If you’ve ever felt overwhelmed by complex budgeting methods with dozens of categories and detailed tracking requirements, the 50/30/20 budget rule might be exactly what you need. This simple, intuitive approach to money management has helped millions of people take control of their finances without the complexity of traditional budgeting methods.

As we discussed in our emergency fund guide, having a structured approach to managing your money is crucial for financial security. The 50/30/20 rule provides that structure in the simplest possible way.

What is the 50/30/20 Budget Rule?

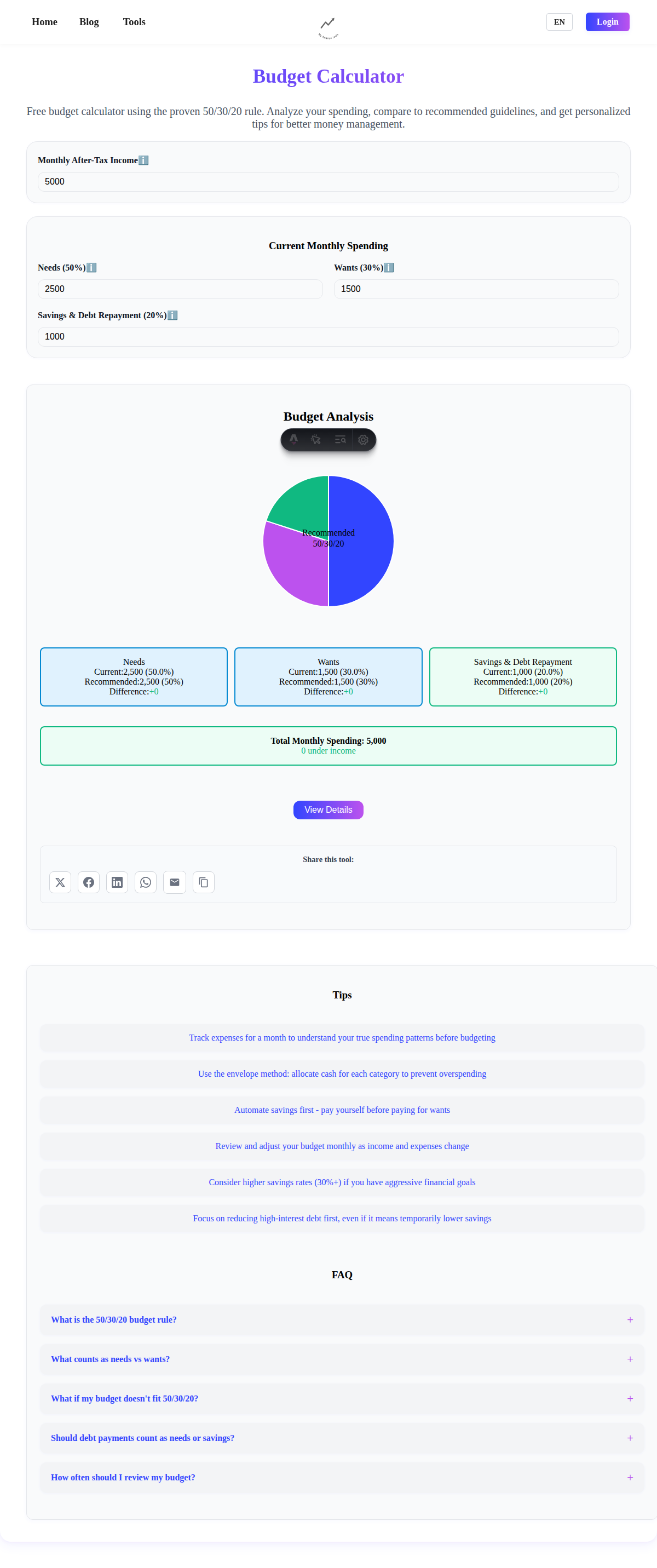

The 50/30/20 budget rule is a straightforward approach to personal finance that divides your after-tax income into three simple categories:

- 50% for Needs: Essential expenses you can’t avoid

- 30% for Wants: Lifestyle choices and discretionary spending

- 20% for Savings and Debt Repayment: Building your financial future

This method was popularized by Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan” and has become one of the most recommended budgeting strategies for beginners.

Why This Rule Works

Simplicity: Only three categories to manage instead of 15-20 Flexibility: Allows for lifestyle spending while prioritizing savings Sustainability: Realistic percentages that most people can maintain long-term Automatic: Once set up, requires minimal ongoing management

Breaking Down Each Category

50% for Needs: Your Essential Expenses

“Needs” are expenses that you absolutely cannot avoid—the costs that would severely impact your life if you didn’t pay them.

