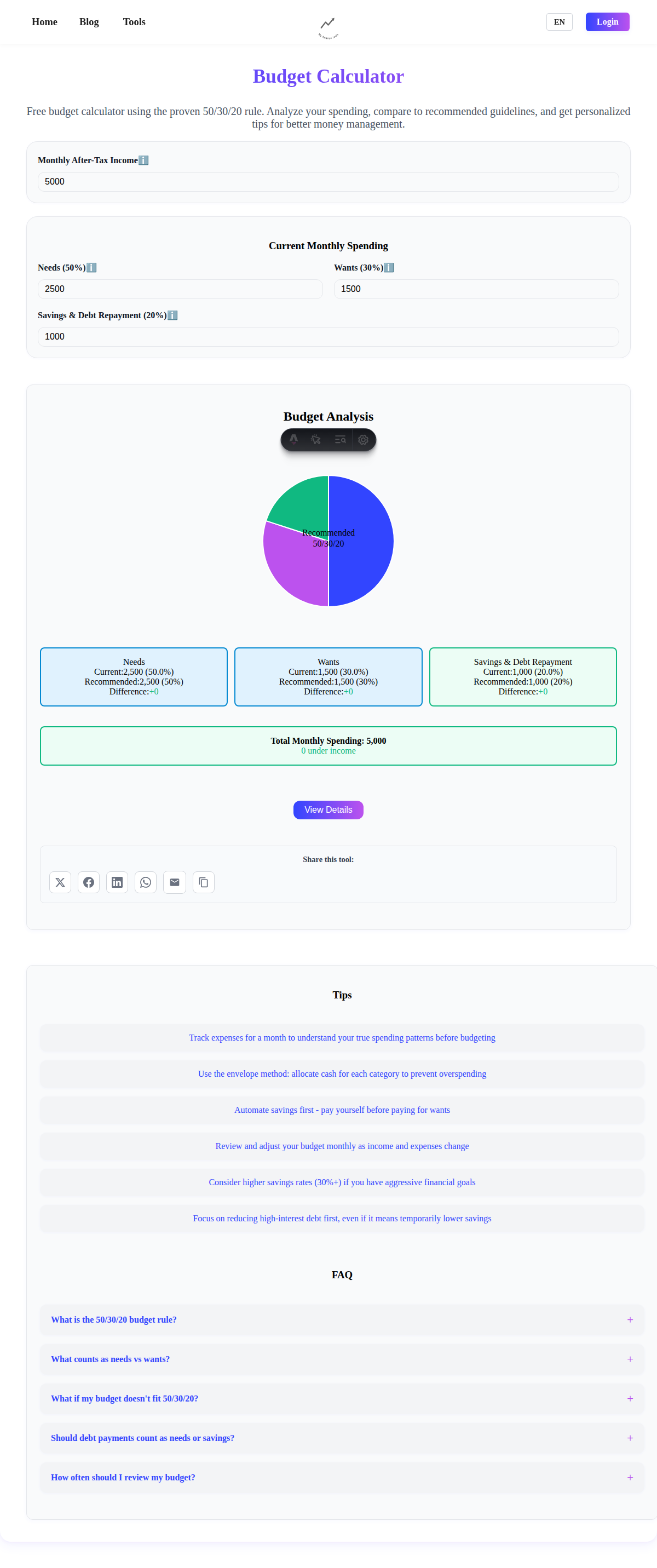

For a deeper understanding of how discretionary spending fits into overall budgeting frameworks, also check out our complete guide to the 50/30/20 budget rule which provides the foundation for balanced financial planning.

Understanding the Psychology of Spending Restriction

Why Restrictive Budgets Fail

The Deprivation Mindset: Research in behavioral psychology shows that extreme restriction often leads to what psychologists call “restraint bias”—the tendency to overestimate our ability to resist temptation. When we completely eliminate discretionary spending, we’re setting ourselves up for eventual failure because we’re fighting against fundamental human psychology.

The All-or-Nothing Trap: Many people approach budgeting with perfectionist thinking: either they follow their budget perfectly, or they’ve failed completely. This black-and-white mentality means that one unplanned purchase can lead to abandoning the entire budget. A $50 impulse buy becomes justification for a $500 spending spree because “the budget is already ruined.”

Financial Stress and Decision Fatigue: Constantly monitoring every dollar and feeling guilty about small purchases creates chronic financial stress. This stress leads to decision fatigue, where our willpower becomes depleted and we make increasingly poor choices. Studies show that people under financial stress make more impulsive decisions and have harder time sticking to long-term goals.

The Neuroscience of Spending

Dopamine and Reward Systems: Our brains are wired to seek rewards, and spending money—especially on things we enjoy—triggers dopamine release. When we completely restrict this natural reward system, we create psychological pressure that eventually seeks release. It’s similar to holding your breath: you can do it for a while, but eventually, biology wins.

The Planning Fallacy: We consistently underestimate how much we’ll want to spend on discretionary items in the future. When creating a budget, we’re in a rational, planning mindset. But in the moment of temptation—seeing a great deal, being out with friends, or feeling stressed—our emotional brain takes over.

Guilt and Shame Cycles: When people spend money outside their restrictive budget, they often experience guilt and shame. These negative emotions can lead to either extreme restriction (as punishment) or continued overspending (because “I’m already bad with money”). Both responses are counterproductive to long-term financial health.

What Is Guilt-Free Spending?

Defining the Concept

Guilt-free spending is money that you deliberately set aside in your budget for purchases that bring you joy, comfort, or spontaneous happiness—without any requirement to justify these expenses as “needs.” This isn’t money for essentials like groceries or bills; it’s money specifically earmarked for things you want rather than need.

Examples of Guilt-Free Spending:

- Coffee shop visits and restaurant meals beyond basic nutrition needs

- Entertainment like movies, concerts, or streaming services

- Hobbies and recreational activities

- Clothing purchases beyond basic wardrobe needs

- Small impulse purchases that make you happy

- Social activities with friends and family

- Travel and experiences

- Books, games, or other leisure items

The Key Principles

1. Predetermined Amount: The money is allocated in advance during your budget planning, not decided in the moment of wanting to spend.

2. No Justification Required: Once the money is allocated, you don’t need to justify individual purchases within this category. The decision to spend has already been made at the budget level.

3. Clear Boundaries: There’s a defined limit that, once reached, means waiting until next month or the next budget period.

4. Separate from Other Categories: This money is distinct from emergency funds, savings goals, or other budget categories.

5. Regular Allocation: Guilt-free spending should be a consistent part of your budget, not something you add only when there’s “extra” money.

The Benefits of Planned Guilt-Free Spending

Psychological Benefits

Reduces Financial Anxiety: Knowing you have money specifically set aside for enjoyment reduces the stress and anxiety that comes with rigid budgeting. You’re not constantly questioning whether you “deserve” to spend money on something fun.

Prevents Budget Rebellion: Just as having a planned “cheat meal” can help people stick to a diet, having planned “fun money” helps people stick to their overall budget. You’re much less likely to overspend in other categories when you know you have legitimate spending money available.

Maintains Motivation: Long-term financial goals like debt payoff or saving for a house can feel overwhelming and abstract. Regular small rewards through guilt-free spending help maintain motivation for these bigger goals by providing immediate positive reinforcement for good financial behavior.

Improves Relationship with Money: Many people develop an unhealthy, stress-filled relationship with money. Guilt-free spending helps normalize money as a tool for both security and enjoyment, leading to a more balanced and sustainable approach to finances.

Practical Benefits

Better Budget Adherence: Studies show that budgets with built-in flexibility are followed more consistently than rigid ones. People who include discretionary spending in their budgets are more likely to stick to their overall financial plan.

Reduced Impulse Spending: Paradoxically, having money specifically allocated for “fun” purchases often reduces overall impulse spending. When you know you have legitimate spending money, you’re less likely to make emotional purchases on credit or by stealing from other budget categories.

Improved Financial Awareness: Tracking guilt-free spending helps you understand your true spending patterns and preferences. You might discover that you consistently overspend on certain categories while underspending on others, leading to better budget allocation over time.