True Needs Include:

- Housing: Rent, mortgage payments, property taxes, essential utilities

- Transportation: Car payments, gas, insurance, public transportation, basic maintenance

- Food: Groceries and essential meals (not dining out)

- Insurance: Health, life, disability insurance premiums

- Minimum debt payments: Credit cards, student loans, personal loans

- Basic phone service: Cell phone or landline (basic plan)

- Essential clothing: Work attire, basic seasonal clothing

Not True Needs:

- Premium cable or streaming services

- Gym memberships

- Dining out

- Premium phone plans with unlimited everything

- Brand-name groceries when generics are available

- New clothing when current clothes are adequate

Real-World Example: Monthly after-tax income: $4,000 Maximum for needs: $2,000

- Rent: $1,200

- Car payment + insurance: $350

- Groceries: $300

- Phone (basic plan): $40

- Utilities: $110

- Total needs: $2,000 ✅

30% for Wants: Your Quality of Life Spending

“Wants” are everything that makes life enjoyable but aren’t absolutely necessary for survival or basic functioning.

Common Wants:

- Entertainment: Streaming services, movies, concerts, hobbies

- Dining out: Restaurants, takeout, coffee shops

- Travel: Vacations, weekend trips, travel experiences

- Premium services: Gym memberships, premium phone plans, subscription boxes

- Shopping: Non-essential clothing, gadgets, home décor

- Personal care: Salon visits, spa treatments, premium beauty products

- Social activities: Bars, clubs, social events

The 30% Rule Benefit: This category gives you permission to spend on things you enjoy without guilt, as long as you stay within the limit. It prevents the all-or-nothing mentality that kills many budgets.

Continuing Our Example: Maximum for wants: $1,200 (30% of $4,000)

- Dining out: $400

- Streaming services: $30

- Gym membership: $50

- Clothing/shopping: $300

- Entertainment: $200

- Personal care: $100

- Miscellaneous fun: $120

- Total wants: $1,200 ✅

20% for Savings and Debt Repayment: Your Financial Future

This category is where you build wealth and achieve financial security.

Priority Order for Your 20%:

- Emergency fund: $1,000 starter fund, then 3-6 months of expenses

- High-interest debt payoff: Credit cards, personal loans above 7% interest

- Retirement savings: 401(k) match, then IRA contributions

- Additional debt payoff: Student loans, car loans, mortgage principal

- Long-term goals: House down payment, children’s education, major purchases

Advanced Tip: If you have high-interest debt (above 7-8%), consider temporarily adjusting to 60/20/20 to accelerate debt payoff, then return to 50/30/20 once debt is eliminated.

Completing Our Example: Available for savings/debt: $800 (20% of $4,000)

- Emergency fund: $300

- 401(k) contribution: $320

- Extra credit card payment: $180

- Total savings/debt payments: $800 ✅

Use our salary breakdown calculator to determine your exact after-tax income for budgeting.

How to Implement the 50/30/20 Budget

Step 1: Calculate Your After-Tax Income

For Regular Employees: Look at your pay stub for “net pay” or “take-home pay”—this is your after-tax income.

For Variable Income (Freelancers, Commission):

- Calculate average monthly income over the last 6-12 months

- Use the most conservative estimate

- Adjust quarterly as income patterns become clearer

For Multiple Income Sources: Add up all sources of after-tax income, including side hustles, rental income, or investment dividends.

Step 2: Track Your Current Spending

Before implementing the 50/30/20 rule, spend 2-4 weeks tracking where your money currently goes:

Simple Tracking Methods:

- Bank statements: Review and categorize last month’s expenses

- Apps: Mint, YNAB, Personal Capital, or even a simple spreadsheet

- Receipt method: Save all receipts for two weeks and categorize

Categorization Questions:

- Would I lose my job/home/health if I didn’t pay this? → Need

- Does this bring me joy but isn’t essential? → Want

- Does this build my financial future? → Savings/Debt

Step 3: Adjust Your Spending

Most people find their current spending doesn’t align perfectly with 50/30/20. Here’s how to adjust:

If Your Needs Exceed 50%:

- Housing: Consider a roommate, downsizing, or moving to a less expensive area

- Transportation: Refinance your car loan, use public transport, or carpool

- Food: Shop with a list, use coupons, buy generic brands

- Phone/utilities: Negotiate bills, switch to cheaper plans

If Your Wants Exceed 30%:

- Dining out: Set a weekly limit and stick to it

- Subscriptions: Cancel unused services—average household has $273/month in subscriptions

- Shopping: Implement a 24-hour rule for non-essential purchases

- Entertainment: Look for free or low-cost alternatives

If You’re Not Saving 20%:

- Automate savings: Set up automatic transfers to savings accounts

- Start small: Begin with 10% and increase by 2% every few months

- Use windfalls: Tax refunds, bonuses, gifts go straight to savings

Step 4: Automate Your Budget

Set Up Automatic Systems:

- Direct deposit splitting: Have your paycheck automatically split into checking and savings

- Automatic bill pay: Set up needs payments to happen automatically

- Savings transfers: Automatic weekly or bi-weekly transfers to savings goals

- Investment contributions: Automatic 401(k) and IRA contributions

The One-Account vs. Multiple-Account Approach:

- Single account: Track categories manually or with apps

- Multiple accounts: Separate accounts for needs, wants, and savings (recommended for beginners)

Common 50/30/20 Budget Modifications

The Debt-Heavy Modification (60/20/20)

For those with significant high-interest debt:

- 60% for needs

- 20% for wants

- 20% for savings and aggressive debt payoff

When to use: Credit card debt above $5,000 or debt payments exceeding 15% of income

The High-Saver Modification (50/20/30)

For aggressive savers or those with specific goals:

- 50% for needs

- 20% for wants

- 30% for savings and investments

When to use: Saving for a house, planning early retirement, or naturally low spenders

The Variable Income Modification

For freelancers or commission-based workers:

- Use your lowest income month as the baseline

- Save excess income from good months in a separate “income smoothing” account

- Maintain strict 50/30/20 even during high-income months

The High Cost-of-Living Modification (60/25/15)

For expensive cities like San Francisco or New York:

- 60% for needs (acknowledging higher housing costs)

- 25% for wants

- 15% for savings (temporary—increase as income grows)

Real-World 50/30/20 Examples

Example 1: Recent Graduate

Annual salary: $45,000 Monthly after-tax income: $3,000

-

Needs (50% = $1,500):

- Rent (with roommate): $800

- Car payment + insurance: $300

- Groceries: $250

- Phone: $40

- Utilities: $110

-

Wants (30% = $900):

- Dining out: $300

- Entertainment: $200

- Clothing: $150

- Gym: $50

- Miscellaneous: $200

-

Savings/Debt (20% = $600):

- Student loan payment: $250

- Emergency fund: $200

- 401(k): $150

Example 2: Young Family

Combined annual income: $75,000 Monthly after-tax income: $5,000

-

Needs (50% = $2,500):

- Mortgage + taxes + insurance: $1,400

- Groceries: $500

- Car payments + insurance: $400

- Utilities + phone: $150

- Childcare: $50 (grandparent help)

-

Wants (30% = $1,500):

- Family activities: $400

- Dining out: $300

- Date nights: $200

- Hobbies: $200

- Clothing (family): $200

- Miscellaneous: $200

-

Savings/Debt (20% = $1,000):

- Emergency fund: $300

- 401(k) contributions: $500

- Children’s education fund: $200

Example 3: Mid-Career Professional

Annual salary: $85,000 Monthly after-tax income: $5,500

-

Needs (50% = $2,750):

- Mortgage: $1,800

- Groceries: $400

- Car payment + insurance: $350

- Utilities + phone: $200

-

Wants (30% = $1,650):

- Dining out: $500

- Travel fund: $400

- Entertainment: $300

- Shopping: $250

- Personal care: $200

-

Savings/Debt (20% = $1,100):

- 401(k): $600

- IRA: $500 (maxing out)

Tracking and Maintaining Your 50/30/20 Budget

Monthly Budget Review Process

Week 1 of each month:

- Review previous month’s spending in each category

- Identify areas where you overspent

- Adjust current month’s plan accordingly

Questions to ask:

- Did I stay within each category?

- What unexpected expenses came up?

- Where can I improve this month?

- Am I making progress toward my financial goals?

Using Technology to Track

Free Apps:

- Mint: Automatic categorization and budget tracking

- Personal Capital: Investment tracking plus budgeting

- YNAB (You Need A Budget): Zero-based budgeting with 50/30/20 templates

- Bank apps: Most banks now offer spending categorization

Simple Spreadsheet Method: Create three columns: Needs, Wants, Savings/Debt Track expenses weekly and compare to your limits

Warning Signs Your Budget Needs Adjustment

Red flags:

- Consistently overspending in any category by more than 10%

- Using credit cards to cover needs or wants

- Not contributing anything to savings for 2+ months

- Feeling stressed or deprived about money regularly

- Emergency fund decreasing instead of growing

Beyond the Basics: Advanced 50/30/20 Strategies

The Graduated Approach

Year 1: Focus on mastering the basic 50/30/20 split Year 2: Optimize within categories (better insurance rates, reduced needs) Year 3+: Fine-tune percentages based on life goals and income growth

Seasonal Adjustments

Holiday months: Temporarily shift wants percentage higher, compensate other months Tax season: Use refunds to boost savings category Bonus months: Put entire bonus toward 20% category goals

The 50/30/20 Wealth Building Evolution

As your income grows, resist lifestyle inflation by maintaining the same dollar amounts in needs and wants, directing all increases to savings:

Example progression:

- $50k income: $1,000 savings/month

- $60k income: $1,000 needs + $1,000 wants + $2,000 savings/month

- This accelerates wealth building while maintaining lifestyle

Common 50/30/20 Budget Mistakes

Mistake #1: Miscategorizing Expenses

Problem: Calling wants “needs” to justify overspending Solution: Be brutally honest—ask “Would I lose my job/health/shelter without this?”