Social and Relationship Benefits: Money stress can strain relationships, especially when partners have different approaches to spending. Having a predetermined amount of guilt-free spending for each person can reduce financial conflicts and allow for individual spending preferences within a shared budget framework.

How Much Should You Allocate for Guilt-Free Spending?

The 50/30/20 Framework Enhanced

The traditional 50/30/20 budgeting rule allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Guilt-free spending typically falls within the “wants” category, but it deserves special consideration within this allocation.

Recommended Guilt-Free Spending Allocations:

Tight Budget (High Debt/Low Income): 2-5% of take-home pay

- Example: $50-125 per month on $2,500 monthly income

- Focus on small, meaningful purchases

- Prioritize experiences over things

- Consider low-cost or free activities

Moderate Budget (Stable Income/Some Debt): 5-10% of take-home pay

- Example: $150-300 per month on $3,000 monthly income

- More flexibility for dining out and entertainment

- Room for occasional larger discretionary purchases

- Can support regular hobbies or subscriptions

Comfortable Budget (Higher Income/Low Debt): 10-15% of take-home pay

- Example: $400-750 per month on $5,000 monthly income

- Significant flexibility for lifestyle purchases

- Can support more expensive hobbies or interests

- Regular dining out and entertainment options

Factors That Influence Your Allocation

Current Financial Priorities:

- High-interest debt should be prioritized over guilt-free spending

- If you lack an emergency fund, consider starting with a smaller allocation

- Major savings goals (house down payment, retirement catch-up) might warrant temporarily reducing fun money

Life Stage and Circumstances:

- Young adults might allocate more to social activities and experiences

- Parents might allocate more to family activities and children’s wants

- Pre-retirees might allocate more to travel and hobbies

- Retirees on fixed incomes might need smaller, more carefully planned allocations

Individual Personality and Values:

- If experiences bring you more joy than things, allocate accordingly

- Consider your natural spending patterns and tendencies

- Account for seasonal variations (holiday shopping, summer activities)

- Think about what purchases historically have brought you the most satisfaction

Geographic and Cultural Considerations

High Cost of Living Areas: Cities like New York, London, or Tokyo might require larger absolute amounts even if the percentage remains the same. A coffee that costs $3 in one city might cost $6 in another.

Cultural Spending Norms:

- Some cultures emphasize social spending and group activities

- Others prioritize individual hobbies or family experiences

- Consider local customs around gift-giving, celebrations, and social expectations

Economic Conditions: During economic uncertainty, you might temporarily reduce guilt-free spending while maintaining the category to preserve the psychological benefits.

Implementing Guilt-Free Spending in Your Budget

Step 1: Assess Your Current Spending

Track Your Discretionary Purchases: For one month, track every purchase that isn’t a necessity. This includes:

- Dining out beyond basic nutrition

- Entertainment and subscriptions

- Clothing beyond replacement needs

- Hobby-related purchases

- Impulse buys

- Social activities

Identify Patterns:

- What types of purchases bring you the most joy?

- When do you tend to overspend (stress, boredom, social situations)?

- Which purchases do you regret, and which feel worthwhile?

- How much are you currently spending on discretionary items?

Calculate Your Baseline: Understanding your current discretionary spending helps you set a realistic guilt-free spending amount. If you’re currently spending $400/month on wants but your budget only allows $200, you’ll need to either increase your income, reduce other expenses, or adjust your expectations.

Step 2: Set Your Guilt-Free Spending Amount

Start Conservative: It’s better to start with a smaller amount and increase it than to start too high and constantly overspend. You can always adjust your budget as you learn more about your spending patterns.

Consider Frequency:

- Weekly allowance: Good for frequent small purchases

- Monthly amount: Better for larger discretionary expenses

- Hybrid approach: Small weekly amount plus larger monthly fund

Account for Irregular Expenses: Some guilt-free spending is seasonal or irregular. Consider setting aside money for:

- Holiday gifts

- Birthday celebrations

- Vacation spending money

- Seasonal activities (summer festivals, winter sports)

Step 3: Create Separate Systems

Physical Separation: Many people find success with physically separating guilt-free spending money:

- Separate savings account

- Cash envelope system

- Prepaid debit card

- Digital envelope apps

Digital Tracking: If you prefer digital management:

- Dedicated category in budgeting apps

- Separate checking account with automatic transfers

- Spreadsheet tracking

- Mobile apps specifically for discretionary spending

Partner Coordination: If you share finances with a partner:

- Each person gets their own guilt-free spending allocation

- Agree on shared entertainment expenses

- Respect each other’s spending choices within allocated amounts

- Consider larger joint discretionary purchases

Step 4: Establish Rules and Boundaries

Clear Guidelines:

- What happens if you underspend in a month (carry over vs. lose it)?

- Can you borrow from next month for a larger purchase?

- How do you handle group gifts or shared experiences?

- What constitutes guilt-free spending vs. other budget categories?

Overspending Protocols: Plan for what happens when you exceed your allocation:

- Wait until next month

- Reduce next month’s allocation by the overage

- Find the money by reducing another discretionary category

- Accept occasional overspending without abandoning the system

Common Implementation Challenges and Solutions

Challenge 1: “I Don’t Have Room in My Budget for Fun Money”

Reality Check: If you truly can’t find money for any discretionary spending, you might need to:

- Increase your income through side work or career advancement

- Reduce fixed expenses (housing, transportation, subscriptions)

- Temporarily reduce savings goals (while maintaining minimum emergency fund)

- Look for free or very low-cost sources of enjoyment

Start Small: Even $25-50 per month can provide psychological benefits. The amount matters less than the concept of having money specifically designated for guilt-free purchases.

Reframe Your Perspective: Guilt-free spending isn’t a luxury—it’s a tool for long-term financial success. If budgeting $50/month for fun helps you stick to your budget and avoid $500 spending sprees, it’s a worthwhile investment.

Challenge 2: Feeling Guilty About Spending “Fun Money”

Address the Root Cause: Guilt about discretionary spending often comes from:

- Childhood messages about money and worthiness

- Comparing your situation to others who have less

- Perfectionist tendencies around financial goals

- General anxiety about financial security

Reframe the Purpose: Remember that guilt-free spending serves important purposes:

- Mental health and stress relief

- Social connections and relationships

- Personal growth and learning

- Motivation to continue good financial habits

Start with Values-Based Spending: If general “fun money” feels frivolous, start with spending that aligns with your values:

- Educational purchases that support learning

- Social activities that strengthen relationships

- Health and wellness activities

- Charitable giving or community support

Challenge 3: Constantly Overspending the Allocation

Examine Your Allocation:

- Is the amount too small for your lifestyle and preferences?

- Are you trying to fund too many different types of wants with too little money?

- Do you need to adjust other budget categories to allow for more discretionary spending?

Identify Triggers:

- Emotional spending during stress or boredom

- Social pressure to spend in group situations

- Lack of planning for predictable wants

- Unclear boundaries about what counts as guilt-free spending

Implement Safeguards:

- Use cash or prepaid cards to create hard limits

- Wait 24-48 hours before purchases over a certain amount

- Find accountability partners or apps that alert you to overspending

- Identify free or low-cost alternatives for common wants

Challenge 4: Partner Disagreements About Discretionary Spending

Communication is Key:

- Discuss different money personalities and backgrounds

- Agree on total household discretionary spending amount

- Respect individual choices within agreed-upon limits

- Regular check-ins about what’s working and what isn’t

Consider Different Approaches:

- Equal amounts for each partner regardless of income

- Proportional amounts based on individual income

- Shared fund for joint activities plus individual allocations

- Alternate months for larger discretionary purchases

Advanced Strategies for Guilt-Free Spending

The Seasonal Approach

Quarterly Planning: Instead of monthly allocations, some people prefer quarterly guilt-free spending budgets. This allows for:

- Larger purchases that might not fit in a monthly budget

- Seasonal activities and experiences

- More flexibility in timing purchases

- Natural alignment with financial planning cycles

Holiday and Special Event Funds: Create separate mini-funds within your guilt-free spending for:

- Gift-giving occasions

- Vacation spending money

- Annual subscriptions or memberships

- Seasonal activities (ski trips, summer festivals)

The 80/20 Rule for Discretionary Spending

80% Planned, 20% Spontaneous: Allocate 80% of your guilt-free spending to planned categories and 20% to true impulse purchases. This provides structure while maintaining flexibility for unexpected opportunities.