Mistake #2: Ignoring Irregular Expenses

Problem: Forgetting about car registration, annual insurance premiums, holiday gifts Solution: Create a “sinking fund” within your needs category for predictable irregular expenses

Mistake #3: Not Adjusting for Life Changes

Problem: Keeping the same budget after job changes, moves, or life events Solution: Recalculate every 6 months or after major life changes

Mistake #4: Perfectionism Paralysis

Problem: Giving up after one month of imperfect budgeting Solution: Aim for progress, not perfection—even 60/30/10 is better than no budget

Mistake #5: Forgetting About Taxes

Problem: Using gross income instead of after-tax income Solution: Always base percentages on take-home pay

Making 50/30/20 Work Long-Term

Building the Right Mindset

- View wants spending as permission, not restriction: You get to spend 30% guilt-free

- Celebrate savings milestones: Track and reward progress toward financial goals

- Focus on automation: The less daily management required, the more sustainable

- Plan for flexibility: Life happens—budget for it rather than abandoning the system

Adapting to Income Changes

Income decreases: Temporarily adjust to 55/25/20 or 60/25/15 Income increases: Maintain same dollar amounts for needs/wants, boost savings percentage Irregular income: Use conservative estimates and smooth with separate account

The 50/30/20 Success Timeline

Month 1-2: Setup and Adjustment

- Calculate your categories and set up accounts

- Track spending and identify necessary adjustments

- Don’t expect perfection—focus on awareness

Month 3-6: Habit Formation

- Automated systems start working smoothly

- Spending patterns align more closely with budget

- Emergency fund begins growing noticeably

Month 6-12: Optimization

- Fine-tune categories based on real spending patterns

- Negotiate bills and find savings in needs category

- Begin seeing significant progress on financial goals

Year 2+: Advanced Management

- Consider modifications based on life goals

- Evaluate whether to adjust percentages

- Start more sophisticated wealth-building strategies

Track your progress with our savings goal calculator to see exactly when you’ll reach your financial milestones.

Tools and Resources for 50/30/20 Success

Free Calculators

- Salary Breakdown Calculator: Determine your exact after-tax income

- Savings Goal Calculator: Plan your 20% allocation across multiple goals

- Compound Interest Calculator: See how your savings will grow over time

Budget Templates

Simple 50/30/20 Spreadsheet Categories:

- Income (after-tax)

- Needs (target: 50%)

- Wants (target: 30%)

- Savings/Debt (target: 20%)

- Actual vs. Budget comparison

- Monthly progress tracking

Recommended Banking Setup

Account Structure for 50/30/20:

- Main checking: Receives paycheck, pays needs

- Wants checking: Monthly transfer for discretionary spending

- High-yield savings: Emergency fund and short-term goals

- Investment accounts: Long-term savings and retirement

The Bottom Line: Why 50/30/20 Works

The 50/30/20 budget rule succeeds where complex budgets fail because it balances three crucial elements:

- Responsibility: Ensuring essential needs are covered

- Enjoyment: Allowing guilt-free spending on wants

- Future security: Building wealth and financial stability

Unlike restrictive budgets that eliminate all fun spending, or loose approaches that provide no structure, 50/30/20 gives you a framework that’s both sustainable and effective.

Key takeaways:

- Start with your after-tax income and divide into three simple categories

- Be honest about needs vs. wants—your financial future depends on this distinction

- Automate everything possible to reduce daily budget management

- Adjust the percentages based on your specific situation and goals

- Focus on progress, not perfection—consistency beats perfection every time

The beauty of the 50/30/20 rule is its simplicity. You don’t need complex spreadsheets, dozens of categories, or daily expense tracking. You just need to understand your income, be honest about your priorities, and stick to three simple percentages.

Ready to implement your 50/30/20 budget? Start by using our salary breakdown calculator to determine your exact after-tax income, then use our savings goal calculator to plan how you’ll allocate your 20% savings category across your financial goals.

Remember: The best budget is the one you’ll actually follow consistently. The 50/30/20 rule provides that perfect balance of structure and flexibility to help you take control of your finances without taking over your life.