Examples: If you have $200/month for guilt-free spending:

- $160 for planned categories (dining out, entertainment, hobbies)

- $40 for pure impulse purchases

Value-Based Allocation

Align with Life Goals: Rather than random discretionary spending, align your guilt-free purchases with broader life values:

- Social connection: dining out, activities with friends

- Personal growth: books, courses, educational experiences

- Physical health: gym memberships, outdoor activities

- Creativity: art supplies, music, crafting materials

- Adventure: travel, new experiences, exploration

The Sinking Fund Method

Saving for Larger Wants: Instead of spending your entire allocation each month, save up for larger discretionary purchases:

- Expensive hobby equipment

- Weekend getaways

- Concert or event tickets

- Seasonal wardobe updates

Multiple Sinking Funds: You might have several concurrent sinking funds:

- $50/month toward annual vacation spending money

- $30/month toward holiday gift fund

- $40/month toward hobby equipment upgrade

Global Perspectives on Discretionary Spending

Cultural Differences in “Fun Money”

Individualistic vs. Collectivistic Cultures:

- Western cultures often emphasize individual discretionary spending

- Many Asian and African cultures prioritize family and community spending

- Latin American cultures often emphasize social and celebration spending

- Scandinavian cultures balance individual enjoyment with social responsibility

Economic Context:

- Developed countries: Higher absolute amounts but similar percentages

- Developing economies: Lower amounts but proportionally similar impact on well-being

- Post-conflict or crisis areas: Emphasis on community and shared experiences

International Budgeting Approaches

European Approach: Many European countries have strong social safety nets, allowing for higher percentages of income to go toward discretionary spending. There’s also cultural emphasis on work-life balance and leisure.

Asian Approach: Traditional emphasis on saving and family support, but growing recognition of mental health benefits of personal spending. Rising middle classes increasingly adopting Western-style discretionary spending.

Nordic Model: High taxes but excellent public services mean discretionary spending often focuses on experiences, travel, and personal development rather than basic security needs.

Guilt-Free Spending for Different Life Stages

Young Adults (20s-30s)

Unique Considerations:

- Lower incomes but fewer financial obligations

- High value on social activities and experiences

- Building lifelong spending habits

- Career development and networking expenses

Recommended Approach:

- Focus on experiences over material purchases

- Prioritize social connections and relationship building

- Consider education and skill-building as discretionary spending

- Start small but be consistent to build healthy money habits

Example Allocation: $150-300/month on $3,000 monthly income

- Social activities: $100

- Personal interests/hobbies: $75

- Clothing and personal care: $50

- Miscellaneous wants: $75

Families with Children

Unique Considerations:

- Individual vs. family discretionary spending

- Teaching children about money and spending

- Balancing adult wants with children’s activities

- Managing increased complexity with multiple family members

Recommended Approach:

- Separate allocations for each adult plus family fun fund

- Include children in age-appropriate money discussions

- Balance individual wants with family experiences

- Consider seasonal variations for school breaks and holidays

Example Allocation: $400-600/month on $5,000 monthly family income

- Each parent: $100/month individual spending

- Family activities: $200/month

- Children’s wants: $100/month

- Seasonal/special events: $100/month

Pre-Retirees (50s-60s)

Unique Considerations:

- Higher incomes but increased pressure to save for retirement

- Desire to enjoy life before retirement limitations

- Potential health considerations affecting activity choices

- Grandchildren and family obligations

Recommended Approach:

- Balance current enjoyment with retirement security

- Focus on experiences that may become difficult later

- Consider travel and adventure while physically able

- Plan for reduced income in retirement

Example Allocation: $500-1,000/month on $7,000 monthly income

- Travel and experiences: $400

- Hobbies and interests: $200

- Social activities: $150

- Personal purchases: $150

- Grandchildren/family: $100

Retirees

Unique Considerations:

- Fixed incomes requiring careful planning

- More time for activities but potentially less energy

- Health considerations may limit some activities

- Desire to enjoy money after years of saving

Recommended Approach:

- Adjust allocations to match retirement income

- Focus on low-cost but meaningful activities

- Consider seasonal patterns and health needs

- Balance personal enjoyment with legacy planning

Example Allocation: $300-500/month on $3,500 monthly retirement income

- Social activities and dining: $150

- Hobbies and crafts: $100

- Travel and day trips: $100

- Personal purchases: $75

- Gifts and family: $75

Technology and Tools for Managing Guilt-Free Spending

Budgeting Apps with Discretionary Categories

Popular Options:

- YNAB (You Need A Budget): Excellent for envelope-style budgeting with specific “fun money” categories

- Mint: Free option with good category tracking and alerts

- PocketGuard: Shows how much you can safely spend after bills and savings

- Goodbudget: Digital envelope system perfect for discretionary spending limits

Key Features to Look For:

- Customizable categories for different types of discretionary spending

- Real-time balance tracking

- Overspending alerts

- Monthly rollover options

- Partner/family sharing capabilities

Cash and Card Strategies

Physical Cash Methods:

- Envelope system for tangible spending limits

- Separate wallet or container for guilt-free money

- Pre-planned cash amounts for specific outings

- Weekly cash allowances

Prepaid Card Approaches:

- Load monthly discretionary amount onto prepaid debit card

- Use separate card for all guilt-free purchases

- Automatic loading to reduce decision fatigue

- Easy tracking through card statements

Bank Account Separation:

- Dedicated checking account for discretionary spending

- Automatic monthly transfers from main account

- Separate debit card linked only to fun money account

- Clear distinction between necessary and discretionary spending

Tracking and Analysis Tools

Expense Tracking:

- Photo receipts for later categorization

- Regular reviews of spending patterns

- Seasonal adjustment tracking

- Value analysis of purchases (satisfaction vs. cost)

Goal Setting:

- Saving toward larger discretionary purchases

- Planning seasonal or annual fun activities

- Tracking progress toward experience goals

- Balancing different types of discretionary spending

Building Long-Term Financial Health with Guilt-Free Spending

Integration with Overall Financial Goals

Emergency Fund First: Before implementing substantial guilt-free spending, ensure you have at least a basic emergency fund. Even $500-1,000 in emergency savings provides security that makes discretionary spending feel more justified.

Debt Considerations:

- High-interest debt (credit cards) should generally be prioritized over large discretionary spending

- Consider smaller guilt-free allocations while aggressively paying down debt

- Avoid using credit for discretionary purchases

- Balance debt payoff motivation with sustainable lifestyle

Savings and Investment Balance:

- Guilt-free spending should complement, not replace, long-term savings

- Consider it part of a balanced financial diet

- Adjust allocations as financial circumstances improve

- Remember that current enjoyment and future security both matter

Teaching and Modeling for Others

Children and Financial Education:

- Include children in family budget discussions (age-appropriately)

- Give children their own small discretionary allowances

- Model thoughtful discretionary spending decisions

- Discuss the difference between wants and needs

- Show how planning enables guilt-free enjoyment

Partner and Family Dynamics:

- Regular family financial meetings including discretionary spending review

- Respect for individual spending preferences within agreed limits

- Joint decisions about large discretionary purchases

- Celebration of financial milestones with planned discretionary spending

Adapting Over Time

Regular Budget Reviews:

- Monthly assessment of discretionary spending effectiveness

- Quarterly adjustments based on lifestyle changes

- Annual review of overall financial priorities

- Flexibility to adapt to changing circumstances

Life Stage Transitions:

- Adjust allocations for major life changes (job loss, promotion, marriage, children)

- Temporary adjustments for financial emergencies

- Planned increases as income grows

- Consideration of changing values and interests

Common Myths and Misconceptions

Myth 1: “Guilt-Free Spending Is Irresponsible”

Reality: Research shows that completely restrictive budgets fail more often than balanced ones. Planned discretionary spending is a tool for long-term financial success, not a sign of poor financial discipline.

The Evidence:

- Studies on diet psychology apply to financial behavior

- Behavioral economics research on restriction and rebound effects

- Financial therapy principles about sustainable money management

- Real-world success rates of different budgeting approaches

Myth 2: “Poor People Can’t Afford Fun Money”

Reality: While lower incomes require smaller absolute amounts, the psychological benefits of any planned discretionary spending apply regardless of income level. Even $25/month can provide significant mental health benefits.

Important Considerations:

- Start with basic needs and emergency fund

- Scale the amount to income level

- Focus on low-cost or free sources of joy

- Recognize that financial stress affects decision-making regardless of income

Myth 3: “You Should Feel Guilty About Spending on Wants”

Reality: Guilt about reasonable discretionary spending often stems from unhealthy money beliefs. Balanced financial planning includes both security and enjoyment.

Addressing Guilt:

- Examine childhood messages about money and worthiness

- Consider cultural and family influences on spending attitudes

- Practice self-compassion around financial decisions

- Seek therapy if money guilt significantly impacts mental health

Myth 4: “Rich People Don’t Need to Budget Fun Money”

Reality: Lifestyle inflation affects people at all income levels. High earners can overspend on discretionary items just as easily as lower earners, potentially compromising their long-term financial security.

High-Income Considerations:

- Larger absolute amounts but same percentage principles apply

- Risk of lifestyle inflation without conscious planning

- Social pressure to spend at higher levels

- Need for intentional allocation even with abundant resources

Measuring Success and Making Adjustments

Key Performance Indicators

Quantitative Measures:

- Percentage of months staying within discretionary spending allocation

- Overall budget adherence rates

- Debt reduction progress (if applicable)

- Savings goal achievement

- Frequency of financial stress or anxiety

Qualitative Measures:

- General satisfaction with spending decisions

- Frequency of spending-related guilt or regret

- Relationship harmony around money (if applicable)

- Sense of financial control and empowerment

- Overall life satisfaction and work-life balance

When to Adjust Your Approach

Increase Allocation When:

- Consistently underspending for several months

- Income increases significantly

- Major financial goals are achieved

- Life circumstances change (promotion, debt payoff)

- Current allocation feels restrictive and causes budget rebellion

Decrease Allocation When:

- Consistently overspending despite good intentions

- Financial emergencies require budget adjustments

- Major expenses arise (home repairs, medical bills)

- Income decreases

- Need to accelerate debt payoff or savings goals

Change Approach When:

- Current system feels too complicated or stressful

- Life stage changes require different spending patterns

- Partner or family dynamics change

- Values and priorities shift over time

- Technology or tools become outdated

Conclusion

Guilt-free spending isn’t about being irresponsible with money—it’s about being realistic about human psychology and creating a sustainable approach to financial management. The most successful long-term budgets are those that account for both our need for security and our need for enjoyment.

Key Takeaways:

- Restriction breeds rebellion: Completely eliminating discretionary spending often leads to larger, more damaging spending sprees

- Small amounts have big impact: Even modest allocations for guilt-free spending can significantly improve budget adherence and financial well-being

- One size doesn’t fit all: The right amount and approach varies based on income, life stage, cultural background, and personal values

- Integration is essential: Guilt-free spending should be part of a comprehensive financial plan, not an afterthought

- Flexibility enables sustainability: The best systems can adapt to changing circumstances while maintaining core principles

Getting Started:

If you’ve never included guilt-free spending in your budget, start small. Even $50 per month specifically designated for purchases that bring you joy can make a significant difference in your relationship with money and your ability to stick to your overall financial plan.

Remember that financial wellness includes both security and satisfaction. A budget that provides for your future while ignoring your present well-being is ultimately unsustainable. By thoughtfully including guilt-free spending in your financial plan, you’re not being frivolous—you’re being strategic about long-term success.

Use our Budget Calculator to experiment with different allocations and see how guilt-free spending fits into your overall financial picture. Start building a budget that you can actually live with, one that provides both security and joy.

The goal isn’t perfect restriction—it’s sustainable balance. Give yourself permission to enjoy your money within planned limits, and watch how this transforms both your budget and your relationship with money.

This article provides general guidance on budgeting and discretionary spending psychology. Individual financial situations vary greatly, and strategies should be adapted to personal circumstances, income levels, and financial goals. Consider consulting with qualified financial professionals for personalized advice.